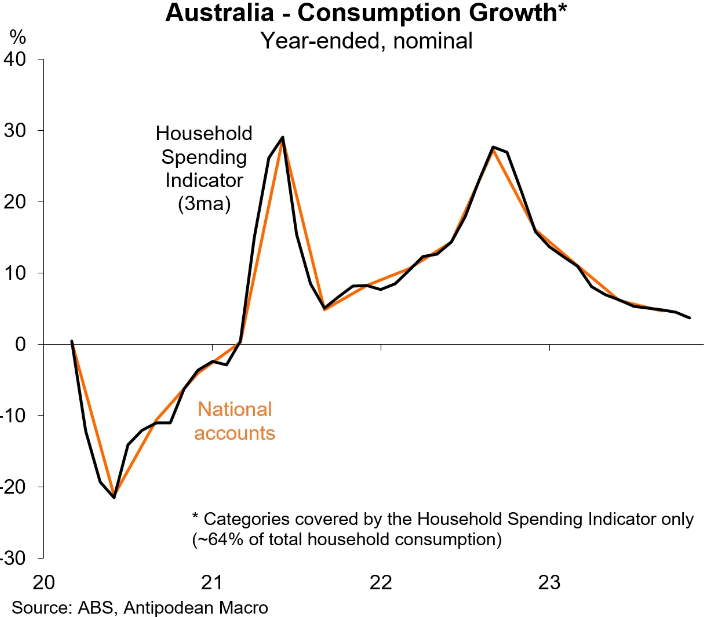

On Monday, we reported on the November household spending indicator from the Australian Bureau of Statistics (ABS), which suggests that household consumption will slow further when the ABS releases the December quarter national accounts in the first week of March.

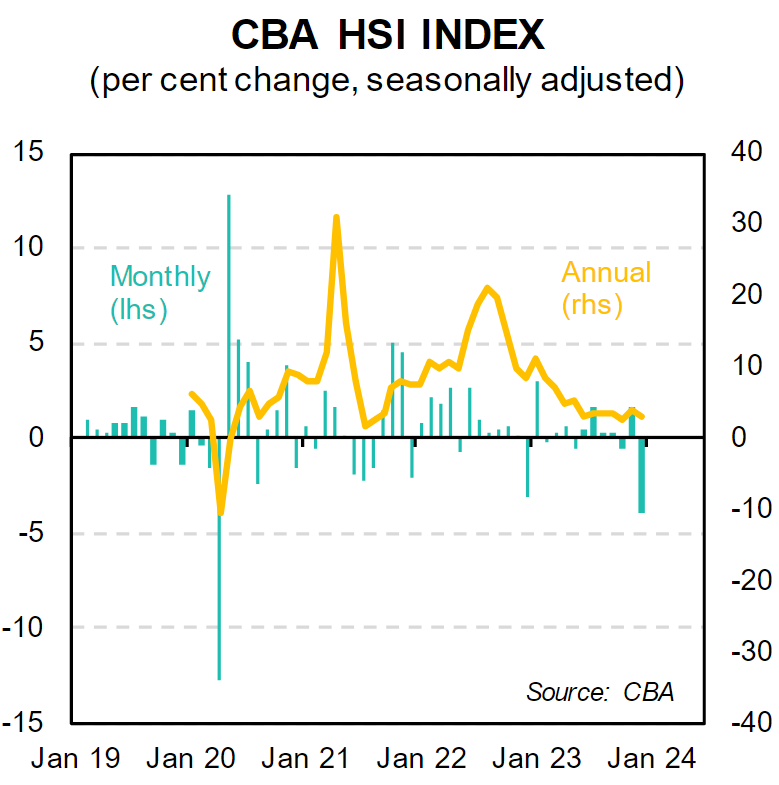

CBA has released its own Household Spending Indicator (HSI), which saw “spending drop sharply in December” on the back of the RBA’s November interest rate rise and soft pre-Christmas retail sales:

Specifically, the CBA HSI fell by 3.9% in December (after a gain of 1.6% in November), with eight out of 12 categories (mostly discretionary) posting declines.

“Household budgets are undoubtedly constrained with rate rises leading to a weakening of consumer spending”, CBA senior economist Belinda Allen said.

“Households in all states reduced spending in December, led by declines in Victoria, South Australia and New South Wales”.

“With the pace of economic growth in Australia moderating and the full impacts of November’s rate rise yet to flow through to the consumer, we expect a further slowdown in the pace of household spending over the coming months”.

