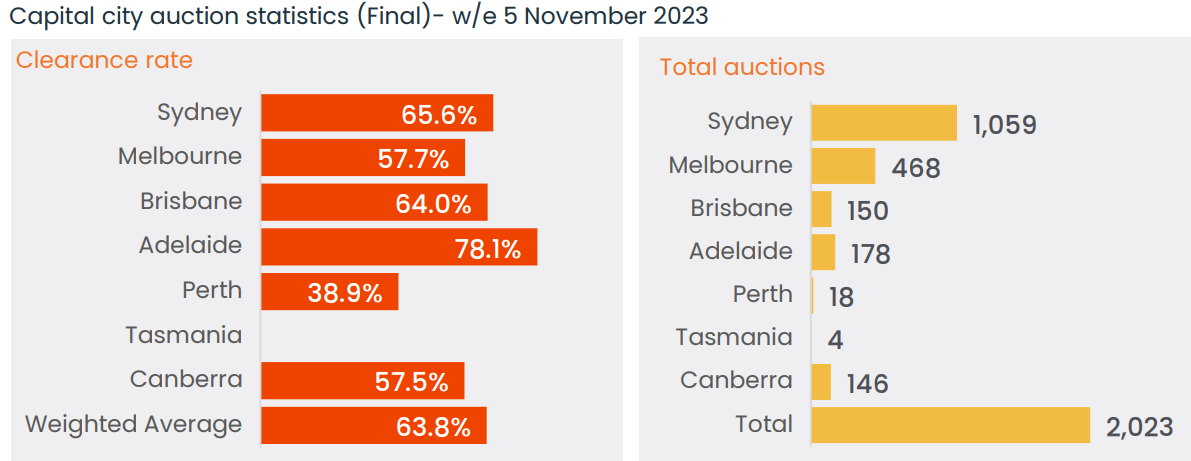

CoreLogic has released its final auction results for last weekend, which reveals that the nation’s clearance rate fell to its second lowest level since Easter with only 63.8% of homes taken to auction selling:

Source: CoreLogic

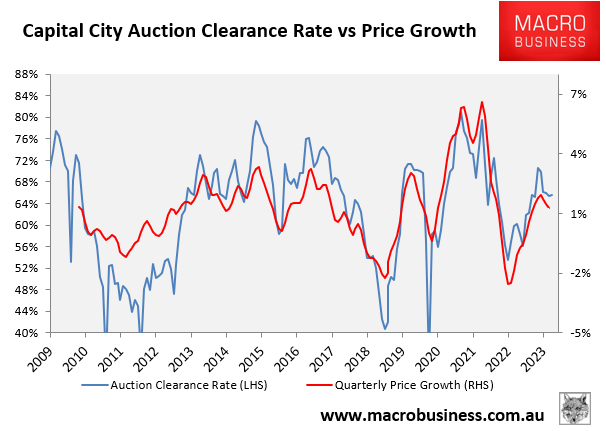

As shown in the next chart, the deceleration in auction clearances is being reflected in price growth, which is also trending lower:

After last week’s (2,023) decline in auction activity owing to the de facto Melbourne Cup long weekend, CoreLogic anticipates a 39.2% increase in weekly auction numbers this week.

This week is projected to surpass the week ending 2 April (2,687) as the second busiest of the year, with 2,816 homes set to go under the hammer across the combined capital cities.

The week ended 29 October was the busiest of the year with 3,381 homes auctioned, whereas 2,170 homes went under the hammer in the same week last year.

Melbourne is expected to host its second busiest auction week of the year, with 1,218 homes scheduled for auction. This represents an increase of 160.3% compared to the prior week’s figure of 468.

Sydney is expecting its busiest auction week since mid-April 2022 (1,490), with 1,125 properties up for auction.

It will be interesting to see if the RBA’s latest interest rate hike dampens sentiment and pushes auction clearance rates lower, along with price growth.