DXY was up last night on a decent 200k US jobs:

AUD was squashed:

CNY is fading:

Oil caught a bid, gold sold:

Dirt meh:

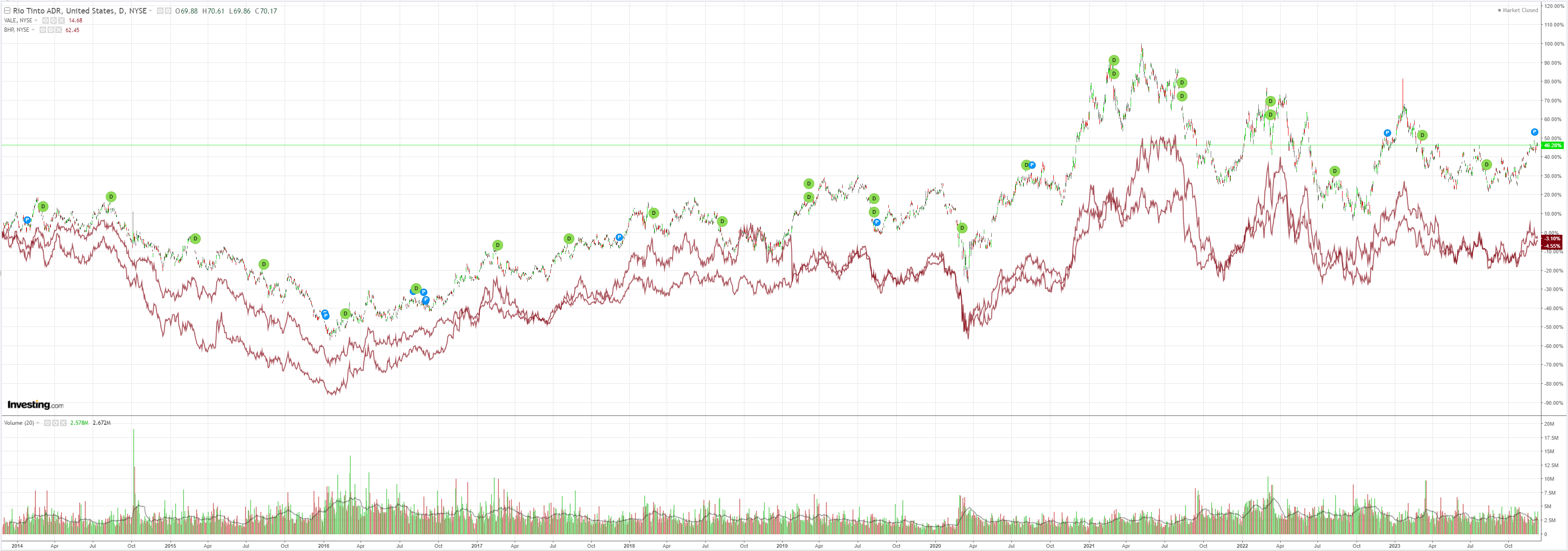

Miner meh:

EM death:

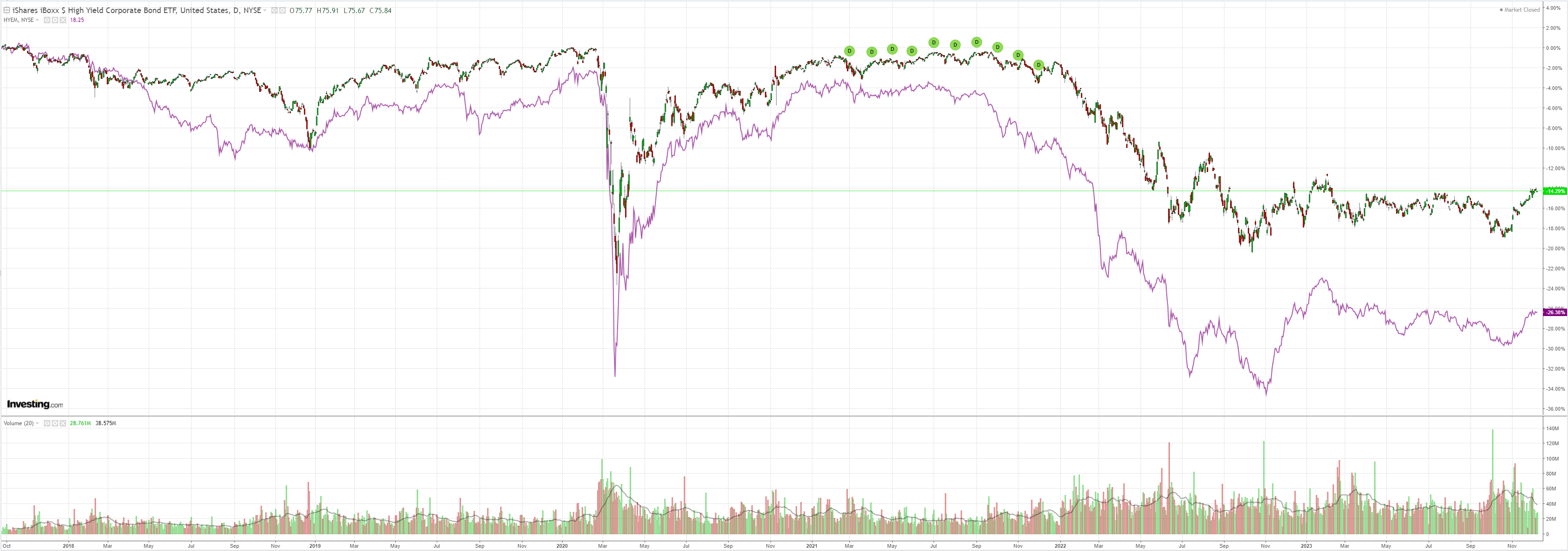

Junk meh:

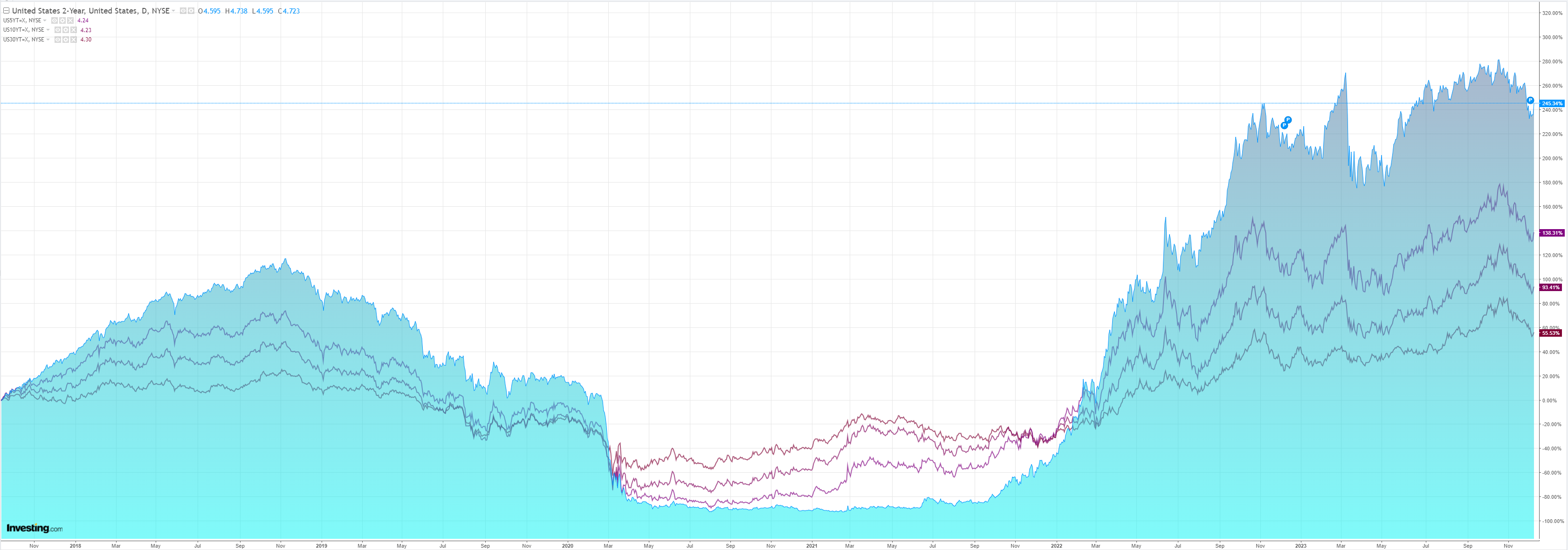

Yields popped with jobs:

Stocks too:

Let’s talk about 2024. Deutsche has a crack at it.

