So says Westpac.

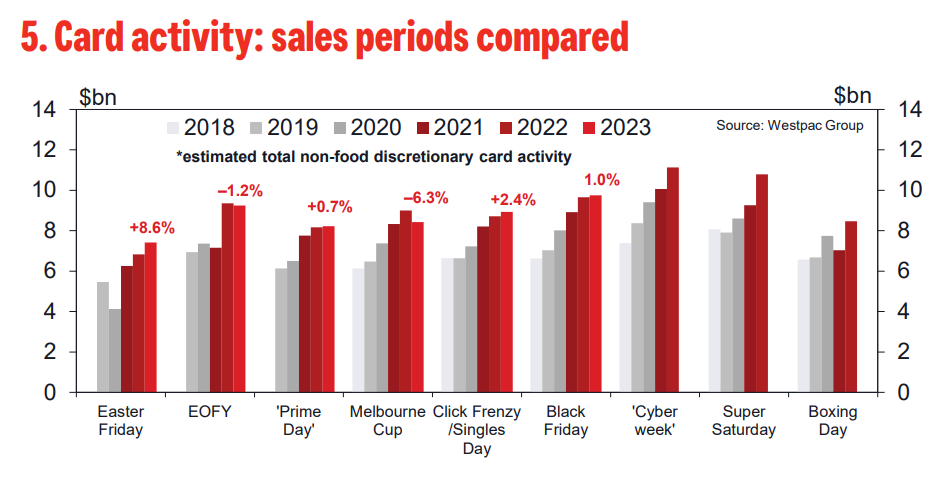

― The Westpac Card Tracker Index* posted a decent 4.5pt bounce in the week ended November 25, Black Friday sales generating a signifi cant lift in discretionary goods spend over and above the regular seasonal pattern. While this restores much of the apparent loss of momentum in October and early November, Black Friday related activity looks to have disappointing overall, up only slight on last year and pointing to a likely decline in inflation-adjusted terms.

― For momentum, much will depend on how much follow through we see in ‘Cyber-week’ and the more general lead-in to Christmas peak season. With cost-of-living pressures still intense and sentiment extremely weak as consumers brace for further rate rises, some of the Black Friday boost may well be a pull forward eff ect as buyers seek to take more advantage of price discounts.