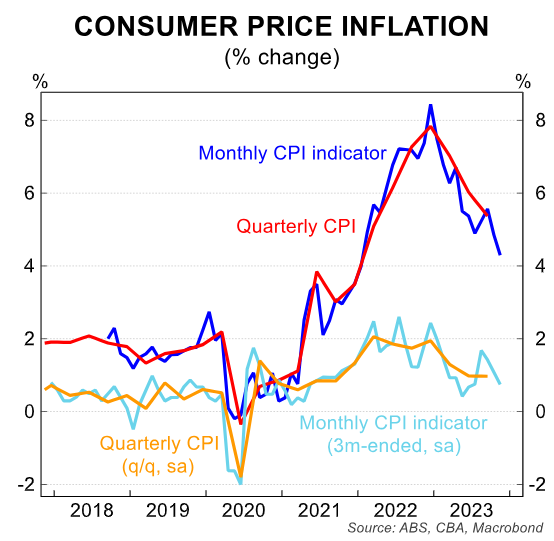

Wednesday’s monthly CPI Print from the Australian Bureau of Statistics (ABS) came in softer than expectations at 4.3% in the year to November, down from 4.9% year-on-year in October and a recent peak of 8.4% year-on-year in December 2022.

While goods deflation continued to be the driver of the lower inflation, the overall tone for household services inflation was also softer than expected outside a sharp jump in insurance premiums:

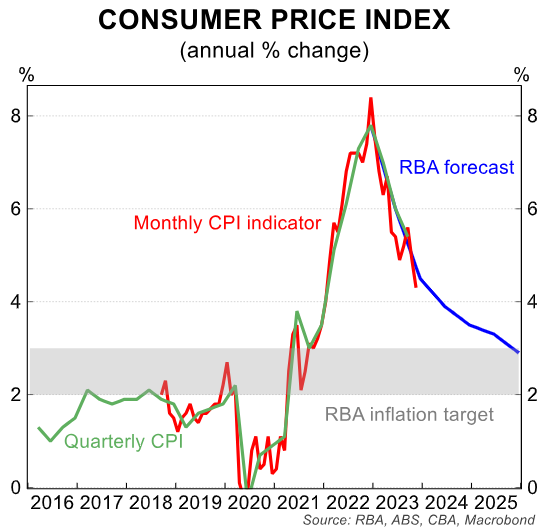

In a note on the result, CBA economist Stephen Wu said “the RBA would consider today’s data an undershoot relative to their forecasts from November”, thus diminishing the chances of further rate hikes:

“The 0.6ppt/mth fall in the headline CPI inflation rate was larger than for many of the exclusion-based measures of core inflation, which were down by 0.2-0.3ppts. But the annual trimmed mean measure fell by a larger 0.7ppts to 4.6% from 5.3% previously”.

“Inflation has declined from a peak of 8.4%/yr in December 2022 to 4.3%/yr in November 2023, a massive 4.1pptfall”…

“Perhaps the most interesting aspect of today’s inflation report is not the headline number but the details around services inflation”…

“Domestic inflation pressures generally look to have eased further. Various market services showed disinflation, for instance with annual rates of inflation for meals out and household services continuing to ease”.

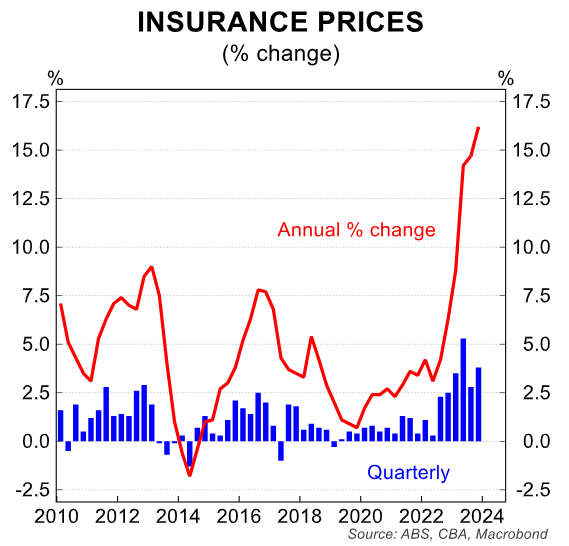

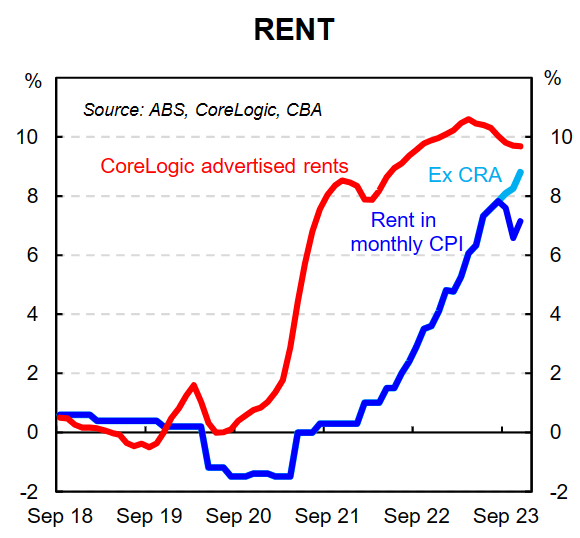

“However, rents inflation remained strong, consistent with low rental vacancy rates. And insurance premiums continued to rise very strongly, notching a record high 16.2%/yr, and reflecting still-elevated building costs as well as weather events”…

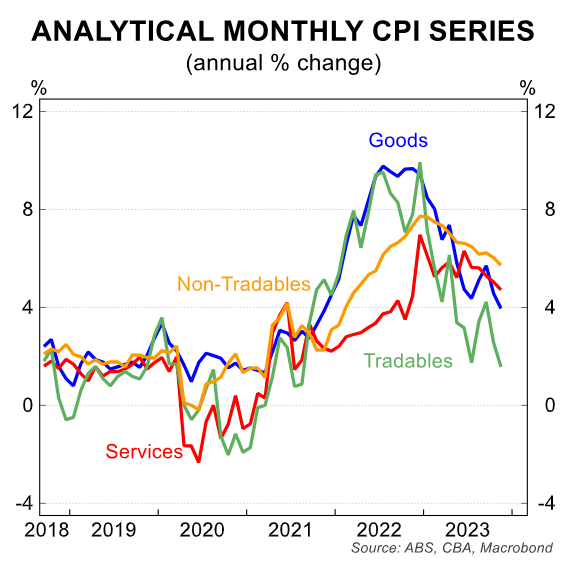

“The ABS’ constructed analytical CPI series also shed some light on the breadth of disinflation. The easing in inflation is not just occurring in goods and tradables; services inflation as well as non-tradables inflation are both moderating”.

Wednesday’s monthly CPI indicator result alone won’t be enough to dissuade the RBA from hiking again, although it certainly lessens the chances.

The final decision on whether to hike next month will hinge on the outcomes of the December labour force survey (18/1), retail trade (30/1) and the Q4 23 CPI (31/1).

Expect these results to come in soft on balance, meaning we have very likely hit the peak cash rate before cuts in the year’s second half.