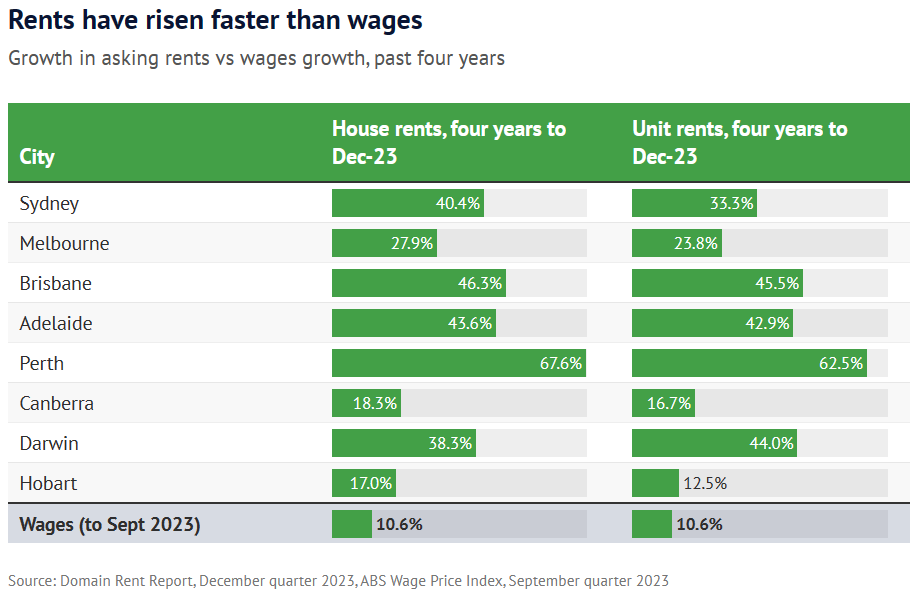

New analysis from Domain shows that asking rents in most major capital cities have risen at least twice as quickly as wages since the pandemic began, placing pressure on tenants facing a cost-of-living crisis.

Wages increased by 10.6% between the December quarter of 2019 and the September quarter of 2023, according to the most recent ABS data.

By comparison, asking rents have risen faster across all capital cities, and significantly faster across the five major capitals:

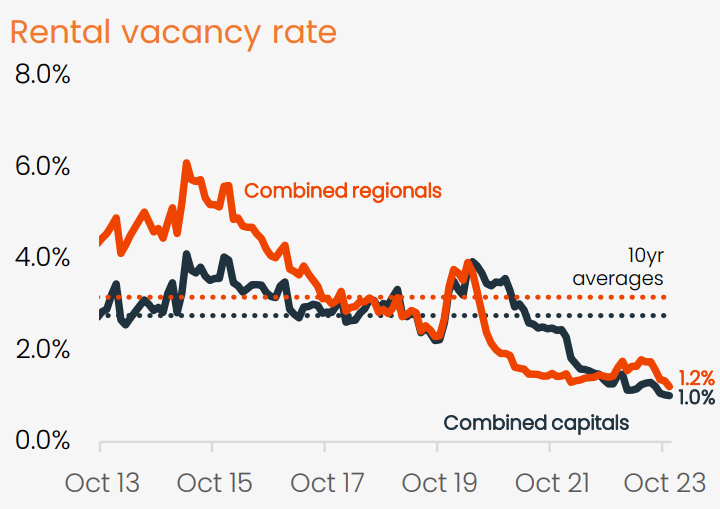

According to ANZ senior economist, Adelaide Timbrell, the rapid rent growth has been caused by extremely low vacancy rates, rapid population growth, and lacklustre development activity that has not kept up.

At the end of 2023, Australia’s capital city vacancy rate was just 1%, whereas a balanced market is deemed 3%.

Source: CoreLogic

“Any renter who is looking for a property is competing with more renters for a smaller number of available properties”, she said.

“This allows landlords to be less competitive when they’re posting their rental price”.

Better Renting executive director Joel Dignam said housing costs were the biggest expense for many households, particularly those on lower incomes.

“There’s a pretty grim picture. A lot of Australians are under pressure these days in terms of the household budget”, he said.

“Even a 10% rent increase, that’s a lot of money”.

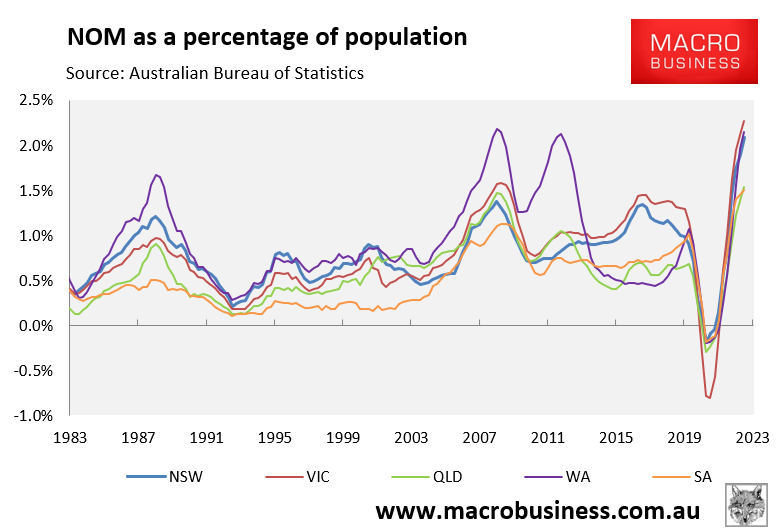

One of the key reasons for this tightness is the record net overseas migration arriving in Australia’s main capitals:

The massive volume of international migrants who have arrived since borders were reopened has directly boosted rental demand and price growth.

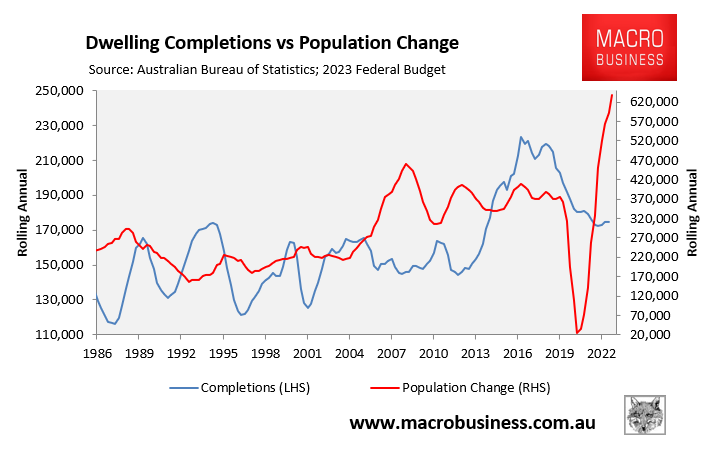

Given that Australia’s population is expected to grow at a historically strong rate in 2024, as new home production slows, rental vacancy rates will remain tight and rental inflation will remain high.

Financially stretched renters will respond to the shortage by shifting into shared accommodation, dispersing the rising costs across a wider number of individuals.