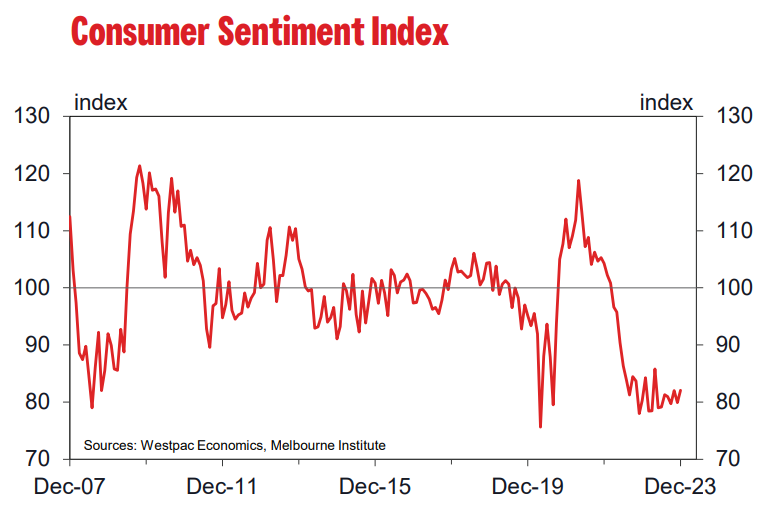

On Tuesday, Westpac reported that consumer sentiment in Australia is stuck at recessionary levels:

NAB also released its business survey on Tuesday, which Westpac senior economist Andrew Hanlan interpreted as dire.

Hanlan’s report is below.

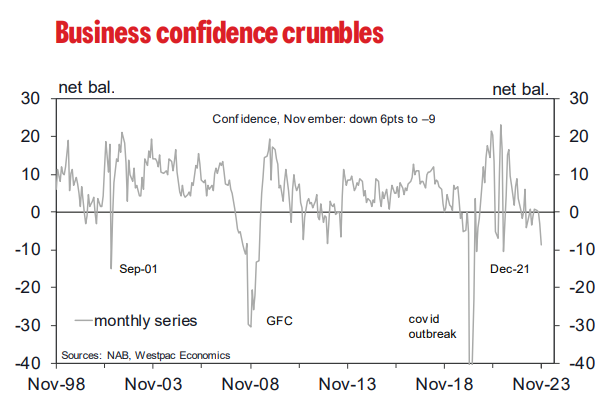

In another sobering update on the Australian economy, it is apparent that business confidence has crumbled at year end.

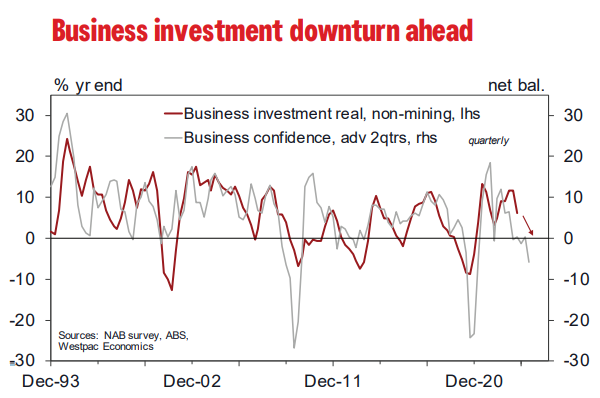

The economy has buckled in the face of the sharply higher interest rates to tame inflation. These developments point to a looming business investment downturn, and an easing of inflation pressures.

These were the key findings of the latest NAB business survey, which was in the field from November 20 to 28. The survey was conducted after the RBA’s November rate hike, which – following a four month pause – likely came as a surprise to many businesses.

The business confidence index declined by 6ptps to -9. That is the 3rd weakest business confidence reading in the history of the monthly series back to 1997 (outside of the GFC and the 2020 covid outbreak).

The two weaker readings look to be noise (a one off in September 2001, -14.8, and a one-off in December 2021, -10.5).

The deeply pessimistic business mood is evident coast-to-coast. Confidence readings range from Victoria at -13; NSW and WA at -9; to -5 for Qld.

Similarly, pessimism is evident across each of the broad industry groups, but is at a dire level for retail, at -28 ~ a reading which matches the low point for retail during the GFC (but is still above the extreme -65 touched during the covid shock in 2020).

Businesses have reason to be downbeat. The national accounts confirmed that consumer spending flat-lined over the past year and the November business survey points to this weakness continuing as we near year end.

The economy is set for a weak start to 2024.

