Iron ore futures were belted again yesterday:

Iron ore fell to the lowest since October — after dropping almost 9% last week — with hopes for a rebound in Chinese steel demand following the Lunar New Year holidays fading.

Futures for the steelmaking ingredient lost as much as 3.6% in Singapore on Monday, a worrying sign given that March and April, typically busy months for construction in China, are fast approaching. Vale SA, the world’s second-largest iron ore producer, said it’s seeking to increase its sales outside of China, an indication that miners aren’t optimistic about a revival.

Steel production is weak and has not fully recovered after the Lunar New Year break, Minmetals Futures Co. said in a note. Mills are likely to determine output based on sales volumes due to low profitability, it said.

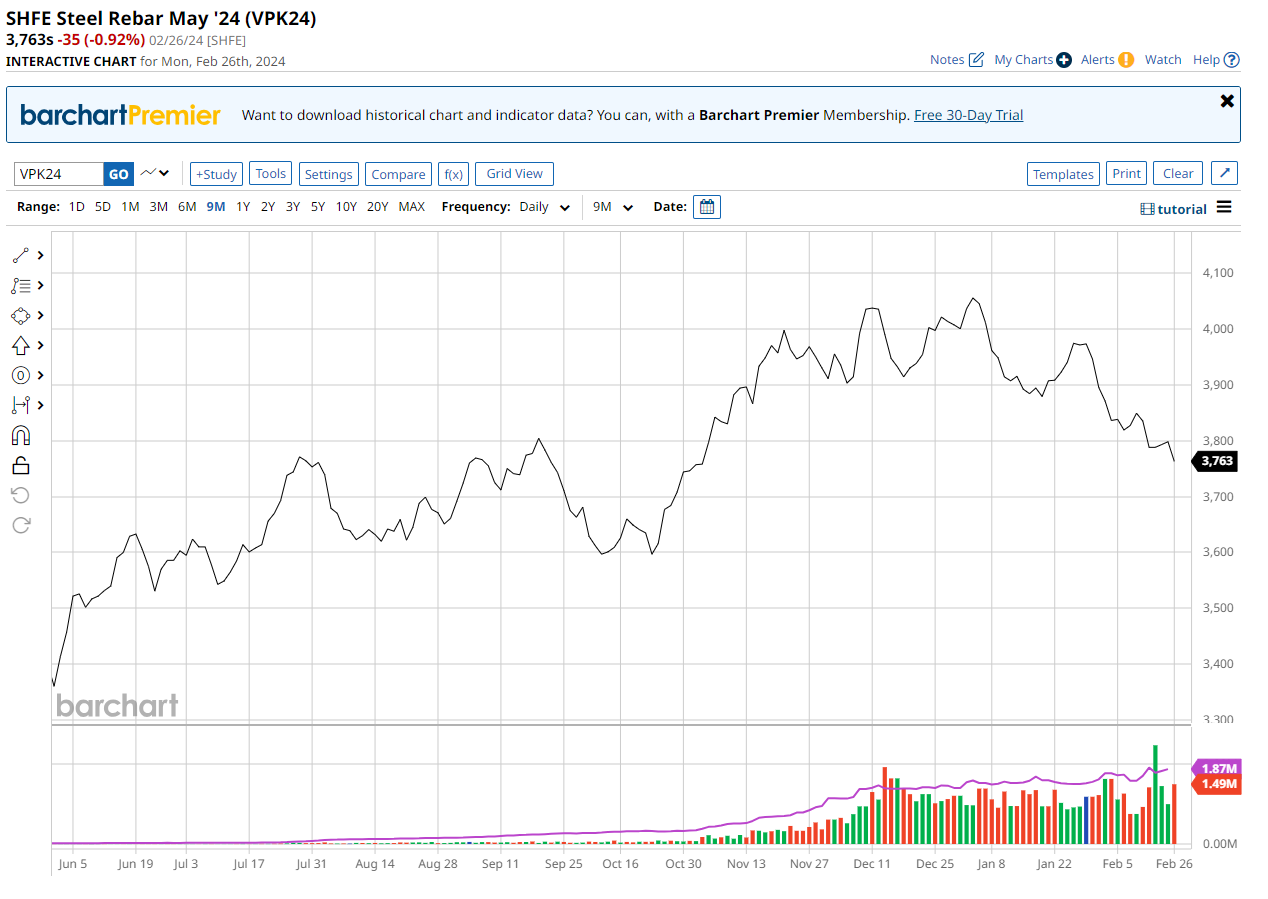

Rebar futures are leading the ferrous complex lower:

CISA steel output was roughly unchanged year-on-year in mid-Feb, and steel inventory surged to around unchanged as well:

So, steel production is OK, if not fantastic.

But iron ore and coking coal exports are getting belted. Coking coal is trying to hold the 30DMA:

Iron ore has just reached the same:

These technicals suggest some of the activity is speculator-driven.

Supply is in good fettle:

“Inventories of iron ore at major Chinese ports rose. Supply concerns also eased, with a cyclone threatening WA (Western Australia) ports now tracking away from the state’s iron ore hub,” analysts at ANZ bank said in a note.

Inventories at major Chinese ports surveyed SH-TOT-IRONINV climbed by 2.1% on-week to 133.1 million tons in the week to Feb. 23, hitting the highest since April 2023, data from consultancy Steelhome showed.

Also, Vale VALE3.SA, the world’s second-largest supplier of iron ore, said the latest train incident caused by heavy rains in Brazil would not impact its shipments or production.

Global iron ore shipments hovered at almost the highest level in three years and if the high shipments continue in a seasonally slow season, ore prices can hardly find any support from the supply side, analysts at Sinosteel Futures said in a note.

India is adding to supply as well.

At this stage, I will put this correction down to reality setting in after the silliness of the Q4 restock and price surge.

March and April would generally revive steel demand and firmer prices.

However, Chinese weakness may take another step down, given the intrinsic chaos of the apartment completions cliff.

This is inevitable. Only timing is the question.

When it happens, iron ore will drop to the highest marginal cost production at $80, which will halve major miner earnings.

Then, it will keep falling to knock out supply.