AMP chief economist, Shane Oliver, has written a note on the economic and investment outlook for 2024, whereby he argues that inflation will fall globally in 2024, which will likely prompt the Reserve Bank of Australia to cut the official cash rate (OCR) to 3.60% by year’s end.

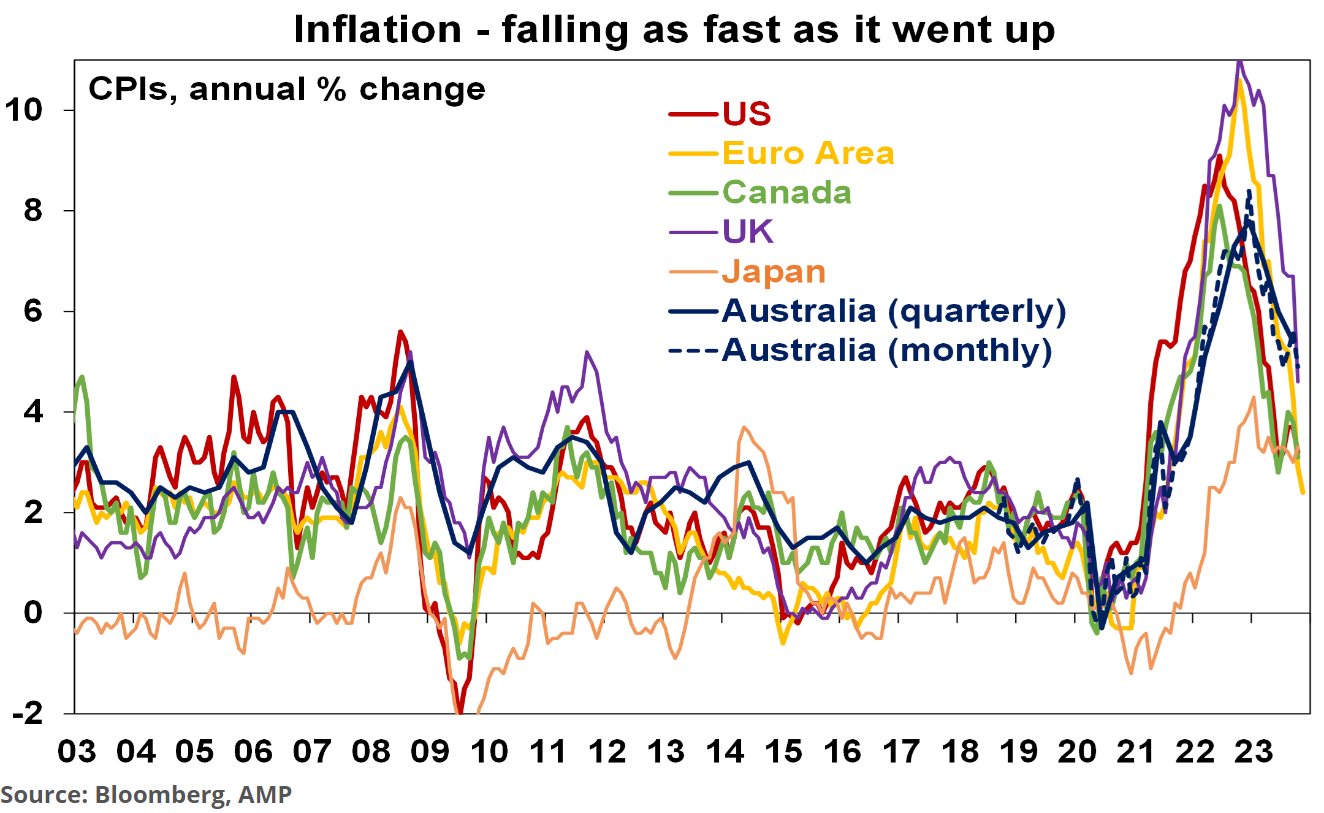

“Inflation across major countries has fallen sharply from peaks of 8 to 11% last year to around 3 to 5%. Australia lagged on the way up and is doing the same on the way down, but it’s falling too”, notes Oliver.

“Inflation has eased sharply to around 3% in major industrial countries and around 5% in Australia and is likely to continue to fall as: supply chain pressures have reversed; demand is cooling; and labour markets are easing with sharp falls in job vacancies”.

“This includes in Australia which lagged US inflation on the way up and is just doing so again on the way down with our Inflation Indicator pointing to a further sharp fall”, Oliver adds.

“We expect central banks in the US, Canada and Europe to start cutting rates in March or the June quarter”.

“While there is still a high risk of one more hike in Australia in February, falling inflation should head this off so our base case is that the RBA has peaked ahead of rate cuts starting mid-year, taking the cash rate down to 3.6% by year end”, argues Oliver.

