ANZ Bank CEO Shayne Elliott told its AGM on Thursday that while the Australian and New Zealand economies remain “remarkably robust”, he expects economic growth to decline in 2024.

“The outlook is certainly more challenging, with interest rates and inflation expected to remain high, geopolitical risks rising and capital flows changing faster than we have seen in some time”, he said.

Chairman Paul O’Sullivan said that many of its customers were struggling with cost-of-living increases and that financial hardship could increase for some of them over the next 12 months.

“We know many of our customers are feeling the financial pressure, and indeed some may find themselves in financial difficulty over the coming year”, he said.

I agree with this sentiment.

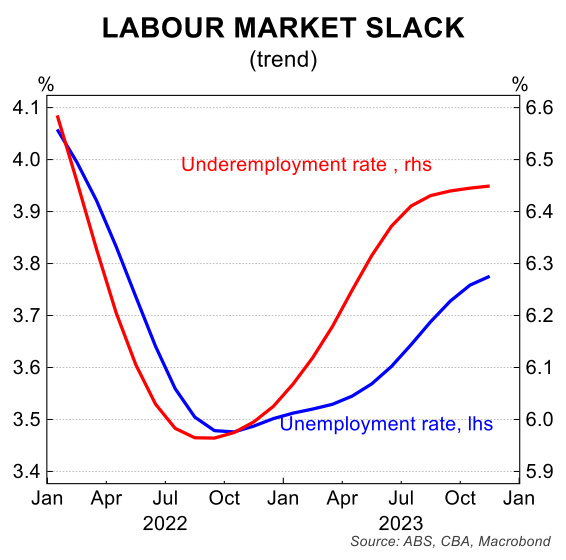

Unemployment is likely to rise significantly in 2024, and I expect it to be approach 5% by year’s end, up from 3.9% currently.

This alone could throw thousands of Australians into financial stress.

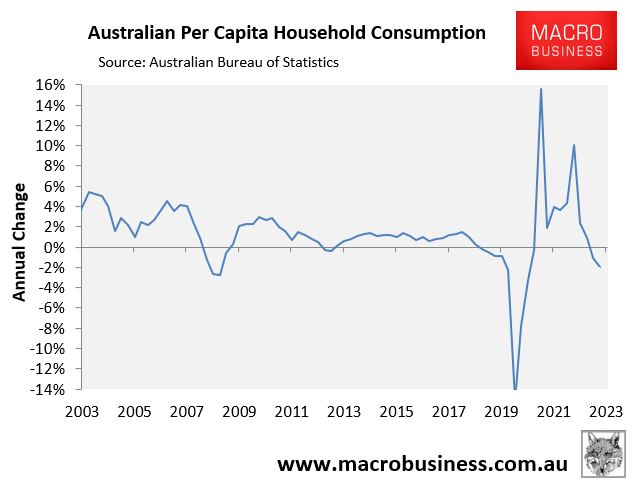

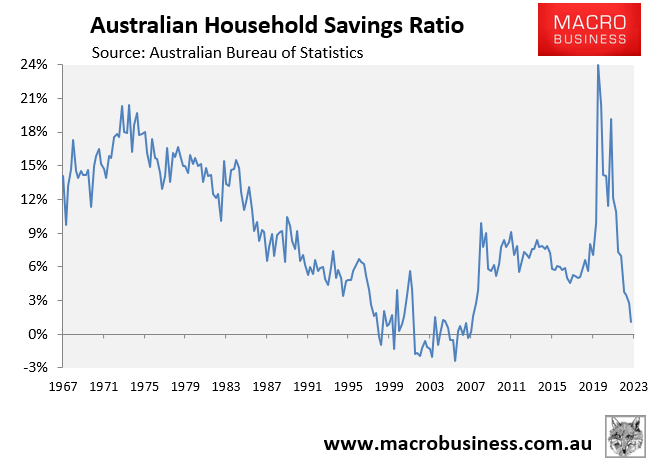

Meanwhile, households are likely to cut their consumption further as the household savings rate is already near zero and there is little prospect of real income growth:

One positive is that relief could arrive for mortgage holders in the second half of 2024 as the RBA commences an interest rate easing cycle.

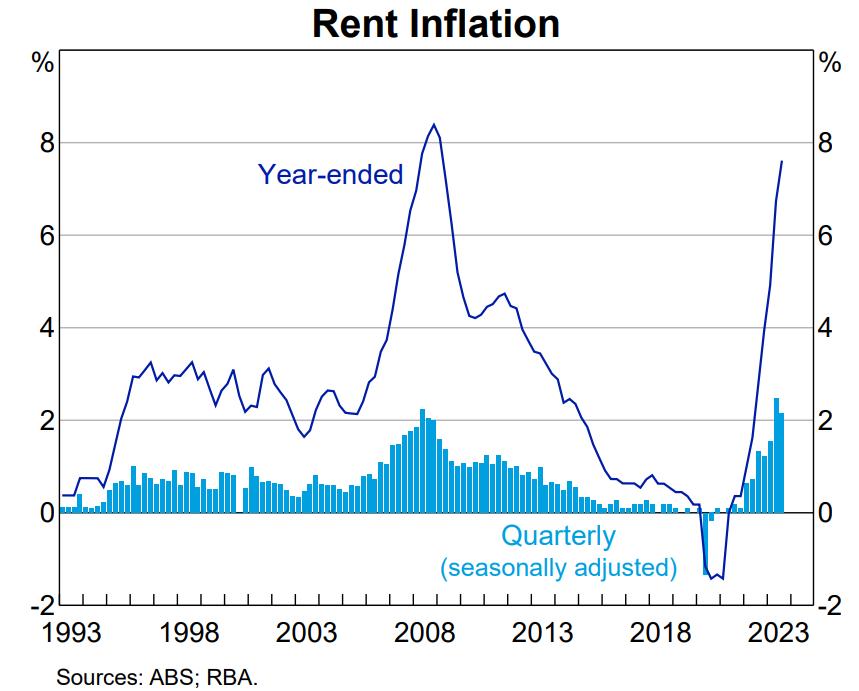

But rents should expect to experience another year of strong rental growth as demand via population growth continues to easily outpace supply.

Overall, Australian households should expect another poor year of falling materially living standards.