Credit Agricole with the report.

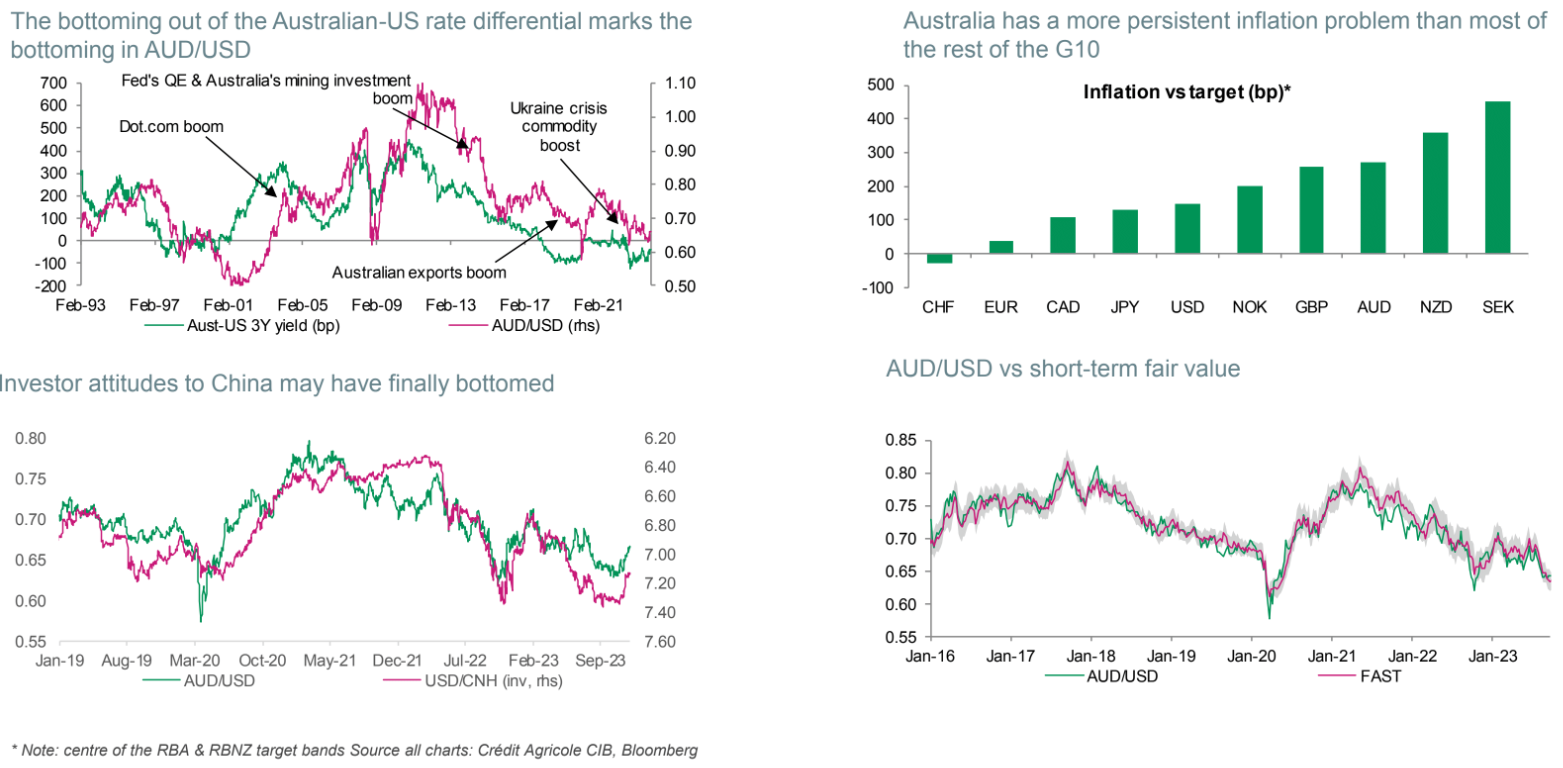

The fundamentals for AUD/USD–relative rates, China and risk sentiment–look like they are all turning.

