In this week’s installment of The Treasury of Common Sense on Radio 2GB, I discussed how the Albanese government has delivered three ‘world record’ declines in Australian living standards:

Below are some key edited extracts along with the pertinent charts referenced in the interview:

“Unfortunately, in the last week we’ve had three pieces of data come through – independent data – showing that Australia is suffering a world-record living standards decline”.

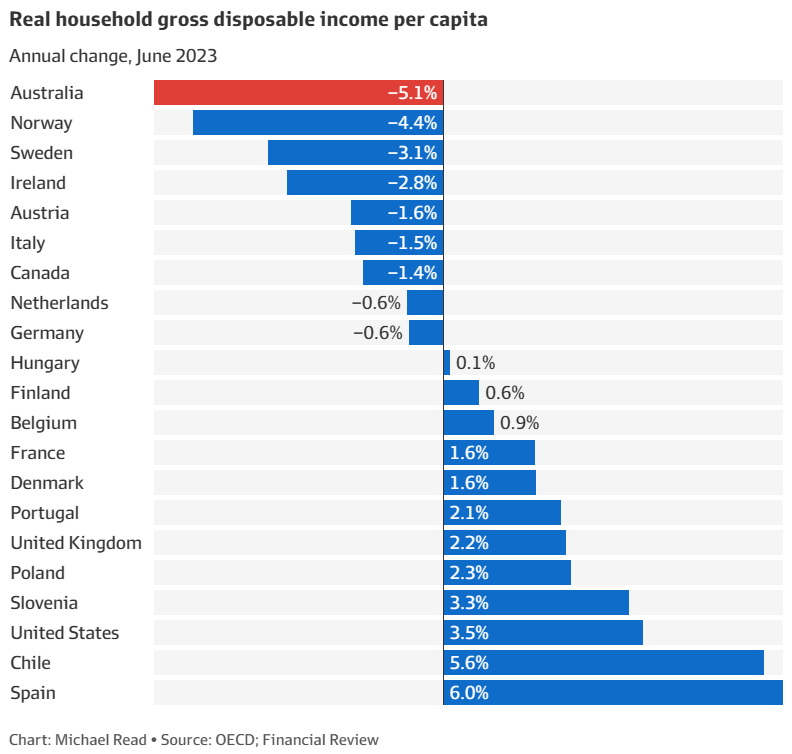

“The first bit of information that came out was about a week ago by Michael Read from The AFR who accessed OECD data and showed that Australian households have suffered the largest income decline after inflation per capita last financial year”:

“So effectively, Australian households per capita went backwards by 5.1% last financial year, and that was the biggest income loss in the world according to this data”.

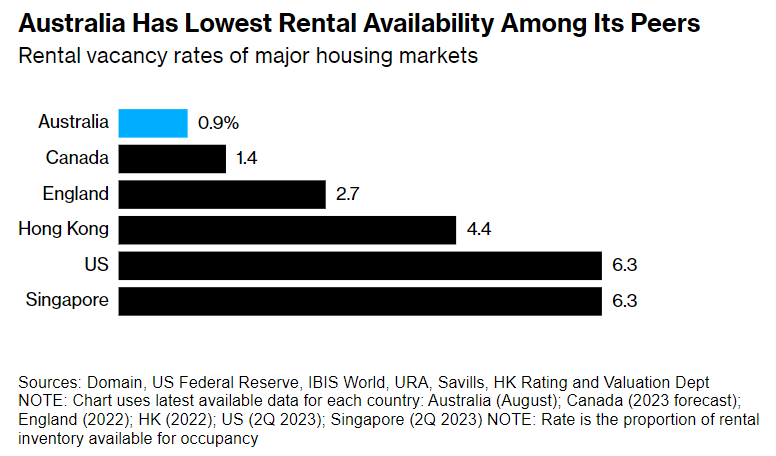

“And literally the very next, Bloomberg reported a survey which showed that Australia has the lowest rental availability. So our rental vacancy rate is 0.9% and that’s – according to Bloomberg – the lowest out of all the countries surveyed in that report”.

