Justin Fabo at Antipodean Macro has posted the below chart showing how resources excluding gold completely dominate Australia’s exports:

As noted by Fabo, “rock and gas exports from Australia are roughly $33 billion (currently) every month, or circa 15% of Australia’s GDP”.

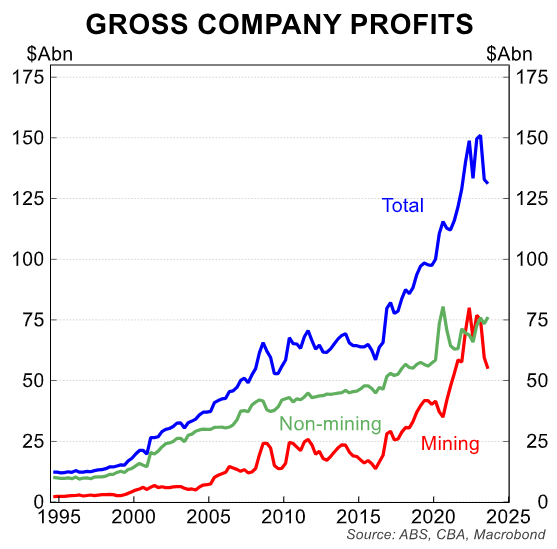

It is a key reason why the mining sector comprises such a large share of Australian company profits:

Soaring commodity prices have seen mining profits more than double such that the sector, which only employs around 2% of Australians, currently earns nearly as much profits as all other businesses combined.

Because most energy companies are foreign-owned, and Australia does not have an effective super profits tax in place, the majority of the benefit from the Russia-Ukraine War price surge flowed offshore to foreign shareholders.

Meanwhile, domestic energy prices soared, leaving Australian households and businesses worse off, despite the fact that Australians own vast gas and coal resources and are one of the world’s major exporters.

Under existing arrangements, the more expensive coal and gas become, and the more that Australia exports, the richer foreign-owned mining corporations become, whereas many individual Australian households and businesses become poorer (via rising increasing energy prices).

Australian workers have gone backwards due to negative real wage and income growth, and some businesses have been sent to the wall by soaring energy costs, while the foreign-owned energy cartel has gouged ruthlessly earning super profits that Australians mostly do not share in.

Last year, former director of the OECD, Adrian Blundell-Wignall, called on the Australian government to copy Norway’s mining super profits tax and sovereign wealth fund.

“Mining makes by far the most profits of any industrial sector in Australia. Thirty per cent of the total on average since China’s WTO debut, and 55% last year. Perhaps that is the great benefit for Australia”, Blundell-Wignall wrote.

Norway understands what a minerals birthright is. Just one single company, Equinor, paid US$49 billion ($A70 billion) to the government in 2022, more than the entire mining industry pays in royalties and taxes in Australia”.

“Its effective tax rate is 64-72%. Aussie miners’ predictions of the doom that would follow didn’t happen to Equinor”.

“Instead, Norway built an enormous Pension Fund Global, which reallocates mineral wealth. Currently, every Norwegian has a birthright of $A363,000 in that fund, compared to about $7000 for every Australian in the Future Fund”.

“A substantive tax on super profits in mining is the right way to get a broad-based new industrial strategy moving for Australia”.

“By failing to reallocate resource profits to more productive forward-looking industries, we allow the future of young Australians to be stolen from them”, Blundell-Wignall concluded.

Unfortunately for Australians, we are stacked with captured policy cowards who prefer to cozy up to foreign-owned energy and mining giants than govern in citizens’ best interests.

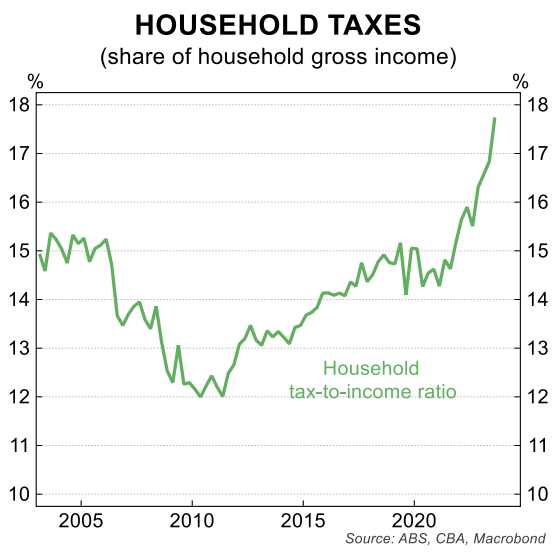

In doing so, they will deprive us of much-needed tax revenue, which simply pushes the pain onto households:

They have also unnecessarily raised our energy costs, which has further cut real disposable incomes, made our businesses less competitive, and forced the RBA to fight inflation harder by raising interest rates.