Last year, the Australian Taxation Office (ATO) reported that Australia had a record 2.2 million landlords in 2020-21, when the Reserve Bank of Australia (RBA) lowered interest rates to an all-time low 0.1%.

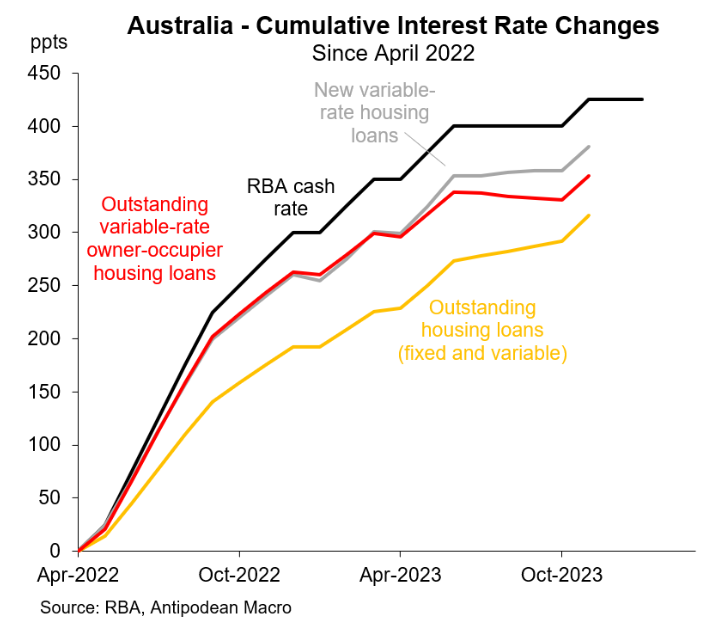

Since that time, we have seen the RBA hike the official cash rate 13 times to 4.35%, which has lifted average outstanding variable rate mortgages by around 3.6%, according to Justin Fabo at Antipodean Macro:

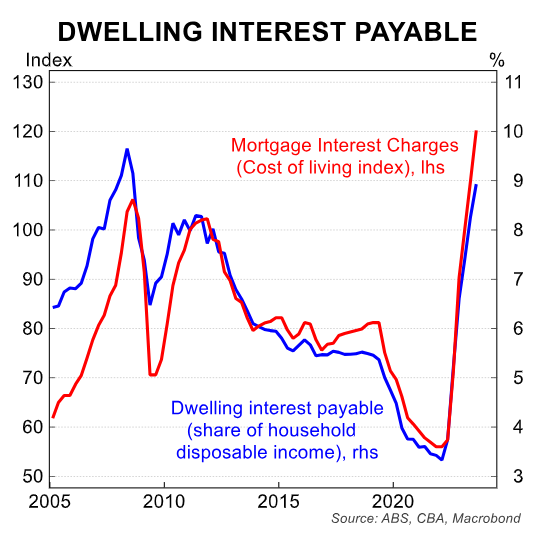

In turn, mortgage interest payments as a share of household income has nearly tripled:

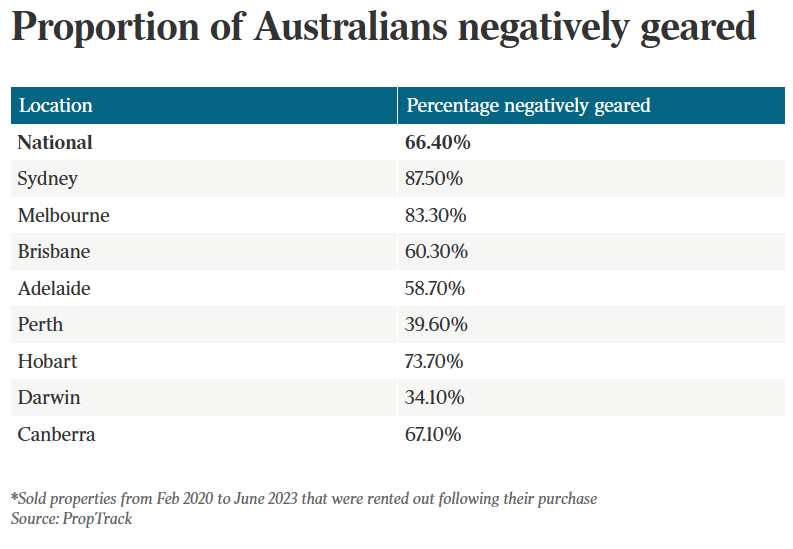

Last year, PropTrack reported that in Sydney, 87.5% of investment properties purchased since the start of the pandemic were operating with negative cashflow, whereas in Melbourne the figure was 83.3%.

Nationally, 66.4% of recent property investors were losing money.

“What we’re seeing since the pandemic is mortgage rates increase faster than rents, although rents have increased very quickly”, PropTrack senior economist Paul Ryan said.

Simon Pressley, the founder of investor buyers agency Propertyology, estimated that the average property investor in Sydney and Melbourne would lose $40,000 each year under current conditions.

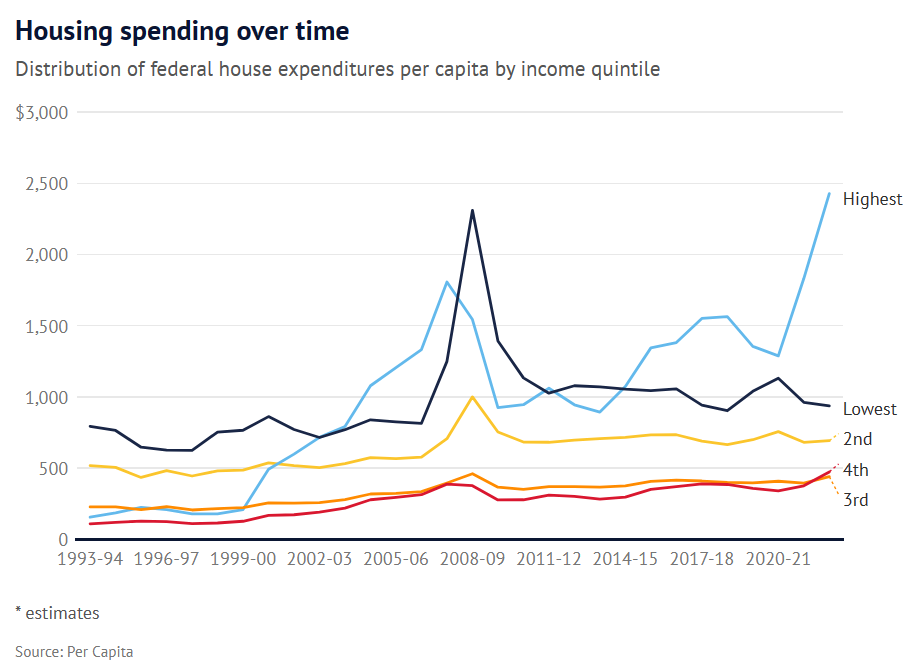

The massive increase in negative gearing losses is having a detrimental impact of the federal budget, according to new analysis by think tank Per Capita, published this week in The SMH.

“As a result of the strong take-up of incentives such as negative gearing, investor tax concessions have ballooned from $1.5 billion in 2000 to an estimated $18 billion, and the estimated share of government housing spending for the top 20% of earners has soared from 9% in 1993 to 43% in 2023”, the article reports.

Indeed, the latest annual Tax Benchmarks and Variations Statement from the Australian Treasury projected $102 billion worth of negative gearing tax deductions over the four years to 2025-26, most of which will flow to higher income earners:

That is up from $73 billion over the prior four years.

However, that projection was made in February 2023, before the RBA hiked the official cash rate another 100bps.

As a result, the federal budget faces significant negative gearing losses as Australia’s army of landlords deduct their net rental losses from their personal taxable income.