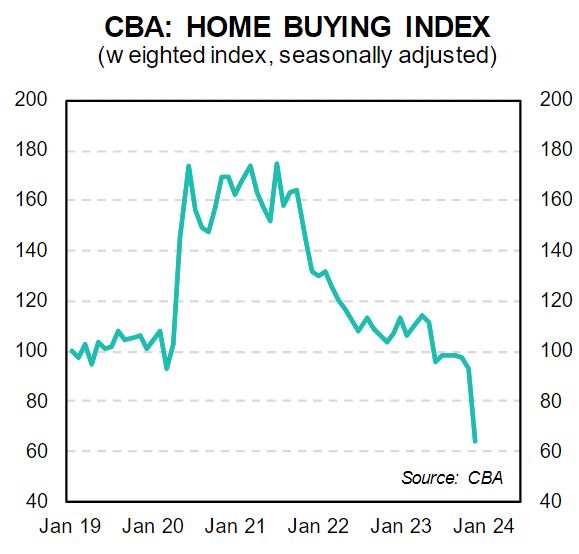

On Tuesday, I reported on CBA’s Home Buying Index, which plummeted a seasonally adjusted 31.1% in December, to be down 40% year-on-year:

“The fall in the Home Buying Index in December likely reflects the effect of the early November rate hike from the RBA, after four months when rates were unchanged”, the CBA explained.

“The timing of the rate hike in November meant home loan applications fell more in December than normal, pulling down the index”.

