The hoopla over the Stage 3 tax cuts has once again exposed that Australia’s tax system is far too reliant on personal income taxes.

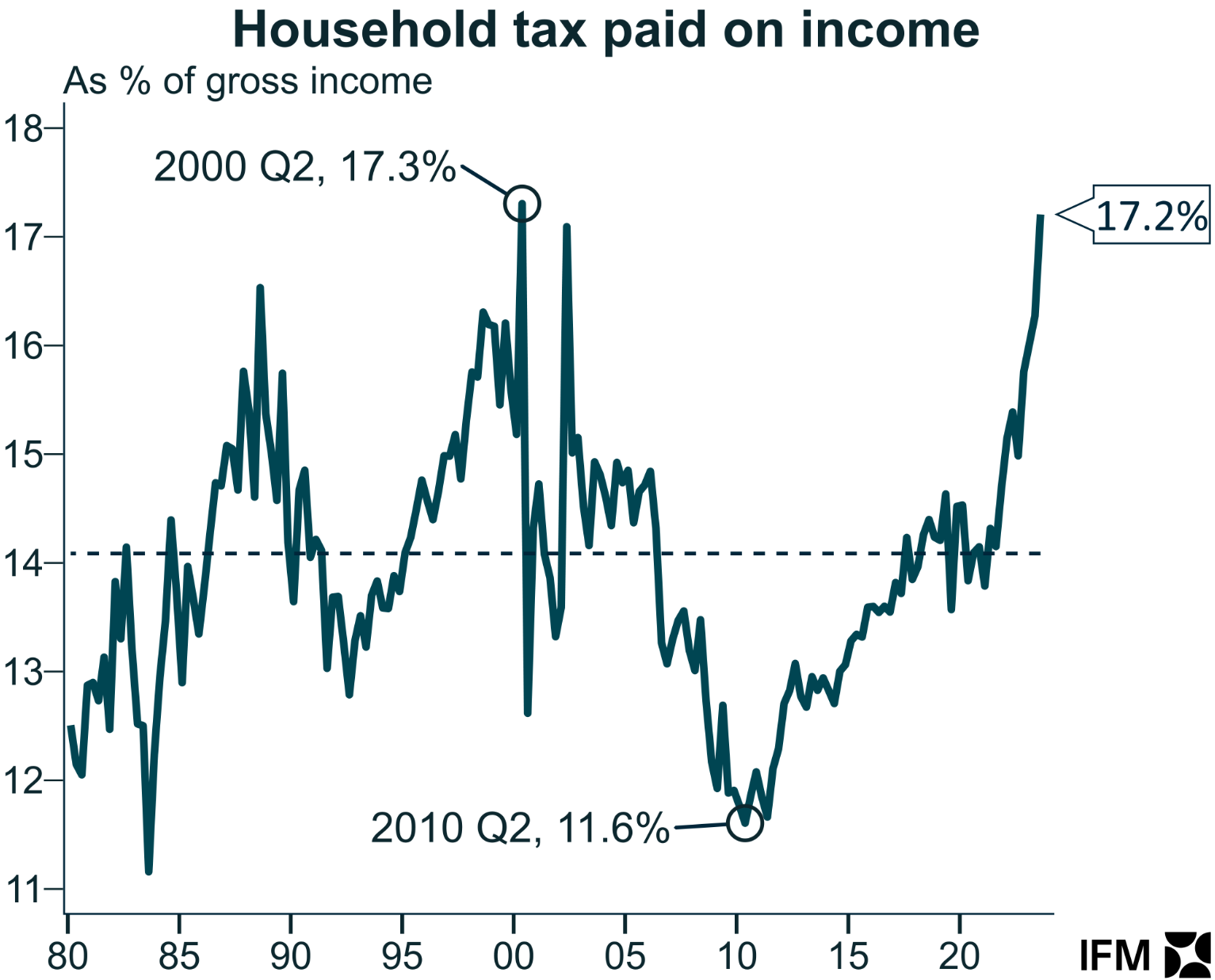

As shown in the next chart, the share of household income lost to personal income taxes hit an equal record high 17.2% in the September quarter of 2023:

Source: Alex Joiner

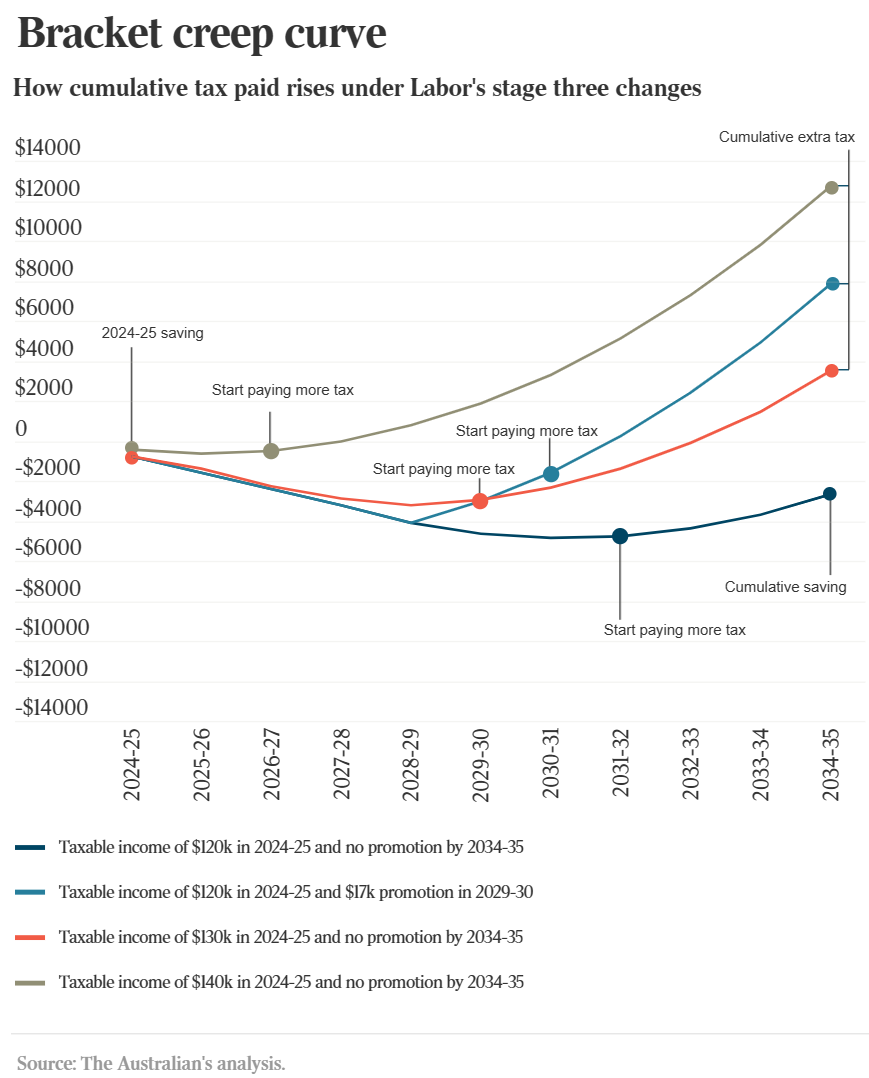

As Alan Kohler writes today, “bracket creep has been costing taxpayers about $2.5 billion a year for a while, and the changes spruiked by the Albanese government last week to hand it back will result in overall tax revenue actually increasing by an average of $3 billion a year for the next 10 years”.

Analysis by The Weekend Australian shows that despite the rejigged Stage 3 tax cuts, 3.3 million Australians are likely to pay higher income taxes over the next 10 years, assuming wages rise a measly 3% a year:

Meanwhile, OECD figures show that around 40% of government revenue in Australia comes from personal income tax, well ahead of the international average of around 24%.

The independent Teal MPs alongside tax groups are now advocating for root-and-branch reform of the tax system to broaden the base and reduce reliance on personal income taxes.

Teal Monique Ryan says she supports ‘fairer’ stage three changes, but claims that bracket creep is becoming a big concern amid Australia’s “unsustainable reliance on income tax”. Ryan says both issues need to be addressed, which is why she has called for a whole of system tax review.

Teal Allegra Spender is leading preparation of a white paper report on tax reform options, due to be completed by mid-2024, with input from former Treasury boss Ken Henry.

The Corporate Tax Association, Business Council of Australia, Institute of Public Accountants, and Chartered Accountants Australia and New Zealand, all claim that an overreliance on income tax exacerbates concerns associated with an ageing population, productivity challenges, and budget pressures.

They want both parties to devise significant tax reform programs before the next election.

Australia is in desperate need of genuine tax reform to broaden the base away from productive effort (namely taxing workers) to more efficient sources like resources, land and consumption.

With the population ageing, and the share of workers in the economy shrinking, Australia’s tax base is becoming increasingly unsustainable and inequitable, especially given the older generation is paying less tax than ever while owning the bulk of the nation’s wealth.

Moving the tax base away from personal income taxes would also reduce the need to import workers via mass immigration to boost the federal budget income tax take.

Politicians do not need to reinvent the wheel here either. They could simply update the 2010 Henry Tax Review, which was fundamentally sound and has already done the heavy lifting.

The important thing is that genuine tax reform gets done rather than remaining in the ‘too hard’ basket for another decade.

This is Labor’s chance to actually do something useful and leave a lasting legacy.