Australia’s rental crisis is worsening as record immigration-driven demand runs way ahead of housing supply.

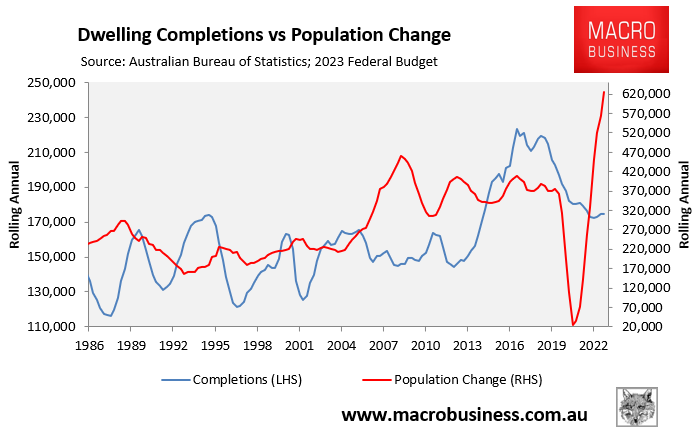

A record 500,000 net overseas migrants are estimated to have landed in Australia in the 2022-23 financial year, which has driven an overall population increase of more than 600,000 people.

At the same time, actual dwelling construction rates have collapsed to near decade lows, causing a gaping housing shortage:

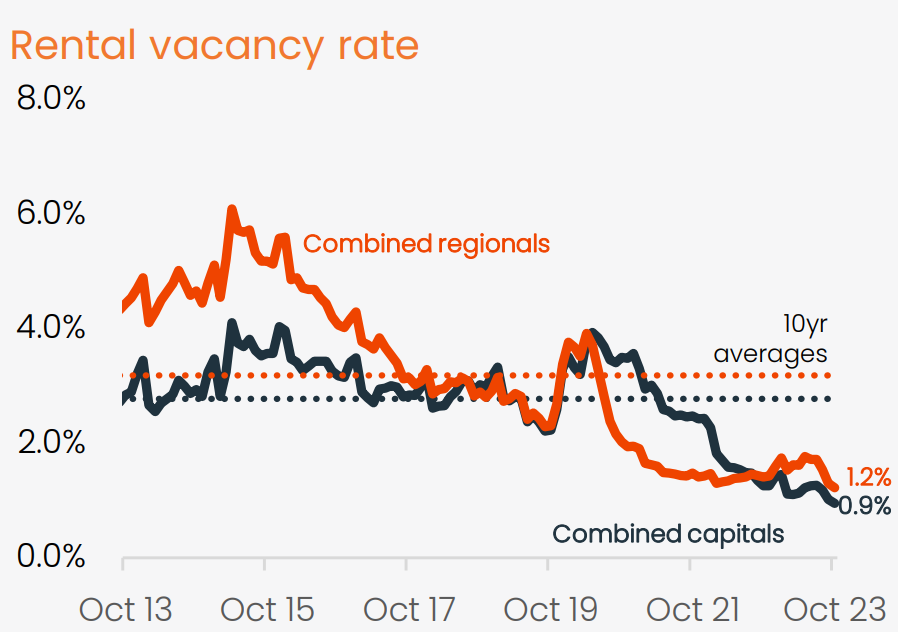

The impact on the rental market has been brutal with Australia’s rental vacancy rate collapsing to a record low:

Source: CoreLogic

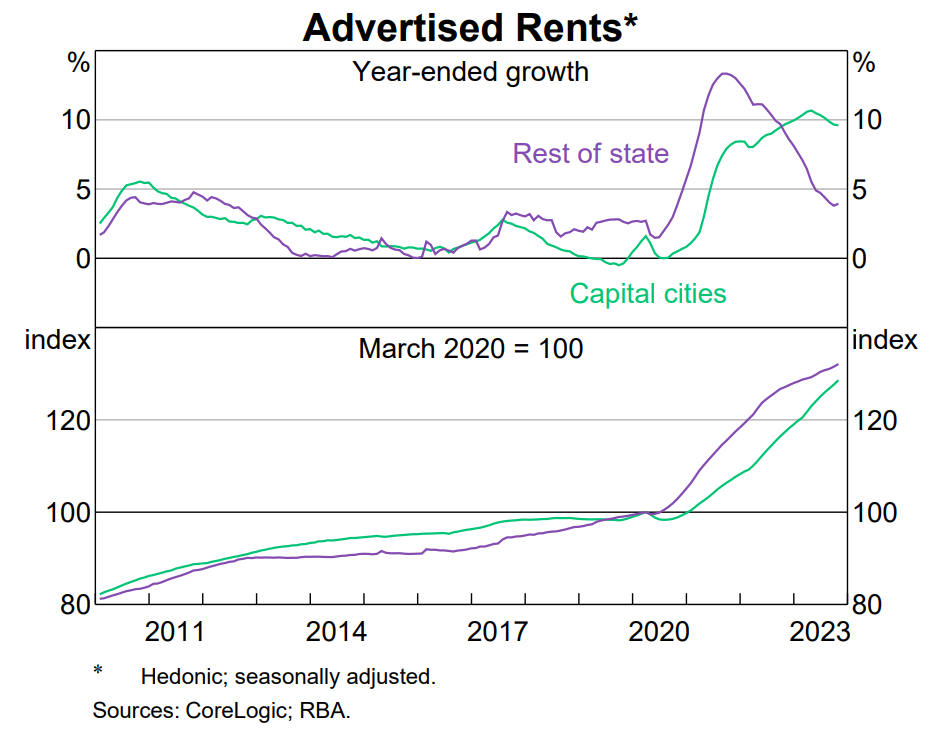

Advertised rents have also soared by around 30% since the start of the pandemic:

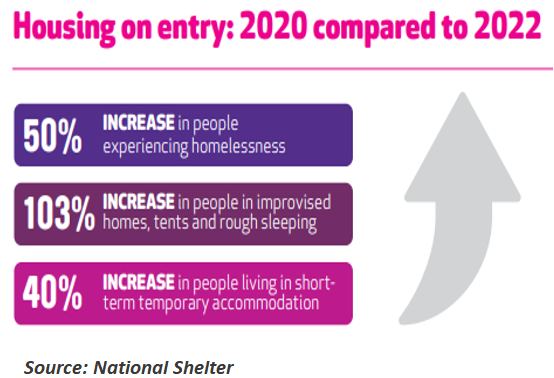

National shelter analysis revealed a 50% increase in homelessness from 2020 to 2022. Additionally, the population residing in “improvised homes, tents, and rough sleeping” doubled over the same period.

The situation would certainly have worsened in 2023, given the collapse in the nation’s rental vacancy rate and soaring rental inflation.

Data released earlier this month from Flatmates.com.au showed that demand for share housing continues to rise.

The number of members joining the platform rose by 11.2% in October, surpassing both the hectic September figure and October 2022 by 15.6%.

The number of newly listed properties advertised on Flatmates.com.au also surged, up 38% in the past year and 9.7% month-over-month, as households sought an alternative income stream amid cost-of-living pressures.

“2023 has been Flatmates.com.au’s busiest year on record, due to a record-breaking summer and without our typical seasonal winter slump”, explained Claudia Conley, Flatmates.com.au Community Manager.

“It’s clear more Australians are turning to share accommodation as pressures on the rental market and a cost-of-living crisis fail to die down”.

Flatmates.com.au has released additional information regarding activity on its platform based on a survey of 10,300 users.

The survey shows that “more people are turning to share house living to alleviate affordability pressures amid the cost-of-living crisis and an incredibly tight rental market”.

Specifically, “almost half (48%) of all respondents – room listers and renters – said that the primary reason they are living in share accommodation is because they cannot afford to live on their own”.

Moreover, “the past year has seen almost a quarter (23%) of respondents enter the share accommodation market for the first time”.

Older Australians are also the fastest growing users of the platform, according to the survey:

“Members aged between 55 and 64 years old on Flatmates.com.au were the fastest growing demographic in the past year, recording a 21% annual increase”.

“Those aged between 65 to 74 were the second largest growing demographic, rising 13% since last year’s survey”.

Commenting on the results, Community Manager, Claudia Conley, noted:

“Australians are looking for new ways to navigate the rental crisis and tackle the rising cost of living”.

“Over the past year, our audience has grown in size and diversity, and with the peak season for share accommodation at our doorstep, we expect demand for share house living to grow”.

“Until more homes are built to keep up with the demand for rentals, we expect share accommodation to remain popular”.

The rental crisis is being driven by the Albanese government’s unprecedented immigration program.

Therefore, net overseas migration must be reduced to a level below the country’s ability to build additional housing and infrastructure.

Otherwise, the rental crisis in Australia will continue to worsen, forcing tenants to suffer greater financial strain, live in share housing, or become destitute.