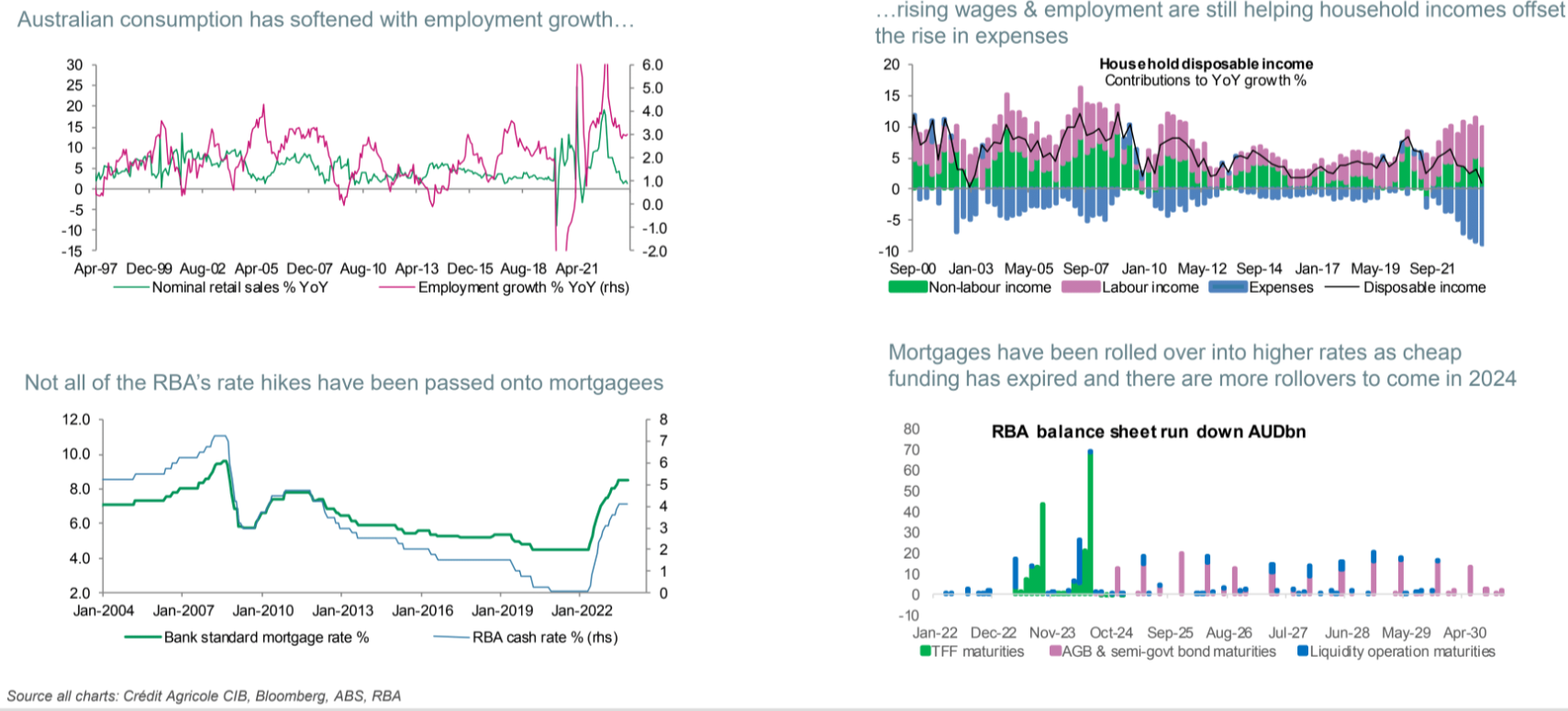

While employment growth has slowed, the housing market remains buoyant and a source of the wealth effect on consumption.

