Whether it was Kevin Rudd’s kiss of death or some other mysterious factor, Chinese stocks have been smashed over the last few days.

Monthly charts are a sight for sore eyes with the CSI300 fast approaching critical support:

And the HS property index on the express elevator to hell:

Multitudes of investment banks are advising buying. The Chinese government is buying:

Chinese equity benchmarks rebounded in afternoon trading, with a jump in turnover in some major exchange-traded funds raising speculation that buying by state funds maybe behind the reversal.

Traded value of the Huatai-Pinebridge CSI 300 ETF surged to 15.3 billion yuan ($2.1 billion) on Thursday, the highest since 2015, while those for Harvest CSI 300 Index ETF and E Fund CSI 300 ETF also saw extraordinary spikes. That coincided with gains in the CSI 300 benchmark of mainland shares, which closed 1.4% higher after declining as much as 1.8%.

“The national team is likely stepping to stabilize the market as they have done in previous market crashes,” said Marvin Chen, a strategist at Bloomberg Intelligence.

ETF rallies rarely last long. Caution is still the better part of valour.

In my view, we are witnessing the unwind of the 2018 introduction of Chinese stocks into MSCI indexes. As the CSI300 shrinks owing to foreign selling, its weighting will be cut in the MSCI index and beget more selling.

Doubtless, shaken local investors are bolting for the exits as well.

And why not? The balance of risks has shifted decisively bearish as:

- the property crash intensifies with many years to run;

- debt deflation overtakes indebted households and corporations;

- the age of stimulus ends, and

- the five D’s of demographics, deglobalisation, deflation, debt and dictatorship make China uninvestable.

China appears to have no idea how to fix any of it:

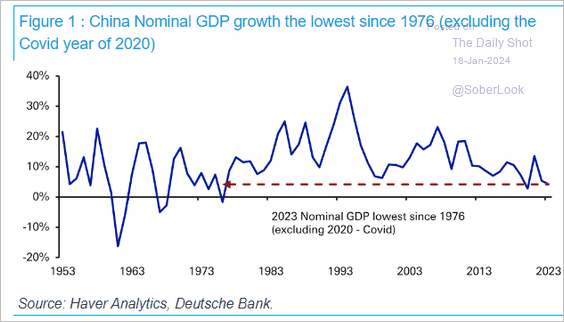

Chinese Premier Li Qiang gave his clearest signal yet that Beijing won’t resort to huge stimulus to revive growth amid the worst bout of deflation in decades. Another batch of troubling data is testing the patience of investors who worry Beijing is behind the curve.

Speaking to leaders at the World Economic Forum this week, Li trumpeted his nation’s ability to hit its roughly 5% growth target last year without flooding the economy with “massive stimulus.” While data Wednesday confirmed that economic goal, it also showed China recording its worst deflationary streak since the Asian Financial Crisis. Home prices fell last month by the most since 2015, underscoring the scale of the property downturn.

In portraying the economy’s trajectory as a success, Li stressed that officials did “not seek short-term growth while accumulating long-term risk” — a veiled reference to Beijing’s old methods of powering growth by borrowing heavily and funding the now-overheated real estate sector.

What on earth is letting structural debt deflation take hold if not a long-term risk?

It is a Kondratiev cycle from which China will never recover.