Justin Fabo at Antipodean Macro has written a great analysis of New Zealand’s economy and inflation, which could see the Reserve Bank backflip on interest rates after hawkish commentary in its last Monetary Policy Committee (MPC) meeting in late November.

According to Fabo, “inflation is falling faster than the RBNZ expected and downwardly-revised GDP data are now consistent with labour market data showing an easing in capacity constraints”.

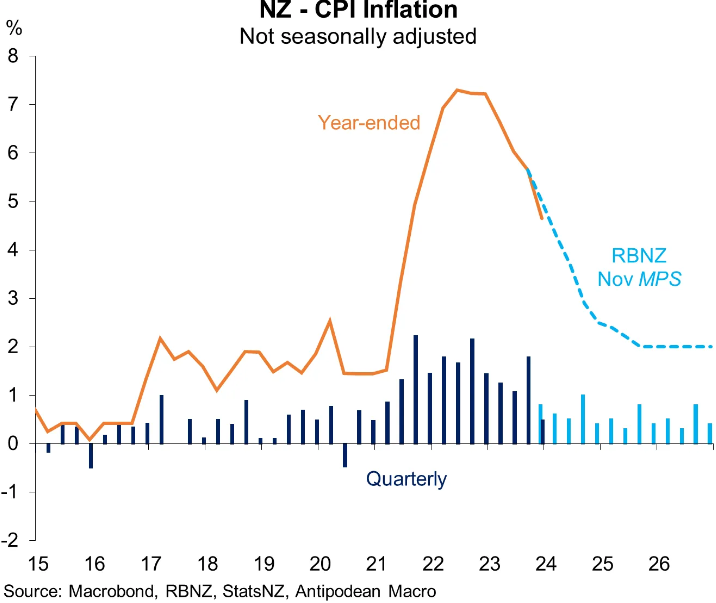

Fabo has produced the below chart showing that “headline inflation was below the RBNZ’s forecast (+0.5% q/q vs +0.8% q/q expected)”:

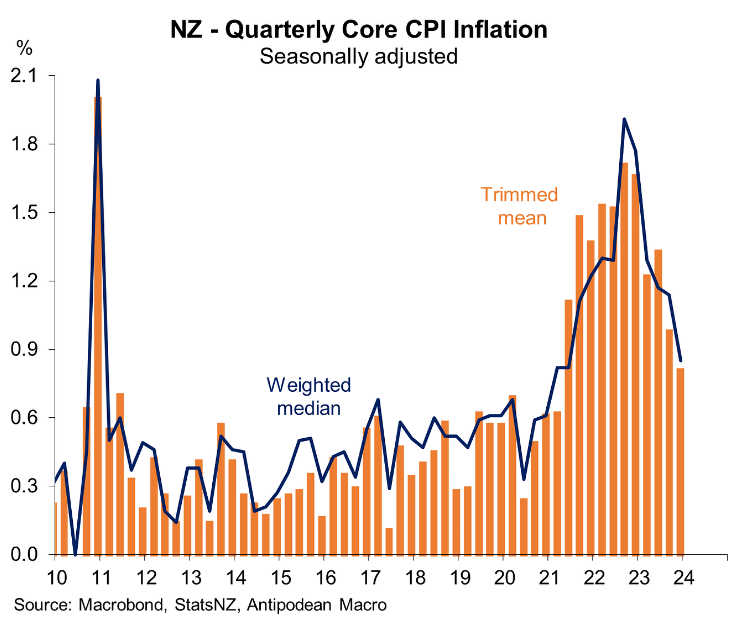

Fabo’s estimate of trend quarterly core inflation, which uses seasonally adjusted CPI sub-group data, “show a noticeable decline in quarterly core inflation to +0.8% q/q in Q4 (see below chart). This is still above the RBNZ’s 1-3% target on an annualised basis, but not by much”:

.

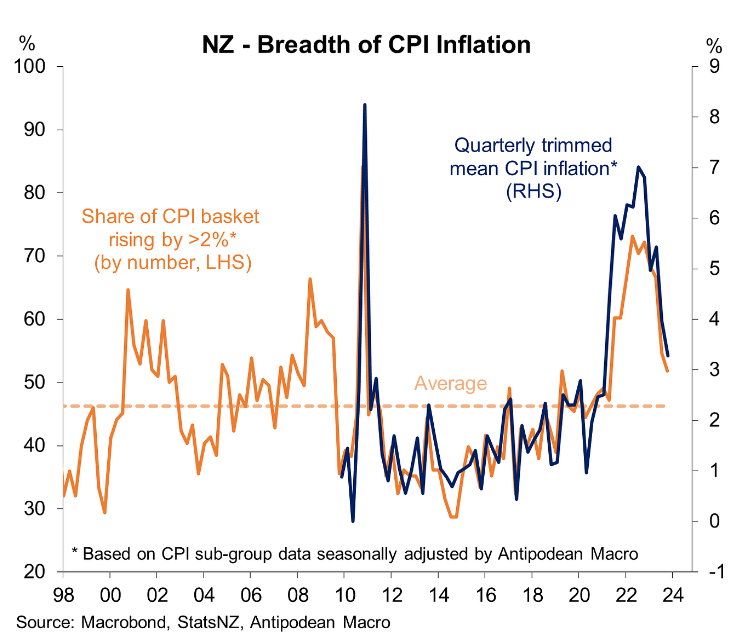

. “Measures of the breadth of inflation across the 108 CPI sub-groups tell a similar story”, according to Fabo:

Meanwhile, the “excess demand” arguments raised in the late November MPC meeting are weakening, according to Fabo.

