In the US, not Australia. The latter is tortured by the madness of Alboflation.

Goldman kicks us off with a victory march.

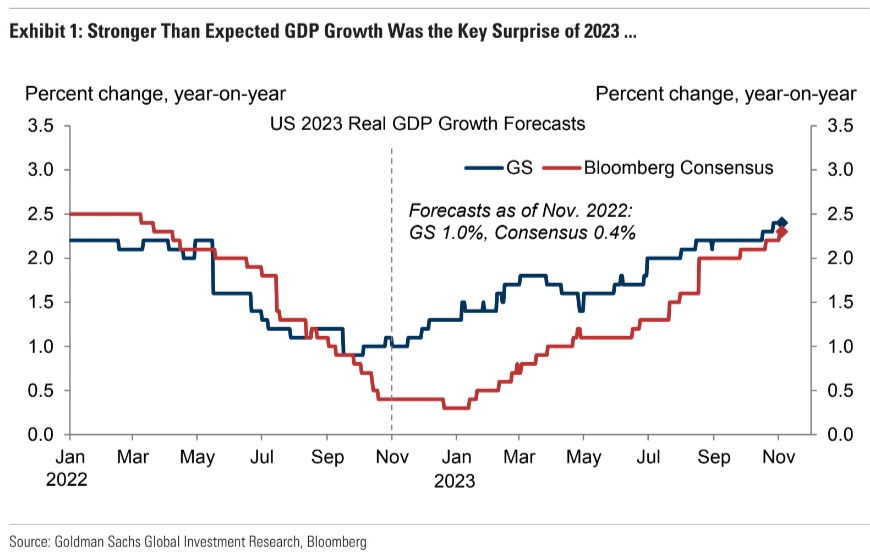

The US economy defied recession fears in 2023 and made substantial progress toward a soft landing. The key surprise has been much stronger than expected GDP growth, though this has not prevented the labor market from continuing to rebalance or inflation from continuing to fall.

The hard part of the inflation fight now looks over. It was fair to wonder last year whether labor market overheating and an at times unsettling high inflation mindset could be reversed painlessly.

But these problems now look largely solved, the conditions for inflation to return to target are in place, and the heaviest blows from monetary and fiscal tightening are well behind us.

As a result, we now see only a historically average 15% probability of recession over the next 12 months.

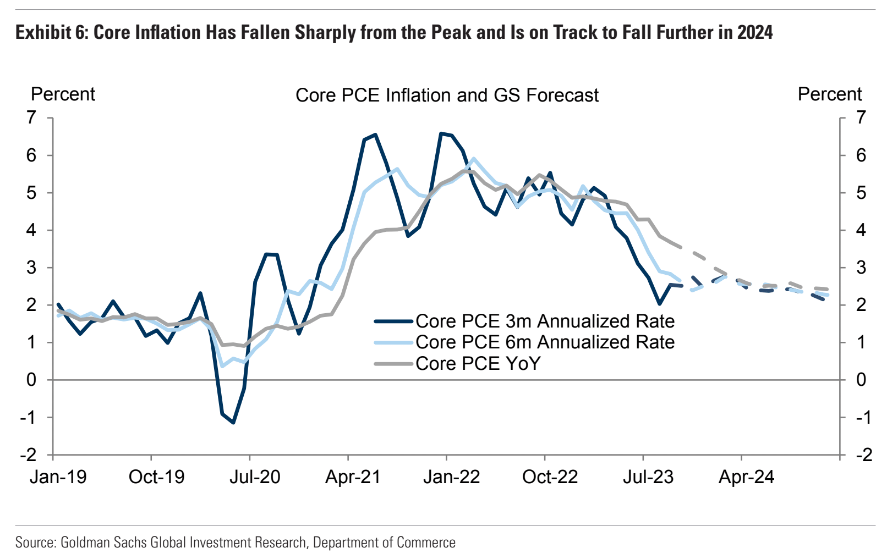

Core inflation has fallen sharply from its pandemic peak and should begin its final descent in 2024.

We see further disinflation in the pipeline from rebalancing in the auto, housing rental, and labor markets, though we expect a small offset from a delayed acceleration in healthcare.

Wage growth has fallen most of the way to its 3.5% sustainable pace, and surveys suggest it will get there next year.

All of this should push core PCE inflation to around 2.4% by December 2024.

We expect GDP to grow 1.8% in 2024 on a Q4/Q4 basis (or 2.1% on a full-year basis), again easily beating low consensus expectations.

We forecast just under 2% consumption growth, with real disposable income growth of nearly 3% partly offset by a 1pp rise in the saving rate.

We also forecast slower business investment growth of roughly 2% as the surge in manufacturing facility investment driven by CHIPS Act and Inflation Reduction Act subsidies slows, and flat residential investment as the housing shortage continues to temper the impact of reduced affordability.

We expect the FOMC to deliver its first rate cut in 2024 Q4 once core PCE inflation falls below 2.5%.

We then expect one 25bp cut per quarter until 2026 Q2, when the fed funds rate would reach 3.5-3.75%, a higher equilibrium rate than last cycle.

While we do not have any major macroeconomic shocks in our 2024 forecast, we think the bar to cut in response to a growth scare will below in coming years and would not be surprised by insurance cuts at some point.

Two key risks remain top of mind. The first is geopolitical conflict and the risk of a spike in oil prices.

While possible, we think this would more likely be a setback in the inflation fight than a game changer.

The second is the risk that something could “break” in the abrupt transition to a higher interest rate regime.

Our analysis suggests that the risks are real but manageable, in part because the Fed would be at liberty to cut in response next year and will have plenty of room.

