Westpac has released a note explaining why it does not believe that the Reserve Bank of New Zealand will hike the official cash rate (OCR) at its February meeting, and why the next move in official interest rates is likely to be down.

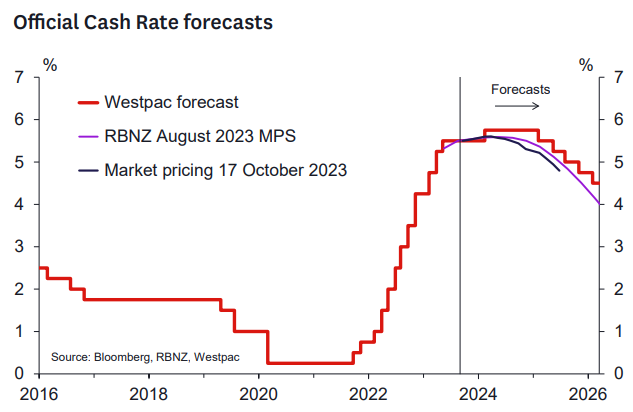

Weaker-than-expected economic growth combined with lower-than-anticipated inflation means the OCR will likely remain at 5.50% through 2024 before rate cuts commence in 2025.

- The case for a hike in February now looks too thin.

- Recent GDP data shows a much weaker starting point for the economy.

- Headline inflation looks lower than previously forecast.

- OCR to stay at 5.5% through 2024 and gradual easing from early 2025.

For a while, markets have been speculating that central banks globally might shift tack towards interest rate cuts in 2024.

This speculation reached a crescendo with the United States Federal Reserve indicating that US rates have likely reached their peak and that 75bps of cuts are possible in 2024.

Locally, we saw data on elements of the Consumers Price Index and GDP which pushed in the same direction – i.e., towards expectations of weaker inflation pressures both now and over the medium term.

This data suggests to us that the further 25bp increase in the OCR that we had expected to be delivered at the time of the February MPS is now much less likely, and instead it’s more likely we see the OCR remaining at 5.5% for 2024.

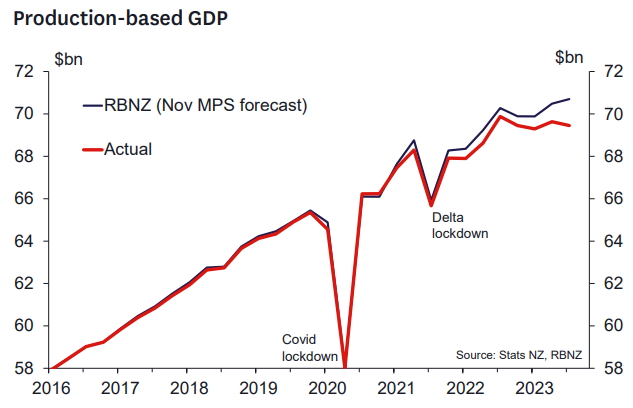

Perhaps the most important data release was the Q3 GDP data and associated benchmark revisions. As we discussed in our review, this data tell us that the economy is in a much weaker position than we (and even more so, the RBNZ) thought even a few weeks ago.

The economy has essentially treaded water since mid-2022 and the two consecutive quarters of negative growth previously reported in Q4 2022 and Q1 2023 have been reinstated after being revised up in earlier releases.

The implication for the RBNZ seems clear as the new data will tell them that the more positive output gap they included in their November 2023 Monetary Policy Statement forecasts has been revised away.

And with those revisions, much of the upward pressure on medium term inflation pressures and the need for a higher OCR will have been reversed.

We think it’s likely, absent any further surprises, that the RBNZ will revert to something like their August 2023 view that the OCR will remain at 5.5% until the latter part of 2024.

We continue to see them as remaining much more cautious than markets on the prospects for lower rates.

While the recent data provides a decent basis for revising down forecasts of inflation this is not the same as being confident those forecasts will be borne out.

The RBNZ’s new Remit requires a sole focus on inflation, and we are sure that they will need to be confident they can hit 2% CPI inflation in the second half of 2025 and meet the new Remit.

All going well, we can see a path to where they get that confidence by the time of the August 2024 Monetary Policy Statement – but there is a lot of water to go under the bridge before that happens.

We think the analysis in our recent note remains relevant.

We continue to see the strongest case for a gradual reduction in the OCR from the beginning of 2025.

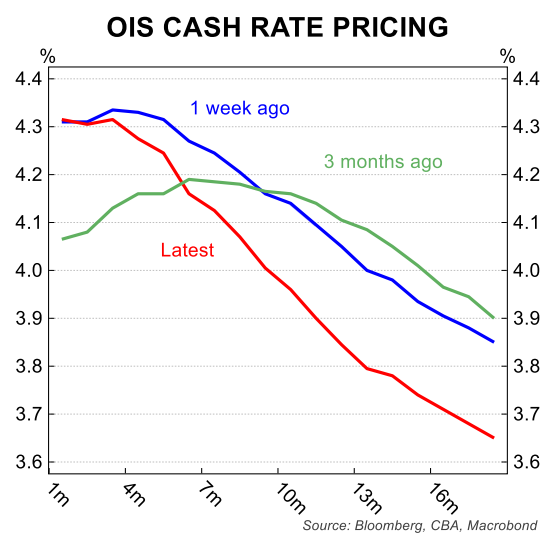

Gareth Aird, head of Australian economics at CBA, published similar analysis pertaining to Australia.

Aird believes the RBA has likely finished with interest rate hikes and is more likely to cut rates in the second half of 2024.

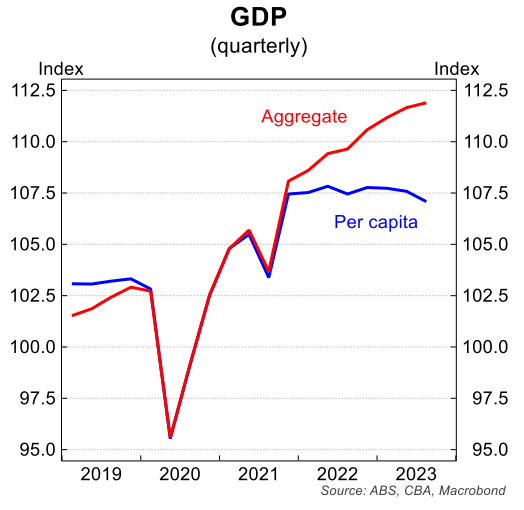

“The economy has gone backwards for three consecutive quarters in per capita terms”, noted Aird:

“Markets have priced that the next move in the cash rate is down. And we agree”, Aird wrote:

Therefore, this looks like the end of rate hikes in both Australia and New Zealand.