The September labour force survey from the Australian Bureau of Statistics (ABS) reported that the nation’s unemployment rate was only 3.6% and had barely moved for nearly a year.

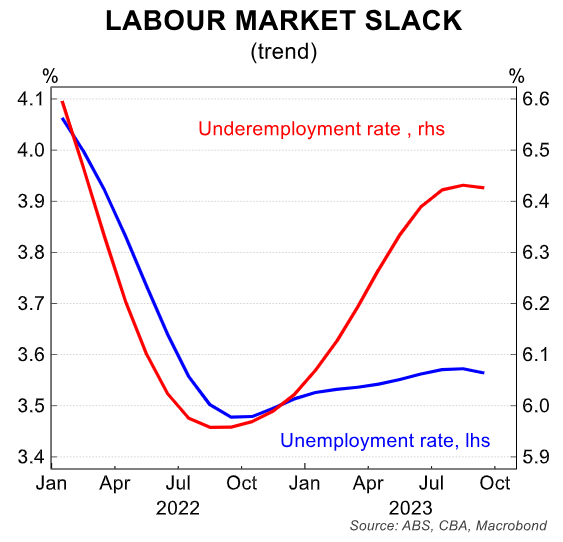

The ABS trend series mitigates monthly fluctuations and shows only a mild deterioration in the labour market.

Australia’s headline unemployment rate has risen only 0.2% since October 2022, whereas the underemployment rate has lifted 0.5% in the same period:

Therefore, the official ABS labour market survey suggests that Australia’s labour market has loosened over the last year but remains tight overall.

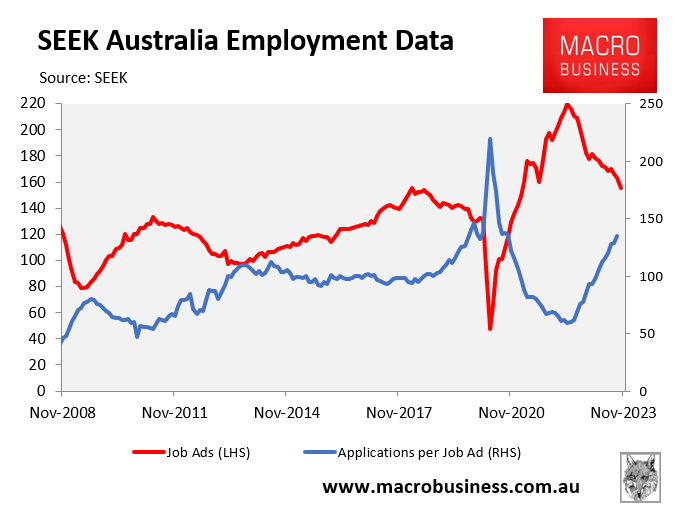

On Wednesday, SEEK released its monthly labour market survey for October, which posted a severe deterioration in both job ads and the number of applications per job ad:

Job ads on SEEK plummeted 5% over the month in seasonally adjusted terms to be down nearly 20% compared to October 2022.

More worryingly, applications per job ad lifted 4.1% in September (there is a one-month lag on this series), and is now tracking at its highest level on record.

SQM Research managing director, Louis Christopher, asked the salient question: “Big question for next year is what happens if employment growth stalls and we still have 400K+ entrants into the country?”

It is a pertinent question.

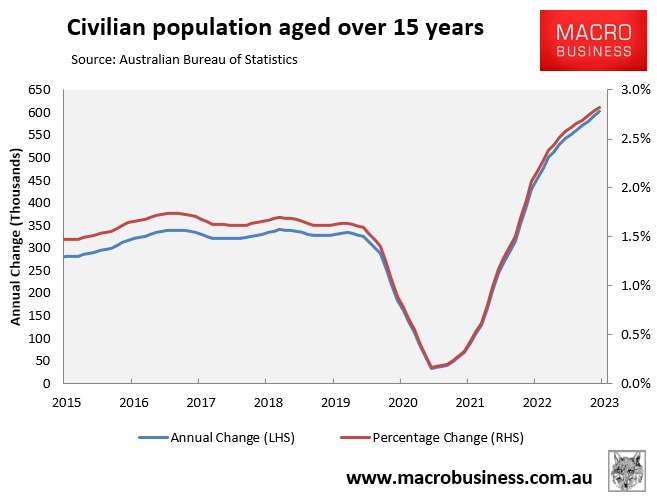

The ABS’s labour force survey shows that Australia’s population aged 15 and up grew by 601,000 (2.8%) in the year to September 2023, about double the rate of the pre-pandemic period:

Amid such rapacious supply growth, Australia’s labour market must generate roughly 37,000 jobs per month to maintain a steady unemployment rate with an unchanged participation rate.

