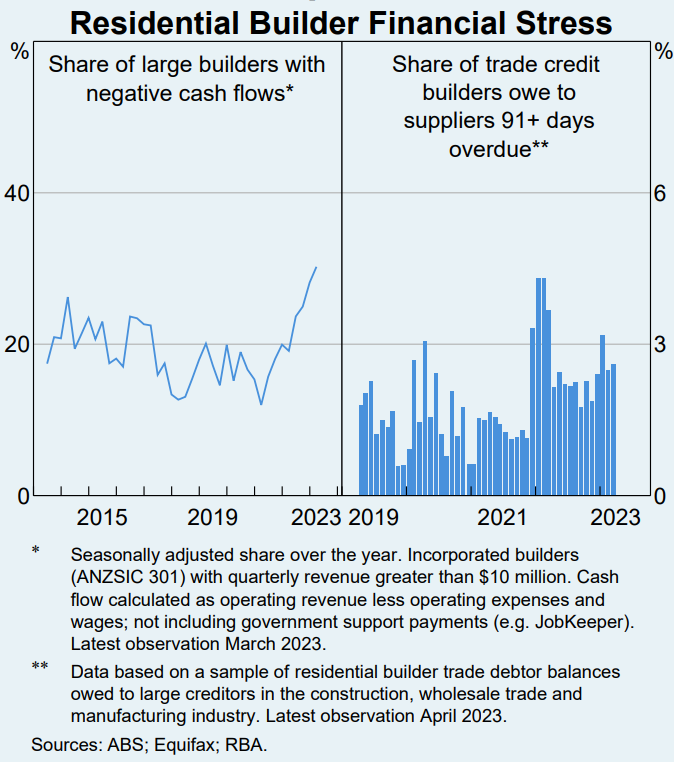

According to the most recent Financial Stability Review from the RBA, approximately one-third of Australian home builders are losing money:

Literally thousands of housing construction firms have ceased operations, leading to a reduction in home building capacity.

The Australian Securities and Investments Commission (ASIC) reported in its most recent quarterly insolvency survey that 783 home-building companies ceased operations during the September quarter of 2023.

This compares to 238 home construction failures in the September quarter of 2021, as well as 605 in the corresponding quarter of last year.

Preliminary ASIC insolvency data for October likewise showed that 569 companies entered into administration or insolvency over the month, a 43% increase compared to the corresponding period in 2022.

Once more, insolvencies increased most rapidly in the construction industry, followed by the hospitality and retail sectors.

New data from Equifax’s Quarterly Commercial Insights for September 2023 reveals that while total insolvency rates rose by 11% versus the same month in 2022, the construction industry recorded the largest share of insolvencies at 31.5% of all cases recorded.

Equifax has downgraded 30% of all construction companies assessed in the last 18 months, with 17% of those downgraded in the nine months to September 2023.

Residential and commercial builders are experiencing higher levels of distress with 23% being downgraded in the same nine month period.

Home builders in particular are most vulnerable, with six rating downgrades for every rating update.

Equifax notes that the last few years have been particularly challenging for this segment, with nearly a quarter of larger home builders reporting net margins below 1%.

Given credit ratings provide a forward-looking view of their capacity to honour commitments, Equifax believes we are likely to see more ongoing fragility in the sector.

This makes sense given that the RBA has just lifted the official cash rate by another 0.25%. with another hike possible.

“Another interest rate rise will continue to impact consumer confidence and spending levels and increase the pressure on industries”, WCT Advisory managing partner Andrew Weatherley warned last week.

“I would also expect increased rates makes it more difficult for borrowers to purchase property, including land, and obtain finance for building, putting more strain on the already challenging construction industry”.

