I reported on Friday how Australia’s real household disposable income per capita – arguably the purest indicator of material living standards – has collapsed.

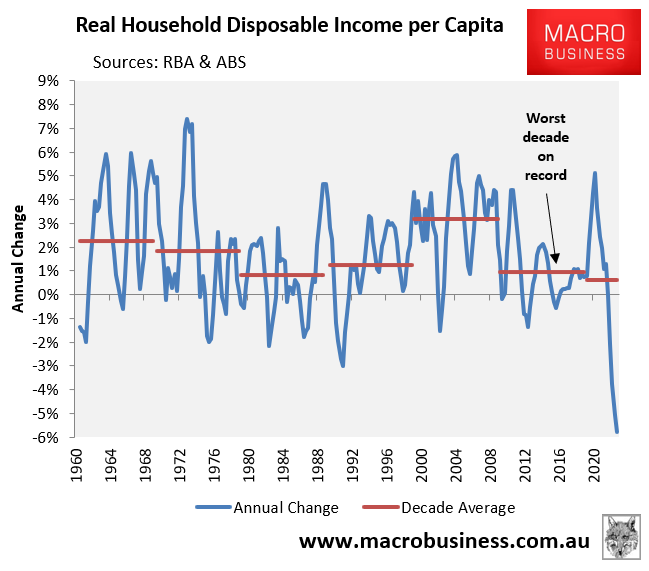

In the year to September 2023, real household disposable income per capita collapsed by 5.8%:

The previous decade saw the weakest per capita household disposable income growth in recorded history, averaging just 0.96% each year.

However, per capita household disposable income growth this decade has been even lower, averaging only 0.62% each year.

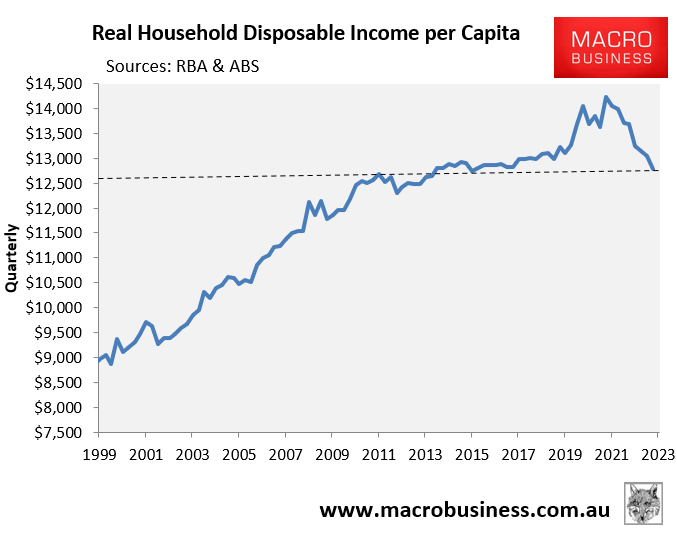

As shown in the next chart, Australia’s real per capita household disposable income is tracking around the same level as December 2011, implying that we have returned to the material living standards of the Rudd/Gillard governments:

Once you account for broader livability indicators such as inequality, housing affordability and quality, traffic congestion, and environmental degradation, the picture is even worse.

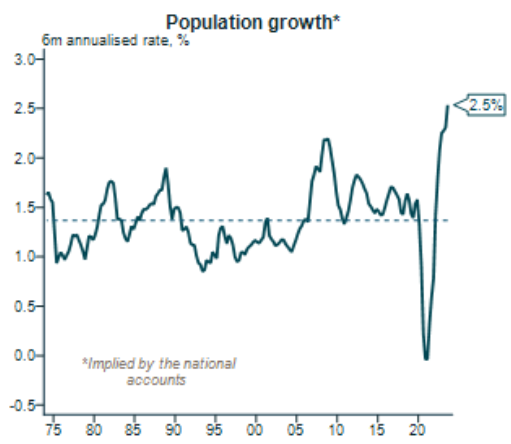

Alex Joiner, Chief economist at IFM Investors, has produced a series of terrific charts showing how policy makers have used “lazy” mass immigration-driven population growth to hide the collapse in Australian living standards.

