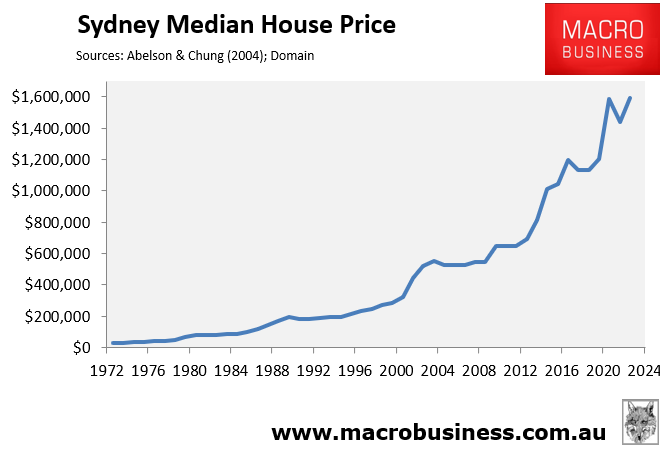

Domain released its House Price Report for the December quarter, which showed that Sydney’s median house price hit a record $1,595,310 at the end of 2023.

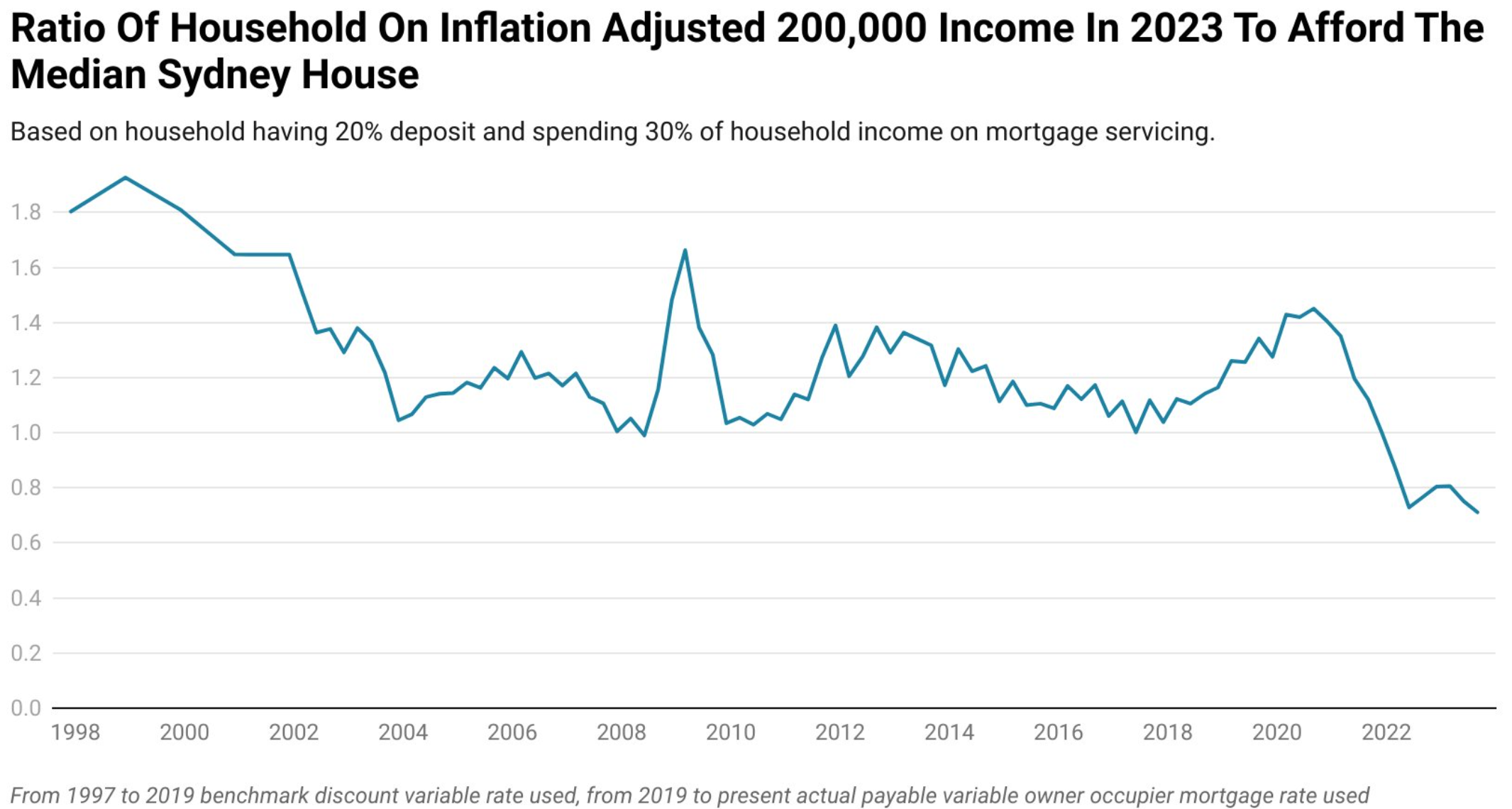

Independent economist Tarric Brooker posted analysis on Twitter (X) showing what proportion of a mortgage on a median-priced Sydney house someone earning $200,000 could afford, adjusted for inflation:

Source: Tarric Brooker

“In 1998, this hypothetical household could afford 1.93 median house mortgages”, notes Brooker.

“As of the latest data this household can only afford 0.71 mortgages”.

“This illustrates nicely the reality of high housing prices. In the late 90s and very early 2000s, this household could have had a palatial home”.

“In 2024, they can’t even comfortably afford the median”, concludes Brooker.

