DXY firmed overnight:

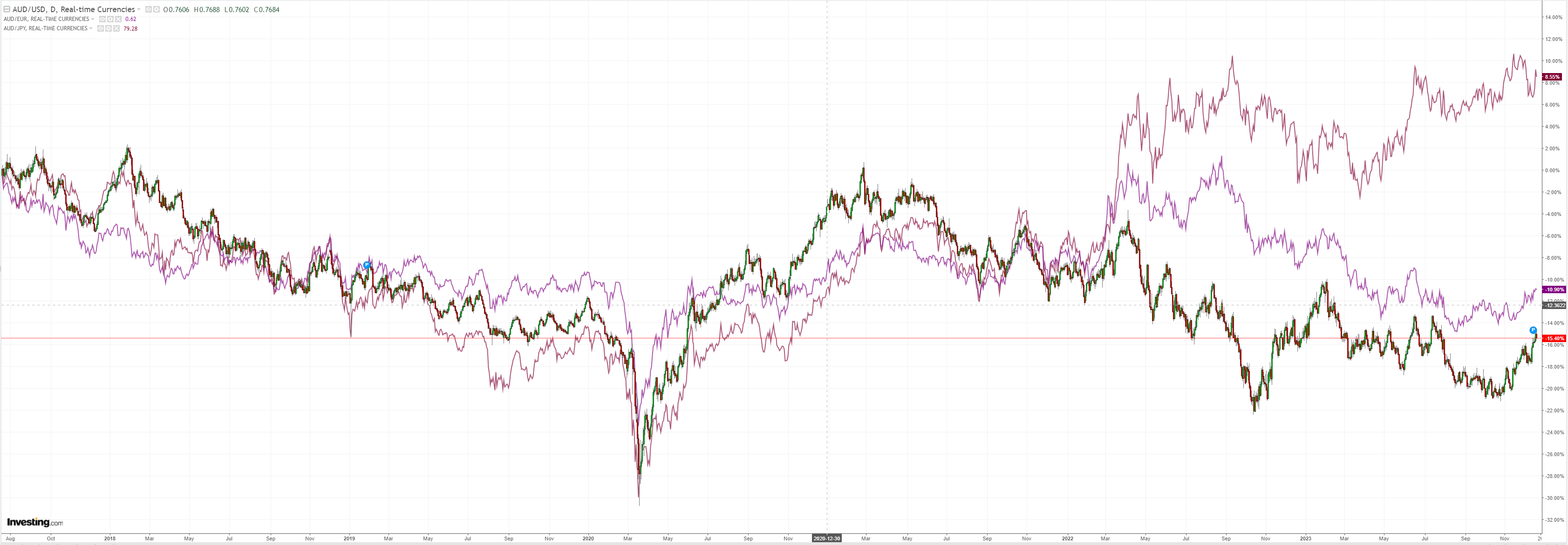

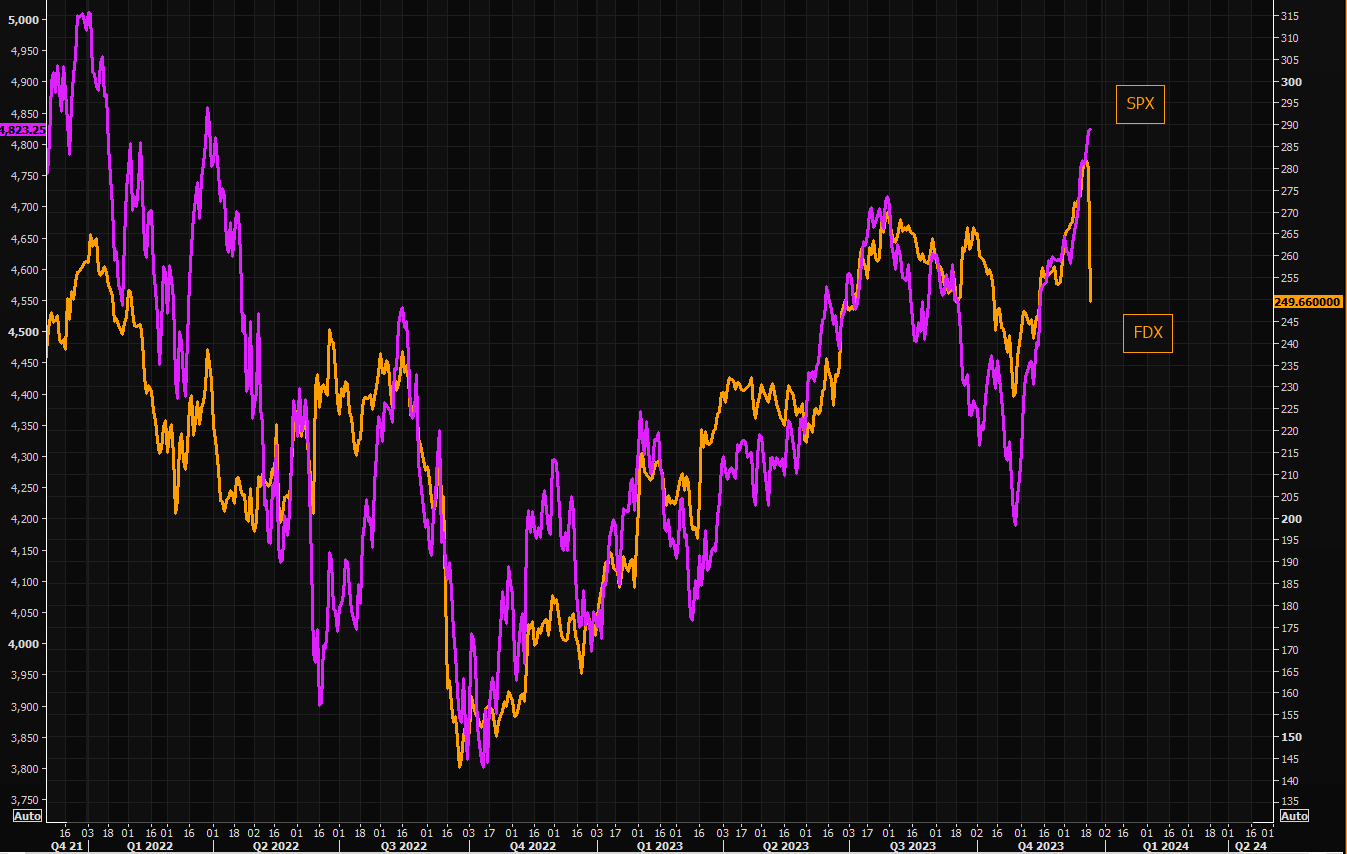