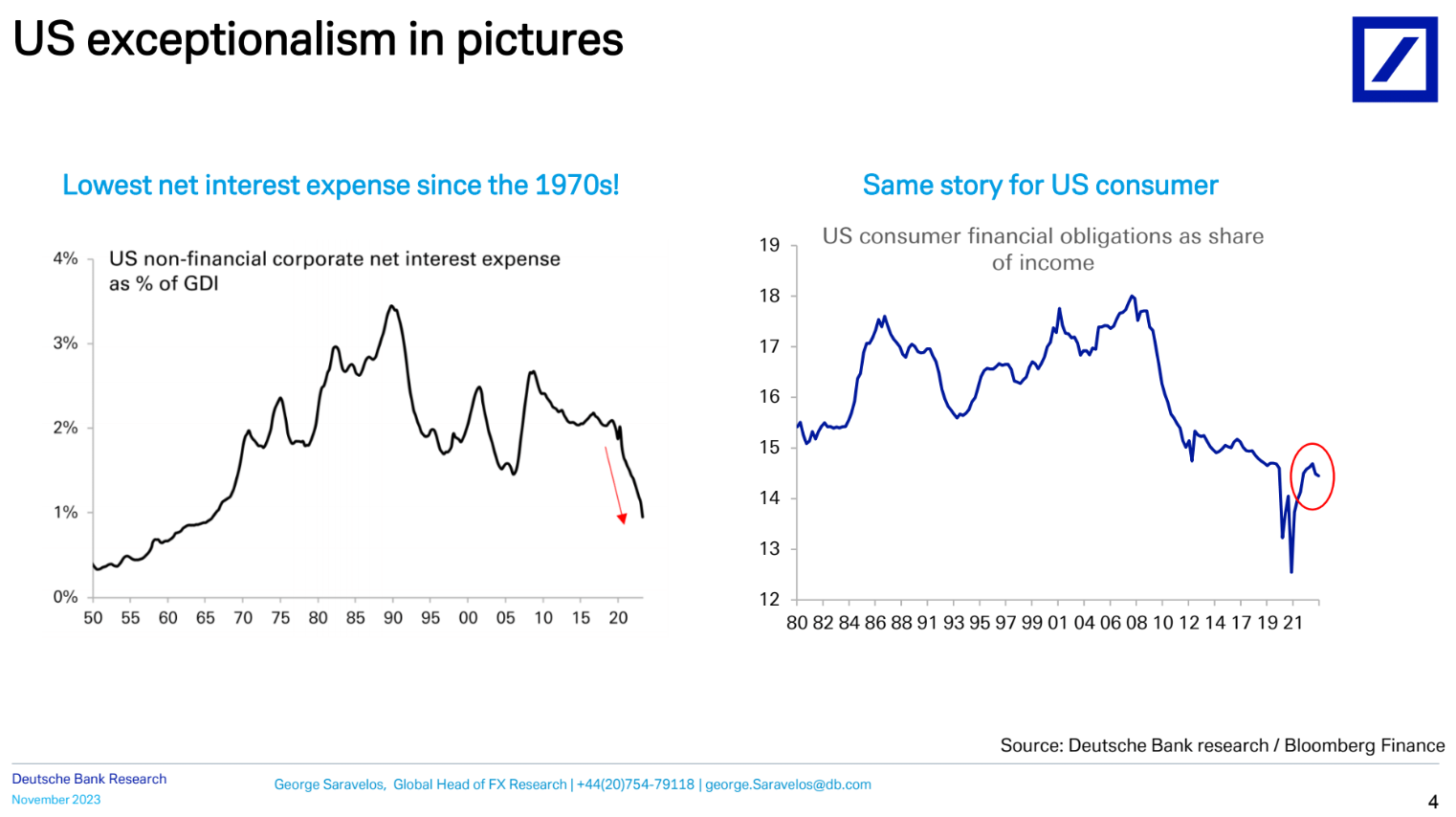

- The dollar has stayed strong this year on a very big widening in US–global growth differentials and high real rates.

This is mostly because tight Fed policy is not yet transmitting to the US economy like elsewhere and Americans are spending their excess savings while others aren’t.

For the dollar to turn the Fed needs to pivot dovish and cut more than elsewhere.

However, the risks versus market pricing are that the Fed easing cycle is delayed and the dollar remains a high-yielder.

There is also now very little safe-haven risk premium priced into the USD despite high (geo)political risks next year.

- European currency fundamentals are strong, this is reflected in a very high trade-weighted exchange rate.

The turn in EUR/USD is therefore more a function of the broader dollar.

We see EUR/USD range-bound below 1.10 for most of next year unless and until the Fed pivots dovish.

There are risks the ECB cuts first, pushing EUR/USD closer to parity.

- The Japanese government is running a huge carry trade, funded in short-dated bank liabilities and invested in long-duration domestic and foreign assets.

This risks slowing down the Bank of Japan and creates fiscal dominance risks.

JPY will only strengthen when the BoJ starts a proper hiking cycle or the Fed cuts rates.

