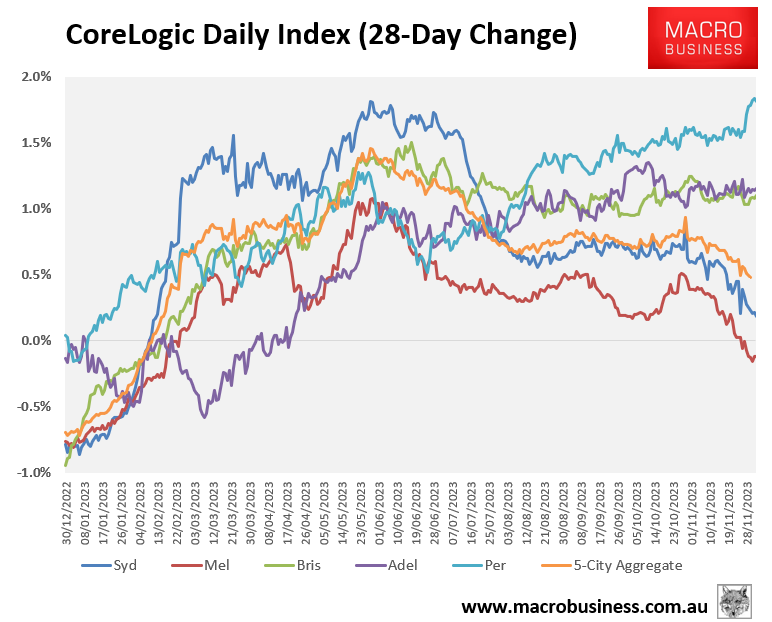

CoreLogic’s daily dwelling values index shows that house price momentum across Sydney and Melbourne has slowed materially since the RBA’s Melbourne Cup Day rate hike, which has also pulled down value growth at the 5-city aggregate level:

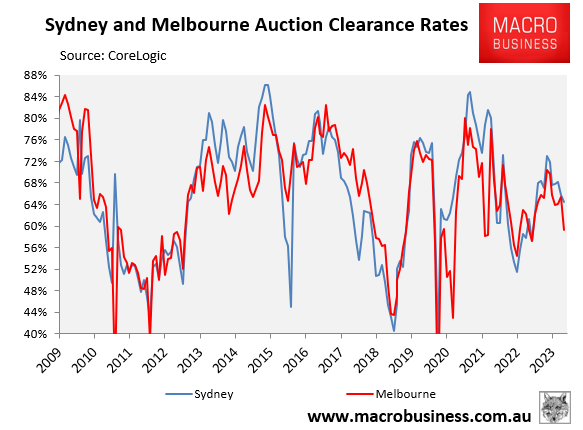

This downturn has been matched by the auction market, with November seeing final clearance rates fall sharply across both cities:

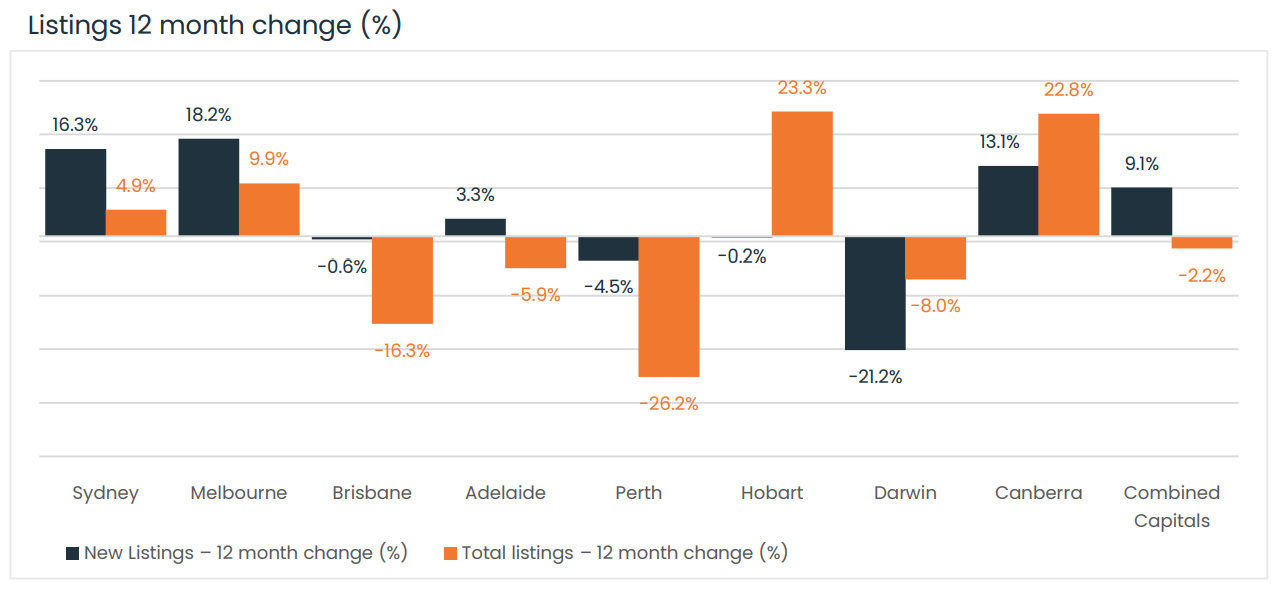

Listings have also swollen across Sydney and Melbourne, which helps to explain their falling price growth:

Source: CoreLogic

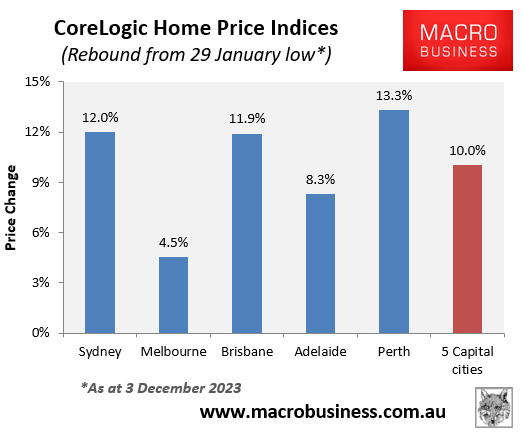

The budding downturn has led to some industry players claiming that Australia is facing a “double-digit” housing correction as the headwinds from the RBA’s latest rate hike overwhelms the stimulus from record population growth.

“With Sydney home values slipping into negative growth over the last week of the month, we could see Sydney following Melbourne’s lead, with home values stabilising or moving into a mild double-dip downturn in December and coming into early January”, CoreLogic’s research director, Tim Lawless, said over the weekend.

“I think that fragility in buyers’ demand has been exposed by the latest rate hike”.

“Borrowing capacity was further diminished, sentiment fell even lower, while lending tightened”.

“But alongside that, those markets are also seeing total advertised stock rise above the five-year average, at a time when demand is quite fragile”.

“It is looking increasingly clear that the housing market is moving through a new inflection point, with the rate of growth in home values becoming more diverse, but generally weakening”, Lawless warned.

It is a sentiment shared by AMP chief economist Shane Oliver:

“Sydney and Melbourne house prices are decelerating faster than expected, so I suspect high interest rates are now starting to dominate”.

“Short of imminent rate cuts, which are most unlikely, it looks like the supply shortfall-driven rebound in home prices this year is rapidly coming to an end as high rates get the upper hand again”.

“I expect national prices to fall between 3% and 5% in the next 12 months”.

To his credit, independent economist Stephen Koukoulas (‘The Kouk’) was one of the only economists to have predicted the strong price rebound in the face of ongoing interest rate hikes:

Last week. the Kouk joined the chorus predicting a correction next year:

“I say, it [the rate rise] could be the straw that breaks the camel’s back. The housing market was holding on there, but all of a sudden, there’s this proverbial last rate hike that’s having those detrimental effects”.

“Stock shortage is no longer as acute as it was six or 12 months ago and there’s evidence that listings are about to increase as people start to feel the strain of repaying a big mortgage”.

“A lot of the demand that came from that initial jump in population growth is still there, but it’s also moderating. At the same time, the labour market is starting to weaken and unemployment is starting to tick up”.

“So when you put all those things in together, I think we’re going to see anywhere between 3% and 5% drop in Sydney and Melbourne house prices”.

SQM managing director, Louis Christopher, also predicted falling home prices for five capital cities next year, alongside the strong possibility of a negative result nationally, in his recently released Boom & Bust Report:

“The interests rate rises of 2022, 2023 and possibly 2024 will finally start to bite homeowners and would-be homebuyers alike”.

“Distressed selling activity is expected to jump, especially in NSW where we are already starting to see a new trend upwards in that data set”.

The end could be nigh for Australia’s house price rebound.