A similar theme was expressed in Justin Fabo’s CPI Preview at Antipodean Macro, who also pointed to falling inflation here and abroad, which will likely leave the RBA “comfortably ‘on hold’ for a while and until there are clear signs of labour market deterioration”:

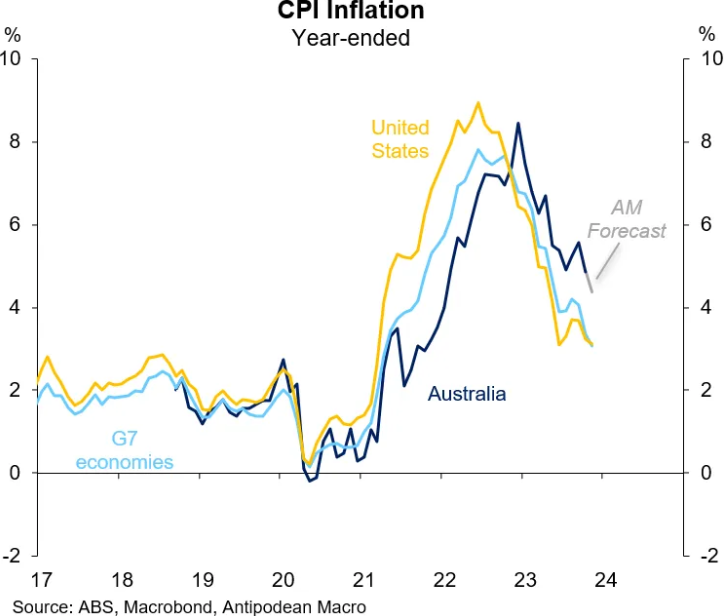

“Australia’s CPI inflation has lagged that experienced in other developed economies. In part this reflects the delayed emergence of the Australian economy (and people) from COVID-related restrictions in 2021”.

“Consequently, the decline in CPI inflation in Australia started later than elsewhere”.

“Encouragingly, however, the disinflation occurring in the US, Europe and Canada bodes well for further near-term falls in Australia’s CPI inflation, albeit with a lag. This is something that the RBA Board hasn’t missed”…

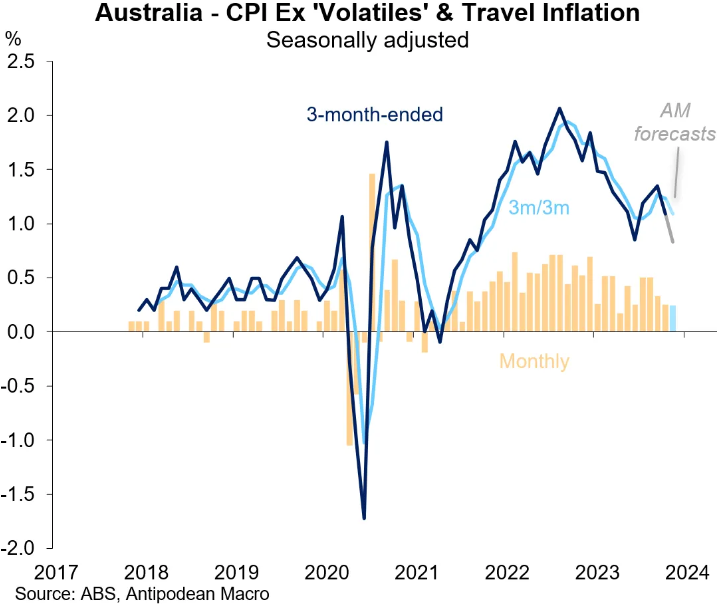

“We place as much emphasis on the higher frequency seasonally adjusted measure of CPI excluding ‘volatiles’ and travel as a guide to underlying inflation”.

“We expect this measure to have remained relatively well behaved in November after moderating in September and October”.

For mine, interest rate cuts in the second half are an odds on bet.

First, there is a global oversupply of goods at present. This means that the cost of anything that arrives in Australia by ship has been decreasing. It’s basically the opposite of what happened during the pandemic, when there were widespread supply bottlenecks and shortages.

Now, we are seeing a resurgence in supply at the same time as global demand has eased.

As a result, we have an oversupply of goods, which is now exporting goods deflation around the world, including into Australia.

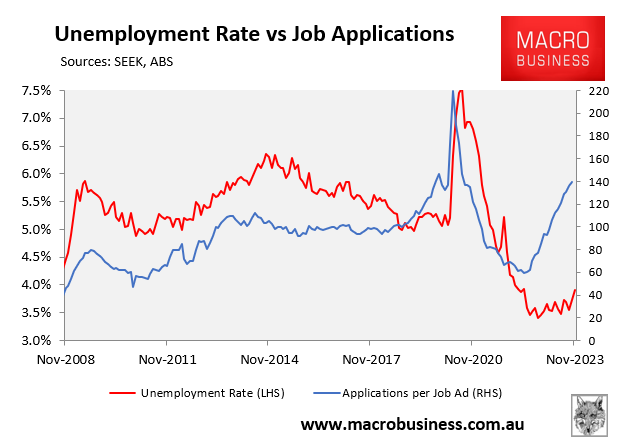

Second, Australia’s labour market is likely to weaken materially amid historically high rates of labour supply and easing demand from employers.

The number of applicants per job ad has already surged well above pre-pandemic levels and this points to sharply rising unemployment in the period ahead:

With those two conditions in place, the RBA is likely to cut rates in the second half.

The key risk to this outlook is if Houthi militants in the Middle East widen their attacks on global shipping routes, thereby disrupting supply chains because we can’t get goods from country A to Country B.