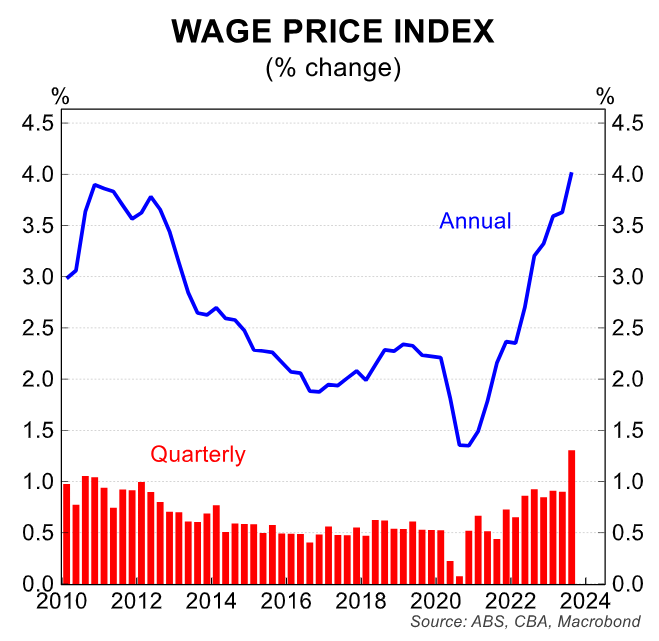

Last week, the media was in a frenzy over the September wage price index (WPI) results from the Australian Bureau of Statistics (ABS), which showed wages growing at their fastest pace since March 2009:

Wages rose by 1.3% over the quarter, which was the strongest result in the 26 year history of the WPI.

However, CBA noted that there were extraneous circumstances driving the result. In particular:

- The Fair Work Commission’s decision to lift minimum and award wages by 5.75% on 1 July 2023. All the pass through occurred in Q3 23, unlike the past two years where the impact was spread out into the December quarter.

- The Aged Care Work Value case saw a 15% lift for workers in this industry. The ABS notes this led to average pay increases of between 5.75% and 21%for these workers when including the Fair Work decision.

- A larger than normal increase from enterprise agreements in the quarter.

- The formal ending of public sector wage caps by state governments. As a result the average pay increase in this segment was 3.3% (up from 2.3%) and 34% of jobs received a pay rise.