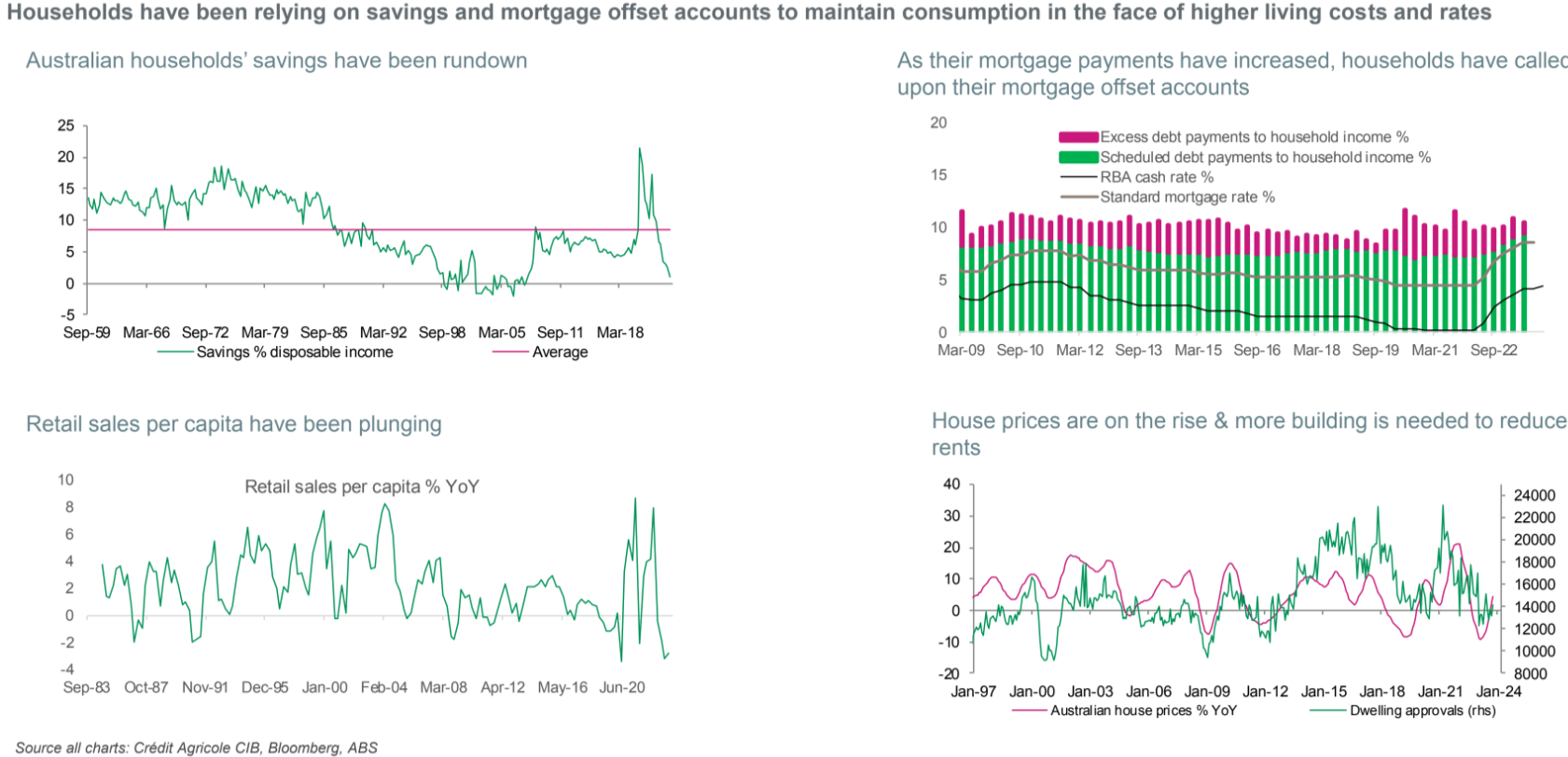

Households have been relying on savings and mortgage offset accounts to maintain consumption in the face of higher living costsand rates.