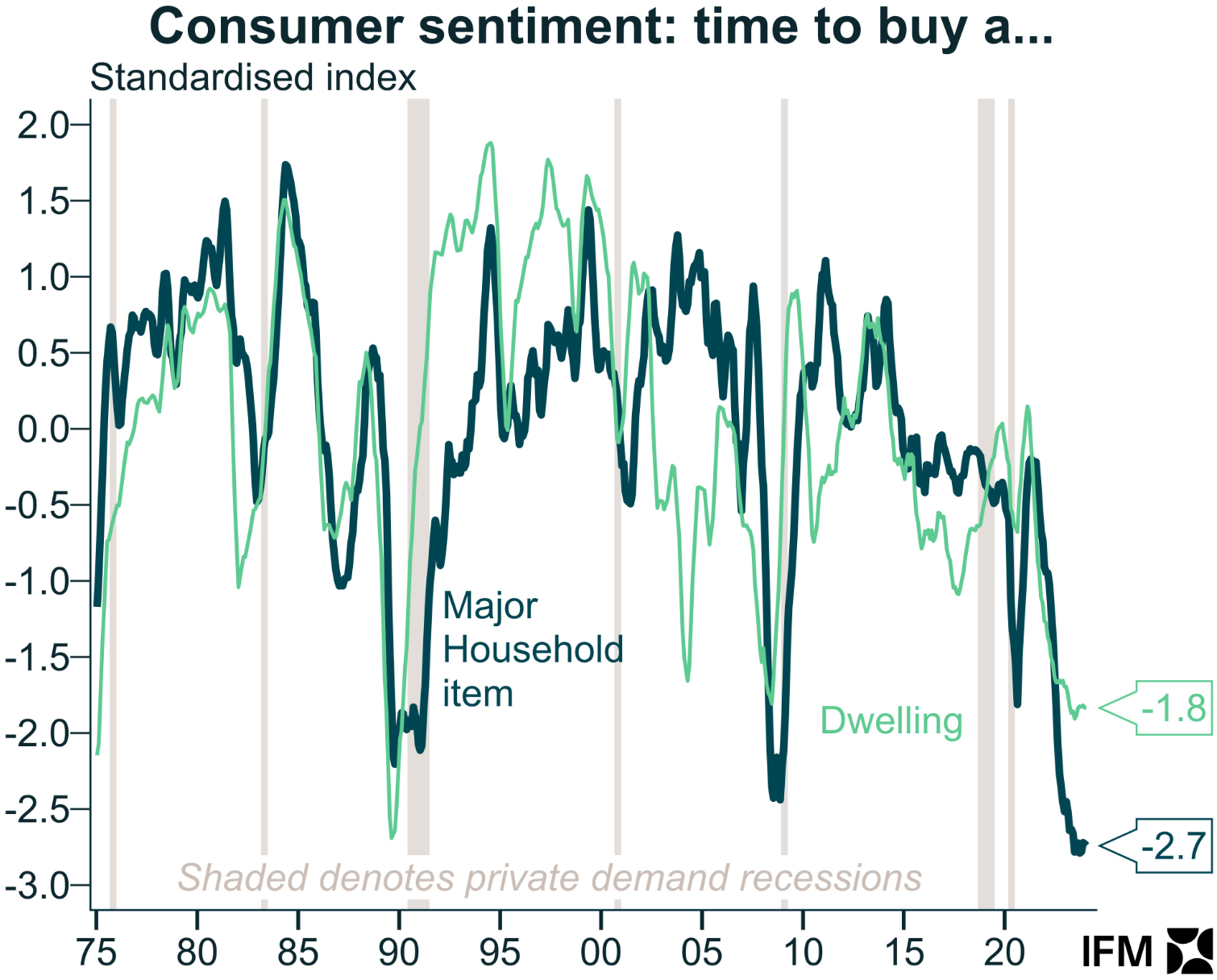

Yesterday, Westpac released its home buyer sentiment index for December, which fell 1.8% over the month to be tracking at historical lows:

As shown in the chart above from Alex Joiner at IFM Investors, sentiment to buy a major household item has also collapsed and is also tracking around record lows.

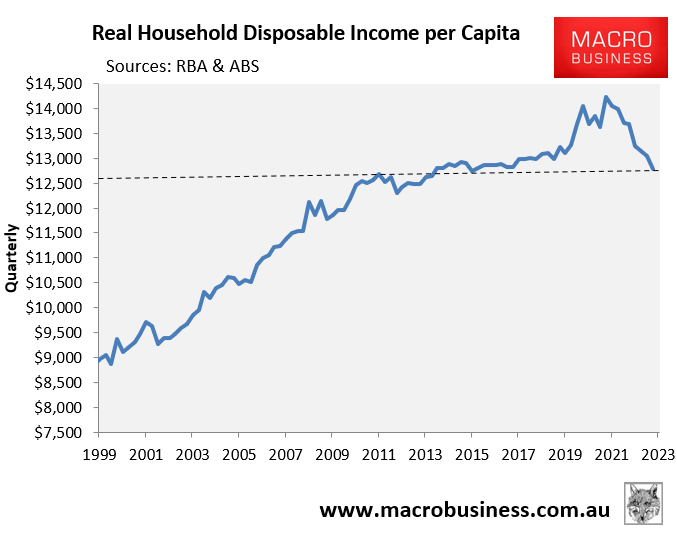

The collapse in home buyer sentiment makes sense when you consider that household incomes have taken a walloping after plunging 6% in the year to September:

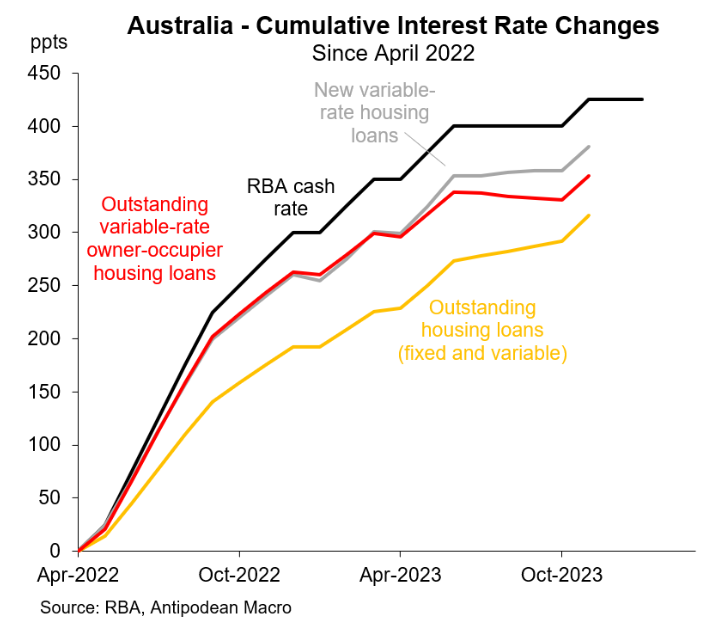

The 13 rate hikes by the Reserve Bank of Australia have also lifted rates on new mortgages to their highest level in decades.

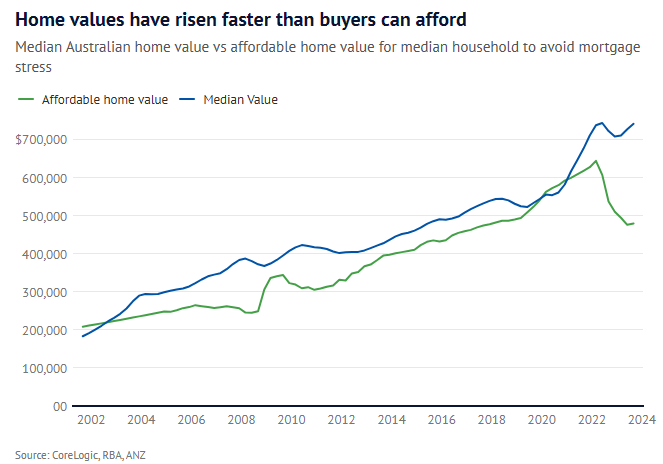

The combination of falling household incomes and reduced borrowing capacity (via higher rates) has meant that the typical Australian home is the least affordable in generations, which has sapped buyer confidence:

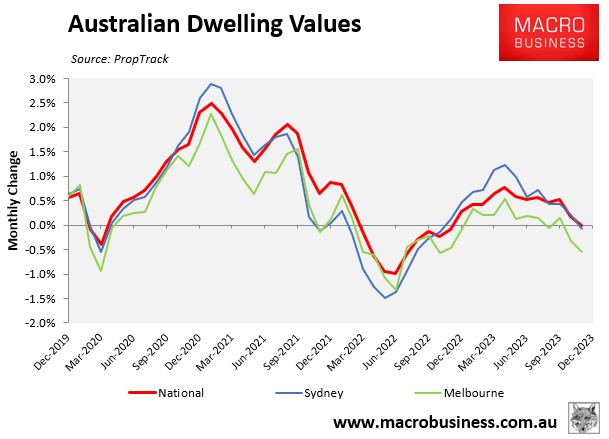

This collapse in confidence has been reflected in a sharp deceleration in price growth following the RBA’s early November rate hike:

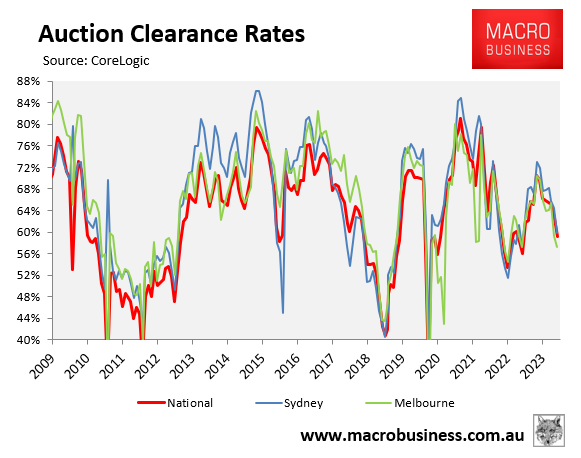

It has also been reflected in the recent sharp fall in auction clearance rates across the major capital cities:

Home buyer confidence probably won’t rebound significantly until the RBA commences its next easing cycle in the second half of the year, which will ease the mortgage burden and improve borrowing capacity.