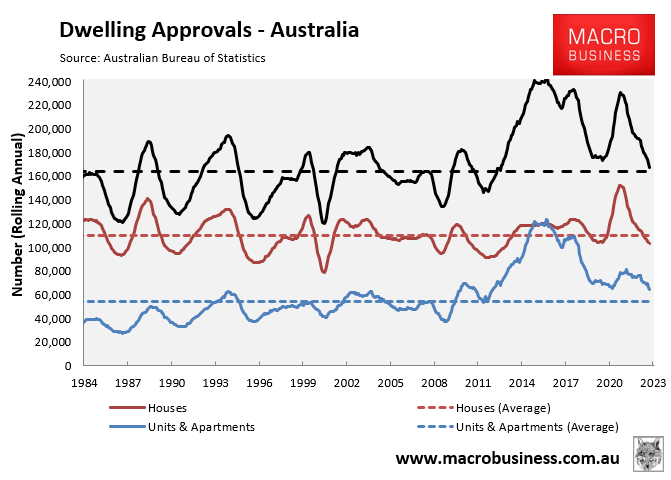

Only 170,000 net homes were added to Australia’s housing stock in 2022-23, according to the ABS. There were also only 164,000 dwellings approved for construction in the year to September.

Given the stiff headwinds facing home builders – including rising interest rates, elevated construction costs, and widespread failures – construction rates will continue to fall.

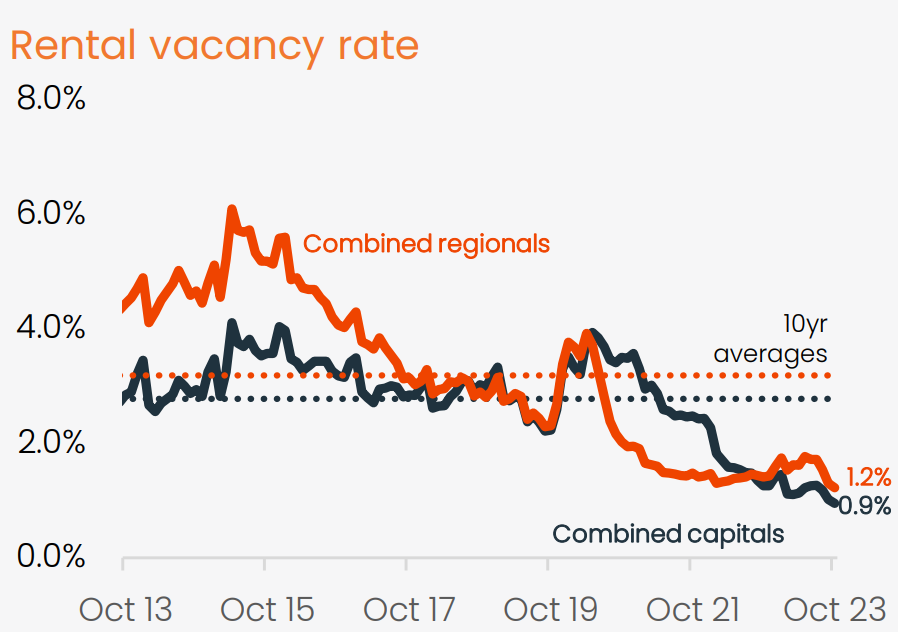

This is a disaster given the nation’s rental vacancy rate is at a record low:

Source: CoreLogic

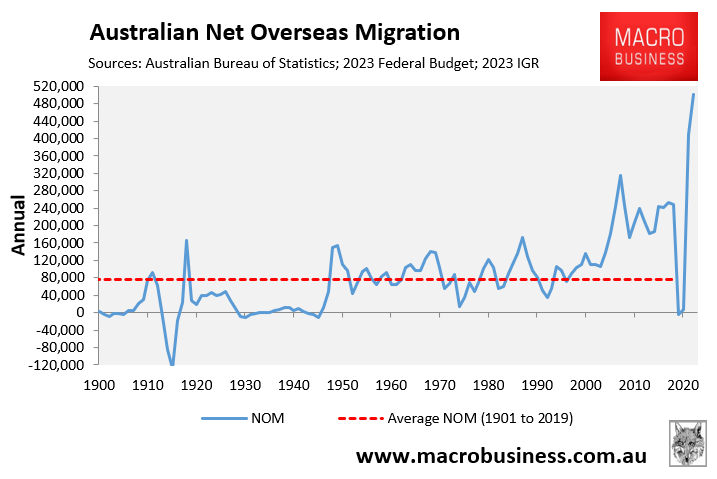

Australia’s population is also growing at a record pace on the back of the Albanese government’s extreme immigration program:

Record population growth amid crashing housing construction means one thing: Australia’s rental crisis will get much worse.

Expect to see ongoing strong rental price inflation, along with more Australians being pushed into group housing or homelessness.