Earlier this year, Big Business mouthpiece The AFR Chanticleer nicely encapsulated why C-suite executives love the Albanese government’s record immigration, which saw 518,000 net overseas migrants land in Australia in 2022-23.

“It is boosting retailers’ sales, increasing landlords’ ability to collect rent, helping miners and contractors find staff, bolstering the big four banks’ customer numbers, lifting pathology providers’ testing volumes, filling up Macquarie’s IT department”, The AFR Chanticleer wrote.

“You name it, chief executives are talking about it. For a lot of them, migration is the new growth”.

“It is the quickest and most logical way to overcome the tight jobs market, find skilled labour, grow sales at mature businesses such as Woolworths and Coles, restock accounting and legal functions, and ultimately make more money for shareholders”.

“They know more workers should mean more wages, more profits, more taxes, and ultimately a bigger economy”, The AFR said.

The AFR has published the results from its latest CEO survey, with the nation’s 50 top bosses believing strong immigration will deliver another year of growth and prevent the economy from falling into recession:

“We’re likely to avoid a hard landing in 2024,” Goodman Group founder and CEO Greg Goodman said…

Macquarie Group’s Shemara Wikramanayake said Australia’s immigration profile and strength in key industries should keep the country out of recession in 2024…

Commonwealth Bank boss Matt Comyn said there was only low risk of a recession next year…

“Overall, we are optimistic about the resilience of the Australian economy and, in particular, non-discretionary sectors like supermarkets”, [Coles CEO Leah Weckert] said.

Nearly all… pointed to immigration and infrastructure spending as reasons why Australia would avoid a recession…

Meanwhile, this month’s national accounts data from the Australian Bureau of Statistics (ABS) was an absolute disaster for Australian households.

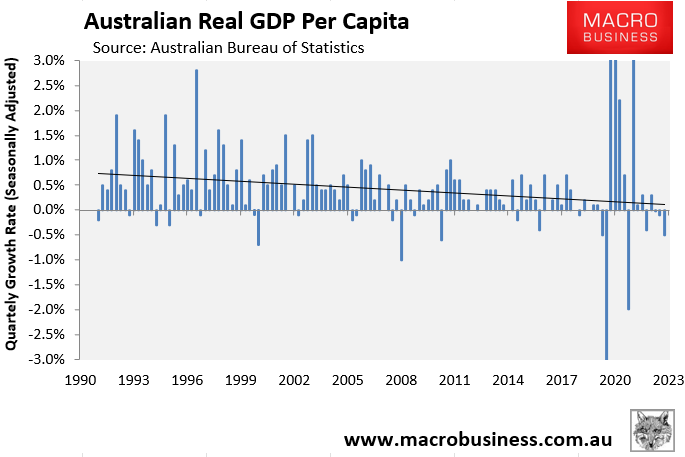

It confirmed that Australia is mired in a per capita recession following three consecutive quarters of declining real GDP in per capita terms:

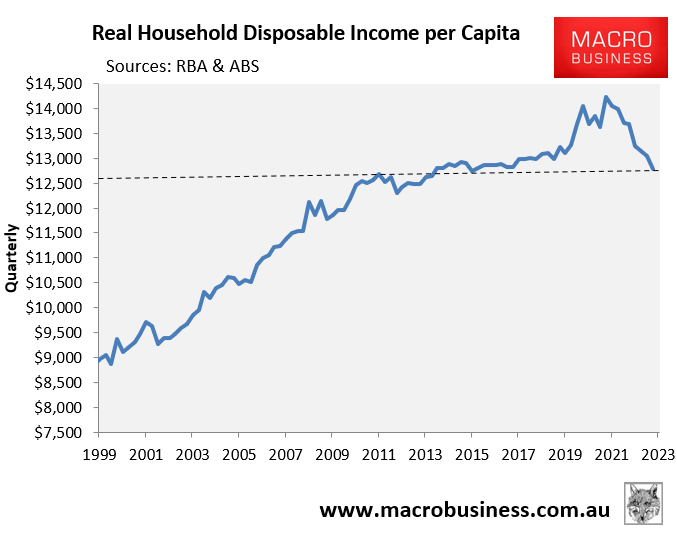

Worse, real household disposable income per capita collapsed over the September quarter to around 2010 levels:

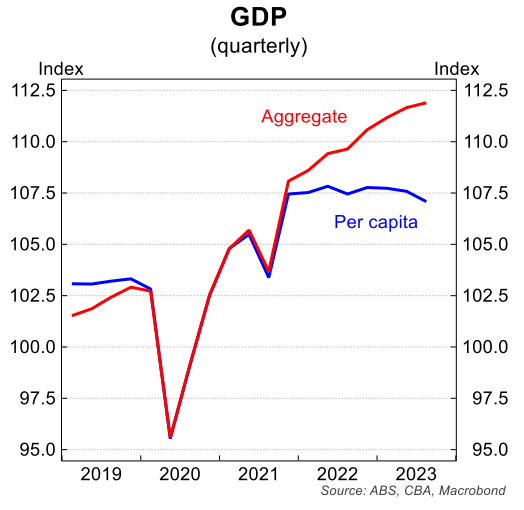

The CEOs are right that the only thing keeping the Australian economy ticking over is the nation’s unprecedented immigration-driven population growth, which has grown the overall economic pie while every Australians slice of the has shrunk:

In fact, this has been Australia’s growth story ever since immigration levels were ramped higher in the mid-2000s.

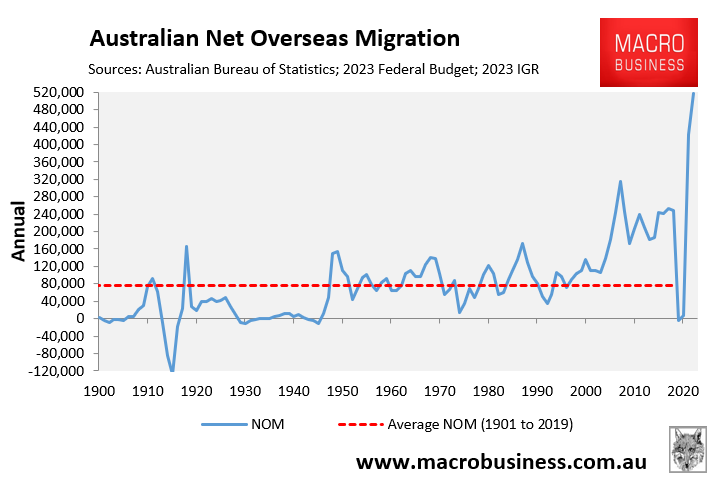

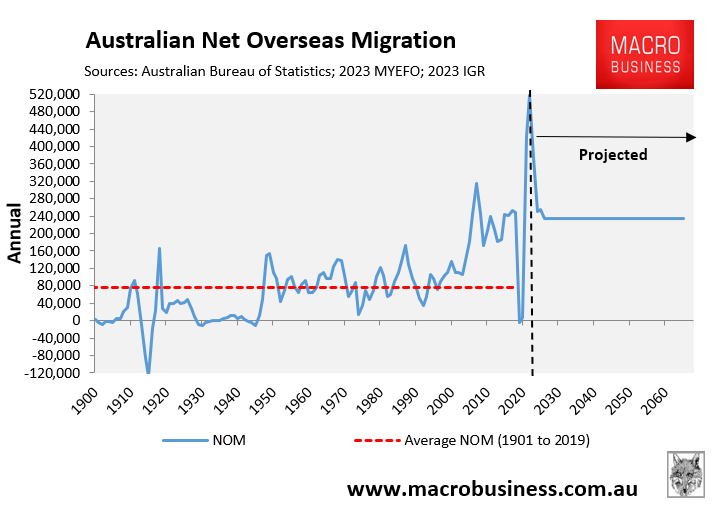

Australia’s net overseas migration (NOM) jumped from an average of 90,500 between 1991 and 2004 to an average of 219,000 between 2005 and 2019 – representing an annual average increase in immigration of 140%.

