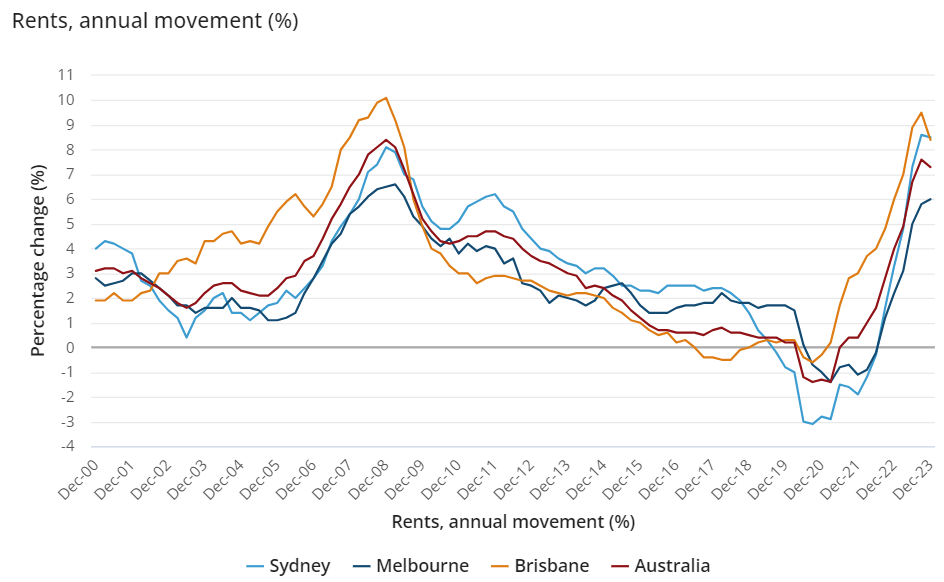

Wednesday’s CPI inflation data from the Australian Bureau of Statistics (ABS) showed that annual rental growth slowed in the December quarter to

Source: ABS

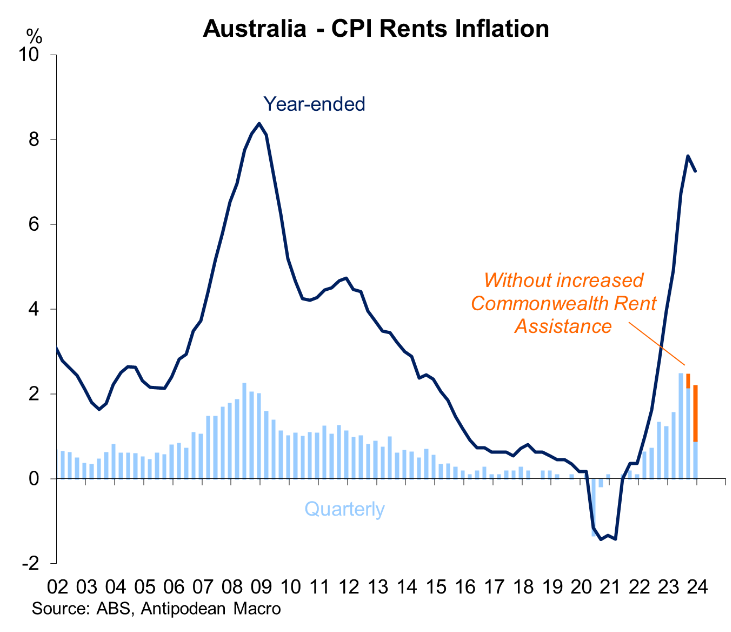

This slowdown in growth was artificial, moderated by increases in Commonwealth Rent Assistance (CRA), as shown by the below chart from Justin Fabo at Antipodean Macro:

Had the CRA not been implemented, the ABS estimates that rents would have increased by 2.2% in the December quarter, rather than the 0.9% actually recorded.

