DXY was stable last night:

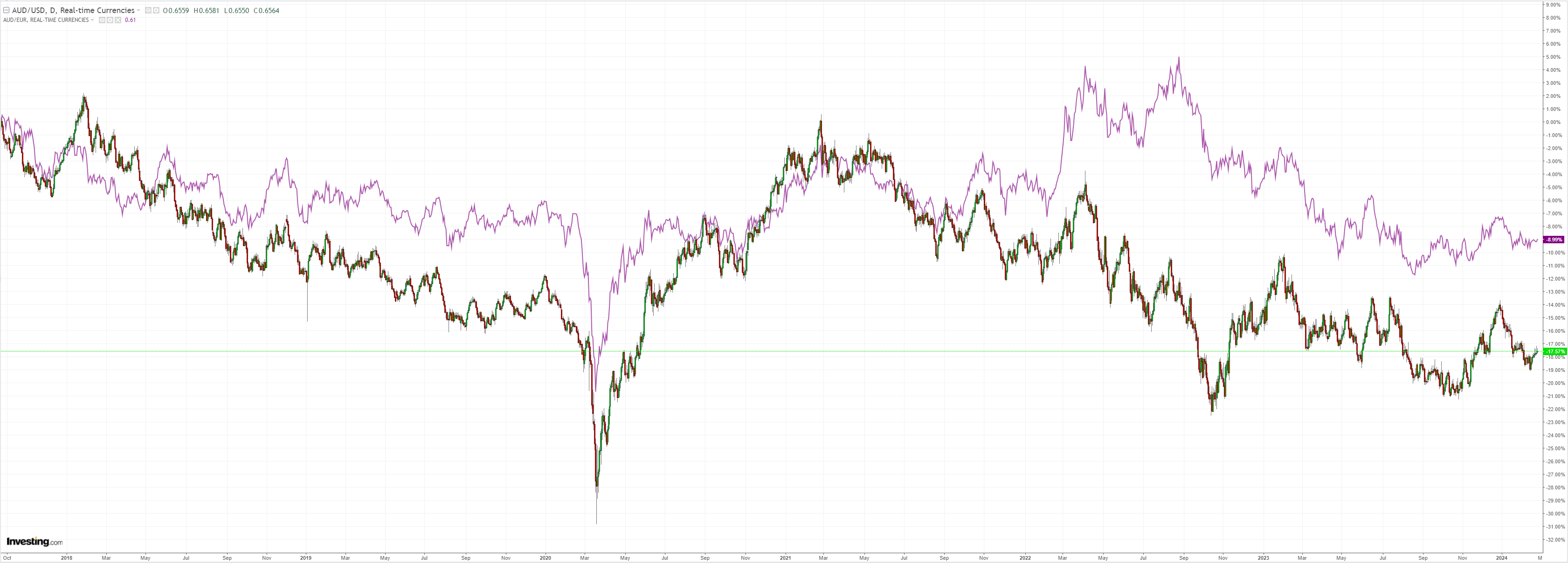

AUD is unconvincingly grinding higher

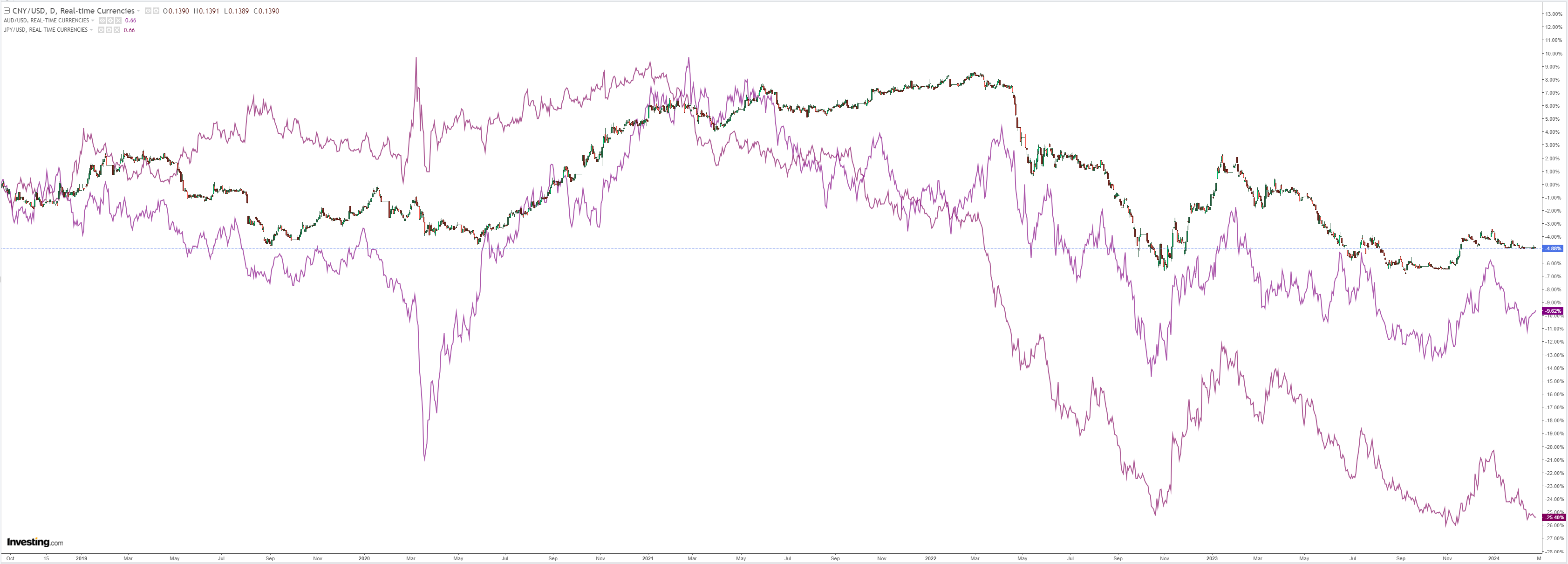