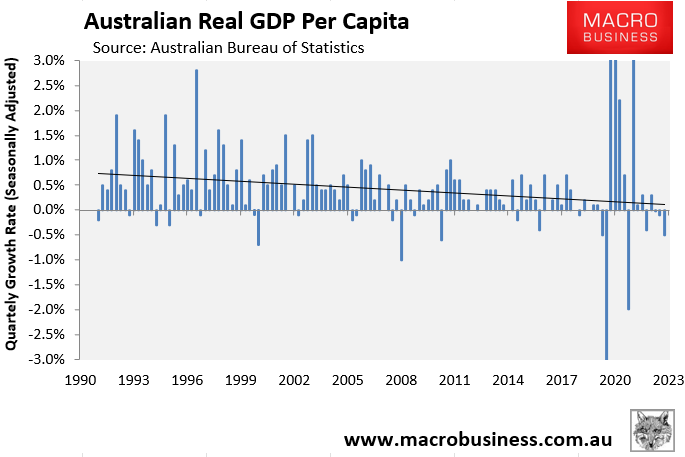

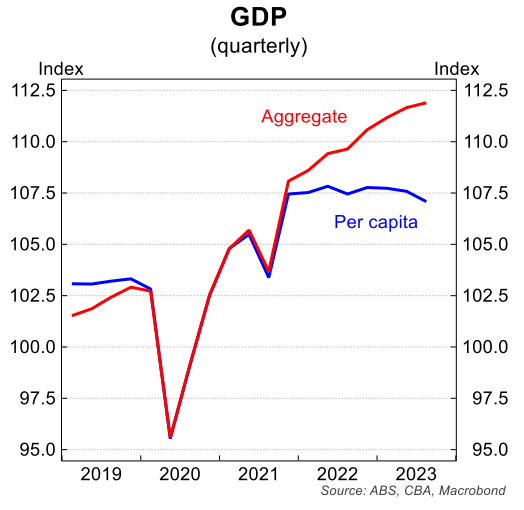

As noted on Monday, Australia is already locked in a per capita recession following three consecutive quarterly declines in per capita GDP:

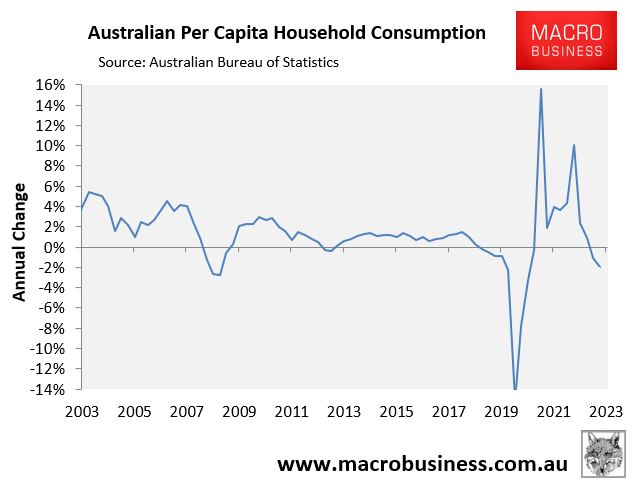

This 0.3% decline in per capita GDP in the year to September has been driven by a sharp 1.9% fall in per capita household consumption:

The above data from both the ABS and CBA, therefore, suggests that Australia’s per capita recession likely deepened in Q4.

Australia has so far avoided outright declines in aggregate GDP and a ‘technical recession’ due to record immigration-driven population growth, which saw the nation’s population expand by 2.4% in the year to September:

However, individual households, on average, are hurting because the nation’s economic pie is not expanding as fast as the population, meaning everyone’s slice of the economic pie is shrinking.

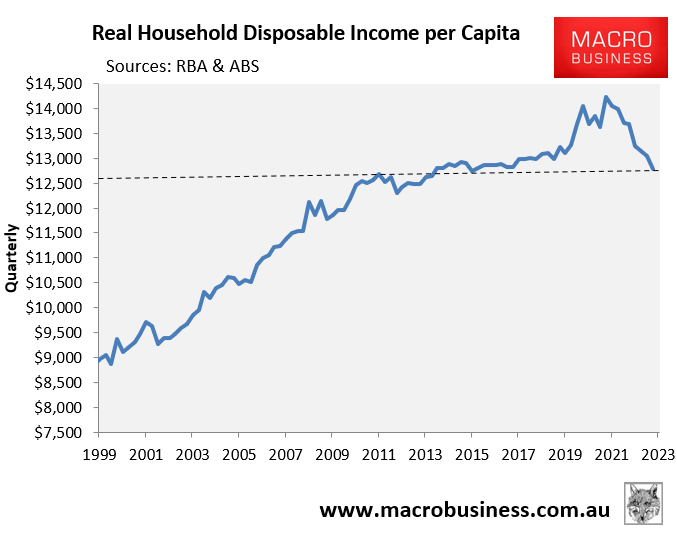

Real per capita household disposable incomes also collapsed a record 6% in the year to September, effectively pulling real disposable incomes down to around 2011 levels:

The only upside from the above data is that it very likely means that the RBA is done hiking interest rates and will more likely cut in the second half.

Indeed, CBA forecasts that the RBA will lower the official cash rate by 75bp in the second half of 2024, starting in September, with a further 75bp of easing projected in first half of 2025.