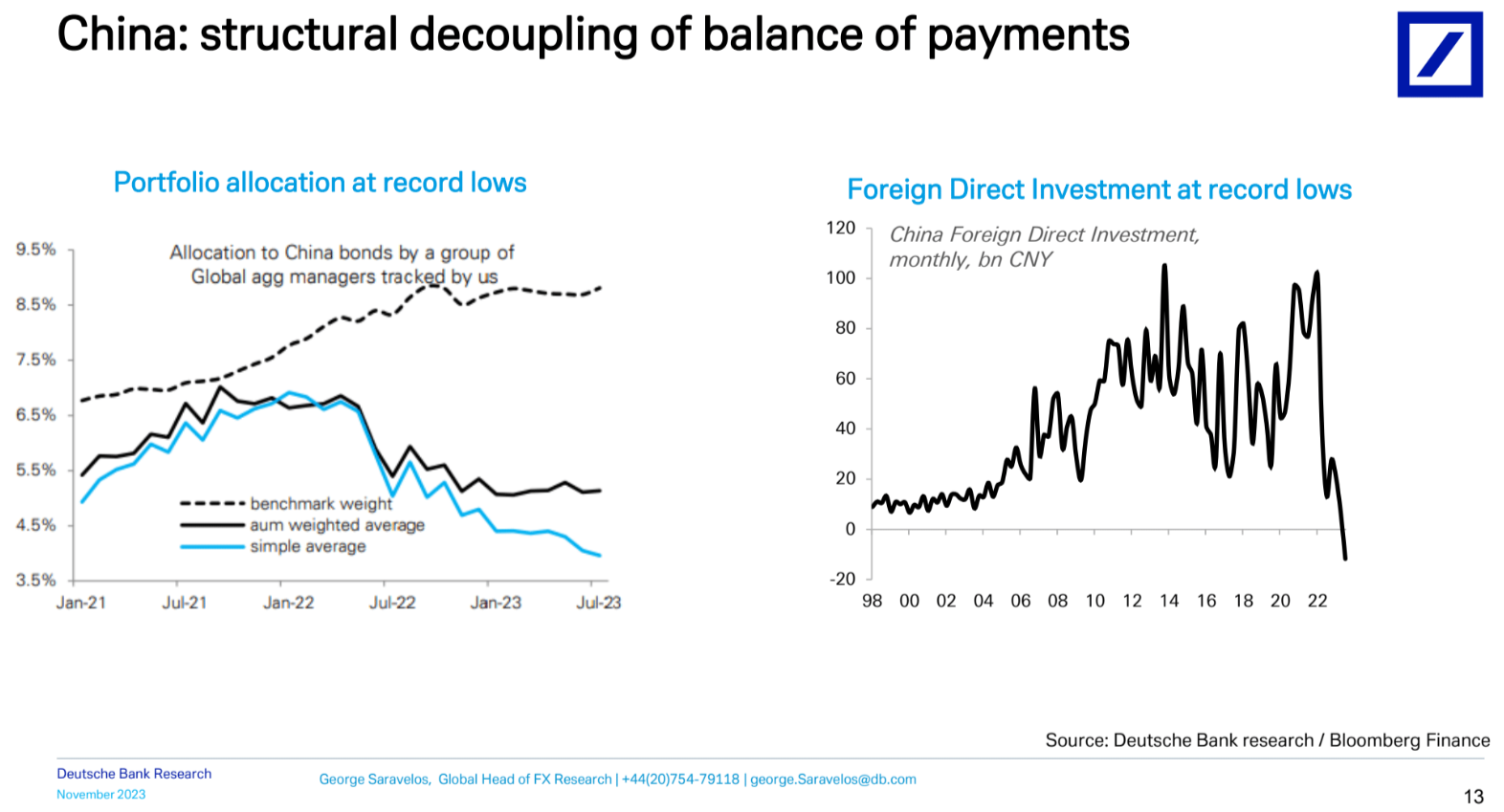

- The Chinese balance of payments is suffering from structural decoupling.

Combined with a need for lower real rates to help the Chinese economy deleverage, this means the CNY should continue to underperform.

- EM FX performance does not depend on a Fed easing cycle but the global growth backdrop.

The most bullish outcome for EM FX is a positive global supply shock,ieFed easing in a soft landing.

Falling equities and falling yields (ie, arecession) are the worst outcome.

US growth outperforming with inflation coming down should be best for EM carry.

My responses to that reasoning are as follows.

DXY will not turn decisively until global growth prospects are better than those of the US.

The US economy is going to slow sharply as public and private credit tides recede together. However, nowhere else is going to be very good, either.

- Europe will be worse than the US.

- China will set a high growth target but only reach it via a weak GDP deflator thanks to the structural property crash.

- EM cannot rally as a group if the US and China are weak.

I expect energy prices to keep deflating and to deliver the world an inflation hard landing in 2024. This might prevent a global recession (<2%). It might not.

But, it should keep some selling pressure on DXY as oil falls and the Fed can cut aggressively.

I would expect other nations to follow and go deeper, most notably in Europe.

The upshot is that a weaker DXY is the base case, but it will not fall out of bed as it has done in prior end-of-cycle events.

AUD will mirror this, and a volatile grind higher through the year is to be expected.

However, the RBA will cut earlier and deeper than futures markets predict, as energy inflation collapses.

This will prevent any tearaway AUD cycle, and a year-end AUD price of 70 cents seems about right.