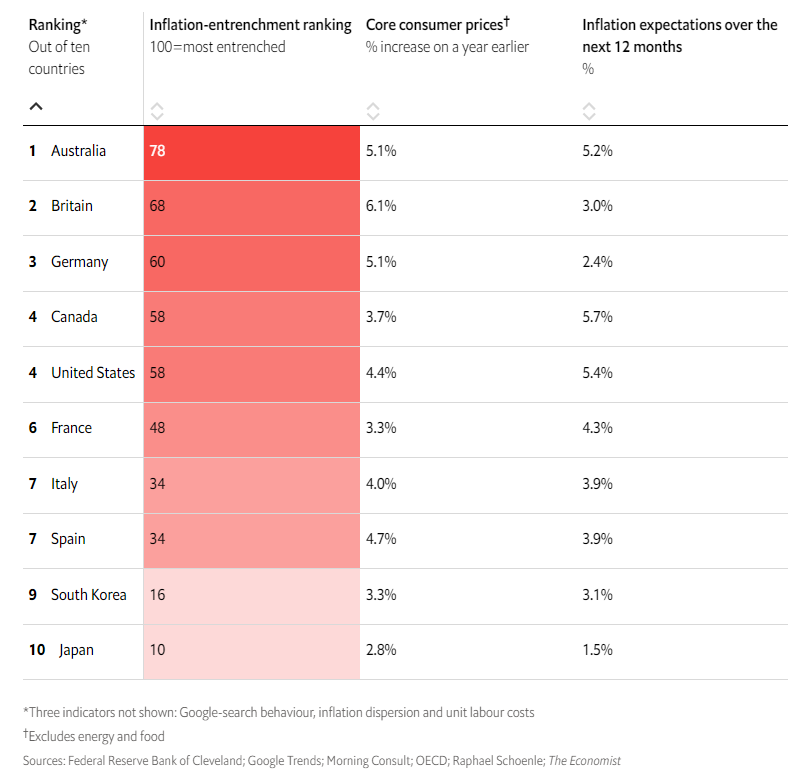

“Then on Monday, The Economist ranked Australia as number one in the world for embedded inflation. The way they worked that out is they looked at the actual inflation and they also look at inflation expectations. And Australia ranked worst on that as well”.

“So effectively we’ve had three surveys in a period of days that show that Australia’s got the worst outcomes”.

“It’s a combination of things [that’s driving it”. Australia’s wage growth has been weaker before inflation than most other countries and then, of course, our inflation’s quite high as well”.

“So effectively, when you put those two things together, we’ve suffered a massive income loss and it’s also exacerbated because Australia has the highest share of variable-rate mortgages in the world”.

“Most markets in the world are fixed rate with a bit of variable. Ours is the other way around. We’re mostly variable with a bit of fixed rate”.

“So effectively, what that means is that the Reserve Bank of Australia has now increased rates by 4.25% since May last year and that has fallen on households with mortgages a lot quicker here than most other countries in the world because we’ve got varable rates predominantly”.

“At the same time, we’ve obviously got this massive rental inflation, so our rents are rising at a very high rate compared to most countries in the world”.

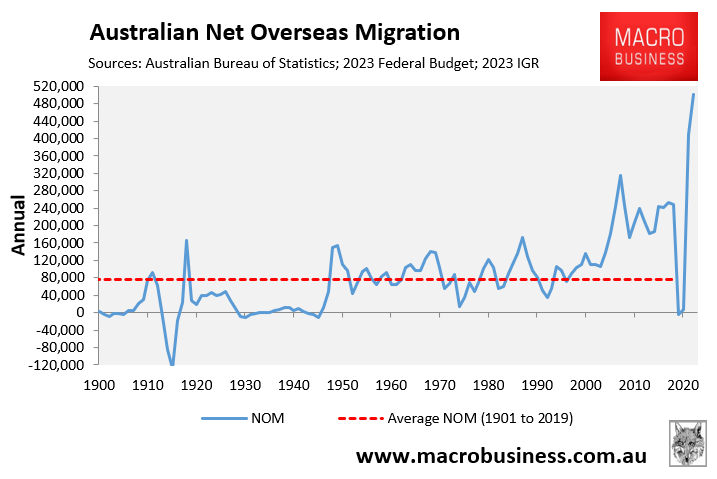

“And that gets back to obviously this extreme immigration-lead population growth that we’re experiencing”.

“So, all these factors combined basically shrink our household disposable income more than most other places in the world”.

The interview also talks about the growing opposition to the Albanese government’s mass immigration policy and the worsening rental crisis.