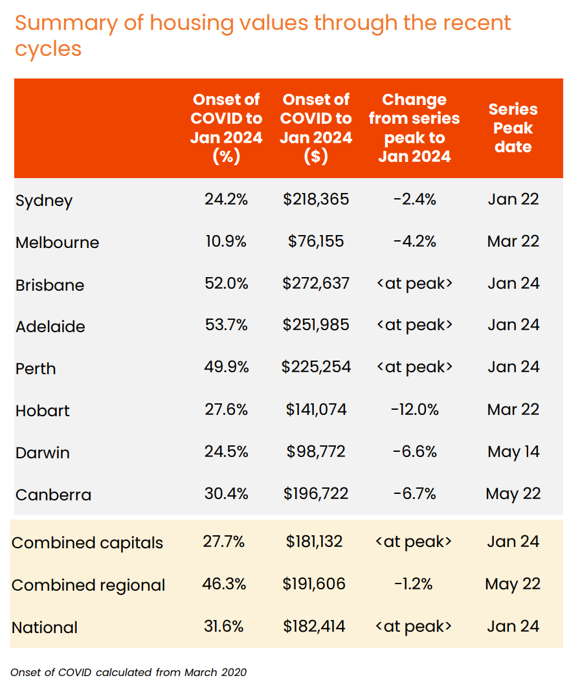

The latest results from CoreLogic showed that Australian home values hit a record high in January at both the combined capital city and national level:

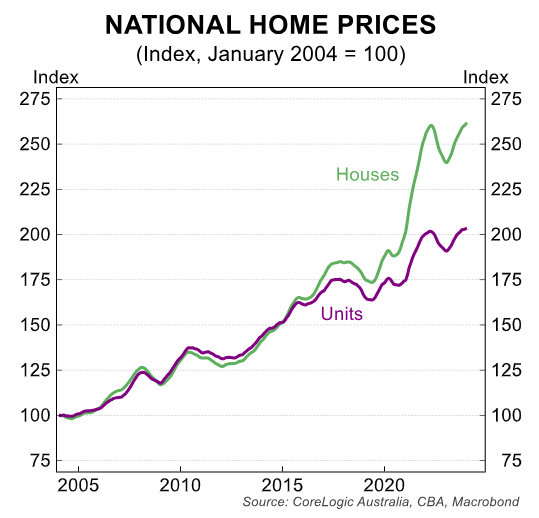

The next chart from CBA plots the time series, with values more than recovering the losses induced from the beginning of the Reserve Bank of Australia’s (RBA) monetary tightening cycle:

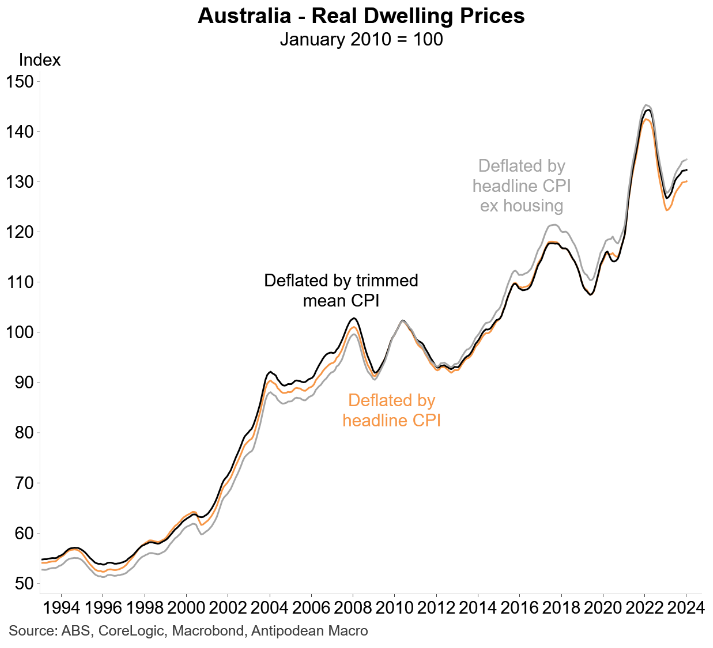

When adjusted for inflation, however, Australian home values are tracking around 7% below their peak, as illustrated by the below chart from Justin Fabo at Antipodean Macro:

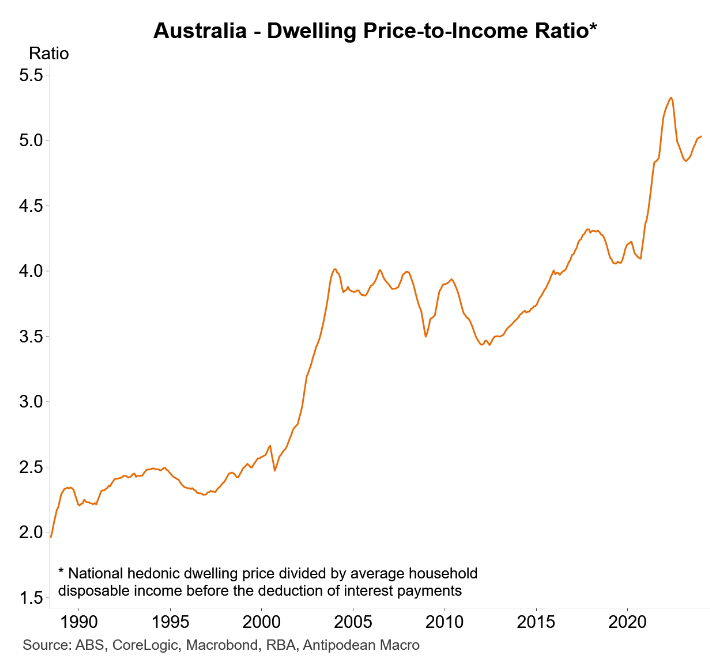

In a similar vein, Australia’s dwelling price-to-income ratio is below the prior peak:

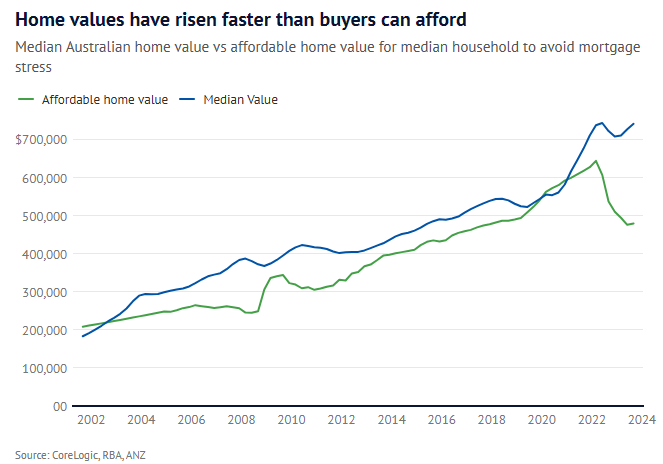

According to Fabo, “deposit affordability, which is directly linked to the ratio of dwelling prices to income, remains unfavourable for many households”.

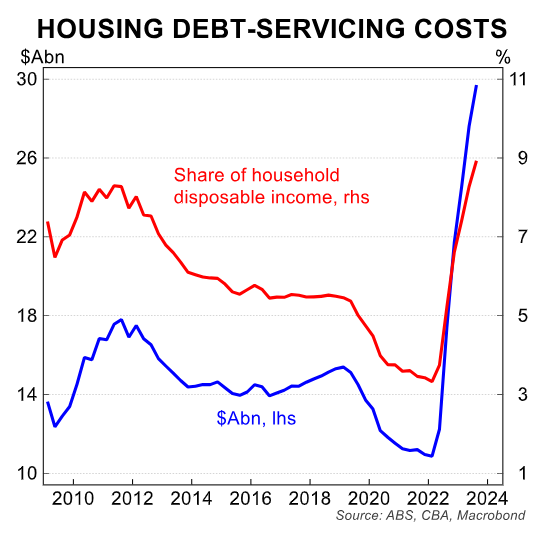

That said, most households purchase a home with a mortgage, and due to 4.25% of rate hikes from the RBA, the share of household income chewed up by mortgage payments is tracking at historical highs:

In turn, Australian housing affordability is tracking at all-time lows:

The situation won’t reverse until the RBA commences an easing cycle likely later this year.