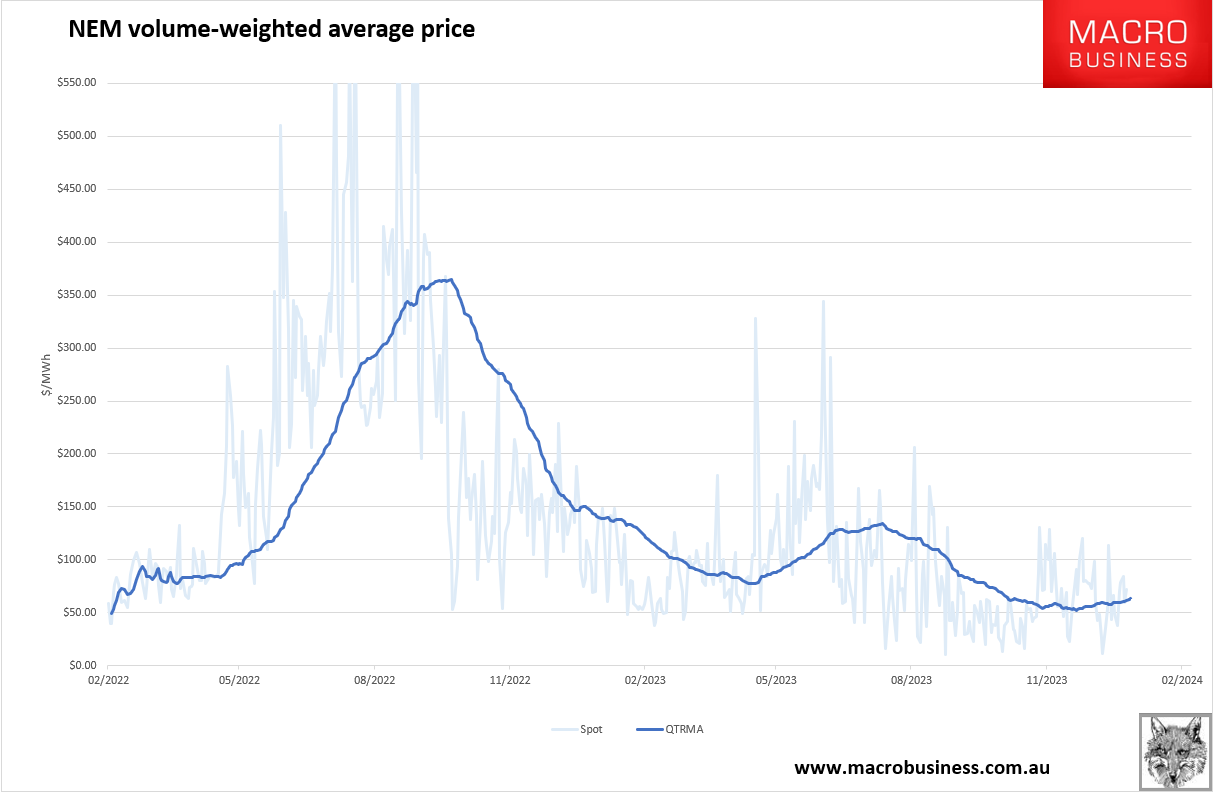

Local electricity prices continue to firm into peak season:

Despite much weaker demand than a year ago:

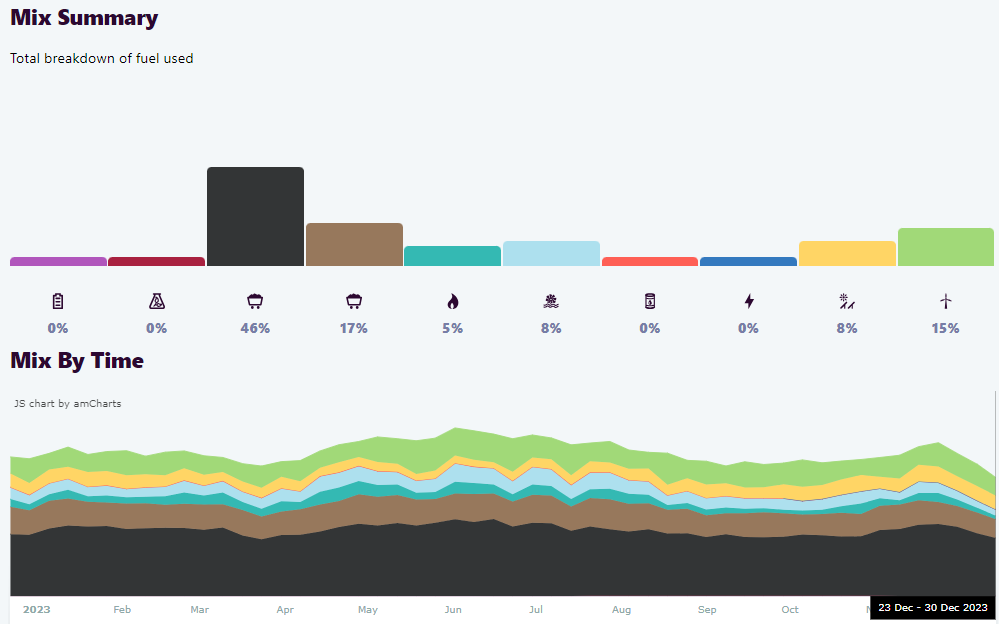

The strong prices are, as usual, driven by elevated gas prices that are glued to the $12Gj price cap:

This is fast going to become a problem as global gas prices keep collapsing:

The average LNG price for February delivery into north-east Asia dropped nearly 10% to $10.10 per million British thermal units (mmBtu) from $11.20 last week, industry sources estimated, its lowest level since June 9.

…In Europe, S&P Global Commodity Insights assessed its daily North West Europe LNG Marker (NWM) price benchmark for cargoes delivered in February on an ex-ship (DES) basis at $9.071/mmBtu on Jan. 11, a $0.85/mmBtu discount to the February gas price at the Dutch TTF hub.

The Aussie export net-back price is around $13.50. For now, locals are still paying less than export customers, even if they are being gouged.

But prices are not done falling. The global gas glut is intact. And prices don’t bottom until May.

All things equal, we’re going well south of sub-$10Gj in Asia soon and the pressure to reduce local gas prices will be on again.

Albo’s dills should be revisiting the “reasonable price” provision of the mandatory gas code of conduct. It will be needed.

Meanwhile, the cartel is keen to consolidate further:

LNG production of the combined Woodside-Santos would increase from 16 million tonnes a year to almost 23 million tonnes in 2028, Mr Burns said.

The potential $80 billion merger would create an LNG portfolio to rival leading oil majors, with access to six major LNG terminals and equity capacity for LNG that could rise to 25 million tonnes a year by the end of the decade, according to Bernstein’s Hong Kong-based energy analyst Neil Beveridge.

He said that would put the Woodside-Santos LNG presence on the scale of Shell’s existing portfolio in the fuel, and opens up more potential upside from LNG trading, which generates more than $US1 billion ($1.5 billion) a year for Shell.

But it also puts nearly all of southeastern Australia’s remaining gas reserves under one toxic roof with an LNG export terminal in QLD that struggles to run at total capacity.

If you trust that that won’t result in a further long-term tightening of local gas supply then I have a bridge I can sell you.

This merger must not proceed.