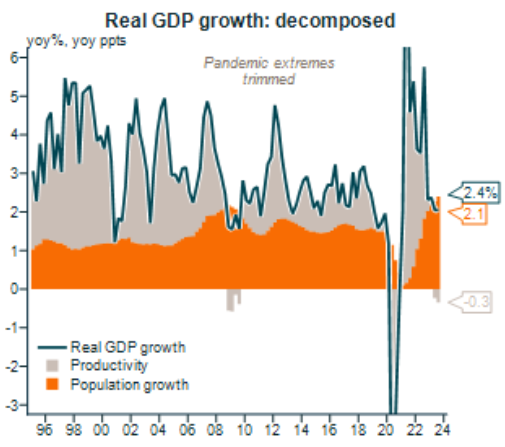

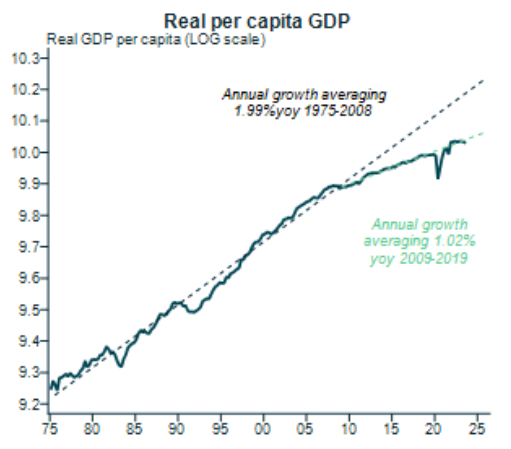

In turn, the Australian economy is experiencing the “hardest of soft landings”, according to Joiner:

“The Australian economy of 2023 has continued to expand, and while the economy is bigger, it is not necessarily better. Population growth has been a key driver, with real GDP growth declining on a per capita basis”.

Source: Alex Joiner (IFM Investors)

“Australia’s economic resilience in 2023 is borne from a dramatic rebound in population growth. Concerns around the imbalances it is causing (housing and infrastructure are two notable sectors) were cast aside as the demand for labour to address skills shortages remained a priority”…

Source: Alex Joiner (IFM Investors)

“Limited productivity growth (if any) has meant this has at the margin supported inflation”…

“The September quarter national accounts showed further modest growth of 0.2%qoq and 2.1%yoy through the year”.

Source: Alex Joiner (IFM Investors)

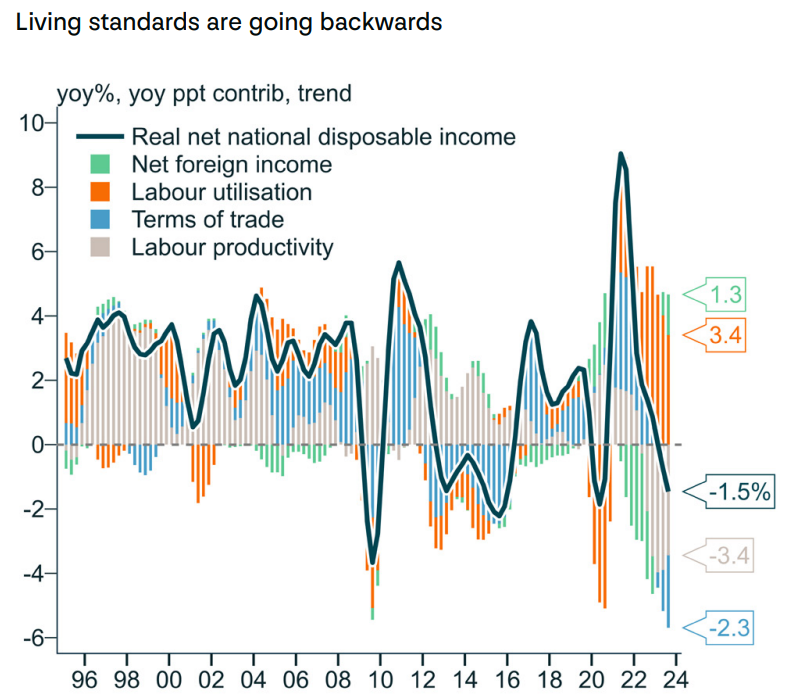

“Poor productivity and a declining terms of trade have prompted an outright fall in living standards growth as measured by gross national income, compounding already very weak per capita growth”.

Source: Alex Joiner (IFM Investors)

“Real household spending decelerated markedly as household disposable incomes come under pressure from increased interest and income tax payments. The savings ratio declined again to the lowest level since 2007″…

“Technical recession (two consecutive quarters of negative growth) in Australia is unlikely given population growth. But GDP per capita risks extending its run of negative growth and further weighing on living standards/national income already under pressure as the terms of trade likely also falls”.

“We look for real GDP growth in the year at around 1½%. But this is lazy growth, with the more important question being whether poor productivity performance can improve, which will add to growth and take pressure off inflation”…

“A rise in the unemployment rate risks unravelling consumer spending, which is a key downside to growth”…

In short, Australia’s lazy immigration-based economy has come unstuck.