This is all kinds of wrong:

The next six months could prove make-or-break for the economy, leading economists warn, as stalling growth in early 2024 risks tipping the nation into recession.

AMP chief economist Shane Oliver said the “big issue” for the year ahead was how severely the economy would slow, warning we may have become too complacent about the risks ahead.

“It’s hard to believe we’d have the biggest interest rate tightening cycle since the 1980s with only a minor impact on the economy, which is what we’ve had so far,” Dr Oliver said.

At MB, we like Shane Oliver, so this is not to have a go at him.

But the framing of this is misleading.

It is not remotely surprising that Australia has not had a recession. If you stuff more than 600,000 people into the economy in a year, that’s 2.4% GDP growth before you start.

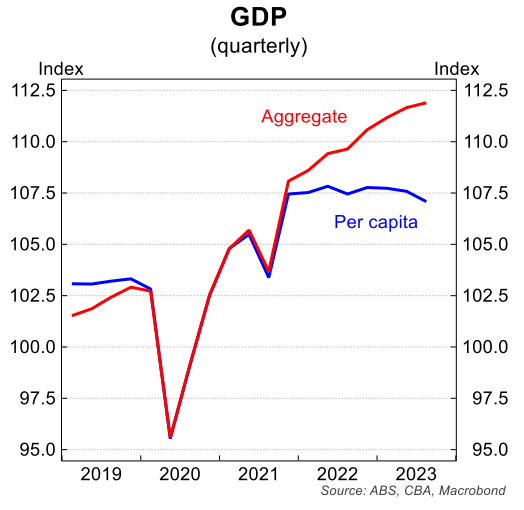

But what matters is GDP per capita, which has been in recession for a year.

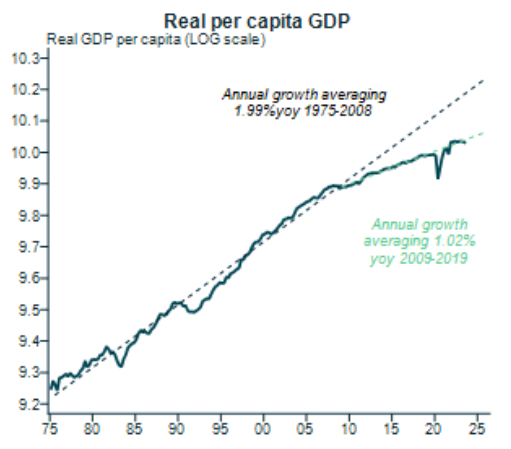

In fact, GDP per capita has not grown in two years, the worst performance since 1990. Worse than the GFC and the Great Deflation:

Source: Alex joiner

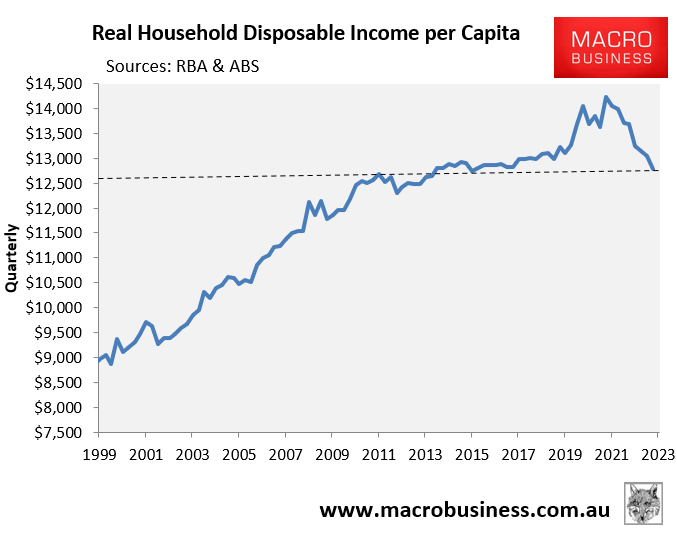

And while that stall has taken place, real net disposable income has been falling at the fastest pace since the mining crash despite record highs in commodity prices. Once they break, incomes will fall even faster

This is a broken economic structure that feeds growth to the beneficiaries of mass immigration and holes in the ground while the overwhelming majority of Australians go backwards:

To describe it as resilient is beyond absurd.

It is gaslighting.