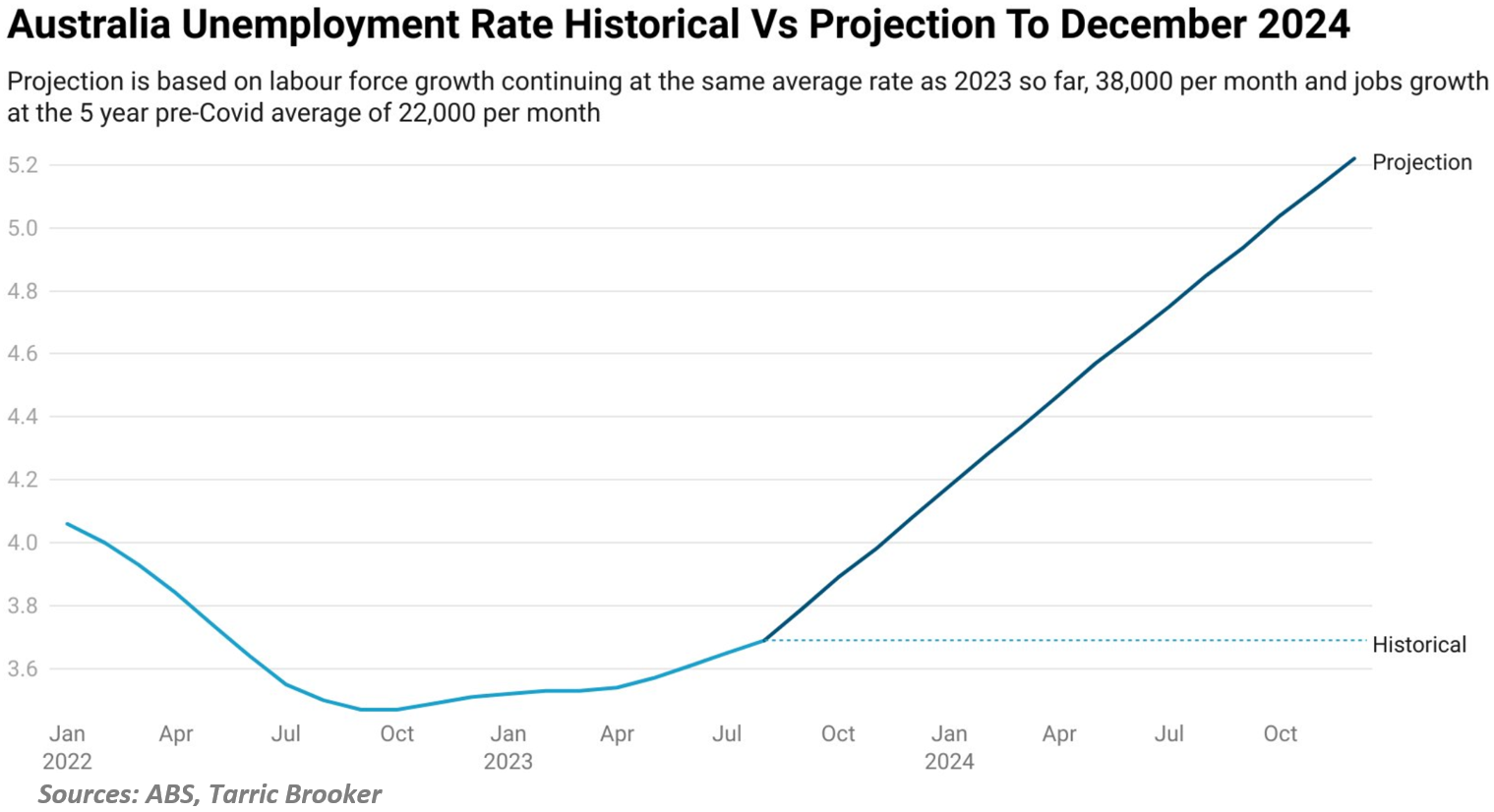

Independent economist Tarric Brooker recently estimated that if the labour force continues to grow at its current record pace and jobs growth simply returns to its five-year pre-pandemic average of 22,000 per month, then Australia’s official unemployment rate would rise to 5.2% by the end of 2024:

In summary, Australia is absorbing a greater number of workers via net overseas migration than it is generating through new employment creation.

As a result, the official unemployment rate in Australia could surpass 5% within a year.

Rising unemployment will also exert downward pressure on Australian wages, meaning incomes will likely continue to lag behind inflation.

It is especially worrying for Australian tenants, who are also facing strong rental price inflation.

The situation is a triple whammy for the one-third of Australians who rent: increasing unemployment, stagnant wage growth, and escalating rents.

And all three whammies are made worse by the Albanese government’s unprecedented net overseas migration.