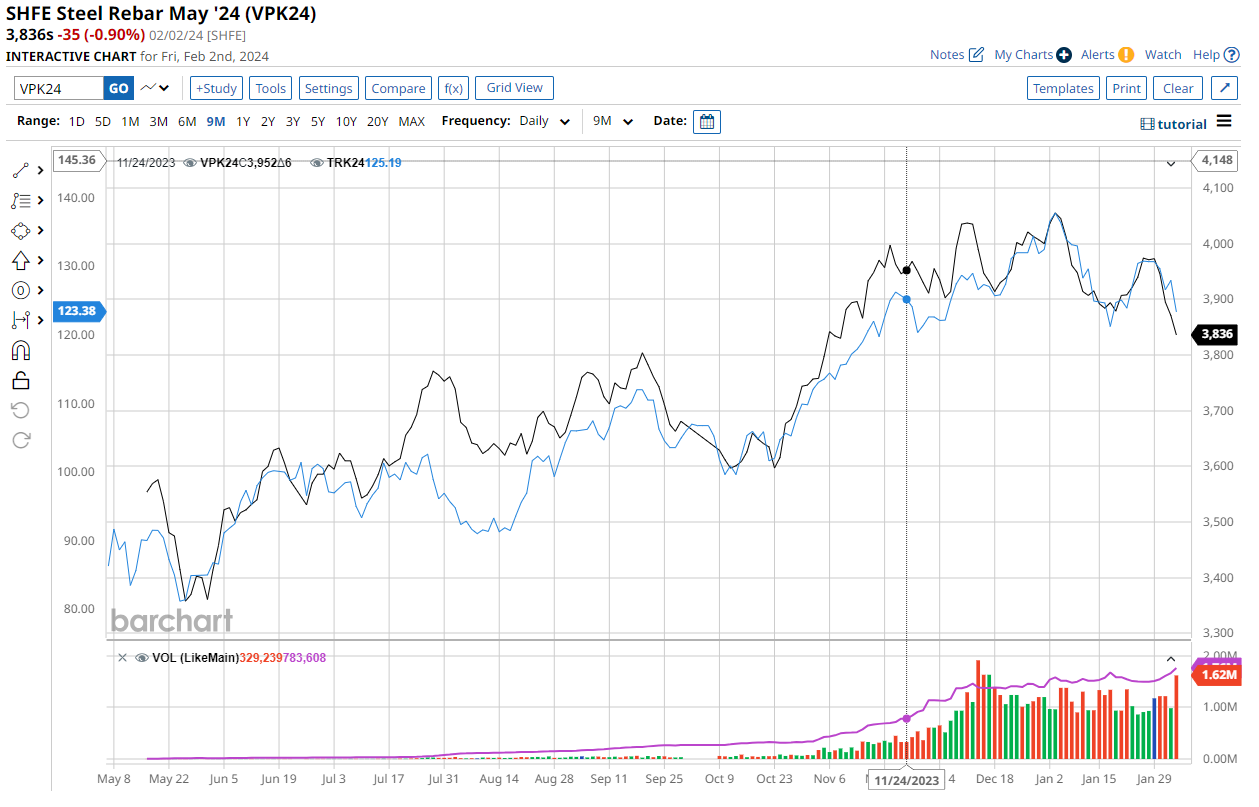

Iron ore is in a bit of trouble as rebar futures break down:

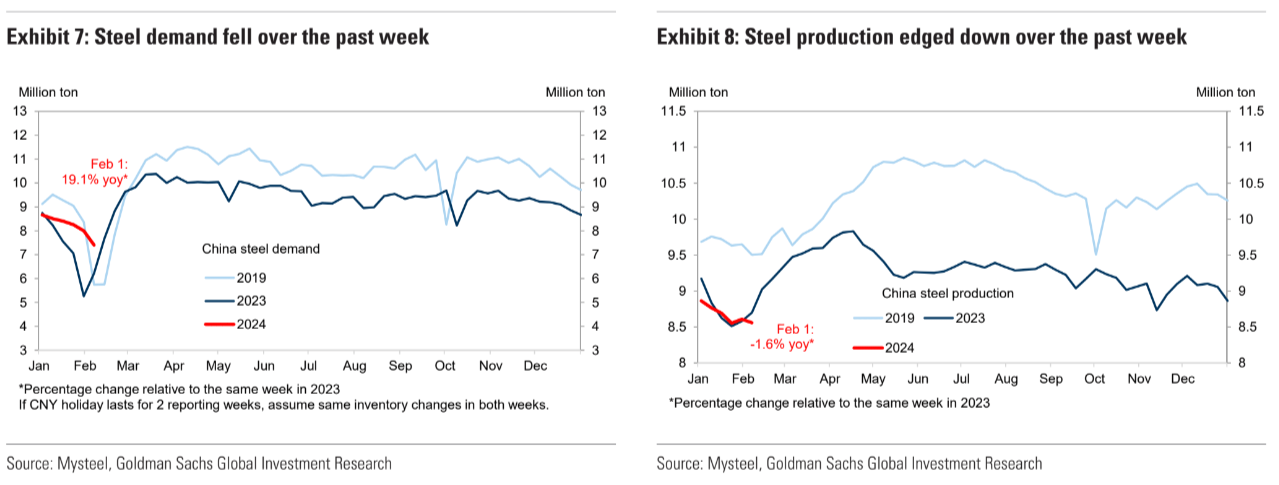

MySteel indexes are OK but beware seasonality:

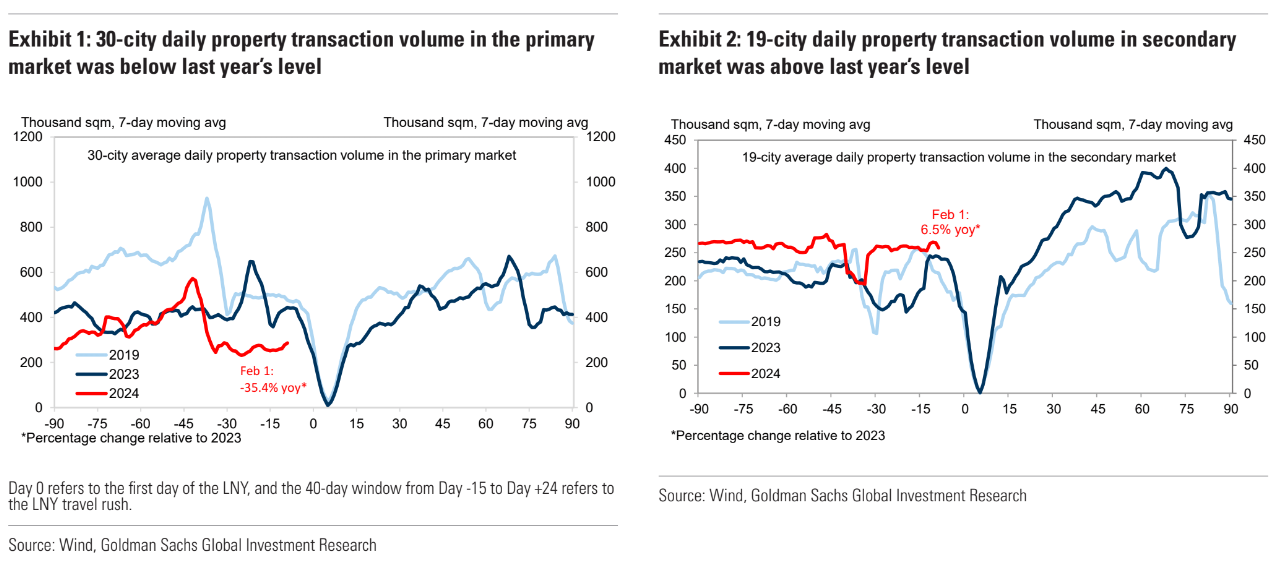

Property sales remain a disaster:

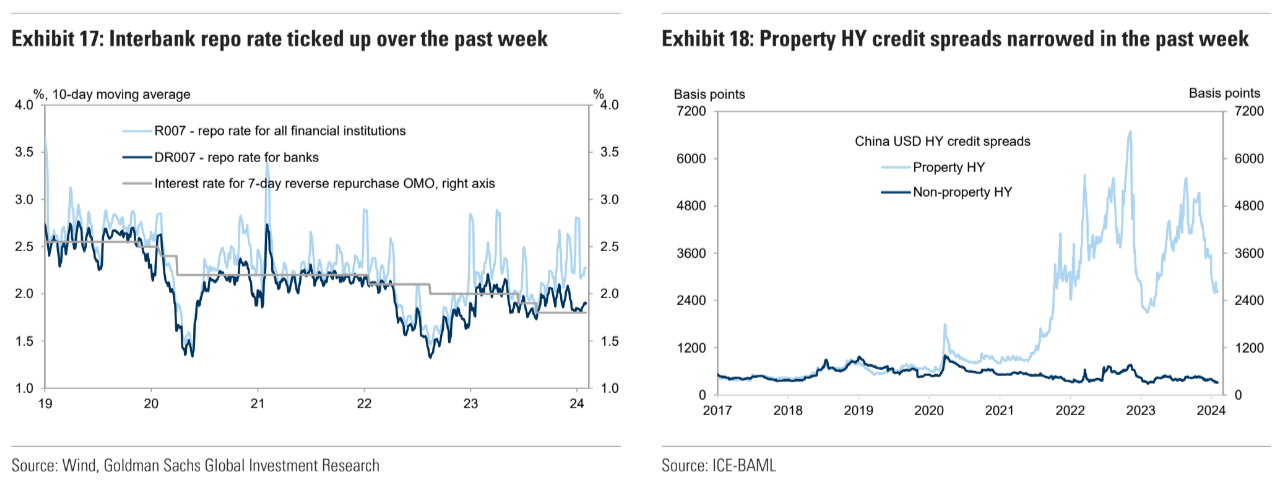

Property funding likewise:

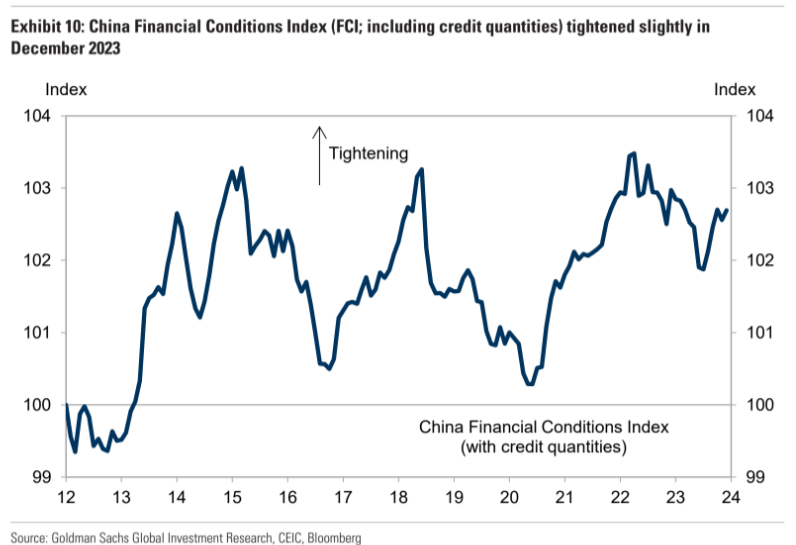

Deflation in everything is driving up financial conditions:

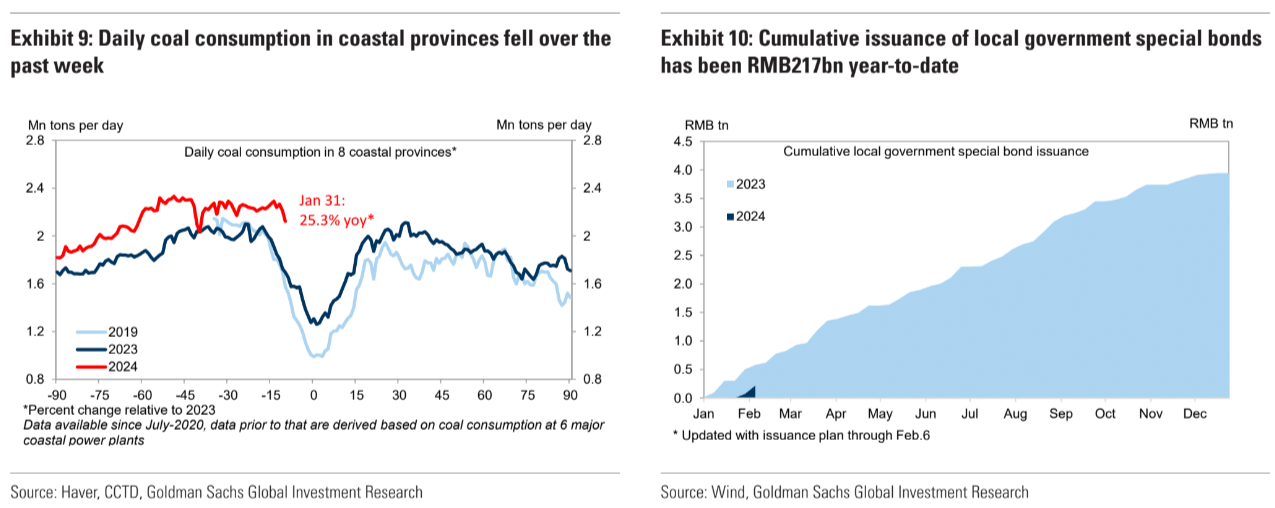

LGSB funding has started slowly:

But Goldman reckons a better quota is coming:

31 provincial-level local governments just held their local “Two Sessions” in January and announced their 2024 growth targets. Compared to 2023 targets, 19 out of 31 provinces lowered their 2024 GDP growth targets, 7 stayed unchanged, and 5 raised their targets. We find that provinces that missed 2023 growth targets tend to lower their targets in 2024, but almost all provinces (except Tianjin) still set their 2024 growth targets no lower than “around 5%”. Based on our estimates, 31-province weighted average GDP growth target declined by 0.3pp to 5.4% in 2024 (vs. 5.7% in 2023). GDP growth targets in Beijing and Shanghai historically had a close correlation with national targets, and these two cities both set their targets at“around 5%” for 2024. Regarding the upcoming “Two Sessions” in early March, we maintain our view that policymakers are likely to announce an ambitious growth target of “around 5%” for 2024, set the official on-budget deficit target at 3.0% ofGDP (vs. the revised 3.8% for 2023), plan an RMB4tn quota for LGSB net issuance(vs. RMB3.8tn for 2023), and introduce an RMB1tn quota for CGSB issuance.

Why would Beijing lift it if it trying to deleverage local governments?

We shall see.