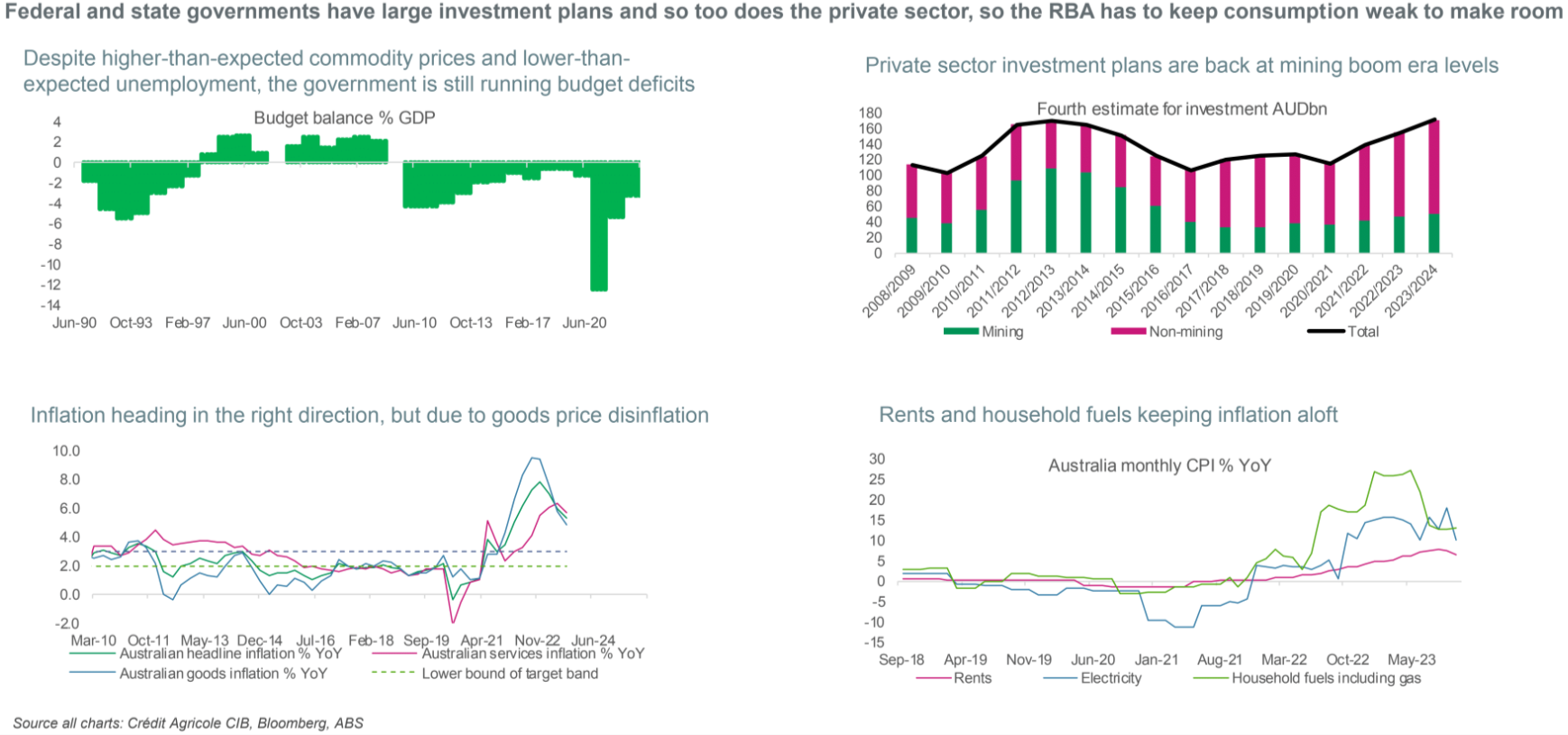

Federal and state governments have large investment plans and so too does the private sector, so the RBA has to keep consumption to make room.