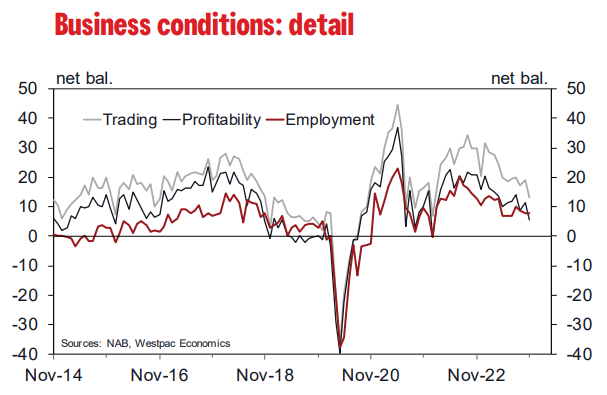

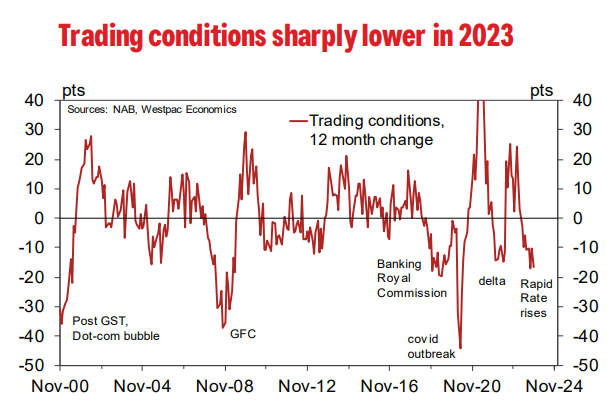

The business conditions index declined by 4pts to +9. This included a fall in trading conditions (sales), down 6pts to +13.

The key point is that trading conditions are well below levels of a year ago, lower by some 17pts. That represents a sharp deterioration in economic conditions.

Employment conditions were unchanged at +8, but down 10pts from the September quarter 2022.

By state, business conditions are weakest in the more interest rate sensitive states of NSW, at +7, and Victoria, +4. The mining states are finding some support from higher commodity prices, conditions (which includes profitability) is at +16 for WA and +12 for Qld.

Consumers are bearing the brunt of higher interest rates, high inflation and additional tax obligations.

Per capita real household disposable income is down 10% from the peak of September 2021 to be at the lowest level since 2015.

The NAB November survey confirms weakness in business conditions for retail, at +2, and recreational & personal, at +5 (down 8pts on last month).

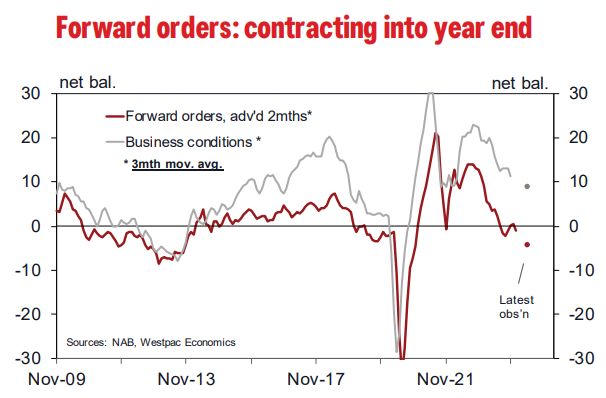

Forward orders are contracting, down 5pts to -4, another pointer to a weak start to 2024.

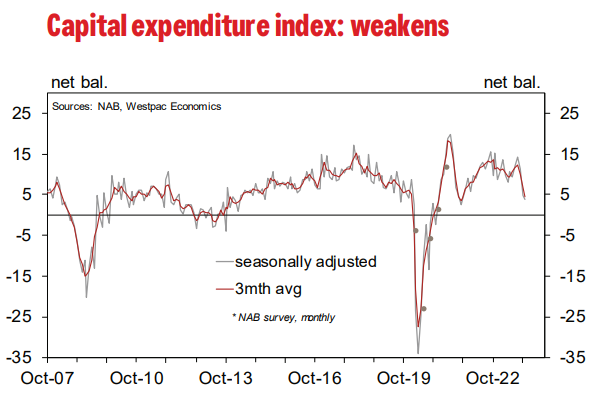

The survey points to a looming business investment downturn, consistent with official data (capex) and our expectation.

We are now seeing the negative spill-over effects from the flat-lining of consumer spending to businesses. The deepening business pessimism will likely see firms trim both their hiring and equipment investment spending decisions.

The capital expenditure index in the November survey moderated to +4, down by 8pts in the past four months, to the lowest level since the delta outbreak.

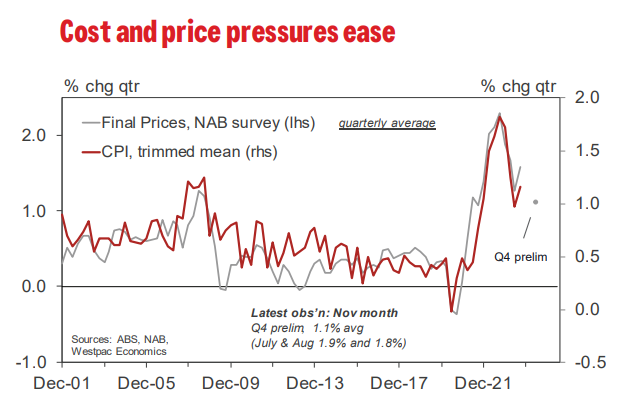

Cost and price pressures have eased in the December quarter the survey reports – as to be expected as the economic downturn continues.

Cost and price pressures increased in the September quarter on the oversized rise in award wages.