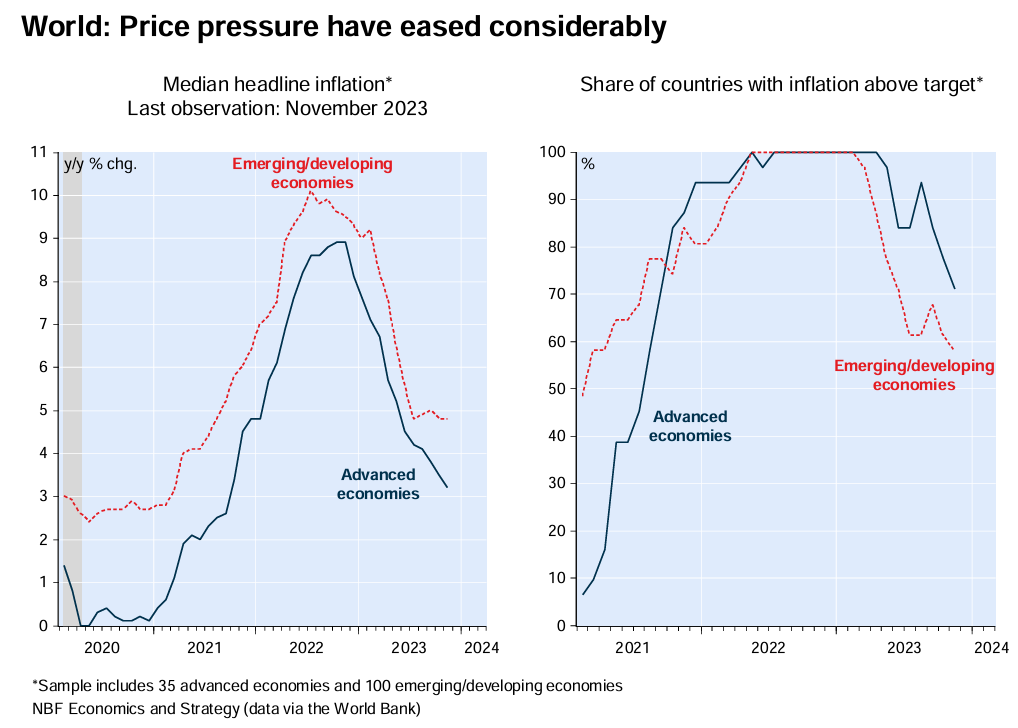

Inflation is falling back down to earth across the globe.

This reflects the unwinding of pandemic supply bottlenecks, which saw factories and shipping lanes close, driving goods and tradeable inflation through the roof amid strong government stimulus.

The world’s economies are now experiencing the flipside.

Factories and shipping lanes are open (save for Houthi attacks in the Middle East), and China is dumping cheap manufactured goods on the world, driving goods (tradeable) inflation down.

Sharp interest rate hikes from the world’s central banks have also worked to tame demand, especially for discretionary items.

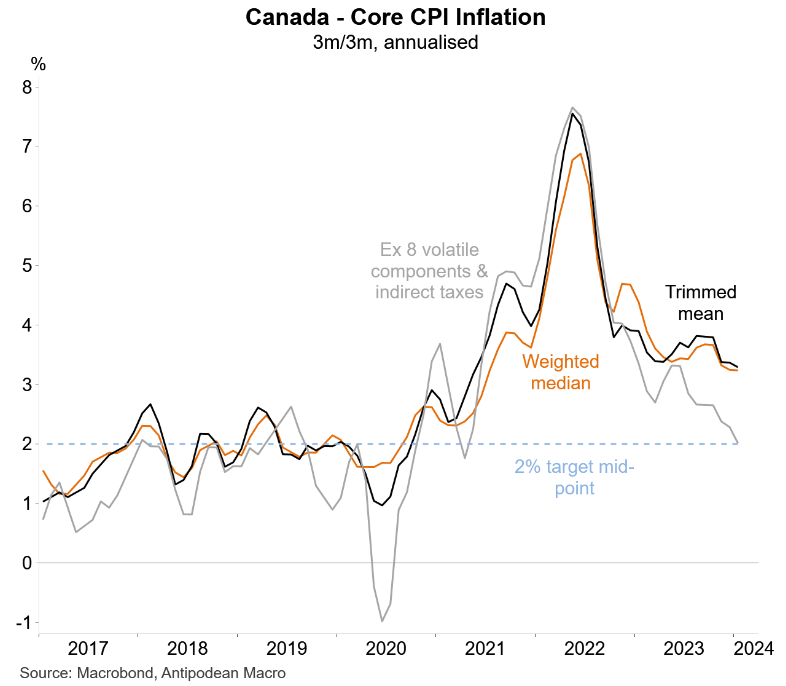

On Tuesday, Canada’s monthly inflation report showed prices up 2.9% y/y compared to 3.3% expected (chart from Justin Fabo at Antipodean Macro):

In response, markets are now pricing in a 24% chance of a March rate cut compared to 19% before the data.

