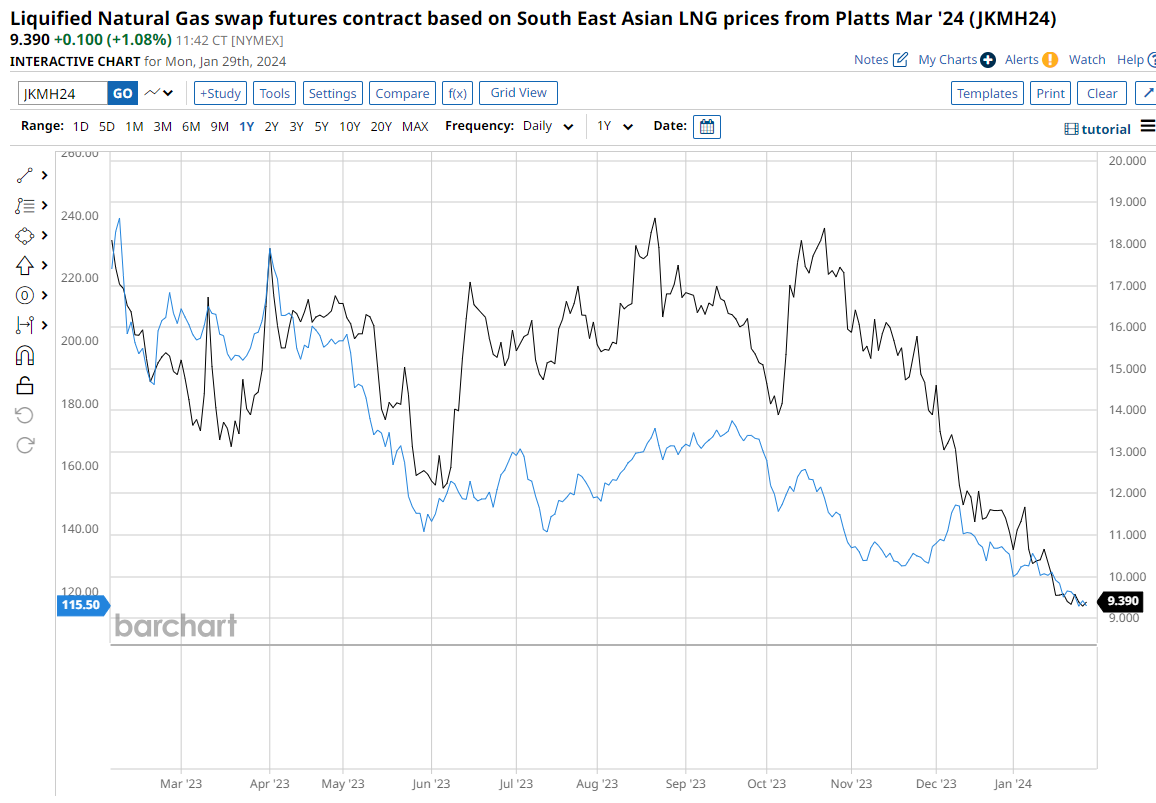

The global energy crash continues apace, with thermal coal (blue) at its weakest price since the Ukraine War, chasing LNG (black) lower:

This is still far above global cost curves. The price will eventually settle back at $80 or so. LNG can go lower yet as well.

