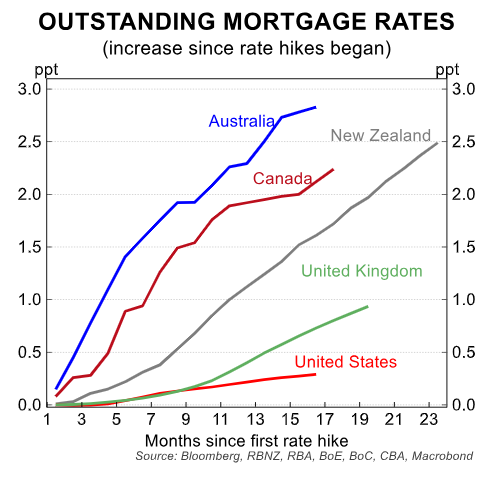

Australians have experienced one of the world’s sharpest rises in average mortgage rates owing to the 4.25% increase in the official cash rate by the Reserve Bank of Australia (RBA), alongside the predominance of variable rate and short-term fixed-rate mortgages:

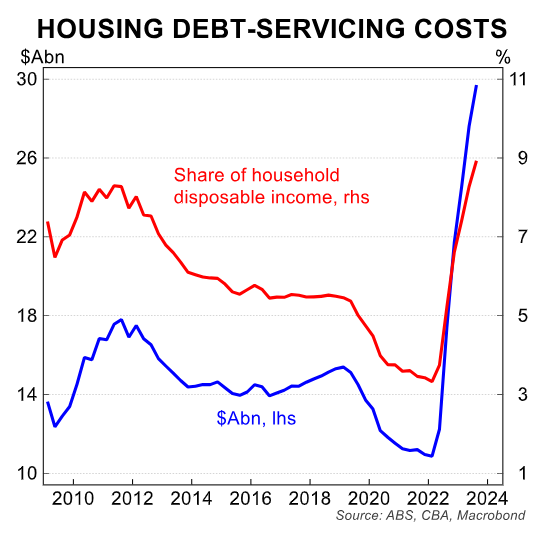

This has sent housing debt servicing costs soaring:

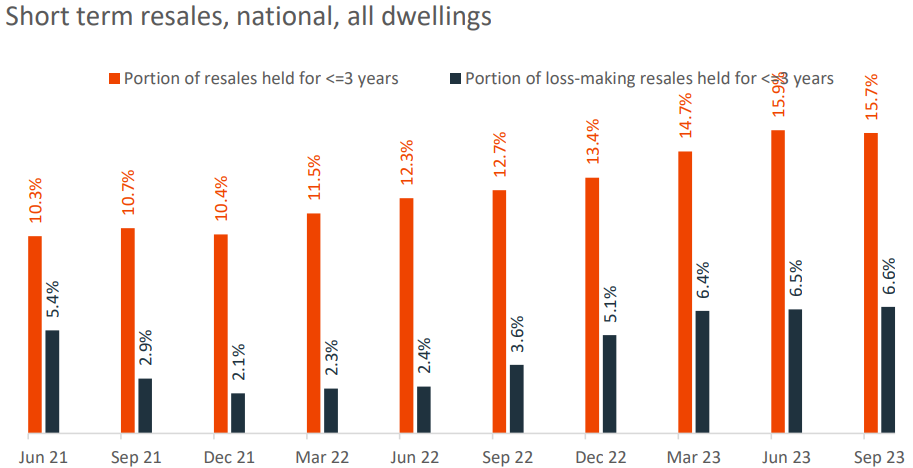

New data from CoreLogic shows that there has been a sharp rise in short-term property resales, defined as home bought and sold within three years:

Source: CoreLogic

Eliza Owen, CoreLogic’s Head of Research, said that a rise in short-term resales is occurring amid rapidly rising interest rates and may indicate increased mortgage stress.

“While the portion of short term reselling dipped marginally quarter-on-quarter, resales with a hold period of three years or less hit a decade high in the year to September”.

“Another emerging trend in resale analysis is the greater share of loss-making that occurred within a relatively short hold period, as opposed to properties commonly making a loss”.

As shown above, loss-making short-term resales (properties held for three years or less) rose to 6.6%, up from 3.6% just 12 months ago.