DXY has pulled out of its swoon for now on some new Fed hawkspeak:

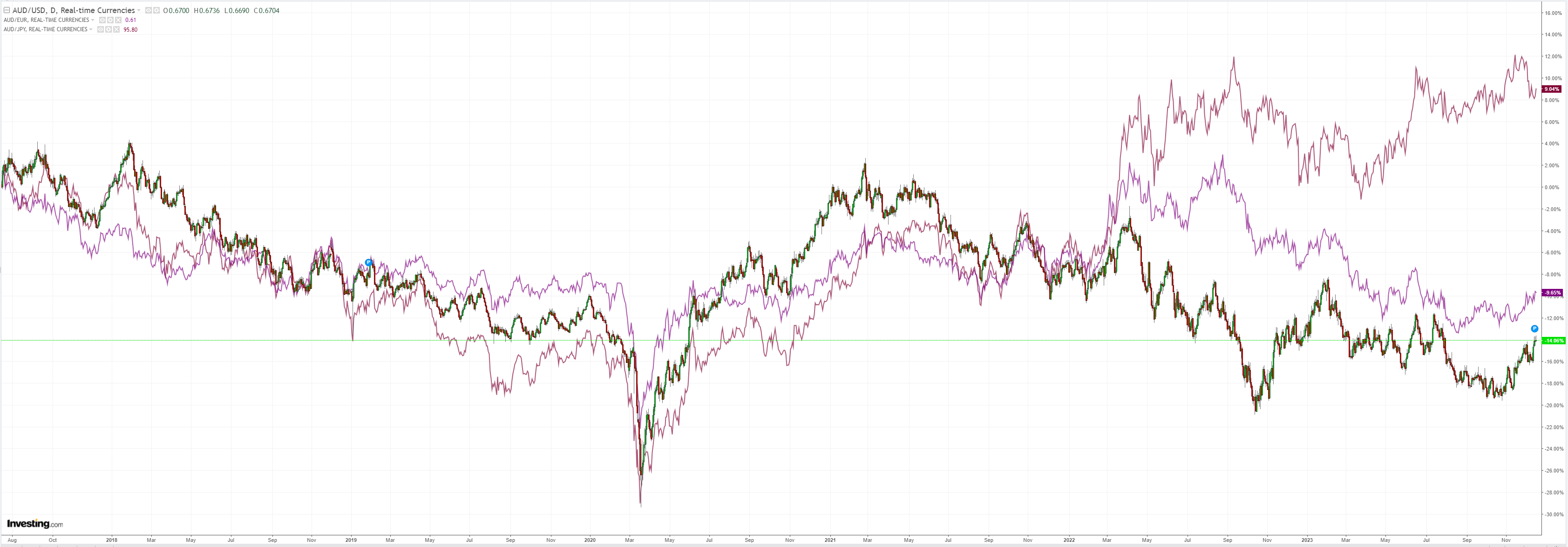

AUD is putting in some pretty impressive bearish candles:

AUD bearish bets have halved:

Advertisement

CNY concrete boots:

If oil runs, the rally will reverse:

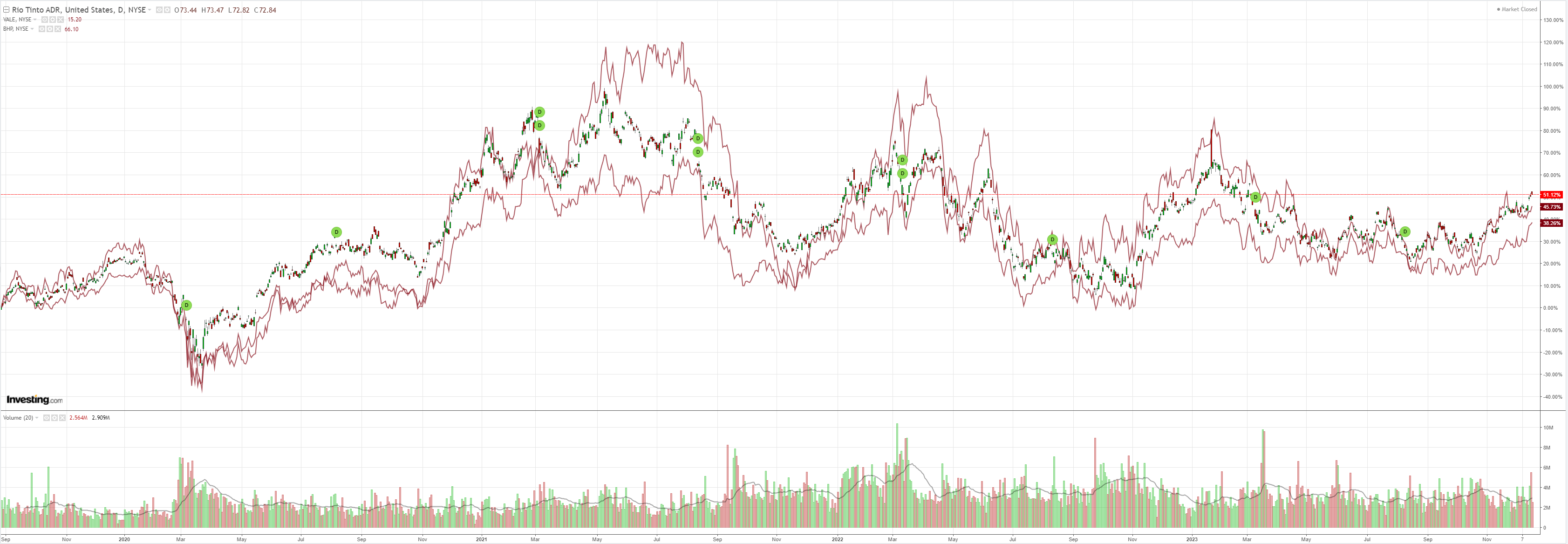

Dirt meh:

Advertisement

Miners look a good short to me:

EM dead:

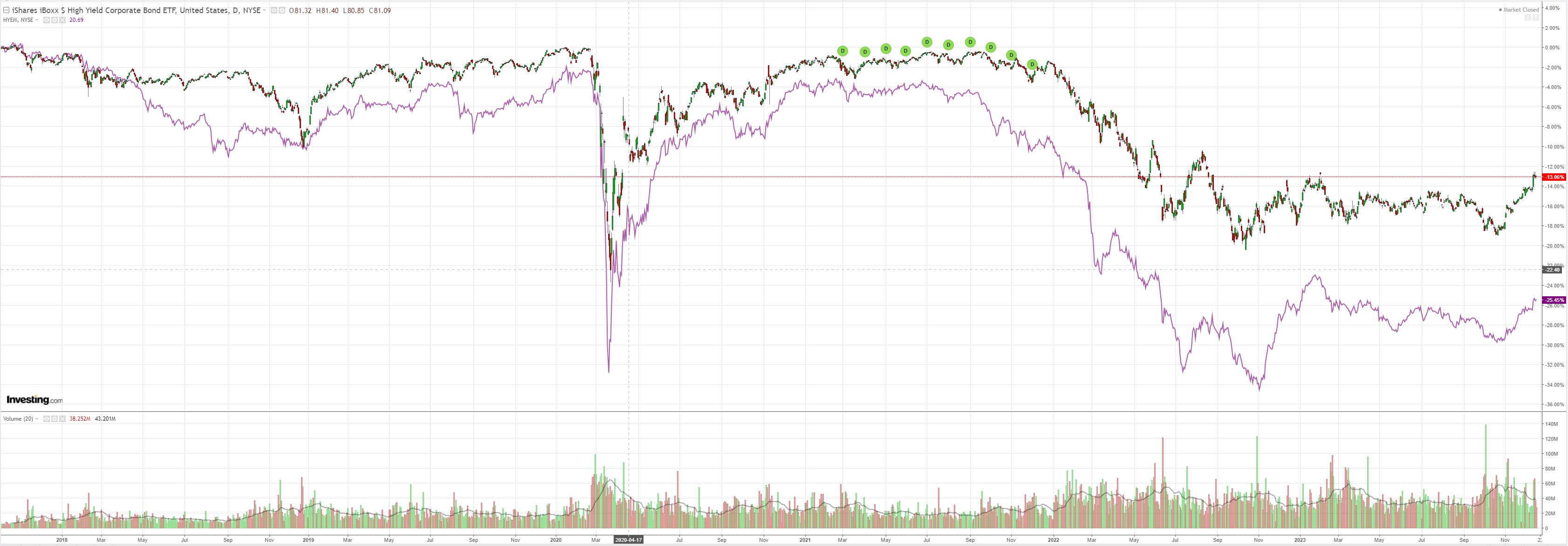

Junk flamed out:

Advertisement

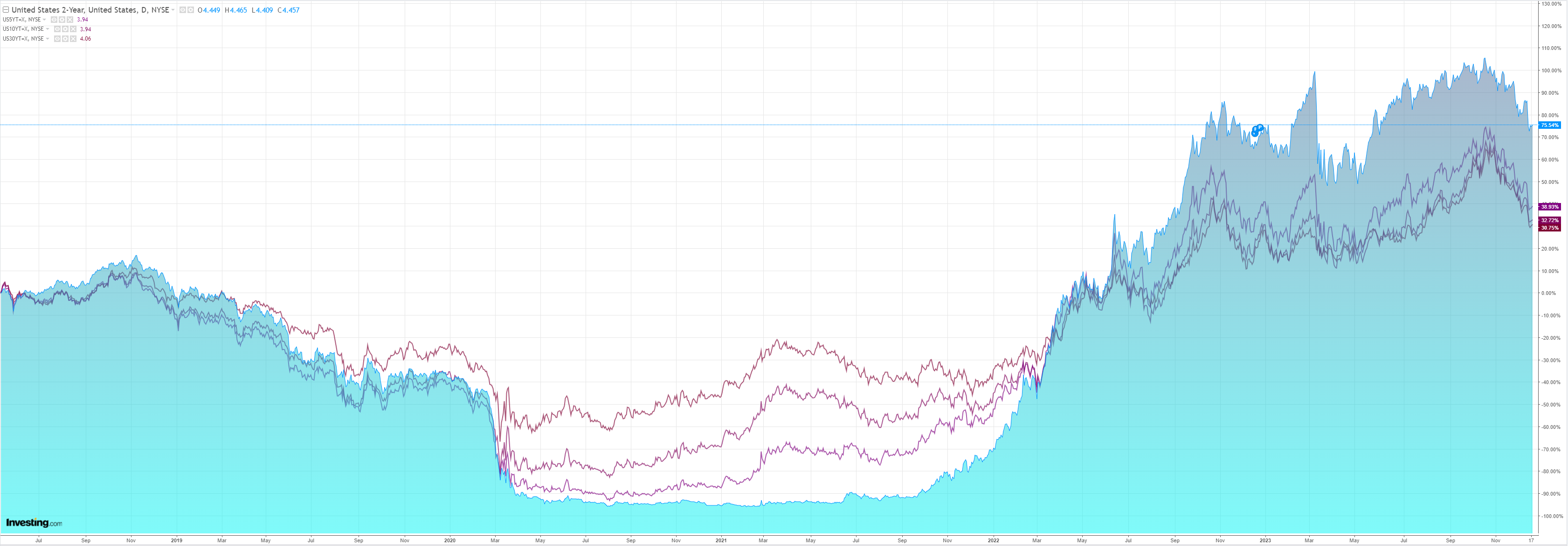

As yields reversed:

Stocks only go up:

Watch oil. It is the potential fly in the ointment for Fed cuts, falling yields, hysterical risk on, and a rising AUD.

Advertisement

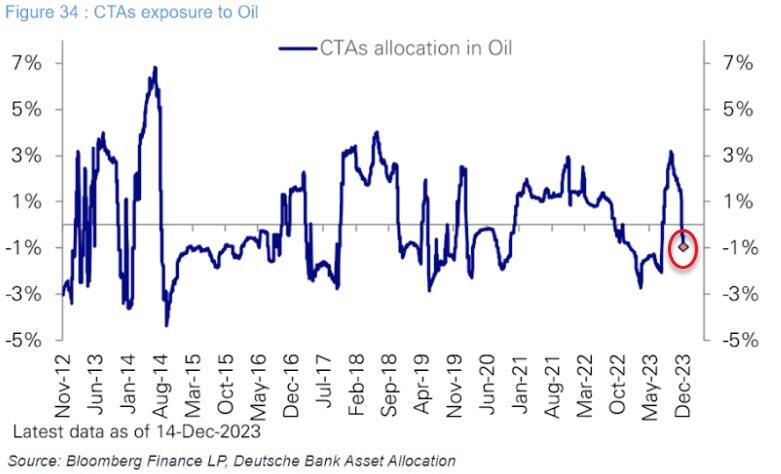

Positioning in oil is soft, so there is some scope for it to run:

But I still expect lower prices in due course as wrecked fundamentals come to bear.

Advertisement

This means any AUD reversal is temporary.