So says Goldman:

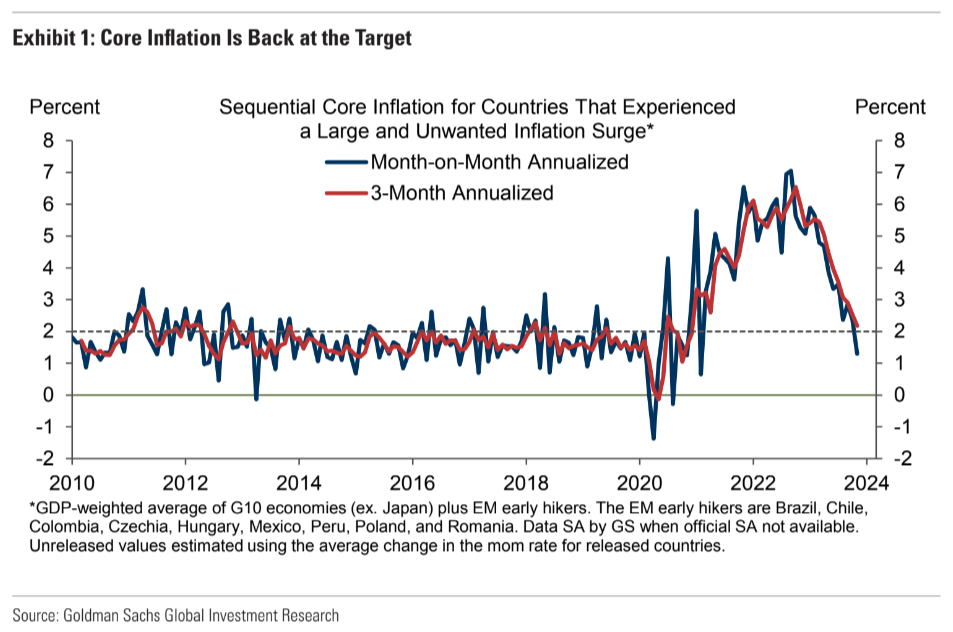

Global inflation continues to plummet. Averaging across the broad group of economies that saw a large and unwanted post-covid price surge—the G10excluding Japan plus the EM early hikers—we estimate that core inflation ran at sequential annualized pace of 2.2% over the past three months and just 1.3% in November. We therefore now see earlier and more aggressive rate cuts from several major DM central banks.

The global inflation surge had three phases.

The first was the supply chain disruptions of COVID combined with large fiscal stimulus spent on goods. It is now entering deflation as supply-side expansions meet normalising demand.

The second phase was the Ukraine War energy shock. It has also largely normalised with large investments in all forms of energy meeting stalled demand for gas, coal and oil, especially in China.

The third phase was the shift into wages and services. This has primarily been dealt with via central bank tightening. Wage growth will be higher than pre-COVID owing to reduced supply but not disruptively.

These stories are consistent across DMs.

Except Australia.

We had the misfortune to have a weak-kneed new government when the inflation phases intensified. This meant Australia suffered one of the world’s worst energy shocks despite having some of the world’s most abundant and cheap fuels. The government was simply too scared to stop energy cartels from conducting the greatest gouge in Aussie history.

The same government proved to be an immigration extremist. The result was a post-COVID population shock that dramatically worsened supply side shortages in housing and infrastructure. Both suffered massive cost-input inflation shocks that are still going.

Global inflation was temporary, as expected.

Alboflaton is as permanent as his government.