New forecasts from the Housing Industry Association (HIA) have rubbished the Albanese government’s target to build 1.2 million homes over five years.

The HIA forecast that 995,500 new dwellings would commence construction between now and 2029, which is more than 200,000 less than the federal government’s target.

“All signs are we are falling short – and the main reason we are not going to achieve the target is the rise in the cash rate, and it’s very hard for the government to fight against that”, said HIA chief economist, Tim Reardon.

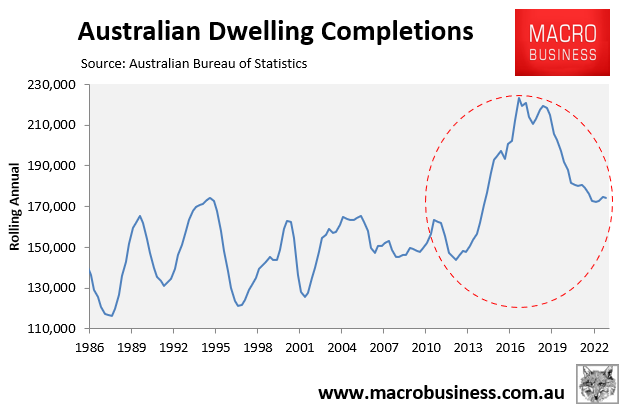

The HIA’s forecast seems overly optimistic given the record number of homes ever built in Australia over a five-year period was 1,045,000 between 2015 and 2019:

Building a similar number of homes this time around will be far more challenging given Australia is facing structurally higher interest rates and materials costs, labour is in shorter supply, and large numbers of home builders have gone bust, thereby reducing supply capacity.

Australia added only 170,000 homes to the nation’s housing stock in 2022-23, against a population increase of around 630,000.

This supply level was 70,000 below the Albanese government’s 1.2 million homes target, which requires 240,000 new homes to be built per year.

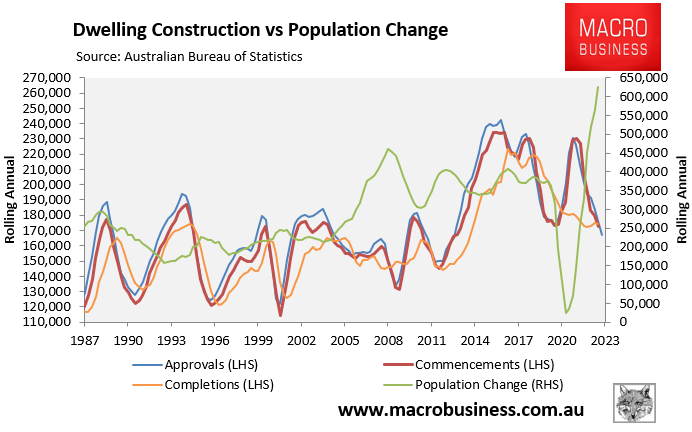

Forward-looking construction indicators are looking even grimmer with dwelling approvals, commencements, and completions nearing decade lows:

For example, only around 164,000 dwellings were approved for construction in the year to September 2023, which is 76,000 less than the government’s housing target.

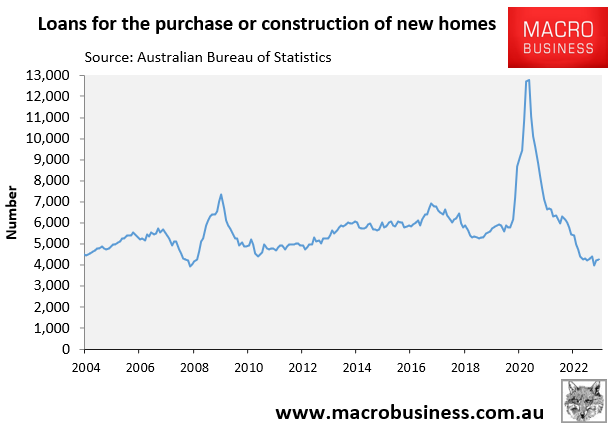

Loans for the construction or purchase of new homes have also collapsed to near record lows, signalling lower housing construction rates ahead:

Indeed, SQM Research’s latest Boom & Bust Report, released last week, warned that “Australia is looking set to build less in 2024 than what was built for 2023”, with only 153,000 dwelling completions expected for the year.

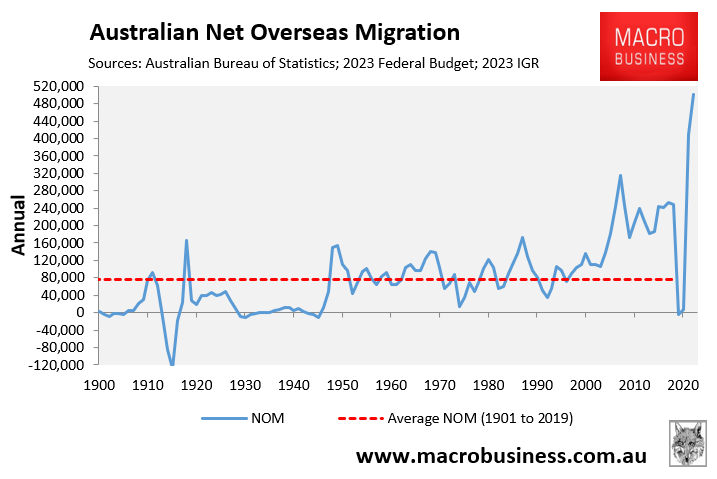

The sad reality is that Australia cannot supply enough homes or infrastructure to keep up with the Albanese government’s record immigration, and it needs to be cut back sharply.

Otherwise, rents, inflation, house prices, and interest rates will continue to rise, smashing both home owners and renters.