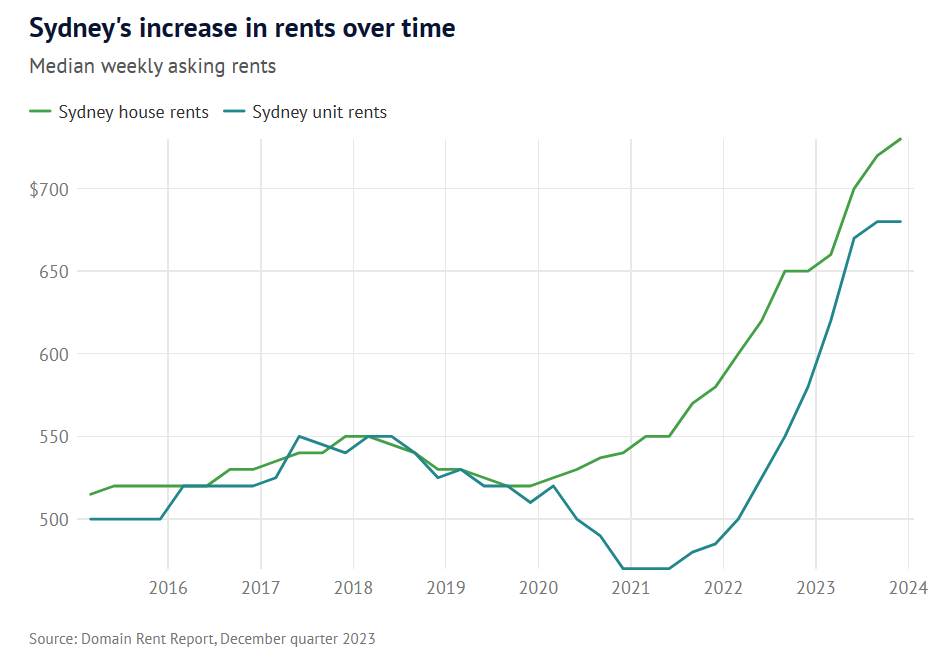

It is not just the price of houses in Sydney that are out of control, but rents as well.

The next chart from Domain shows that median weekly rents across Sydney have ballooned over the past three years, with detached houses experiencing the fastest inflation:

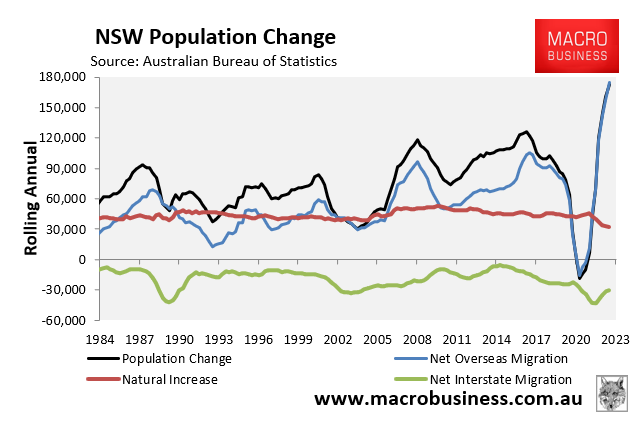

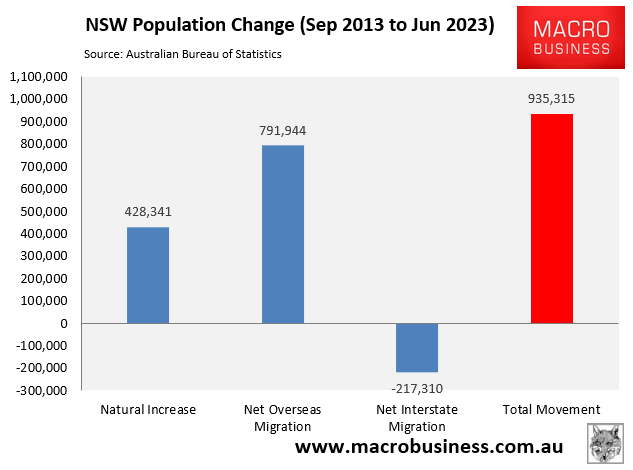

The situation facing Sydney home buyers and renters is unlikely to improve given the rapid growth in population, driven by record net overseas migration:

In the decade to June 2023, NSW added 935,315 people with 791,944 or 85% of this growth coming from net overseas migration. Most of this growth obviously landed in Sydney:

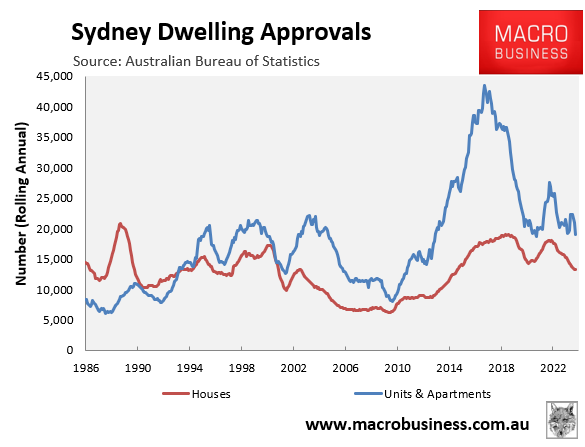

Meanwhile, dwelling approvals across Sydney have collapsed:

So long as Sydney’s population continues to grow like a lab experiment through mass immigration, the city’s housing shortage will worsen and both house prices and rents will continue to rise.

Blind Freddy can see that the primary solution to Sydney’s (and Australia’s) housing crunch is to cap immigration at a level below the capacity to provide high-quality housing and infrastructure.

Otherwise, the housing crisis will become permanent.