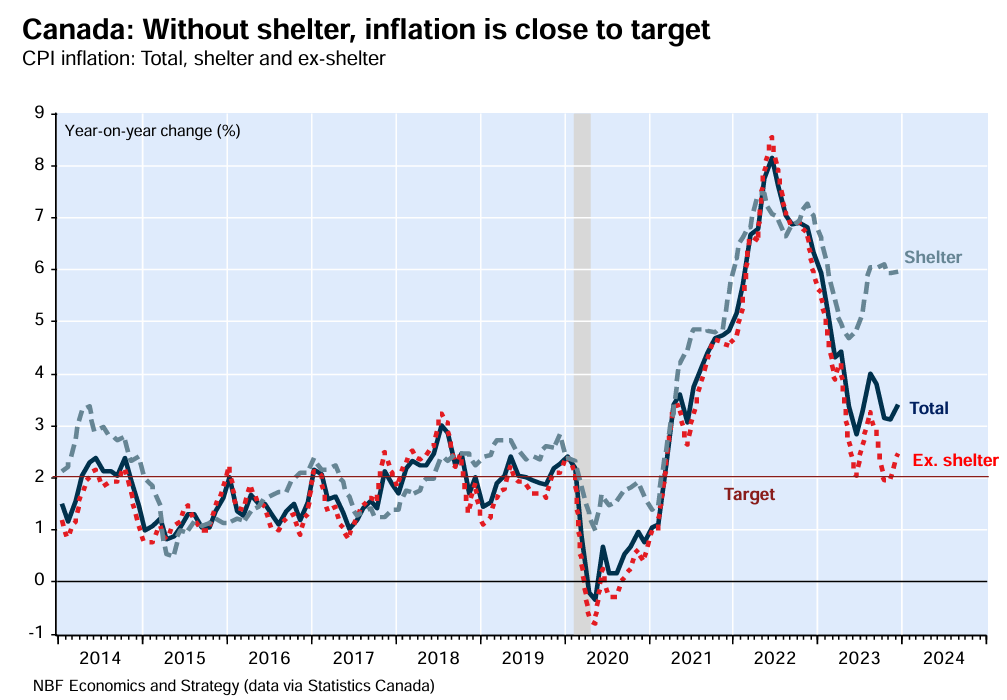

Although some banks worried that rental inflation, driven in part by the immigration-fueled housing shortage, is placing upward pressure on inflation (much like Australia):

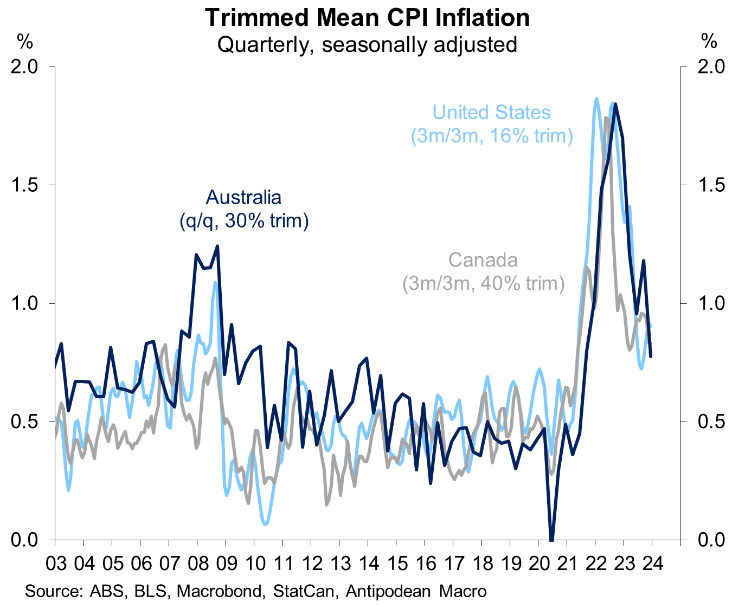

Regardless, the next chart from Justin Fabo shows that underlying inflation is falling more or less in tandem across Australia, Canada and the United States:

Softening economies, combined with falling inflation, will see the world’s central banks cut rates this year, including Australia’s.