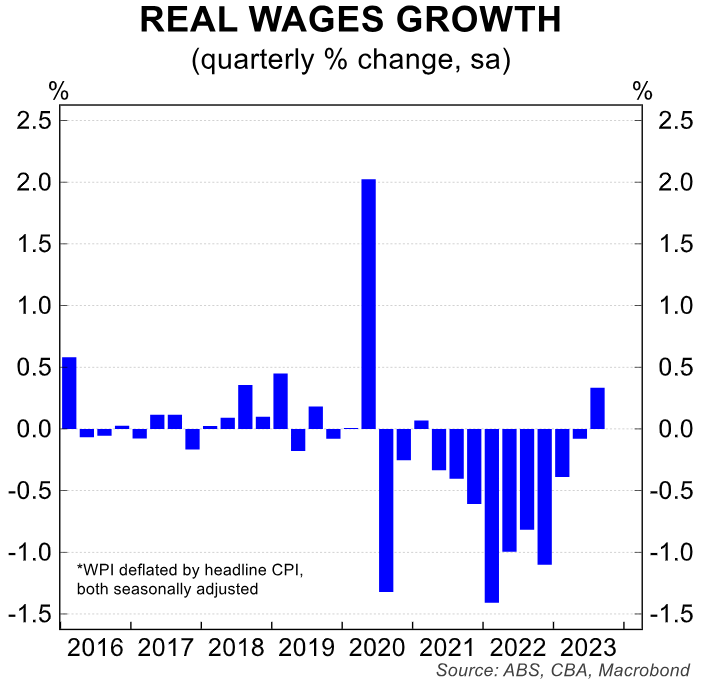

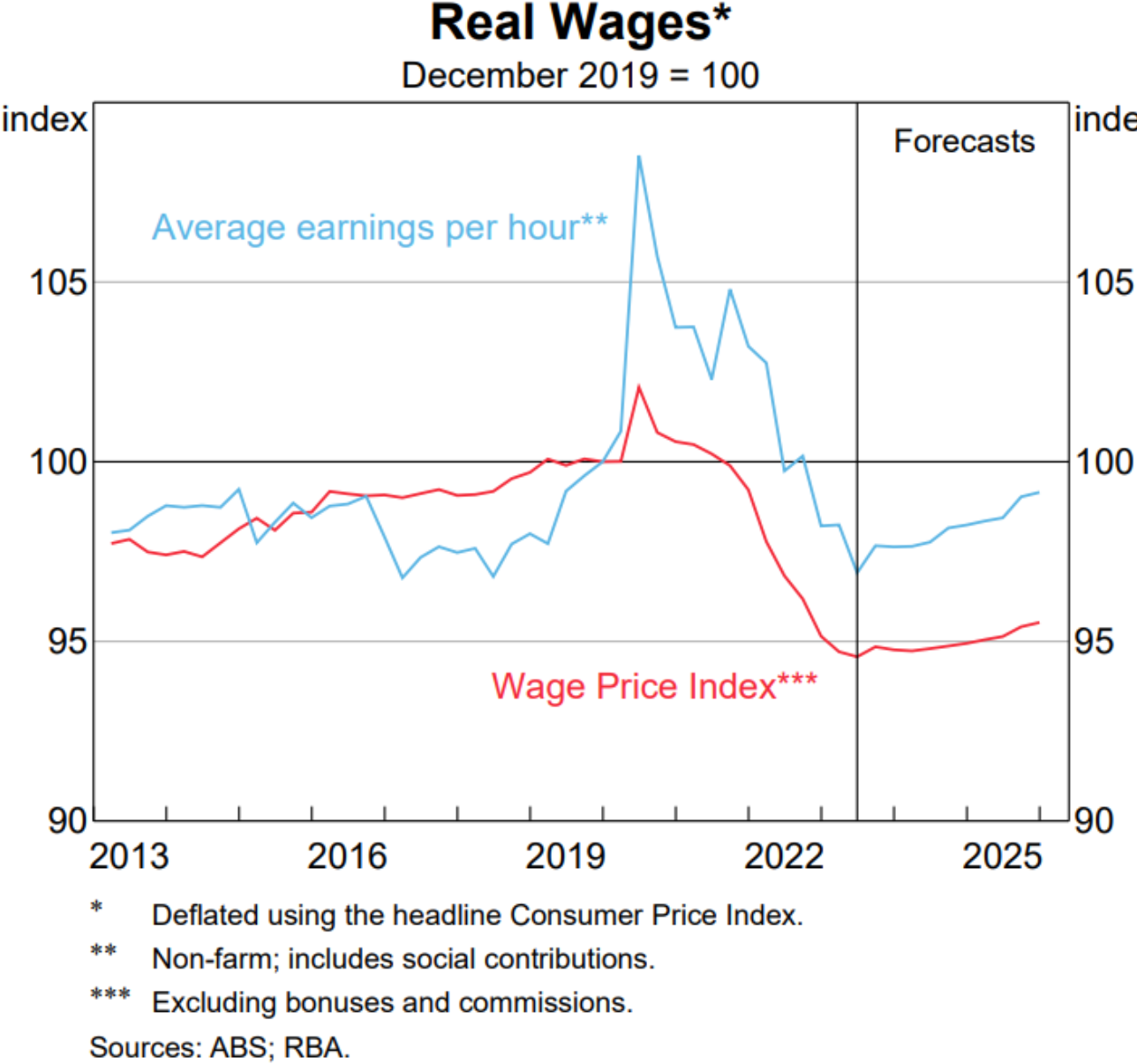

Nevertheless, Australia eked out positive (0.3%) real wage growth for the first time in 10 quarters:

This could be as good as it gets for a while, however, with forward-looking indicators suggesting that wage growth will stall.