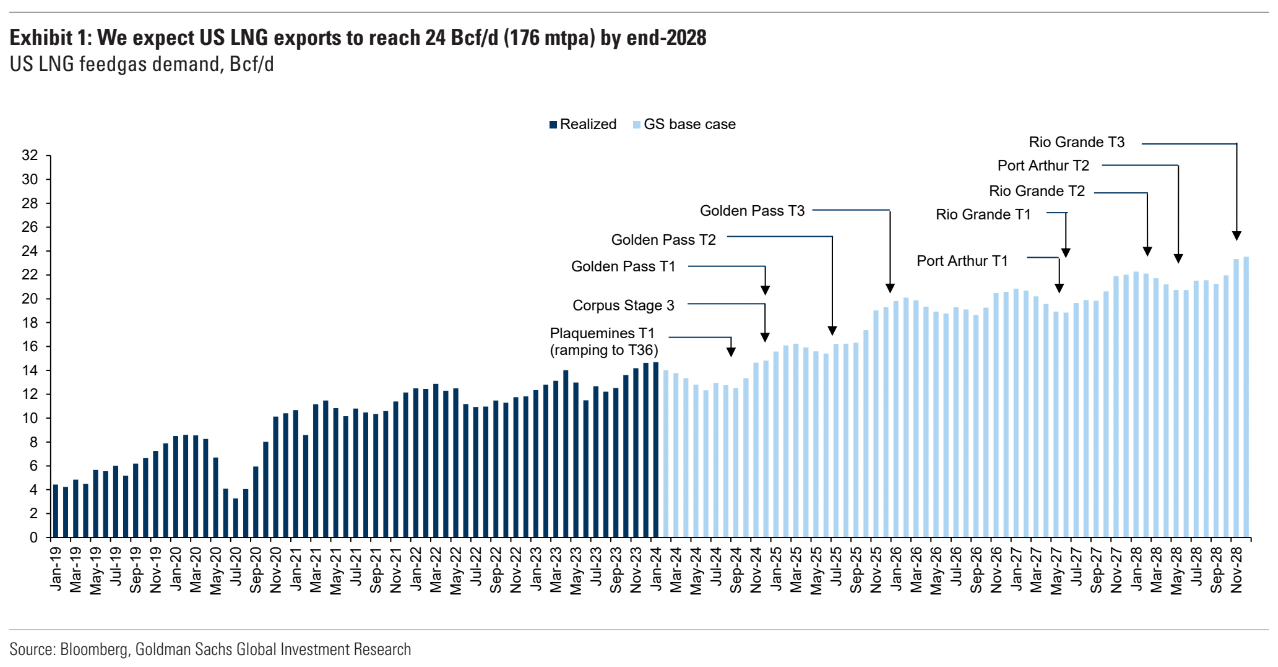

In fact, LNG can crater over the next five years as US supply goes bananas:

Don’t be fooled by breakevens holding prices up. They won’t. As supply floods the market, prices will fall below US cash costs. There will be writedowns as demand takes time to catch up.

Alas, this looms as a double-whammy loss for Australia. Crashing energy prices is an income shock that will weigh on national income. When joined by coking coal and iron ore, it will become macro-economically defining.

But, crashing global gas prices will not bring energy prices down in Australia unless the gas export cartel is broken.

Local gas prices are glued to Albo’s $12Gj price cap, $1Gj higher than the same gas can be bought in Europe.