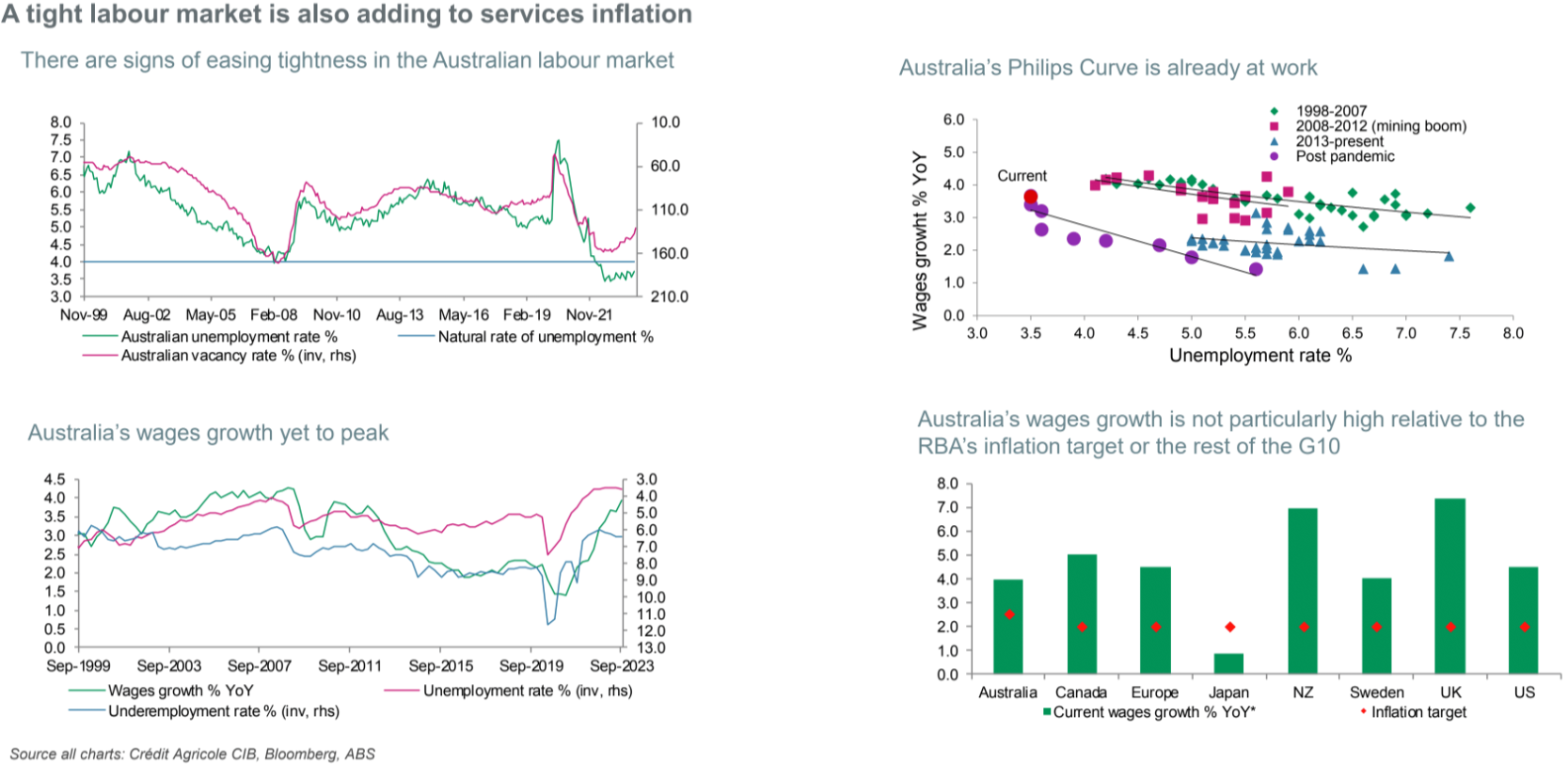

A tight labour market is also adding to services inflation.