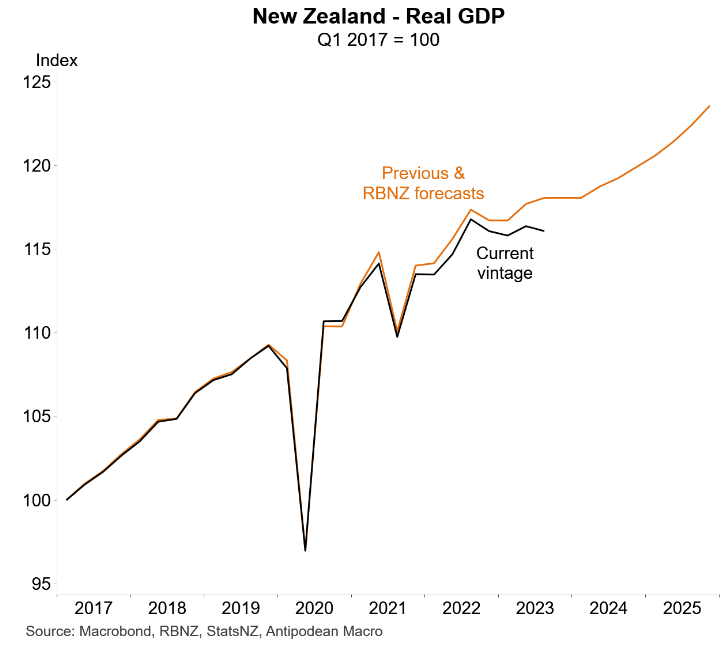

This is evidenced by “downward revisions to GDP and weaker-than-expected Q3 GDP (-0.3% q/q)”:

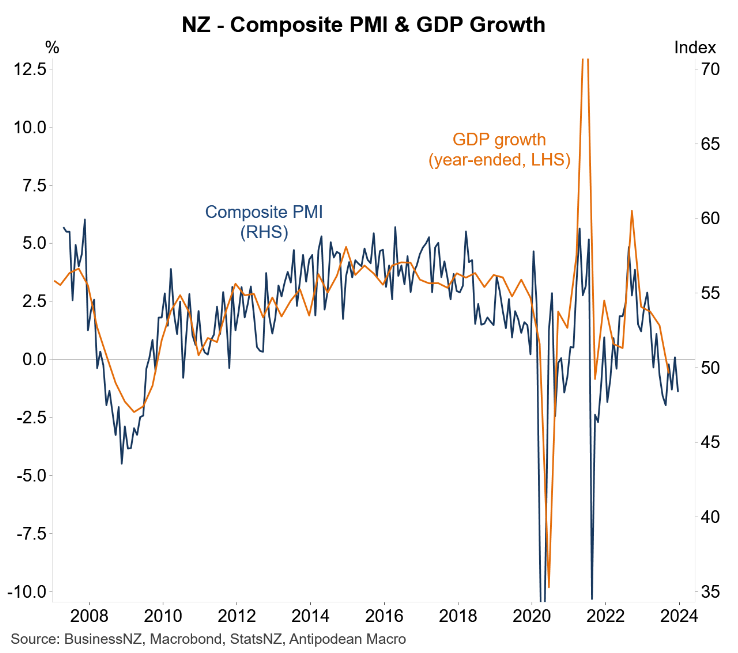

Moreover, “the composite PMI suggests that growth remained weak in Q4 2023”:

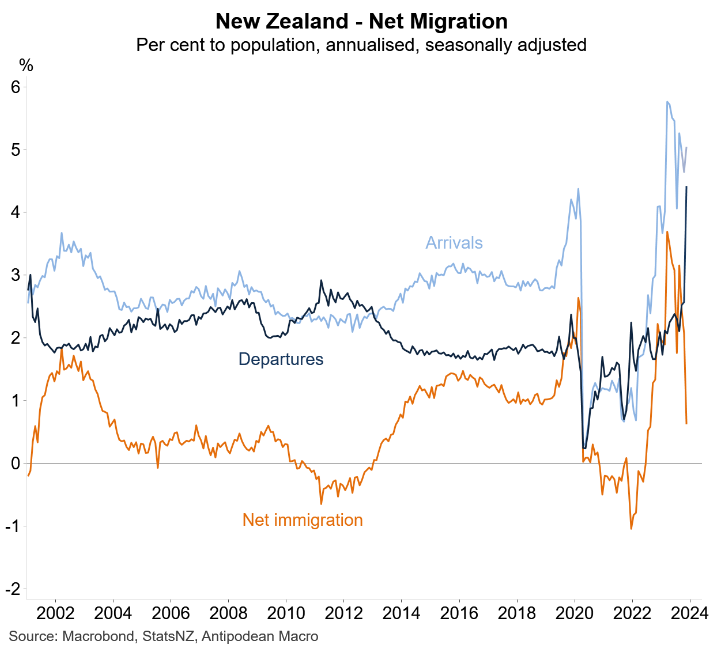

Net migration into New Zealand is also falling back to earth, which should allay the Reserve Bank’s prior fears that strong immigration has been “increasing the risk of inflation remaining above target”:

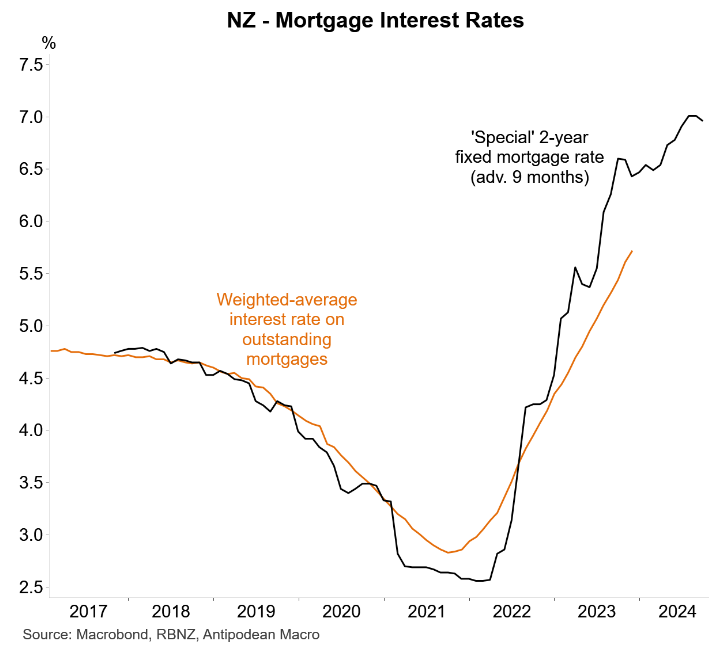

Finally, New Zealand mortgage rates are continuing to rise as fixed mortgages expire, which is tightening monetary policy even without further rate hikes:

The upshot is that Justin Fabo predicts that the Reserve Bank could backflip into an easing bias:

“Pulling all that together, it would be brave for the RBNZ to continue characterising the risks to inflation as being to the upside”.

“Our view is that the discussion should now turn to when some modest policy easing can be delivered given the restrictive stance of monetary policy, encouraging disinflation trend (including globally) and easing in labour market conditions”.

“It’s too early for the RBNZ to be talking about rate cuts. By the MPC meeting on 22 May, however, the Committee will have Q1 labour market, wages and inflation data, plus readings on net immigration to March. We think this will be the first opportunity to start lowering the OCR”.

“While the MPC’s focus is on the 2% mid-point of the target, it need not wait to reach it before starting to wind back how restrictive monetary policy is”.

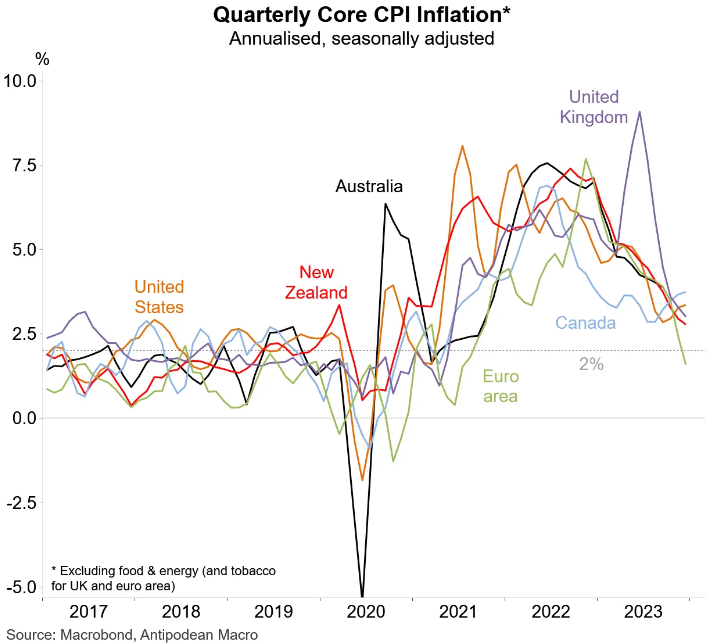

With inflation easing globally amid softening economies (see below chart), similar deliberations will be taking place at other central banks, including Australia’s.