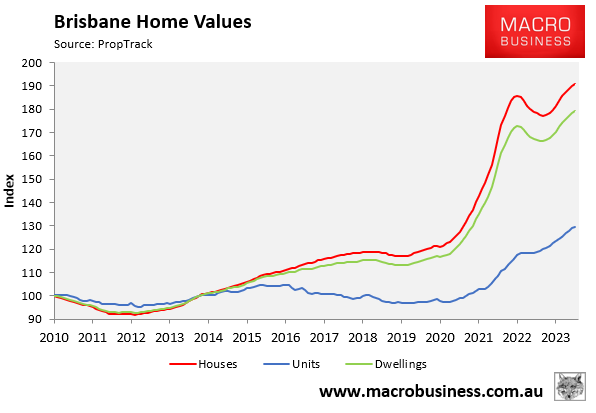

PropTrack’s dwelling values index shows that Brisbane dwelling values have soared 53% above its pre-pandemic (March 2020) level, driven by a 57% increase in detached house values:

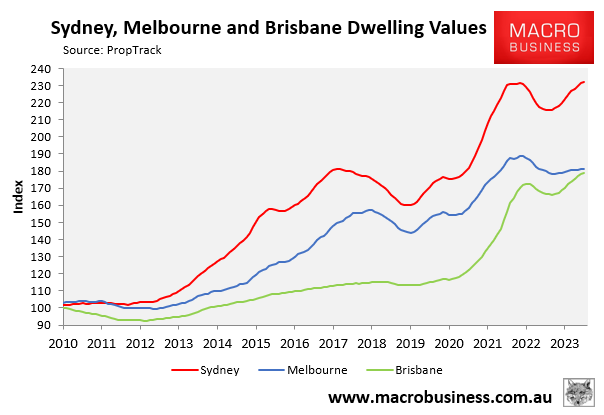

Taking a longer-term view, Brisbane dwelling value growth has underperformed its larger east coast cousins since 2010:

Since January 2010, Brisbane dwelling values have only risen by 79%, versus 132% growth for Sydney and 81% growth for Melbourne.

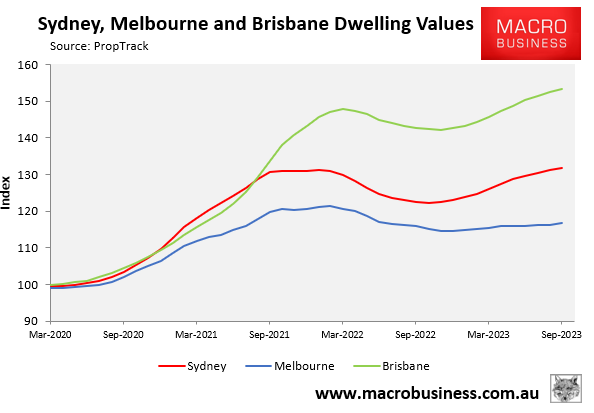

However, since the start of the pandemic in March 2020, Brisbane dwelling values have grown by 53% versus 32% growth for Sydney and 17% growth for Melbourne:

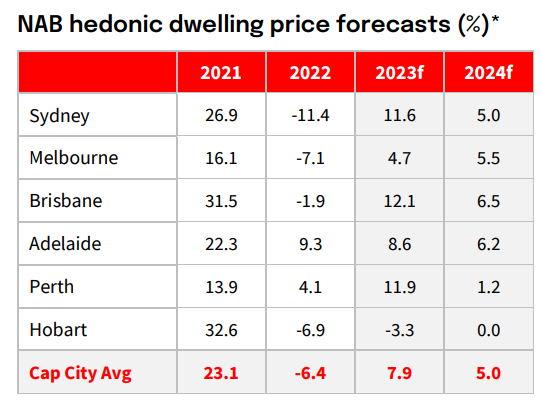

NAB latest dwelling price forecasts are especially bullish about Brisbane, tipping 18.6% growth over 2023 and 2024:

Brisbane’s forecast dwelling price growth is well ahead of both Sydney (16.0%) and Melbourne (10.2%), according to NAB.

Brisbane dwelling values should also out-perform over the longer term, given Brisbane housing is considerably more affordable than its larger east coast cousins.

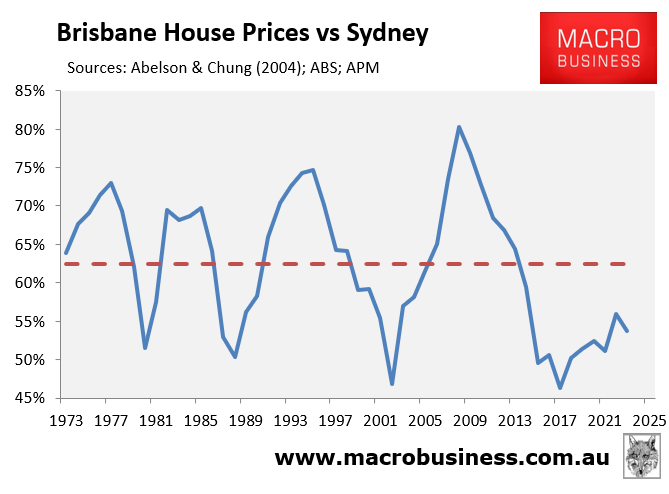

According to Domain, Brisbane’s median house price is only 54% that of Sydney’s:

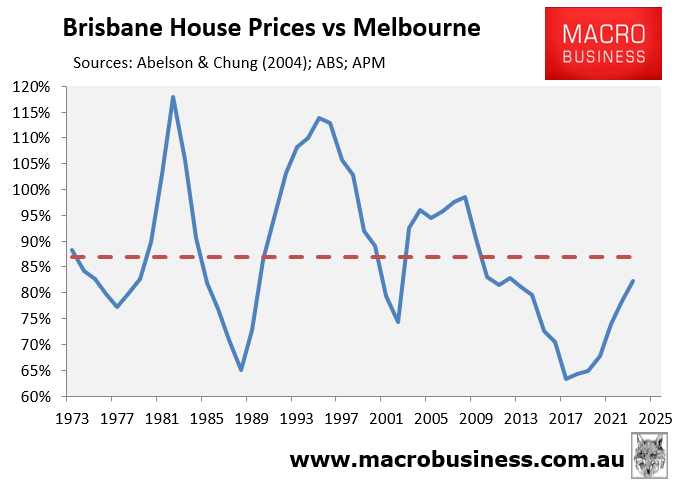

Moreover, despite its recent strong growth, Brisbane’s median house price is still only 82% as expensive as Melbourne’s:

This data, therefore, shows that Brisbane housing is relatively affordable compared to its Southern big city counterparts, implying that prices should appreciate more quickly over the long run.

The Olympics in 2032 will also spur infrastructure investment and cement Brisbane’s standing as a global city, thereby increasing demand from overseas buyers.

Simply put, the elements appear to be in place for strong house price appreciation across Brisbane.