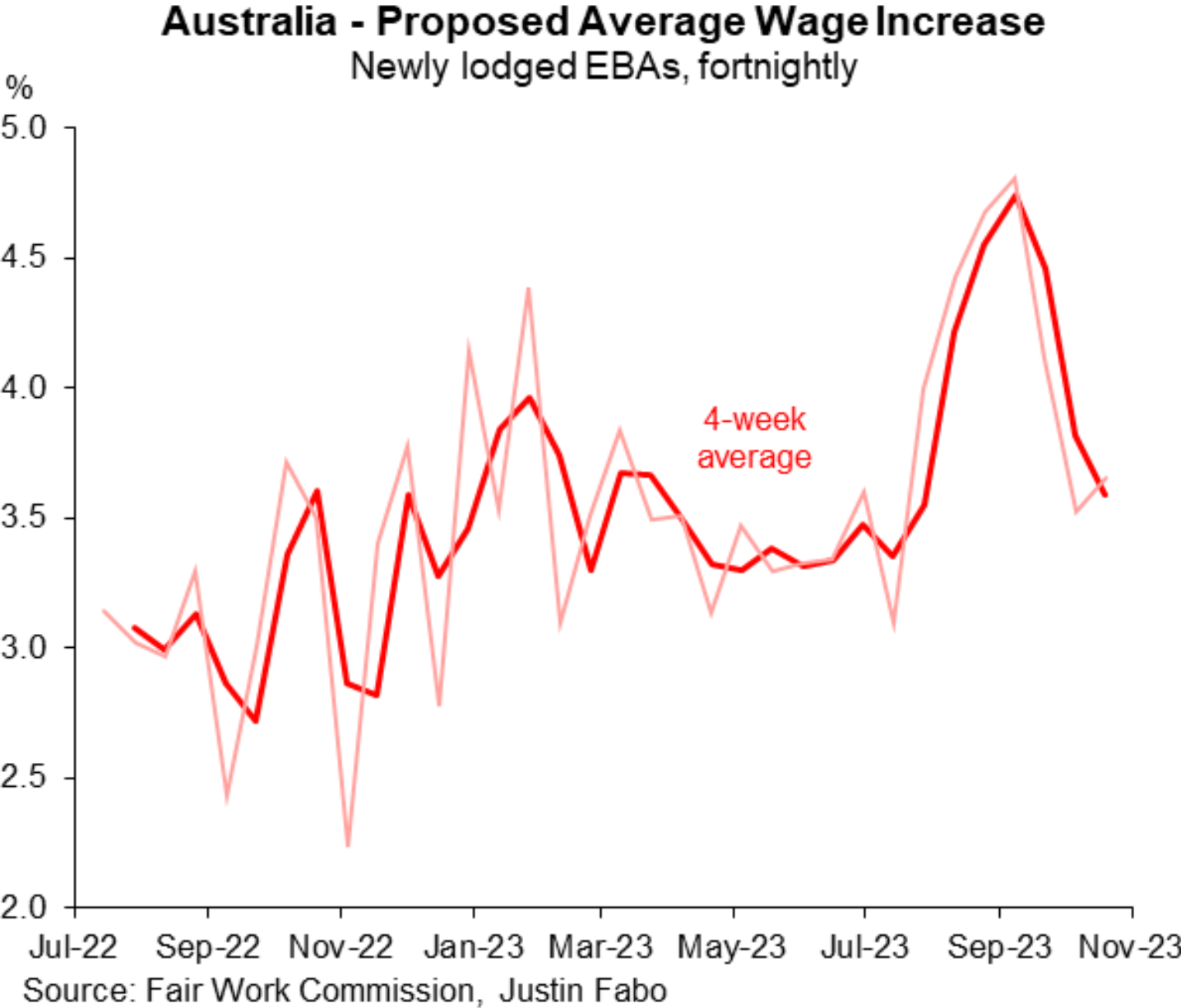

Justin Fabo from Macquarie Group posted the below chart on Monday showing that wage growth implied by newly lodged enterprise agreements fell sharply over the past month or so:

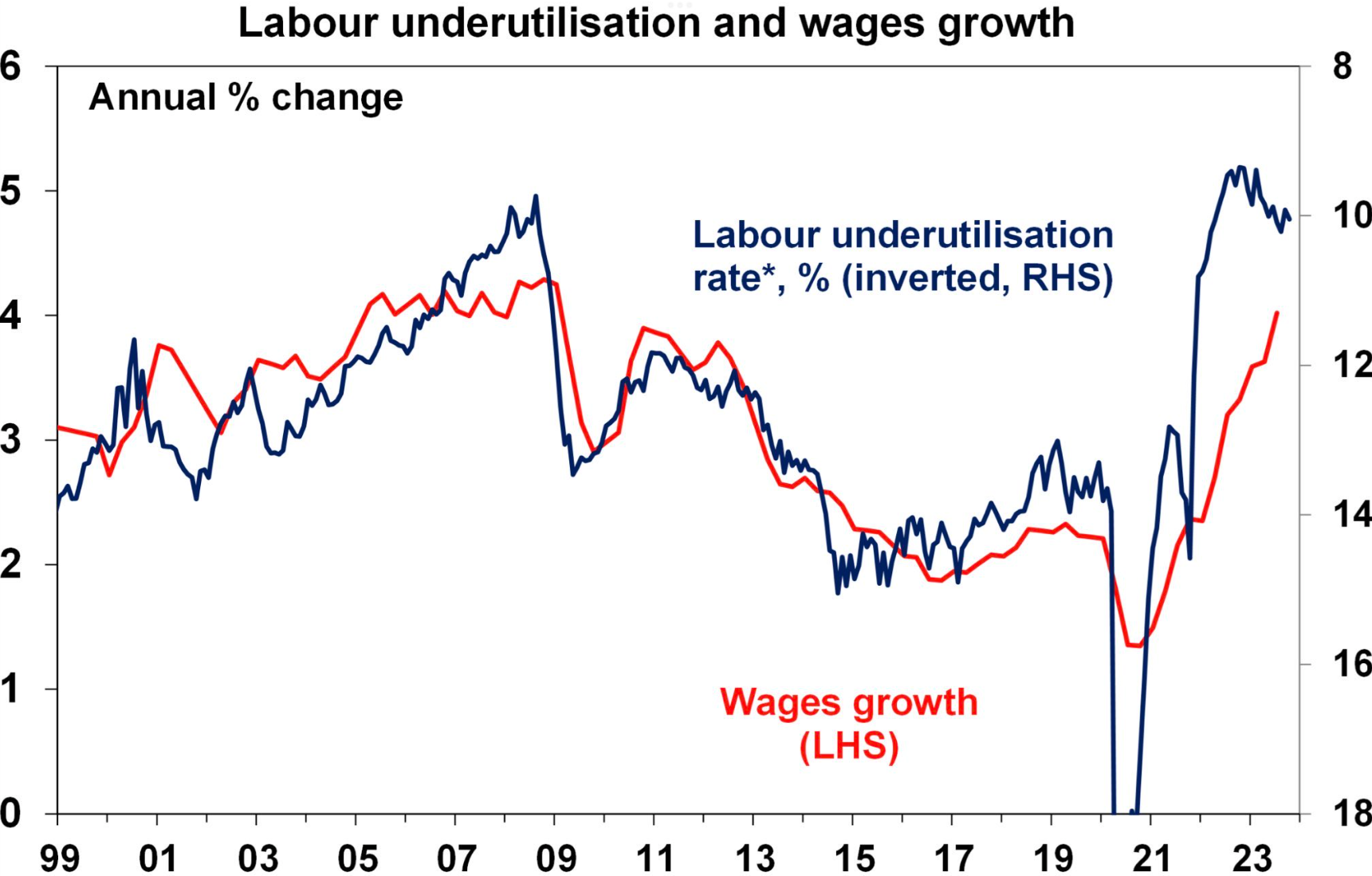

AMP chief economist, Shane Oliver, likewise suggested that the rise in the underutilisation rate will lower wage growth:

Source: Shane Oliver

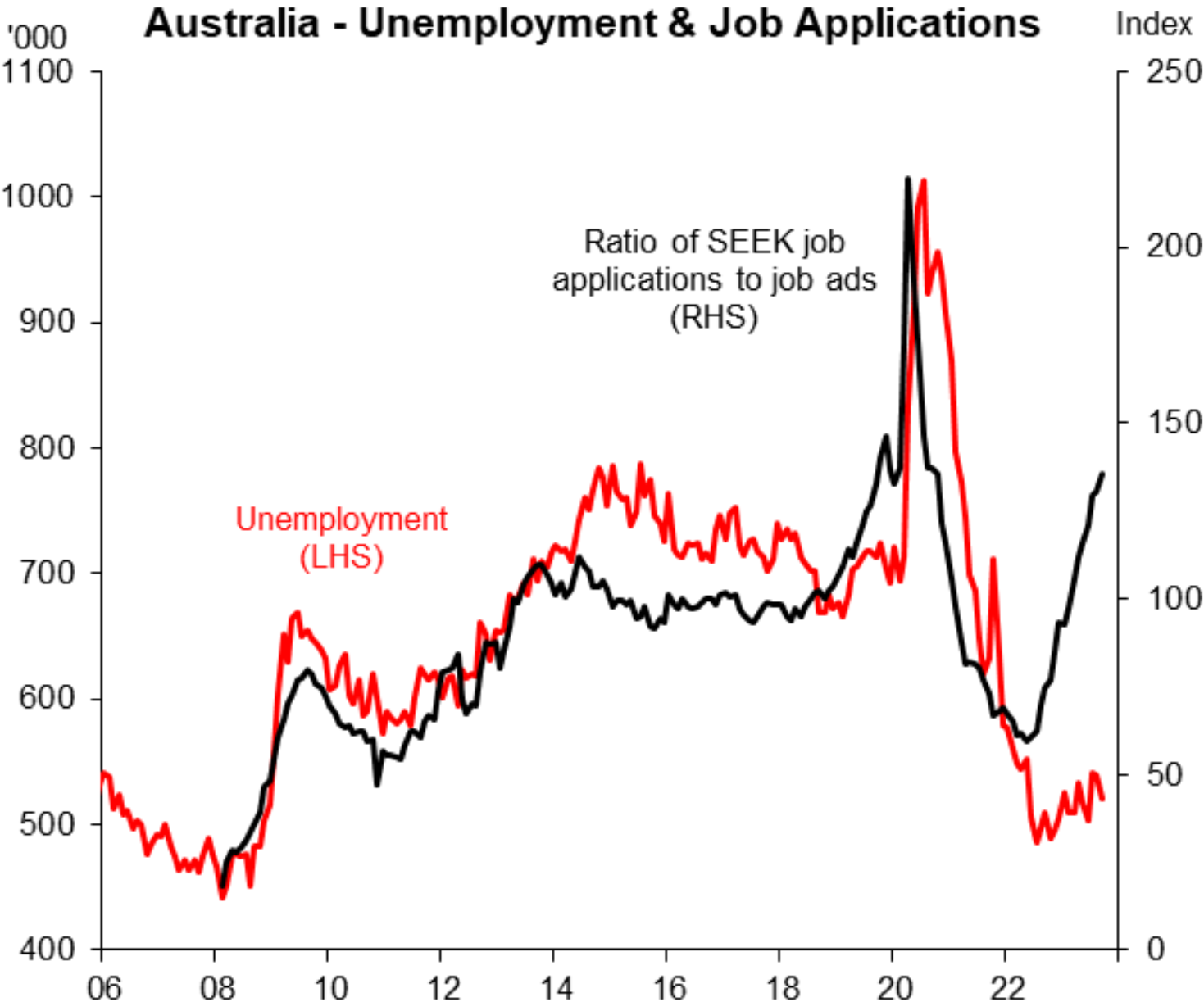

The record immigration-driven growth in Australia’s population, combined with the slowing economy, has already driven the number of applications per job ads well above pre-pandemic levels:

Source: Justin Fabo

In turn, unemployment should soon rise and wage growth should stall.

The upshot is that it is going to be a long and painful road ahead for Australian workers.

Indeed, the latest RBA Statement of Monetary Policy forecast that it will take years for Australian real wages to recover from recent heavy losses:

A lost decade confronts Australian workers.