My own view is strictly speaking the Fed has more work to do to meet its mandate but the political economy is allowing it some wiggle room. Nobody wants a recession in 2024 delivering a second Trump presidency.

TS Lombard is there abouts.

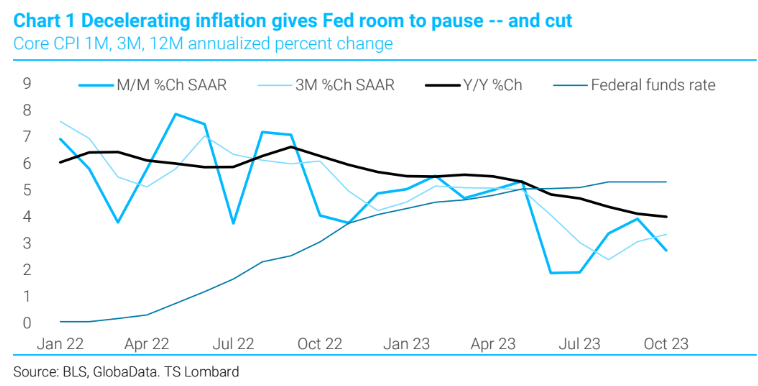

As long as core inflation is under 4.5%, the Fed will do what is necessary to sustain growth and that means cutting rates sooner and faster at the first sign of falling payrolls or unemployment rising towards 4.5%.

Ideally, the 2024 FOMC will be happy if growth stays above 2% and inflation remains in the 3% range.

That scenario creates zero incentive to raise rates to pull inflation down and risk recession.

Keep in mind that 4% core inflation puts the funds rate in sync with the adjusted Taylor Rule.

Second, the FOMC SEP only expects 2% inflation by 2026–a long runway precisely because they fear recession.

During his last press conference, Powell repeated theFed’s mantra of the moment–proceed carefully.

In other words, keep growth positive.

When considering the fever pitch of presidential politics in 2024, any policy bias keeping the FOMC on the shelf for the next 12 months must be extraordinarily attractive.

And, by extension, recession is to be avoided at all costs (or close to it).

Over time, there will be a price for no recession—-an eventual U-turn in inflation. The keyword is“eventual”.

This data dependent Fed is consequently poised to react to economic weakness first and suffer the inflation consequence later–believing that the consequence will be far more manageable than a recession.

I am still agnostic on how hard is the landing. A landing there shall be.

Let’s conclude with Charlier McElligott of Nomura on the asset allocation implications.

Yesterday’s post- CPI price-action made a bunch of stuff clearer:

In USD Rates,the “Immaculate Disinflation” downside surprise in – Core and – Supercore CPI evidenced that despite a recently noted “constructive” tone-shift on Bonds from Customers, Investors nevertheless remain extremely underpositioned in Duration and still-overpositioned in legacy “High for Longer” views, in a world that is now violently capitulating past “2024 Fed insurance cuts” scenario, and wildy, into a hypothetical full-fledged “Fed cutting cycle” for 2024 instead…with policy now perceived to be running “too tight” versus the trajectory of the short-term trailing disinflationary trend.

Perhaps this is too much wishful thinking of near-linear projection of something that’s proven “unforecastable”…but the worst-case “hard-landing” / “over-tightening accident” left-tail LOST Delta yday, while the “softest landing” scenario PICKED-UP Delta instead…i.e.IF inflation were to continue to decline precipitously, the Fed is almost FORCED TO CUT NOMINAL RATES just to maintain levels of “Real Yields”….because without cuts in that scenario, Fed policy would actually be TIGHTENING despite the commencement of economic slowing across – growth and –inflation…so yeah, cross-asset EUPHORIA vs expectations and underpositioning.

So despite the SOFR and UST -Call / -Upside Vol buying, this capitulation from any legacy “H4L / Hawkish” structures post CPI was the perfect set-up for my recent “Short Jan SOFRStrangles” idea,now that Dec Fed is now completely wiped-out of the event-risk picture and priced at “0”… FWIW overnight, we see SFRF4 94.75 Straddle sold 10k x’s as well, with Vol sellers looking to pounce on anything in that short-dated horizon.

My buzzline since late Summer—“Duration has no friends until the data dumps”—now seems to be playing-out globally, with data “downside surprises” picking-up pace (e.g. Bloomberg USEconomic Surprise Index with 14 of the past 16 inputs “missing”)…which is now setting the table for the return of “Bonds / Duration as your Hedge” regime, and seeing the Bloomberg Global Aggregate Bond Index now just -0.3% YTD after having been -3.8% less than a month ago, while the Bloomberg 60/40 Index experienced its best 1d return since Jan ‘23.

“Spot up, Vol up in Equities”(particularly in the massively-shorted “Economically Cyclical / High Refi Wall / Leveraged Balance Sheet” -proxy Russell 2000 / IWM, where spot finished +5.5%and front month contract finished +2 Vols) evidenced 1) a panic grab into both “chase-y” Upside and new Downside –hedges as Index blows into a wider distribution, as it2) continues to display the ugly truth behind my “worst case scenario” call from a month ago: the painful realization of a massive Beta rally, but in a world where few-if-any institutional investors had enough “Net Exposure” on, which was largely a function of having “too grossed-up” Short books….and in-turn, seeing much of the L/S and Macro HF universe miss the past few week’s collective Upside breakout move in brutal fashion(ES +9.7% low-to-high move over past 13 days; NQ +12.7%; RTYA +10.5%).

The further we get into this repricing, the more likely the soft landing on wealth effects alone. Equity markets do not price recoveries; they create them.

MB Fund is long bonds and moving into equities on the dips.

Cash is trash!