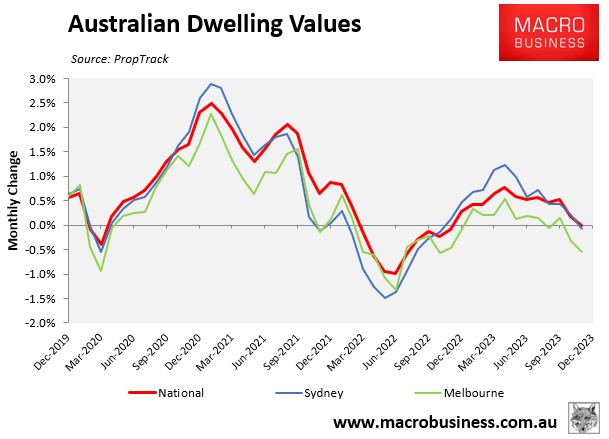

PropTrack’s Australian dwelling values index showed that the Reserve Bank of Australia’s (RBA) 0.25% interest rate hike in November had an immediate impact on house prices.

As illustrated in the next chart, values nationally decelerated from 0.5% growth in October to just 0.2% growth in November and 0.0% growth in December:

This deceleration in dwelling values nationally was driven by Melbourne and Sydney, which posted -0.5% and -0.1% declines in December.

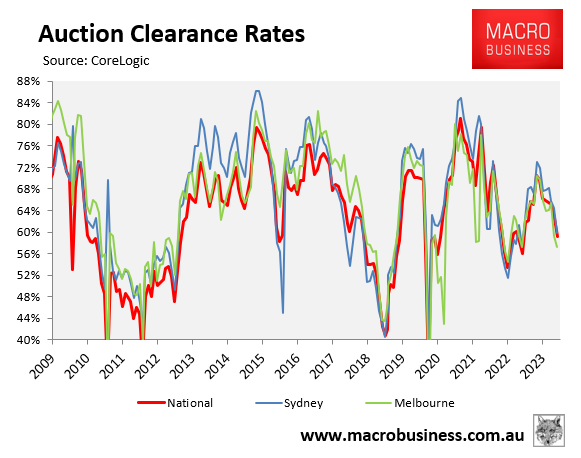

Auction clearance rates revealed similar decline, falling from a peak nationally of 71% in May to just 59% in December, with Sydney and Melbourne recording similar declines:

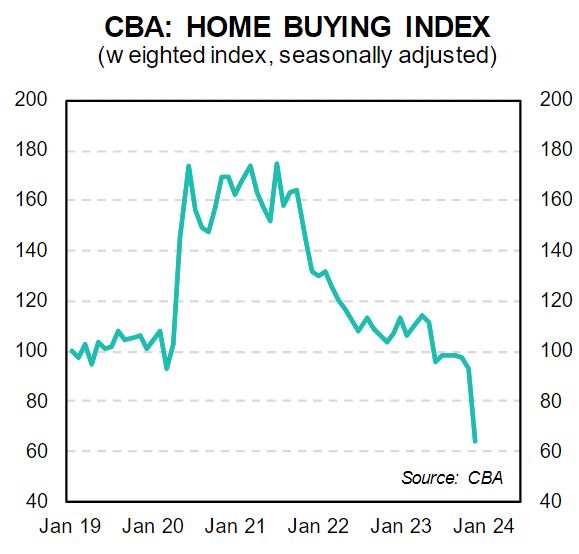

CBA on Monday released its Home Buying Index for December, which plummeted a seasonally adjusted 31.1% in December, which follows November’s 4.6% decline:

On an annual basis, CBA’s Home Buyer Index fell from -9.9% in October to -40% in December.

CBA explained the result as follows:

“The fall in the Home Buying Index in December likely reflects the effect of the early November rate hike from the RBA, after four months when rates were unchanged”.

“The timing of the rate hike in November meant home loan applications fell more in December than normal, pulling down the index”.

“We expect home prices to rise in 2024, but at a slower pace than the 9.3% recorded in 2023”.

The housing market will no doubt kick back into gear if the CBA’s forecast of 75bp of rate cuts in the second half of 2023 (followed by another 75bp of easing in the first half of 2025) comes to fruition.