AUD was Fedexed a profit warning:

Oil is a problem:

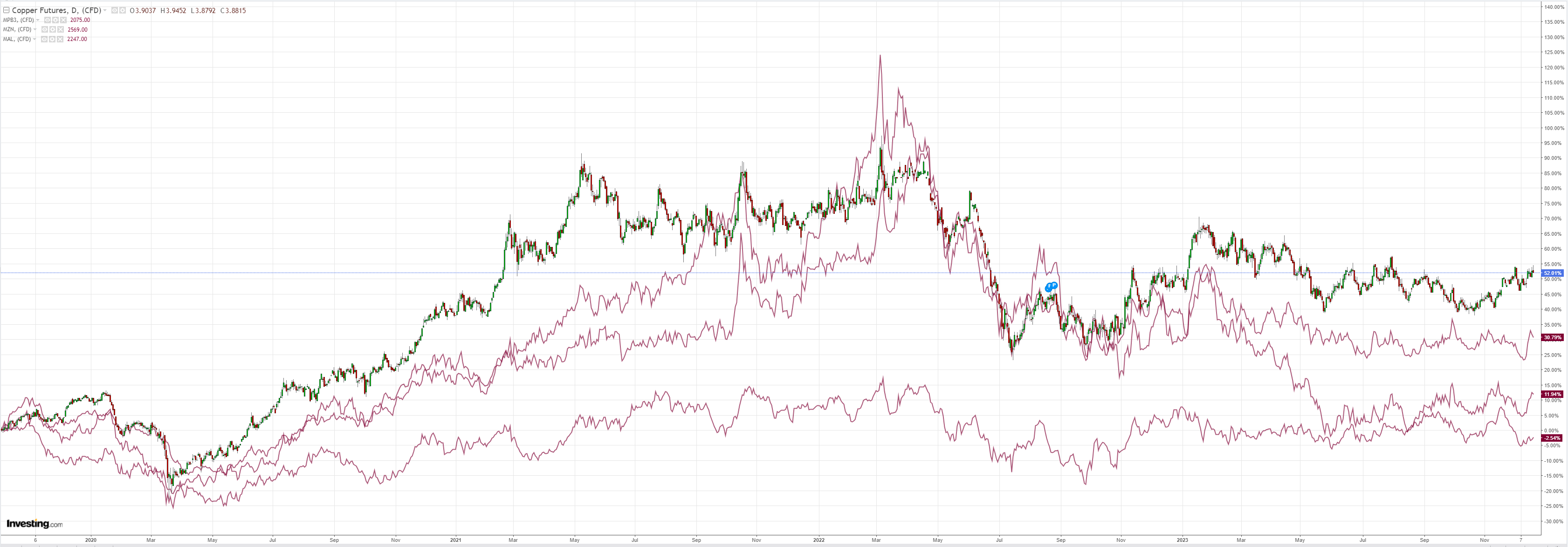

Dirt rolled:

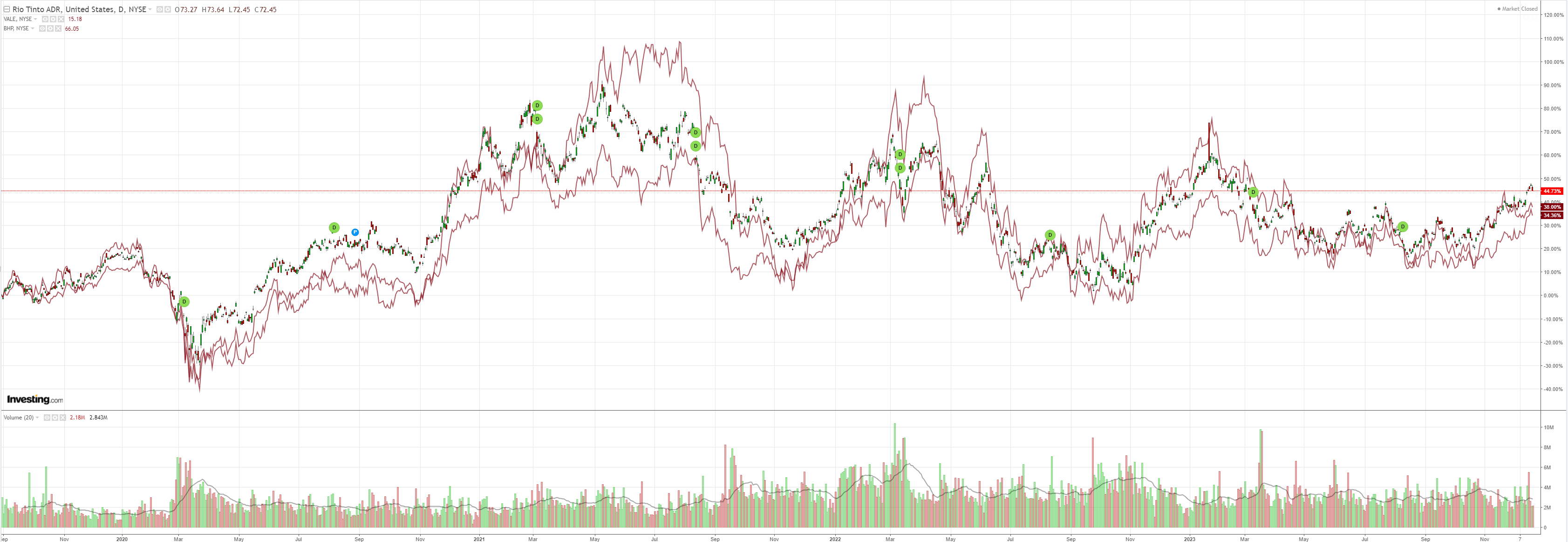

And miners:

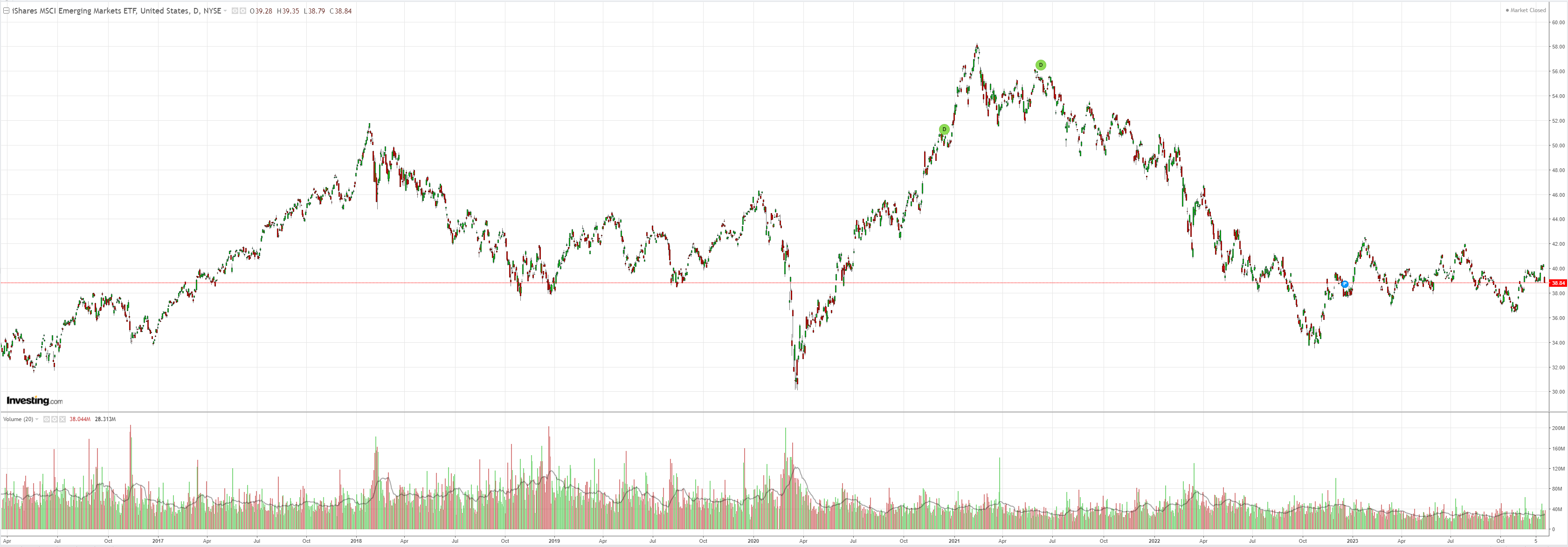

EM LMAO:

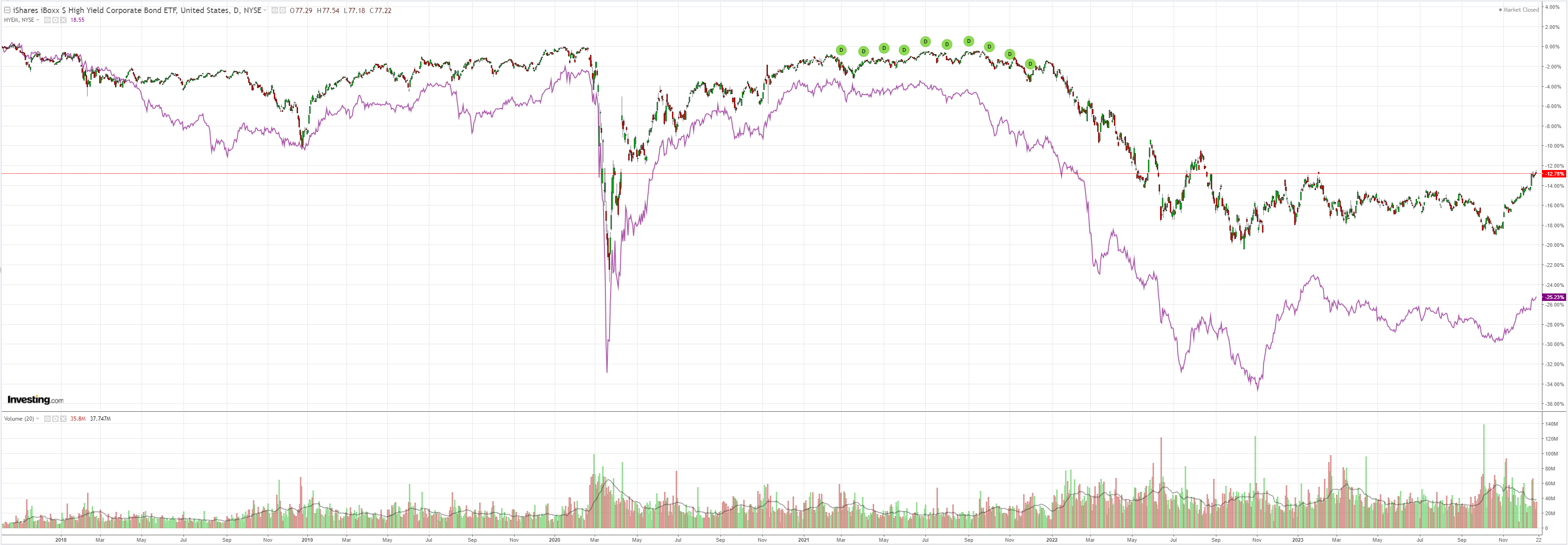

Junk still holding hope:

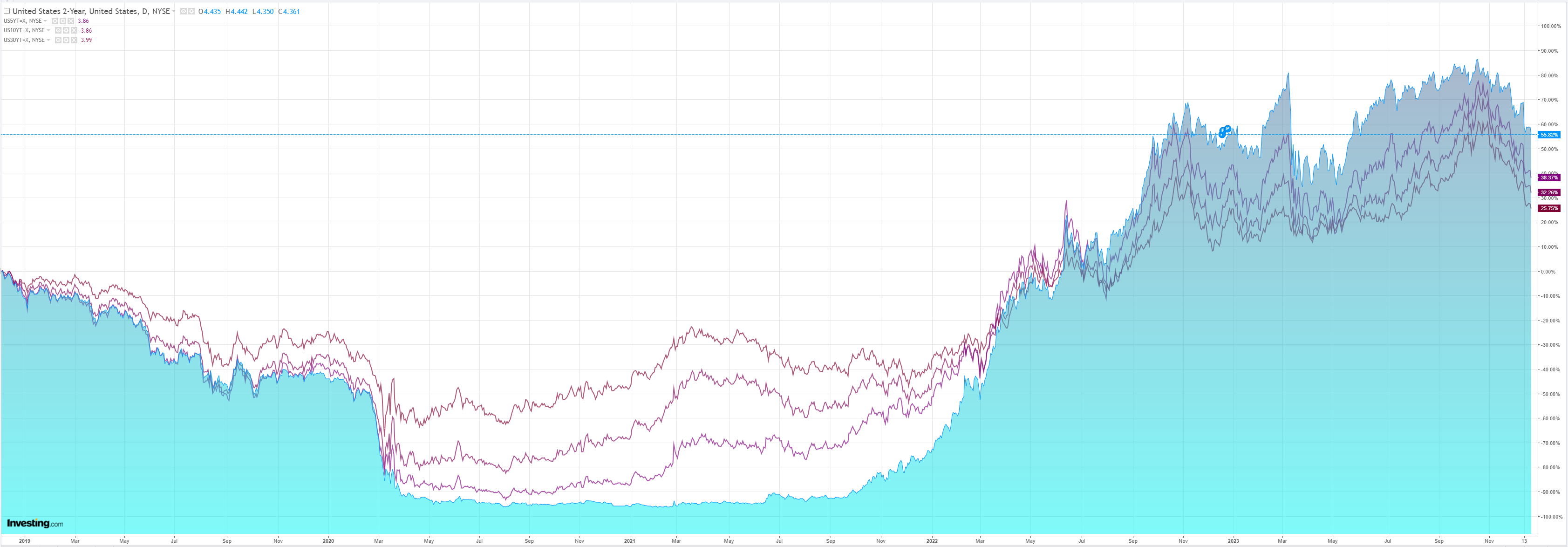

Yields kept falling:

But for the wrong reason for stocks:

At issue was a Fedex profit warning that shook market confidence in the soft landing:

As I have said repeatedly, profits are not going rise in 2024. Ongoing margin declines will confront any topline growth as inflation disappears.

Worse, both the Suez and Panama canals are choked with missiles and drought, which would raise input costs as growth slows.

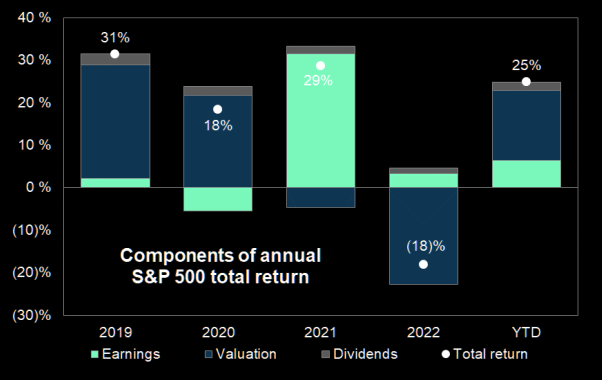

This does not necessarily mean that the rally is over. So far, it has all been multiple expansions and if yields keep falling, then than may continue:

But it does mean that any market rally will be volatile as earnings keep disappointing tearaway valuations.

Of course, if energy prices keep rebounding then the entire soft landing thesis will come into question, and multiples also contract as yields stabilise or rise.

AUD is still trending higher, but do not expect it to be clean.