DXY eased last night:

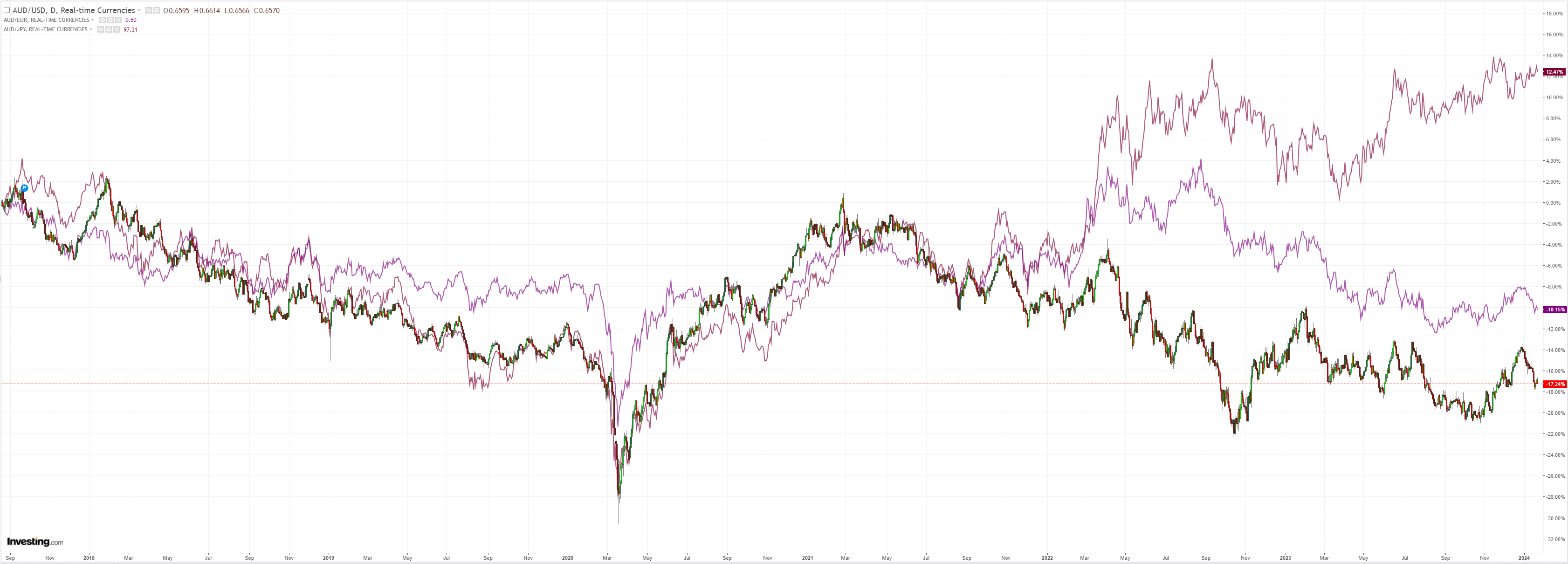

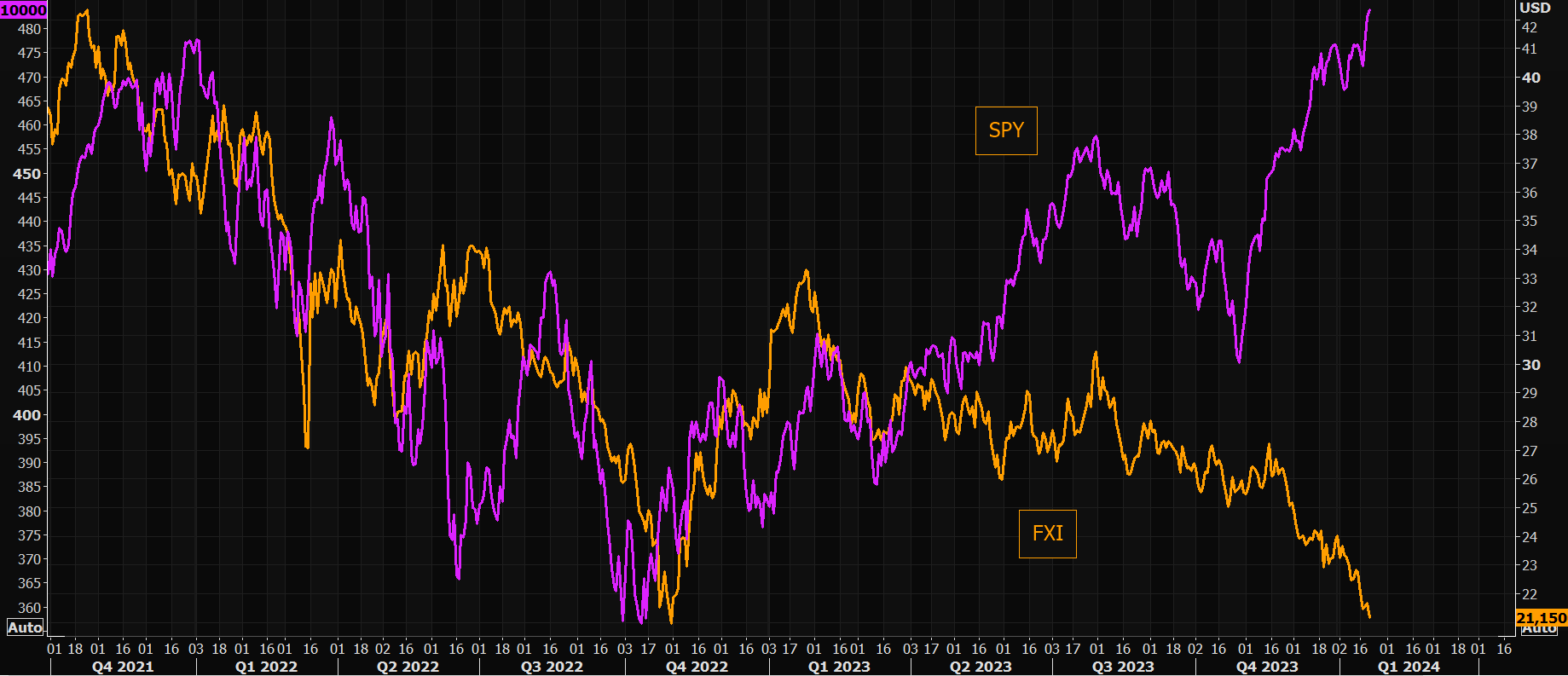

But AUD fell anyway as the ravenous China bear market eats everything in its path:

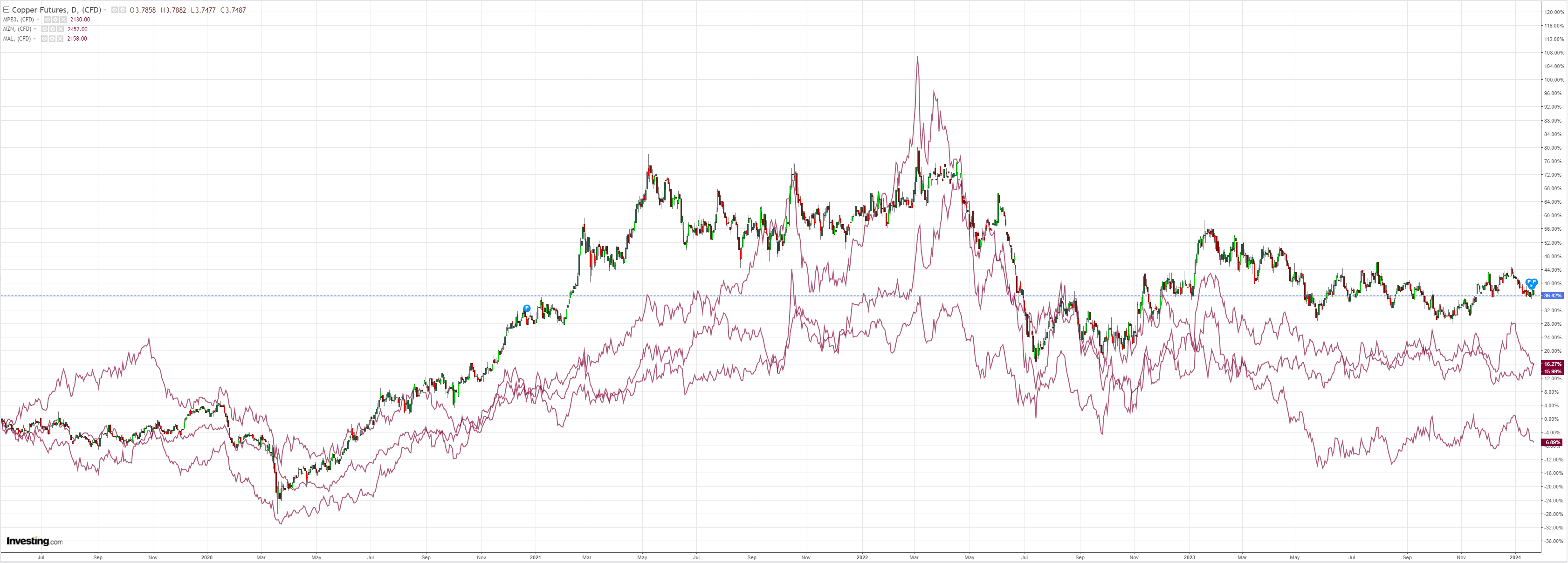

Holding up CNY is killing the Chinese economy:

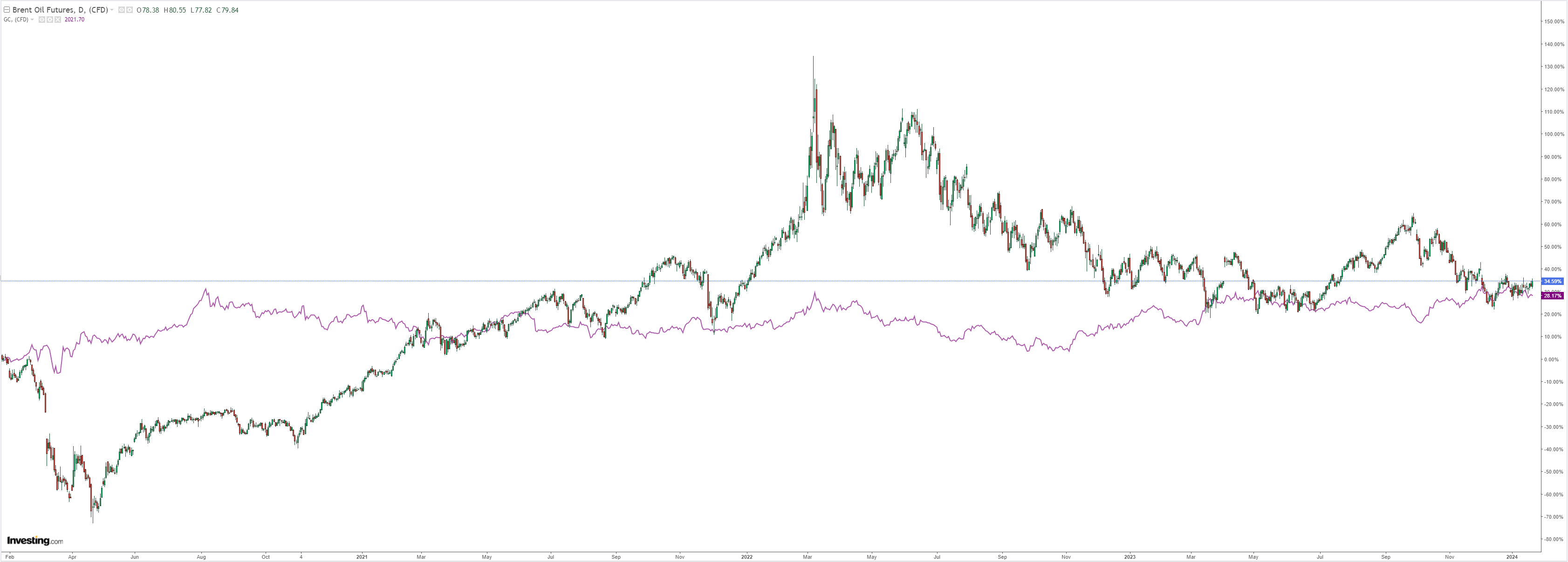

Oil firmed. Gold fell:

The Chinese bear is eating base metals:

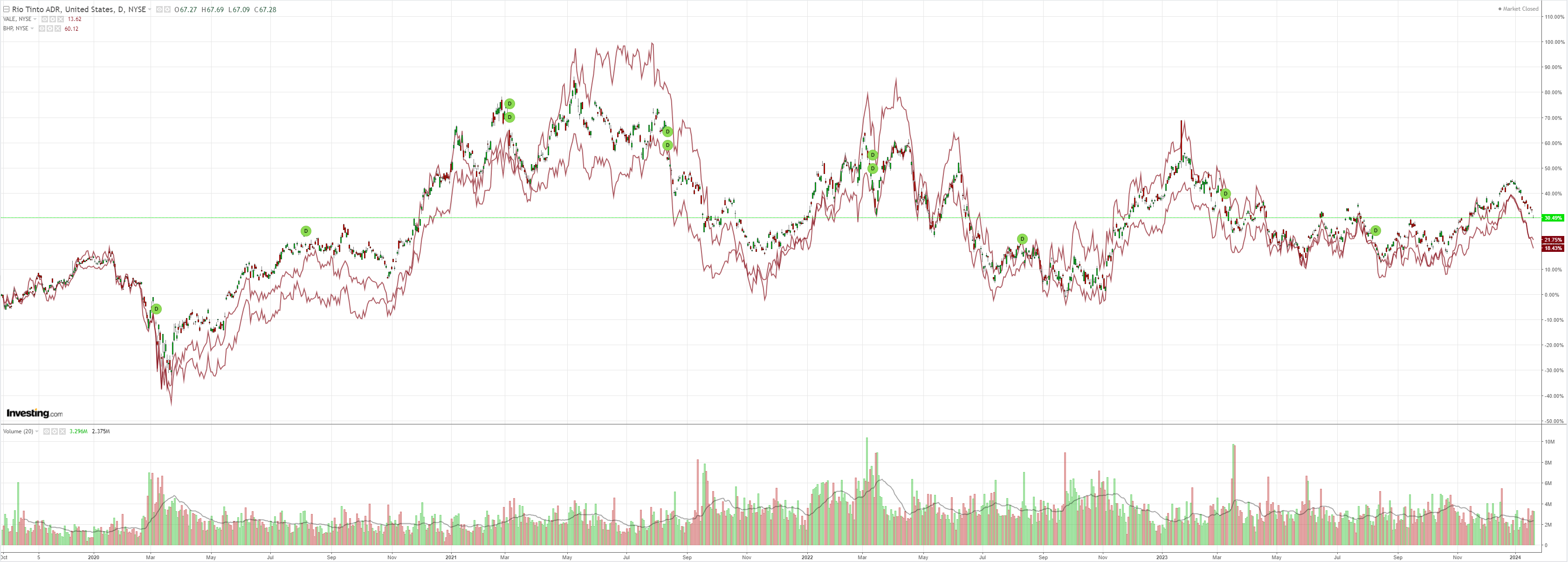

And miners:

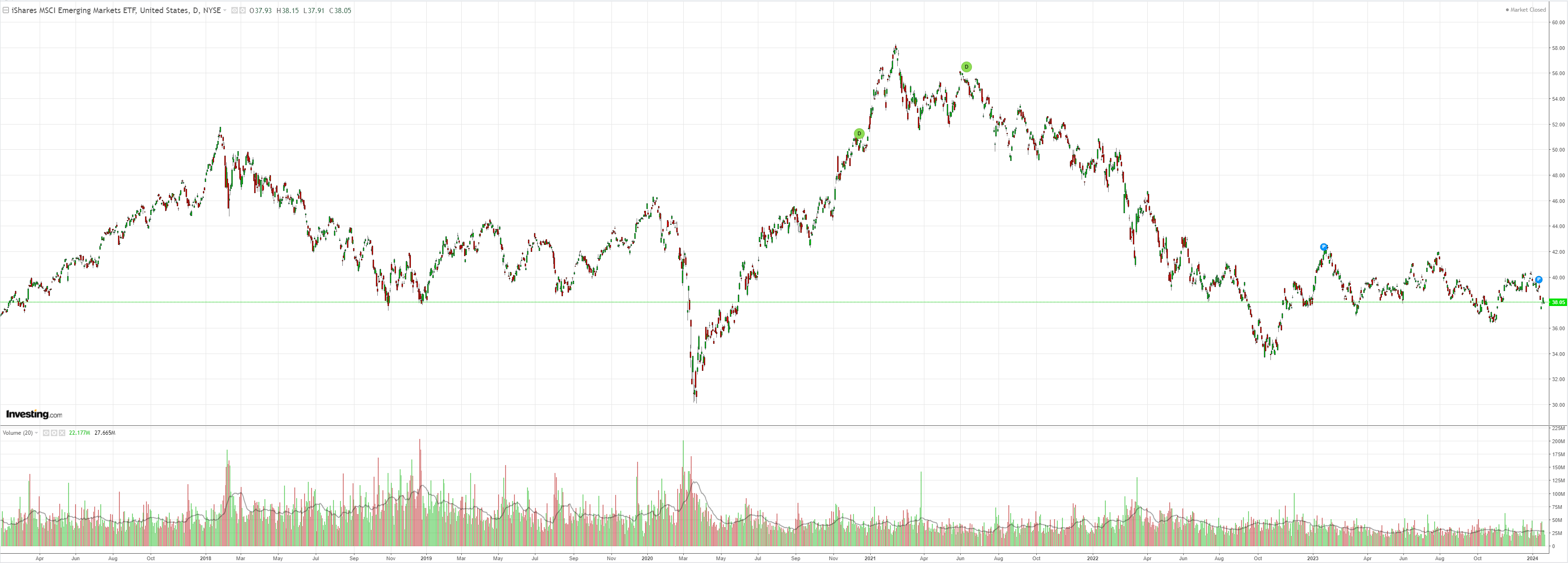

And EM stocks:

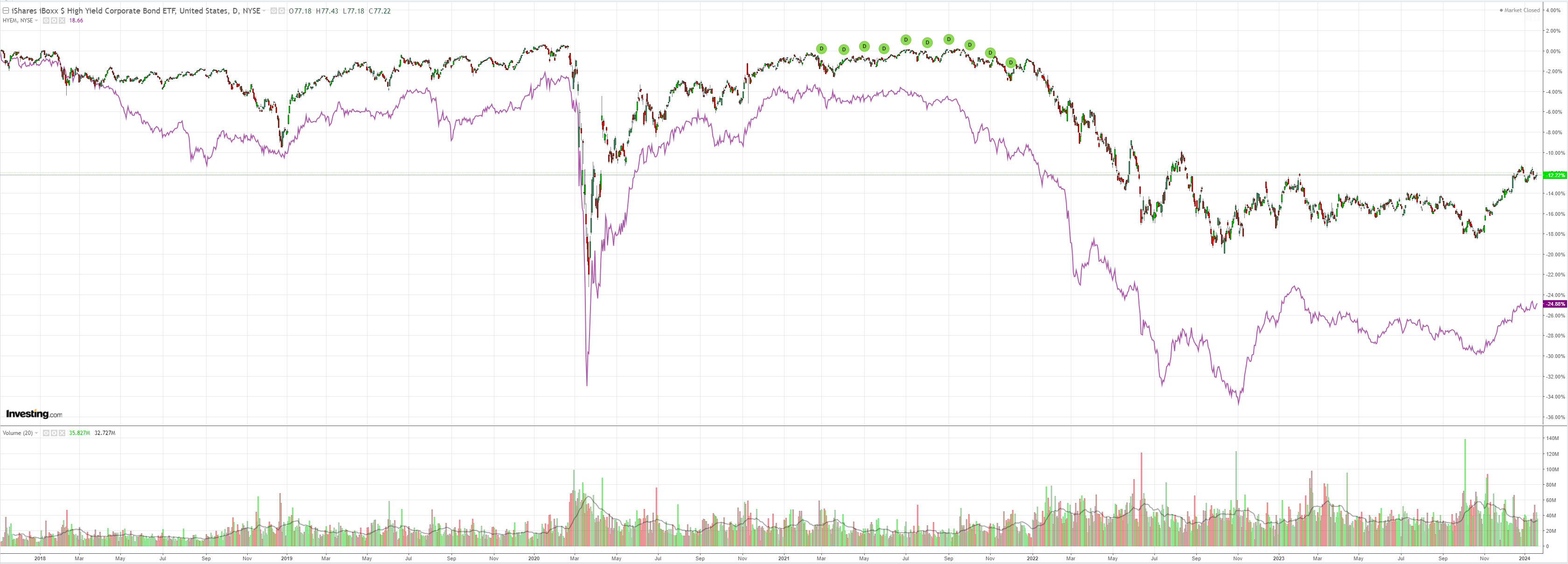

The DM stock rally is no longer credit-led. This is a warning sign:

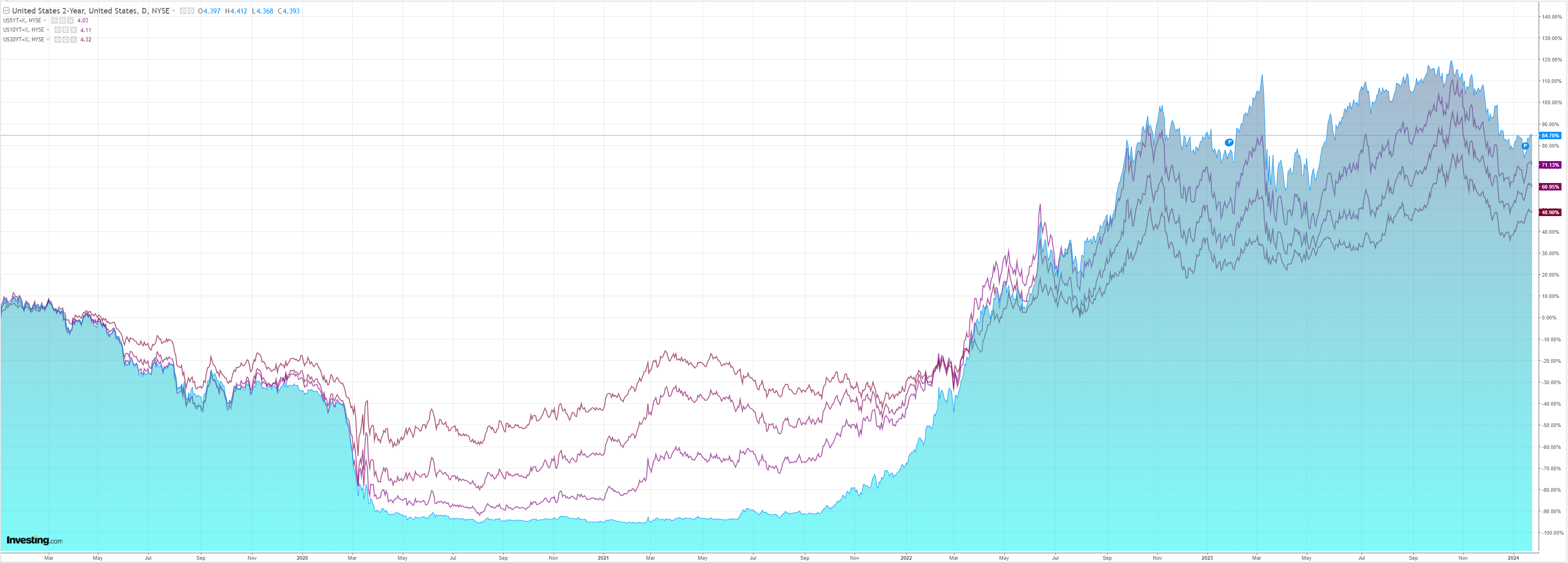

Though Treasuries were bid:

Stocks to the moon!

The AUD is increasingly caught in the claws of the ravenous China bear market (FXI is large cap China stocks) that is derating all assets as capital flees:

China is holding CNY steady by refusing to ease monetary policy enough to aid its deleveraging. This is embedding debt deflation, only guaranteeing that yields will ultimately have to fall even further.

The base case is still DXY falling as the Fed cuts, likely in March, adding further upward pressure to AUD in 2024.

But this China derating is unstoppable, and AUD is a central FX proxy, so the risk case of peak AUD being past is also burgeoning.

It’s nearly a toss of the coin at this point.