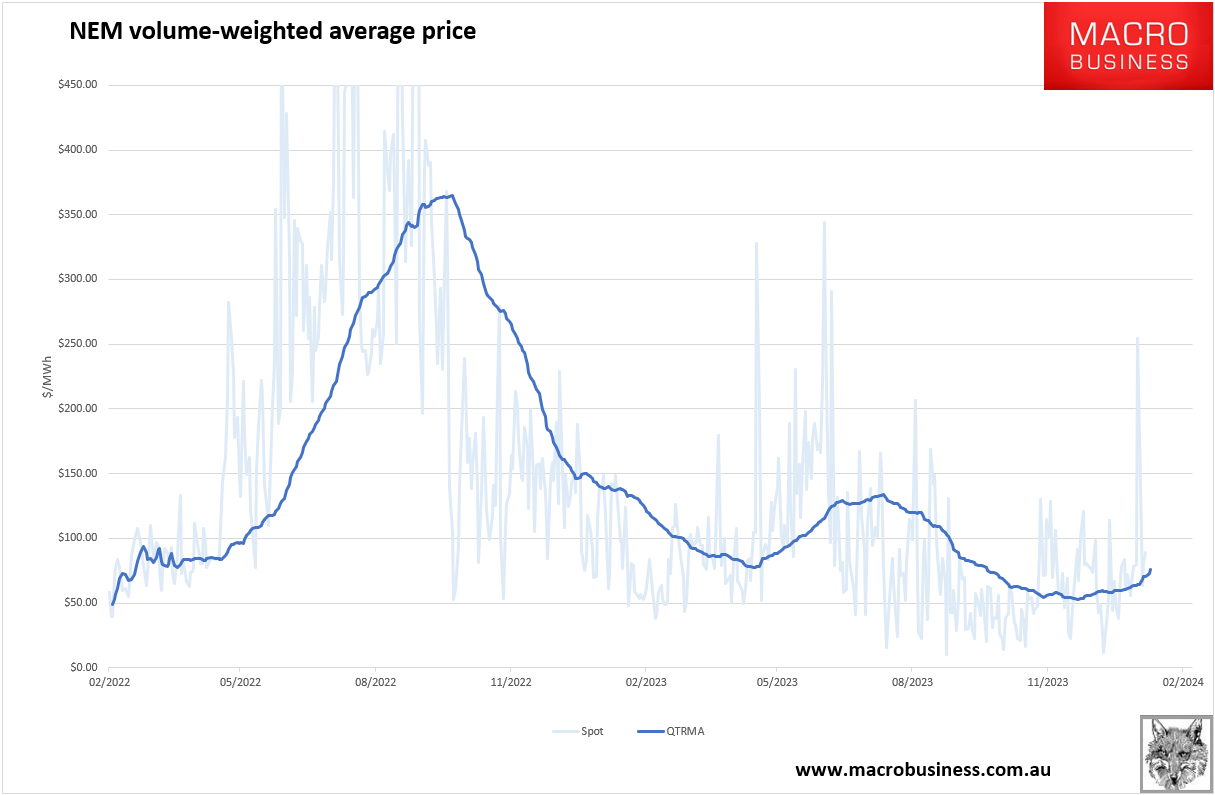

And as summer strains the electricity grid, more gas-fired power means higher power prices as well:

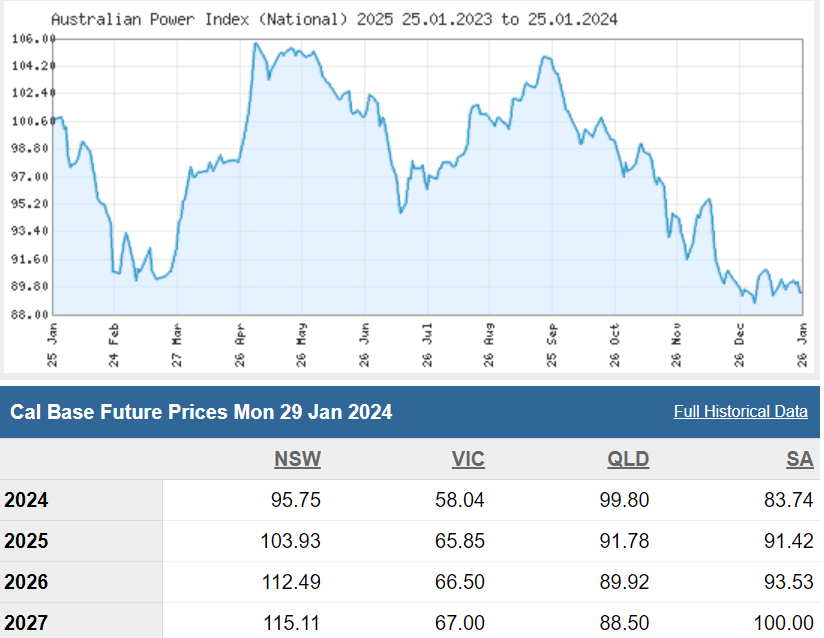

With power futures making it quite clear that it will keep getting worse as coal is supplanted by renewables/gas:

The timing of Albo’s new energy shock could not be worse as the AER finalises its default market pricing into March.

For the life of me, I do not know why government does not fix this with lower energy price caps of gas export levies.

It is permanent left tail risk embedded at the heart of the economy with the potential to destabilise whoever is in power.