With no help from North Asia:

Oil fell on Gaza peace plans:

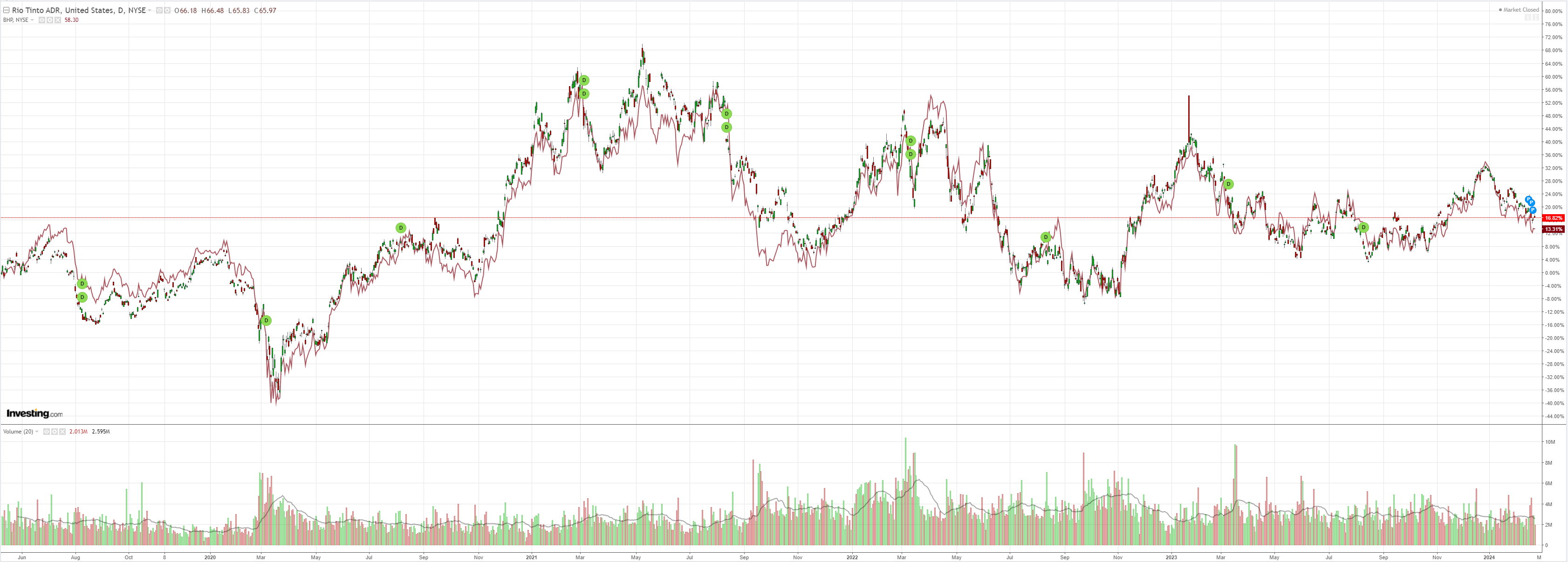

Dirt meh:

Big miners meh:

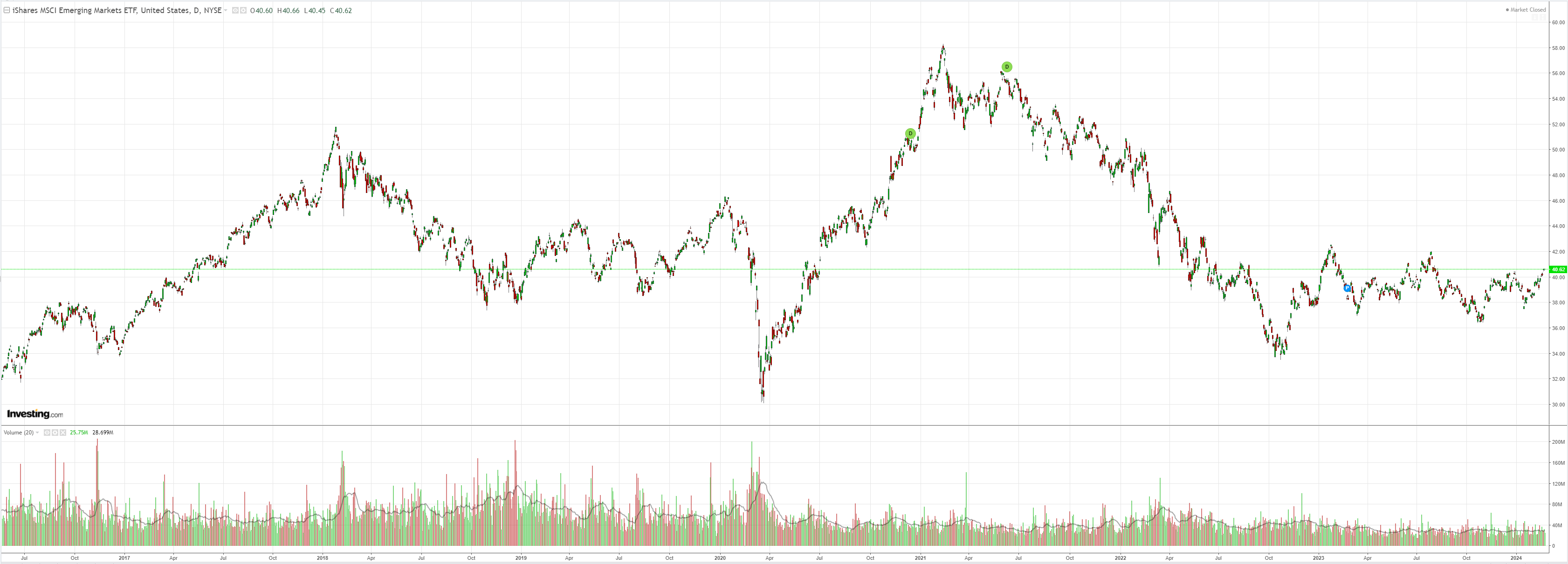

Pooh bear has his rally:

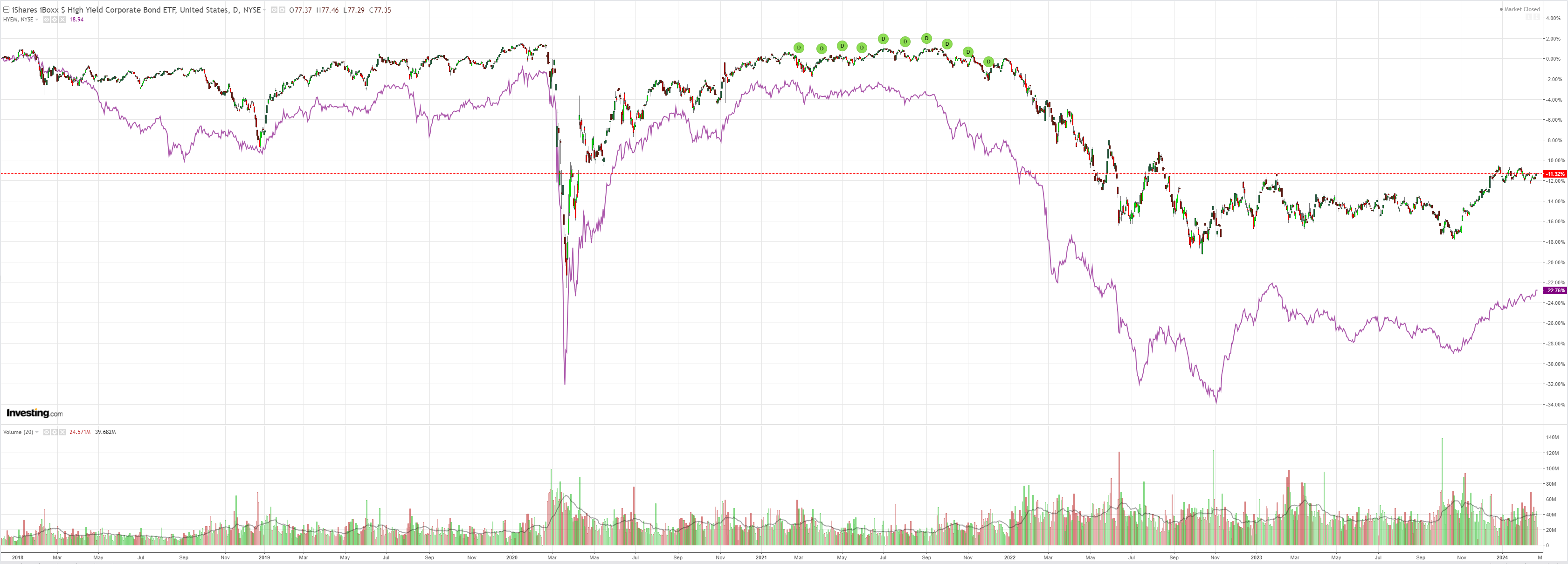

EM junk is trending bullish:

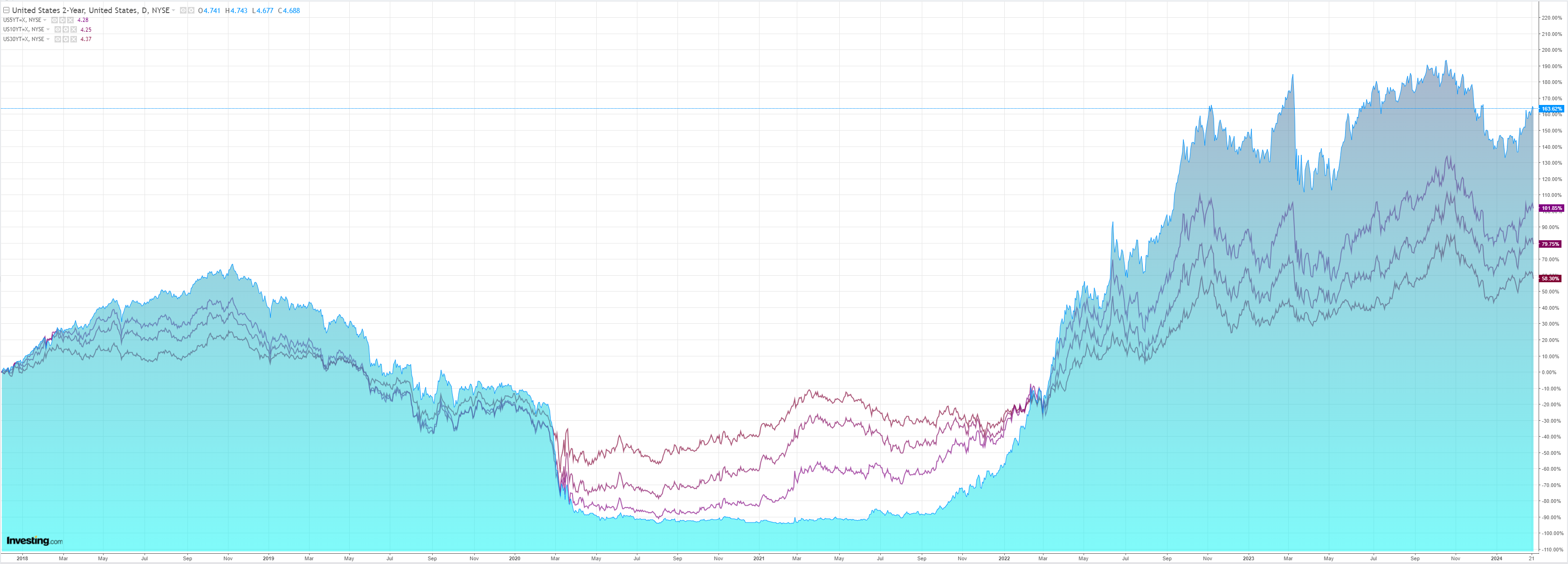

So long as yields dump:

Stocks took a breather:

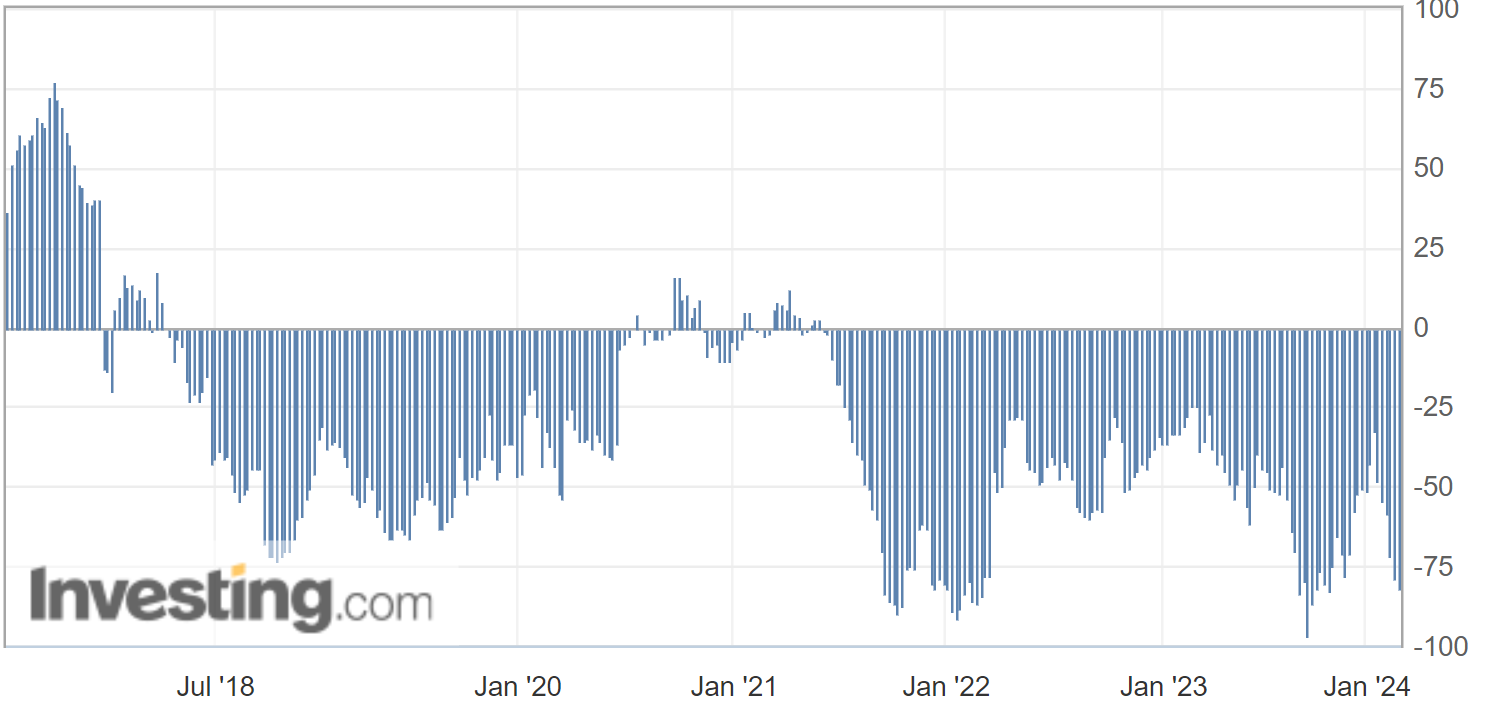

The AUD is being helped by a new extreme bearish short on CFTC, so don’t expect much downside in the short term:

However, I think we can see the outlines of the AUD mega-bear market I’ve discussed over the past six months coming more sharply into view.

The three major trends of the developing business cycle are all super AUD bearish:

- AI, Peak Fat, and supply chain repatriation supercharge US growth outperformance.

- The five dooms of demographics, debt, deflation, deglobalisation and dictatorship demolish Chinese growth permanently.

- Decarbonisation.

Put these three together, and what you get for Australia is a kind of super-deflationary bottomless pit as:

- Bulk commodity prices relentlessly collapse in a replay of the post-Japan 1990s bust culminating in iron ore at $20.

- Energy prices collapsing globally but continuing to hollow out the Aussie industry.

- AI colliding with the immigration-led economy to deliver a worker and wages apocalypse.

This is an economy headed into chronically weak nominal growth burdened with global-leading household debt run by a pack of property developer gangsters.

Taxes will have to rise, requiring world-beating low-interest rates versus other developed markets that offer far better returns and yield spreads.

An AUD with a 4-handle won’t happen overnight, but the conditions for it to happen are now apparent.