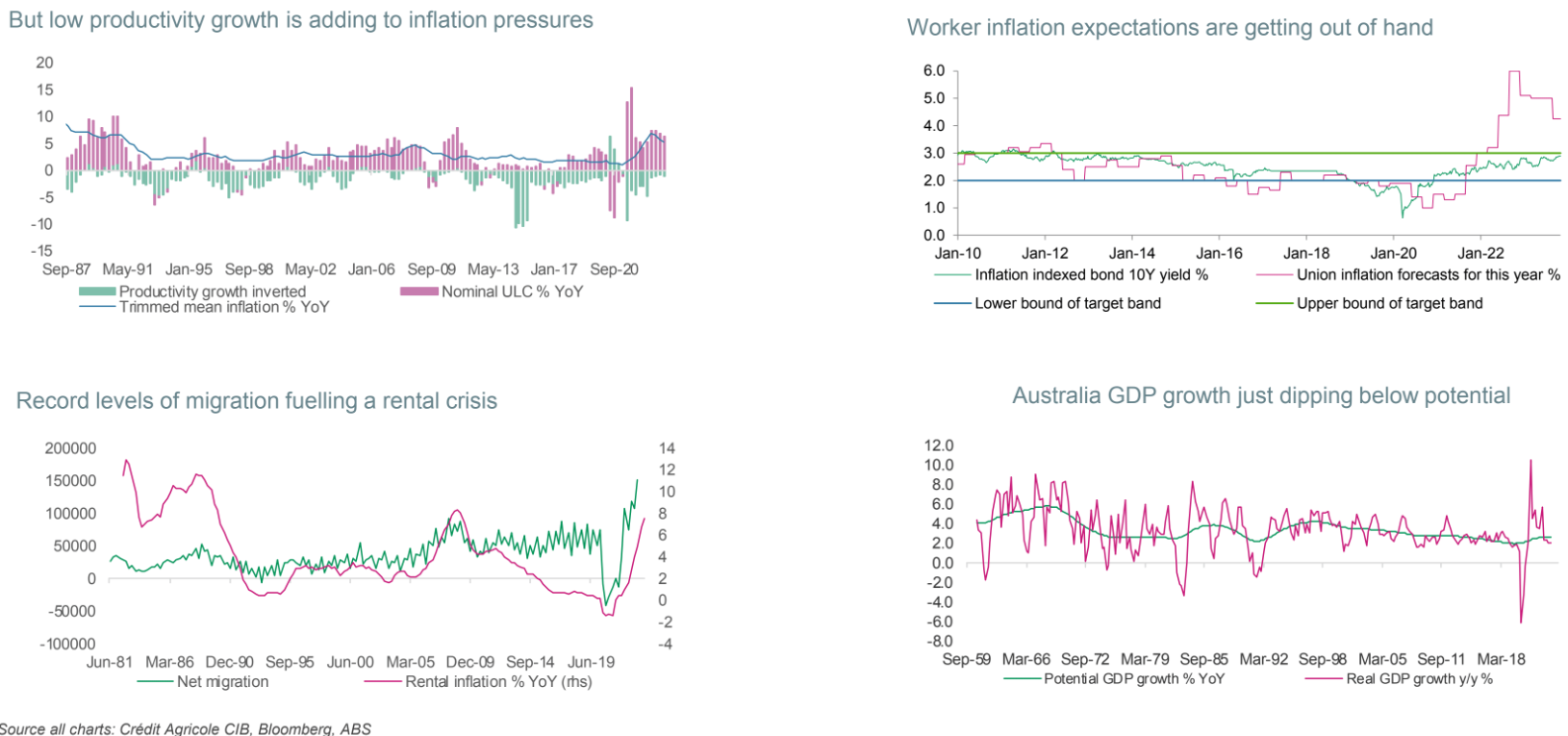

Low productivity growth is adding to inflation, inflation expectations are becoming unanchored from the inflation target, growth is slowing.