Over the Albanese government’s first 18 months in office, we have seen Australia’s NOM surge even higher to an unprecedented 518,000, with NOM projected to remain permanently high for generations to come:

Throughout the ‘Big Australia’ era, Australia’s productivity growth has collapsed along with living standards.

Here is former long-time Australian Treasury secretary, Ken Henry, who described Australia’s worsening economic performance over the past 20 years as “a great disappointment”.

Henry said the belief 20 years ago was that if Australia only managed productivity growth of 1.75% per year, the nation “would be in a hell of a mess in 40 years time”.

“We actually achieved 1.25%”, Henry lamented.

The most significant policy change that happened during this time period was Australia drastically lifted its immigration intake on the fallacious idea that it would increase productivity and living standards, when in fact the opposite occurred.

Ken Henry warned in 2016 that Australia’s rapid population expansion would suffocate living standards, particularly in Sydney and Melbourne.

The Australian population is growing by something like 400,000 a year. Think of it: a new Canberra every year between now and the end of the century”, Henry said.

“My observation in Sydney and Melbourne today, is that people already think, with very good reason, that the ratio of population to infrastructure is too high”.

“But we have set ourselves on a journey that implies an increase in that ratio. An increase in that ratio that is associated with more congestion, longer commute times to work, increasing problems with respect to housing affordability”.

Around the same time, Ken Henry explained how the mass immigration model benefits corporate Australia, while leaving Australians worse off.

“Research NAB carried out earlier in the year showed that among our customers there’s not wholesale support for a larger Australia”, Henry said.

“For many, the prospect of a higher Australian population means more stress in the ability to buy a house, to live where you want to live, to get to work with a reasonable commute time”.

“And many in the community are also concerned about our ability, as a nation, to maintain norms of Australian social and economic inclusion, and to continue to provide access to high quality services in areas such as healthcare and education”.

“But what is the business perspective? The same NAB research showed that most of our business customers would strongly prefer a larger population, which supports better business growth”.

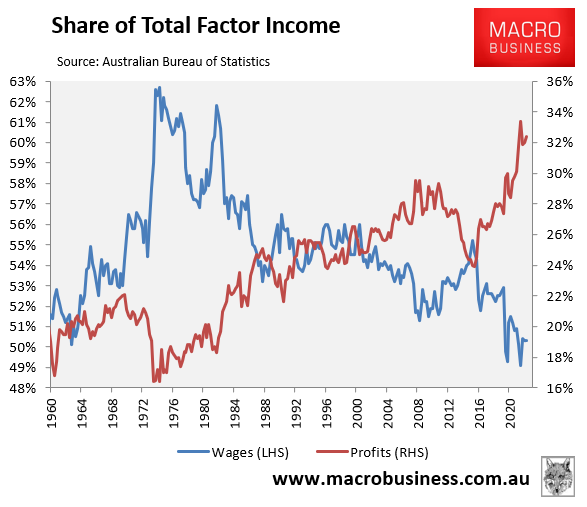

The one segment of Australia that has benefited from high levels of immigration in the face of collapsing productivity is corporate Australia, which has grown its profit share while workers have gone backwards:

Large private enterprises such as toll road operators (e.g. Transurban), retailers (e.g. Harvey Norman), the Big Four banks, property developers (e.g. Meriton and Stockland), and education providers (e.g. the universities) benefit from mass immigration because it allows them to enjoy easy revenue and profit growth from an ever-expanding customer base.

By contrast, households face growing competition for jobs and lower bargaining power, rising housing costs, rising infrastructure costs, a deteriorating natural environment, and longer and more expensive commutes.

These are the hidden costs of a ‘Big Australia’: massive private taxes that are neatly ignored by policy makers and mass immigration advocates.

Sadly, the Albanese government has doubled down on this failed growth model.