DXY was hammered last night:

AUD took off though could not hit a new high:

In part thanks to CNY’s concrete boots:

Advertisement

Oil didn’t fall for once. Gold popped:

Base metals meh:

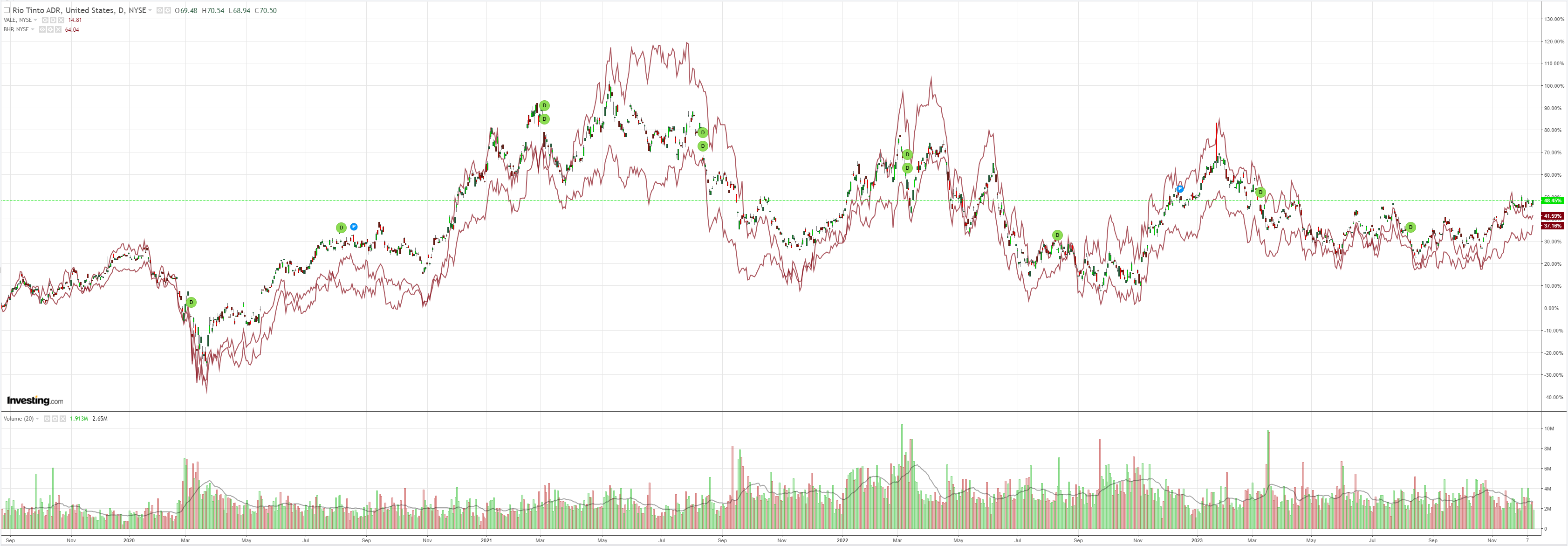

Miners meh:

Advertisement

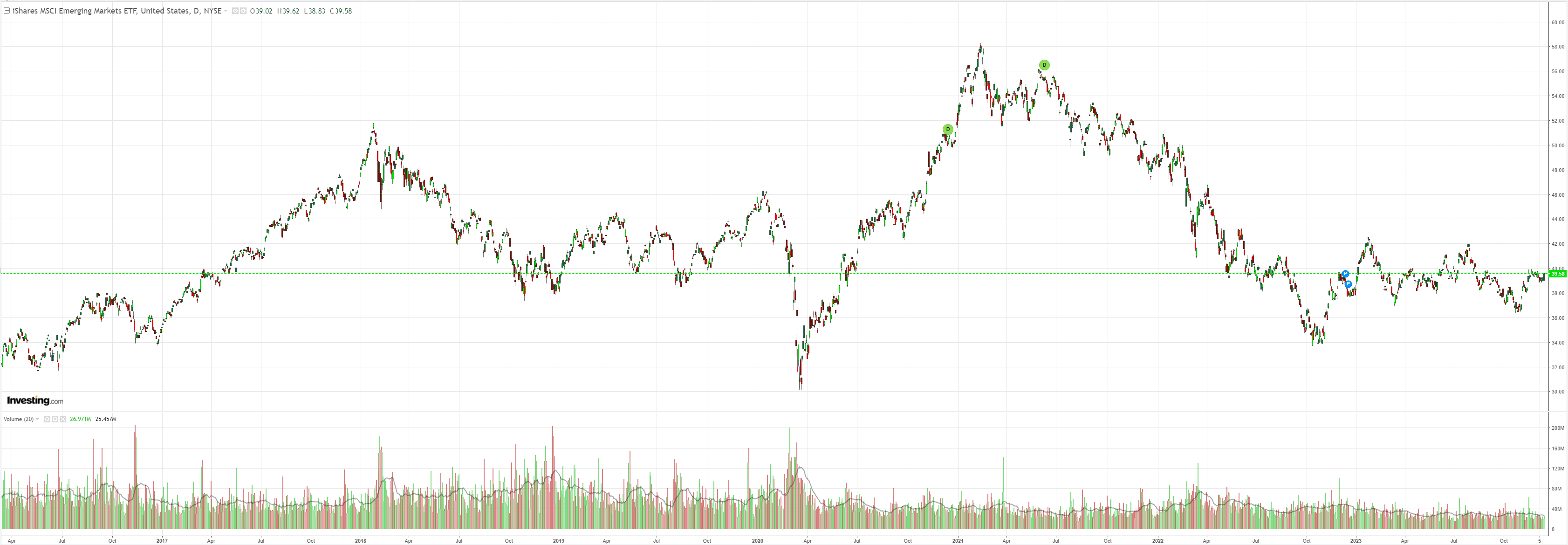

EM meh:

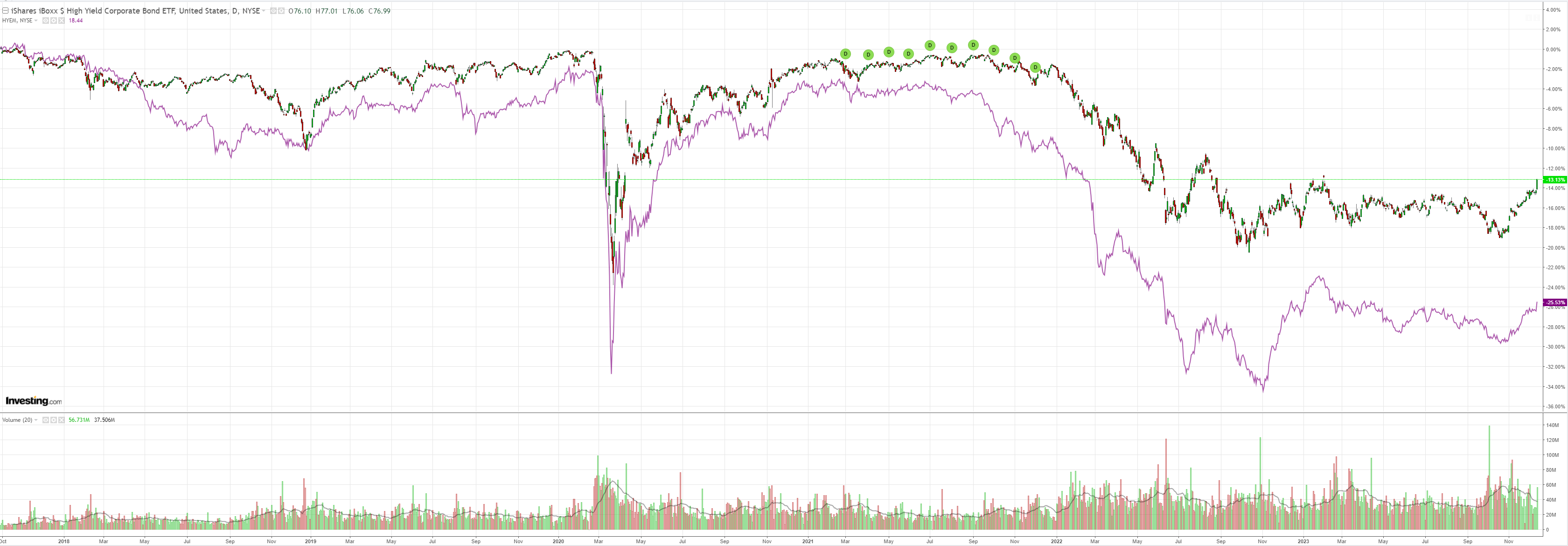

Junk is screaming up:

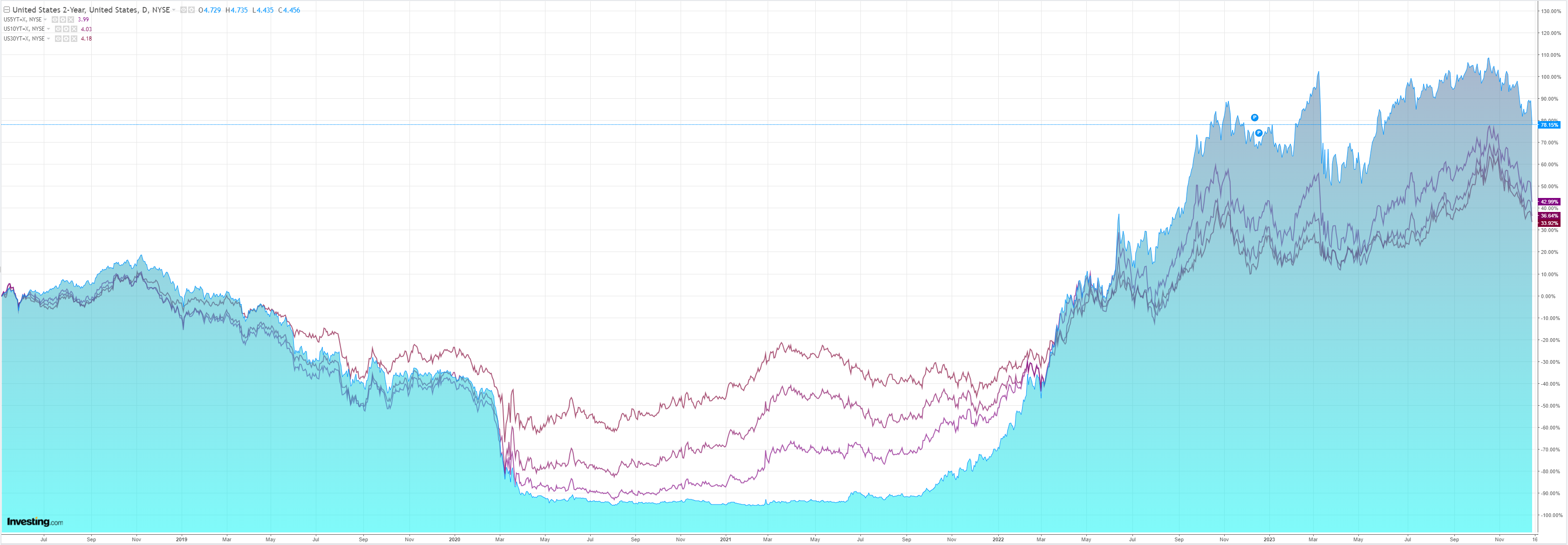

Yields are tumbling:

Advertisement

Which is all stocks care about:

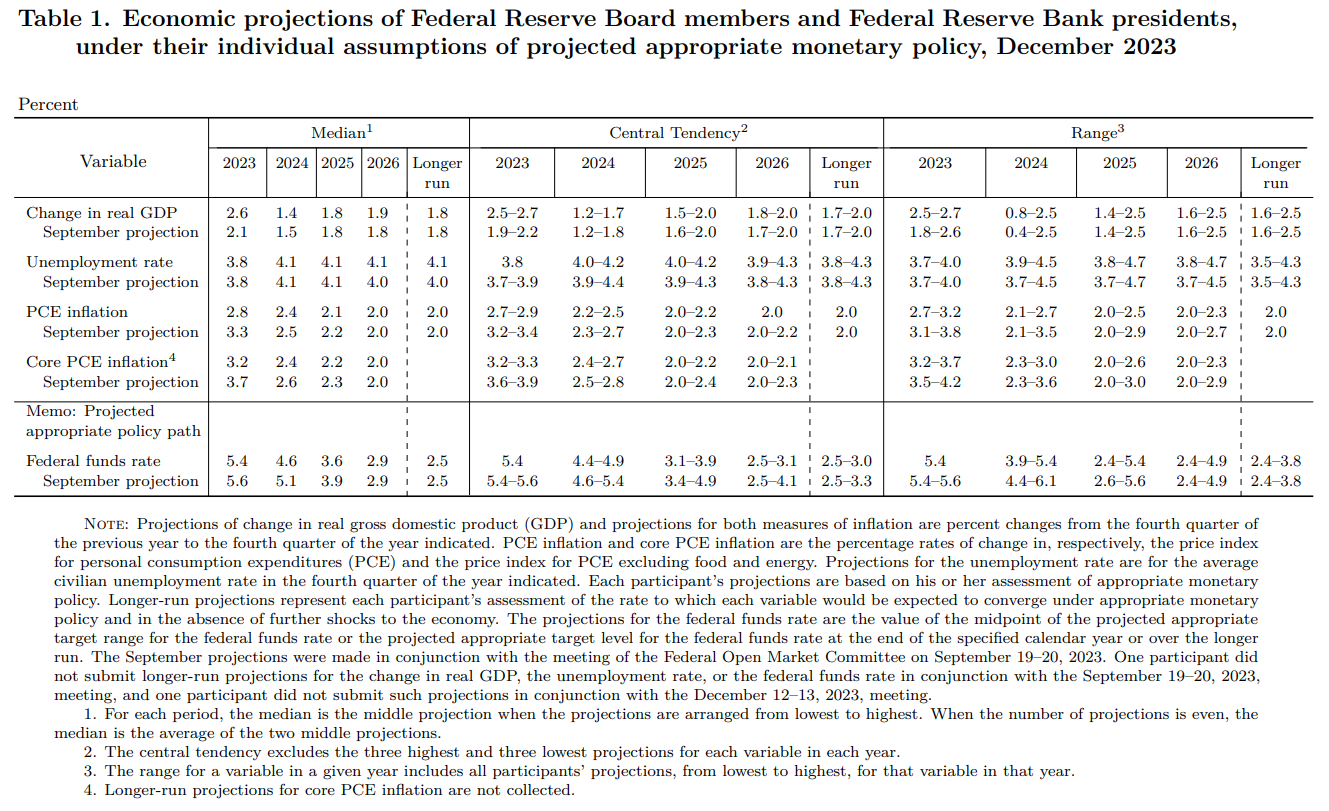

The Fed has pivoted dovish. Forward projections all came down:

Advertisement

And the dots opened the a trap door under rates, pricing 75bps in cuts:

My view is it will double that.

Advertisement

AUD up while the market can pretend there is no landing coming.