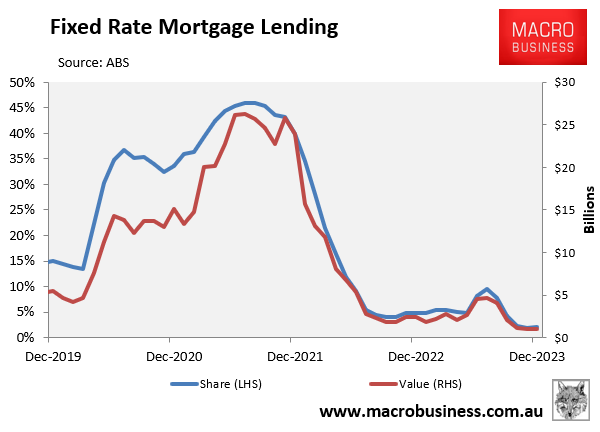

Over the pandemic, we saw a record share of mortgages taken out at cheap fixed rates.

According to the Australian Bureau of Statistics (ABS), fixed-rate mortgage lending peaked in August 2021 at 46% of total lending, or $26 billion in dollar terms:

The latest data from the ABS shows that fixed-rate mortgage lending collapsed to around 2% at the end of 2023, which was the lowest share in the series’ history.

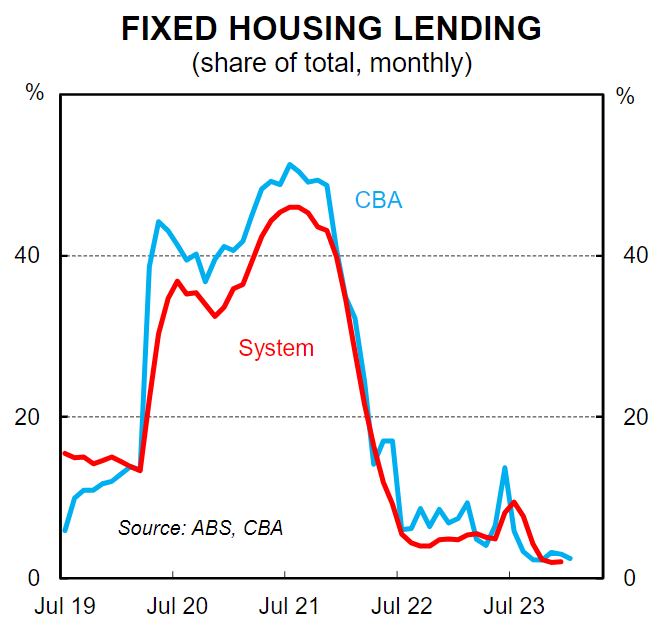

New data from CBA shows that fixed-rate mortgage lending took another leg down in January:

“Like the pattern seen over recent months, there were virtually no new fixed rate housing loan commitments in January”, noted economist Stephen Wu.

“Variable rate home loans remain the preferred option among borrowers”.

“Among the very small share of home borrowers at fixed rates, more than two-thirds are fixed for just 1 year”.

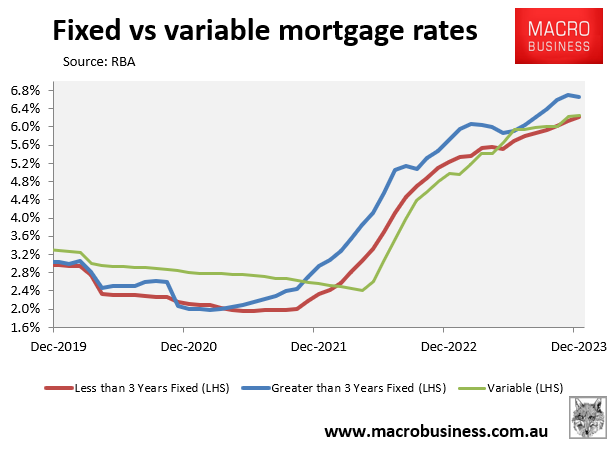

The above data makes sense given that fixed rates are tracking at or above variable rates:

With the RBA expected to keep rates on hold for an extended period before cutting rates, it makes no sense to lock oneself into a high fixed rate.