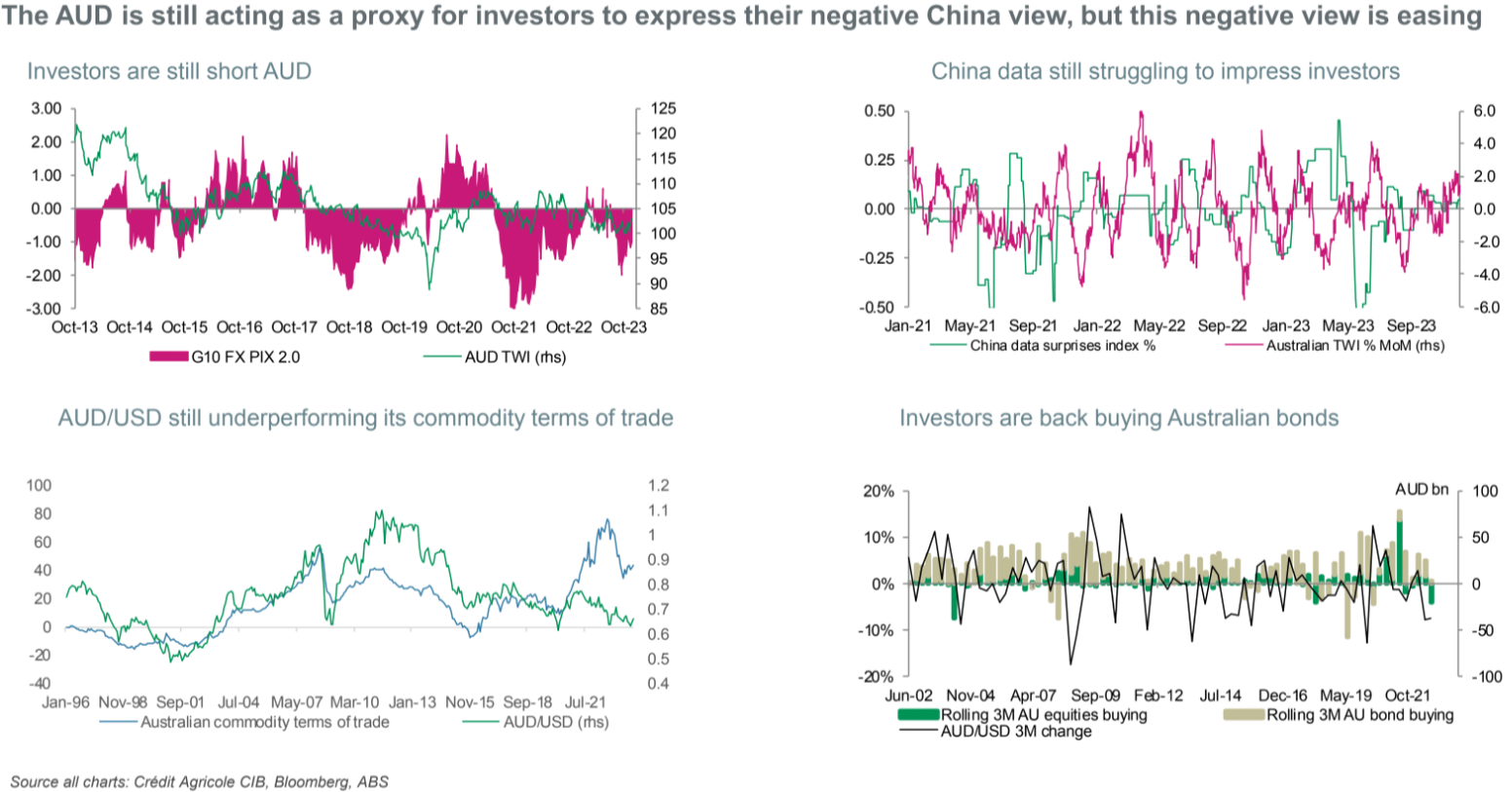

The AUD is still acting as a proxy for investors to express their negative China view, but this negative view is easing.

A few points. I agree that the negatives have diminished, and AUD has bottomed. However, it is not going to get far because the analysis is too rosy:

- households are not resilient, they are being crushed;

- this is to make room for migrants and lagged investment, the definition of unsustainable;

- China’s adjustment is structural, and the Aussie terms of trade will crater sooner or later;

- the RBA will be cutting sooner than most think owing to all of the above problems.