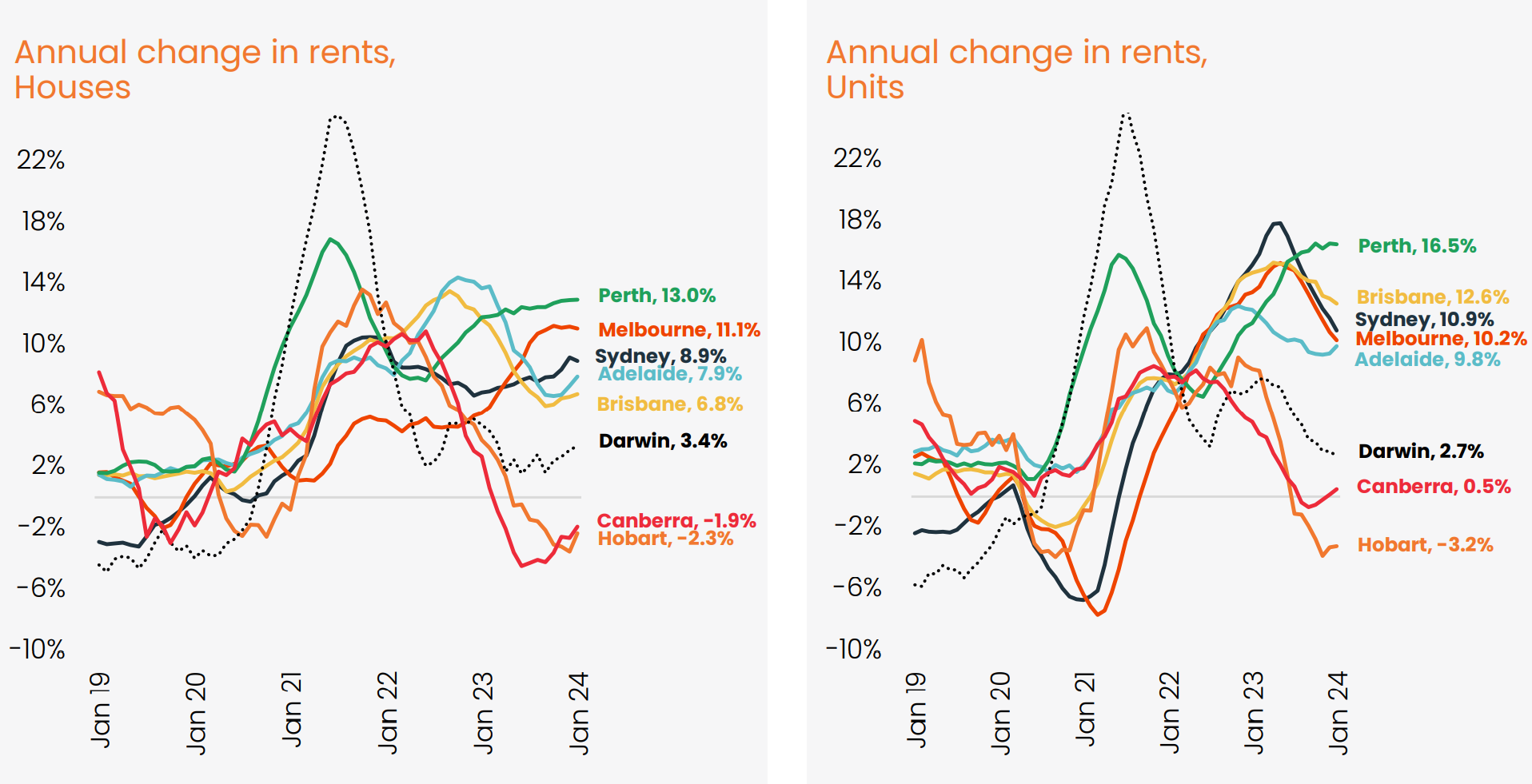

CoreLogic’s latest data on asking rents is worse, with rents reaccelerating “as leasing markets enter the seasonally stronger first quarter of the year”:

Source: CoreLogic

CoreLogic’s national rental index recorded its strongest monthly rise since April with rents up 0.8% in January, following a 0.6% rise in December.

“Most years see rental growth accelerating through the March quarter as competition from students and new year leases adds to rental demand”, noted Core Logic’s Tim Lawless.

“It’s looking like we will see a similar trend this year with the usual pattern of higher rental growth emerging in January”.

Detached house rents, in particular, are reaccelerating, with house rents recording a larger rise than units across most cities over the past three months.

“Across the combined capitals, house rents rose by 2.5% compared with a 1.4% lift in unit rents, with a larger quarterly rise in house rents noticeable across every capital except Perth”, noted Lawless.

