Westpac with the Bad Santa.

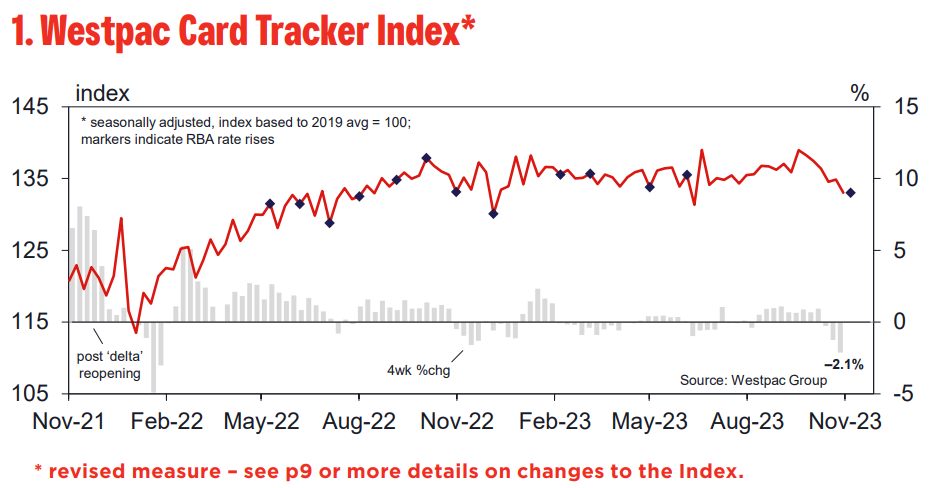

The Westpac Card Tracker Index has shown a further softening over the last two weeks, moving 1.5pts lower to 133. The Index has fallen by 6pts from its mid-September peak but is still slightly above its mid–June low.

Momentum-wise, there continues to be a tension between the quarterly pace, which is still showing a firming since mid-year, and higher frequency reads, which are warning of an abrupt slowing over the last month. If the latter sustains, the quarterly growth pace will slow sharply in coming weeks.

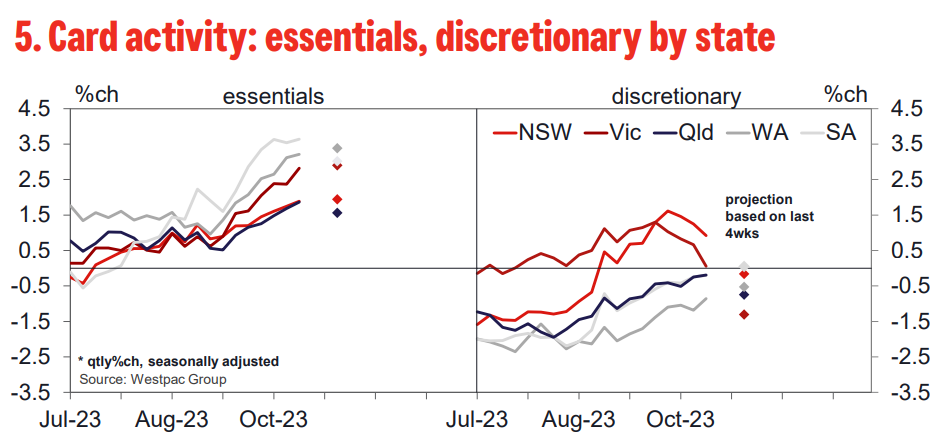

The category detail shows the improvement in quarterly momentum has been led by essential goods where higher fuel prices have been a factor, and a stabilisation in discretionary goods spend.

The more recent weakening has centred on discretionary services spend and is more pronounced in NSW and Vic.

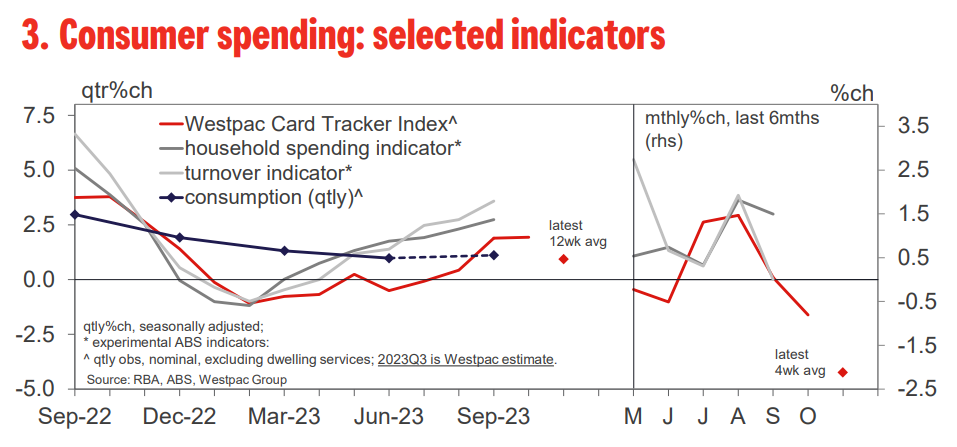

A range of official measures have now confirmed the Q3 improvement in spending momentum with the ABS retail survey, ABS household spending indicator and the consumer components of the ABS monthly business turnover indicator all showing a lift in nominal activity.

The Q3 national accounts, due to be released on Dec 6 will provide a comprehensive estimate for total consumer spending. We expect it to show a 0.5%qtr gain in real, inflation-adjusted terms and a 1.8%qtr gain in nominal terms.

However, the card data suggests the consumer narrative is shifting quickly from this improved Q3 performance.

The shift bears close monitoring given the RBA’s latest rate hike, the series of highprofile sales events scheduled in coming weeks and the broader lead-in to the Christmas high season for retailers.