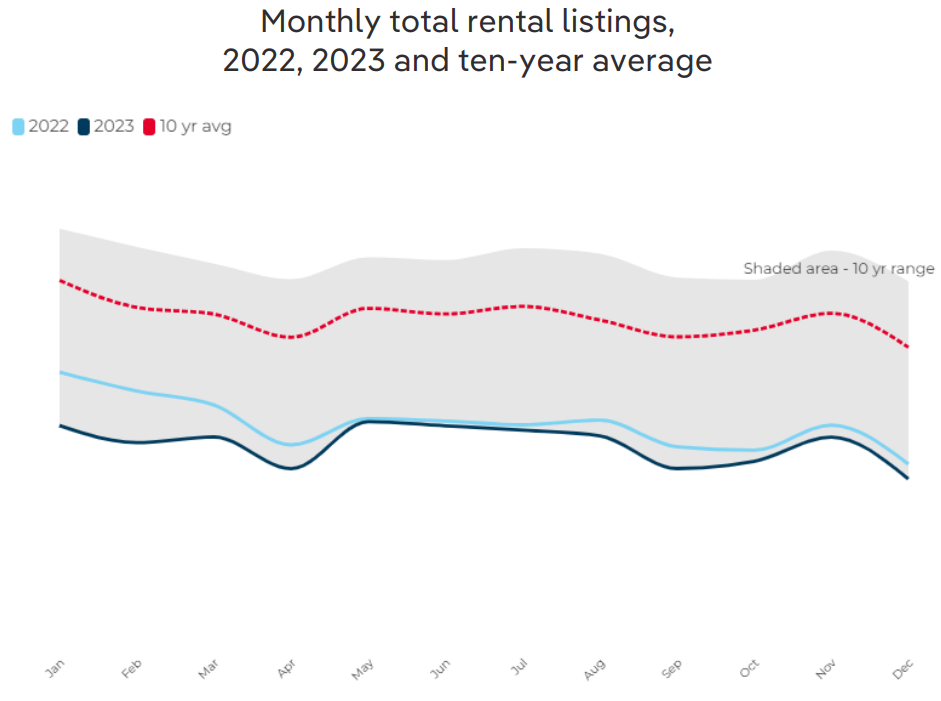

Last week, PropTrack reported that total rental listings fell to a record low in December 2023 after declining 4.7% year-on-year.

The total number of properties available for rent nationally in December 2023 was 30.2% below the December decade average:

Source: PropTrack

In turn, PropTrack warned that rental conditions would remain “challenging” in 2024:

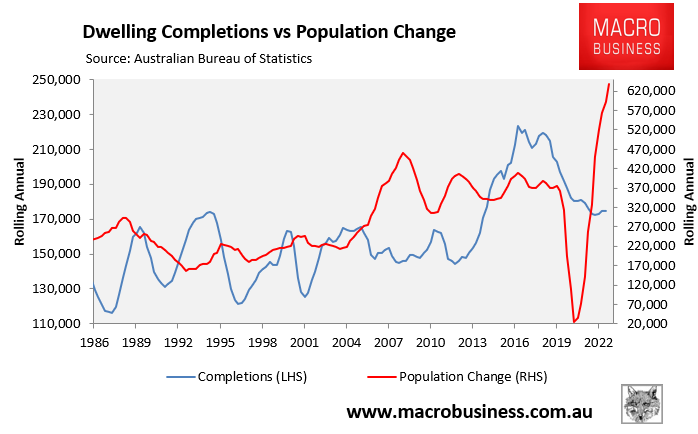

“Given ongoing strong population growth and the low volume of new rental stock under construction, it is likely that competition for rental stock will remain significant”.

“The overall supply of rental stock is anticipated to remain low, while strong migration to Australia, particularly of students, is likely to drive continued strong rental demand”.

“From here, we expect rents will continue to climb, particularly in the major capital cities, due to persistent low supply and strong demand, which is being exacerbated by the rapid rate of population growth. Although population growth is forecast to slow, it will remain elevated this financial year and next”.

“Increasingly, renters will be looking for smaller and cheaper properties or will be forced into share house living to save on rental costs”.

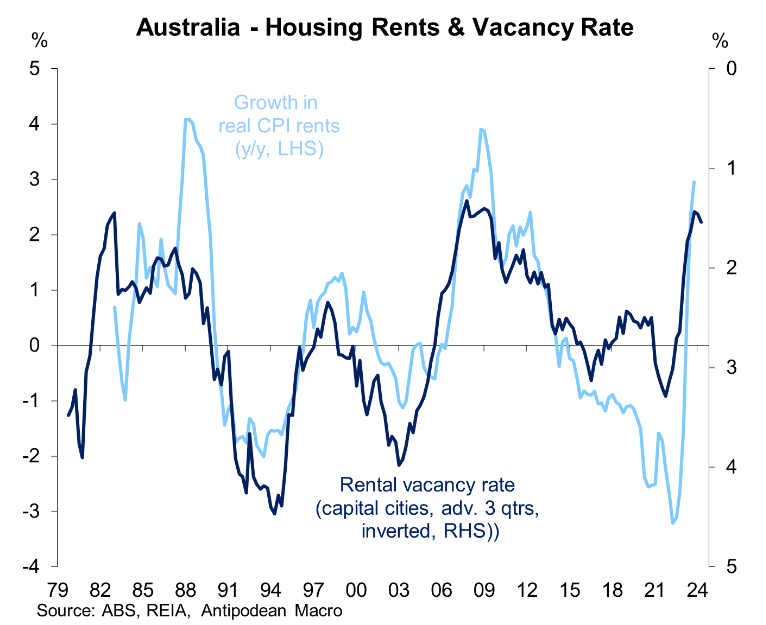

Indeed, with the rental vacancy rate likely to remain near historical lows amid strong demand and low supply, rental growth will remain elevated:

The only realistic solution to Australia’s rental crisis is for the federal government to slash net overseas migration so that the nation’s population grows at a slower pace than housing construction.

Otherwise, Australia’s rental crisis roll on and on.