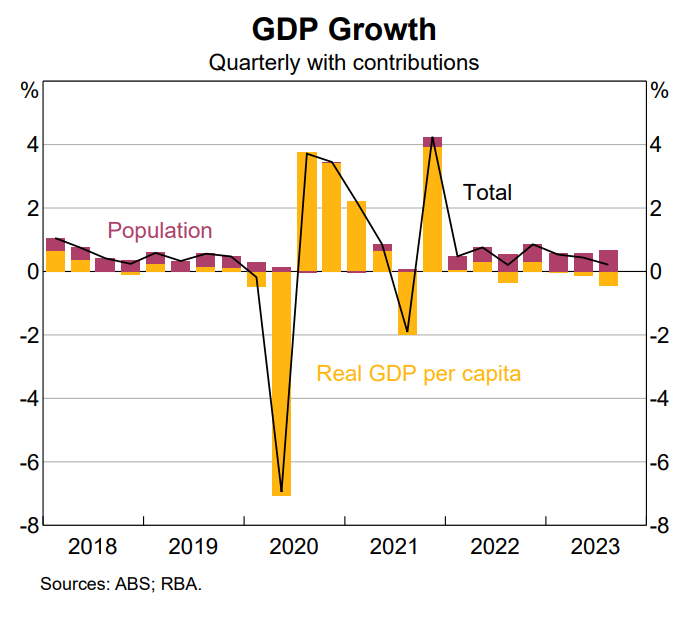

The Reserve Bank of Australia’s (RBA) Statement on Monetary Policy (SoMP) confirmed that Australia is mired in a per-capita recession:

The RBA explains that “the slowing in GDP growth over the past year has primarily been driven by weak growth in household consumption amid cost-of-living pressures”.

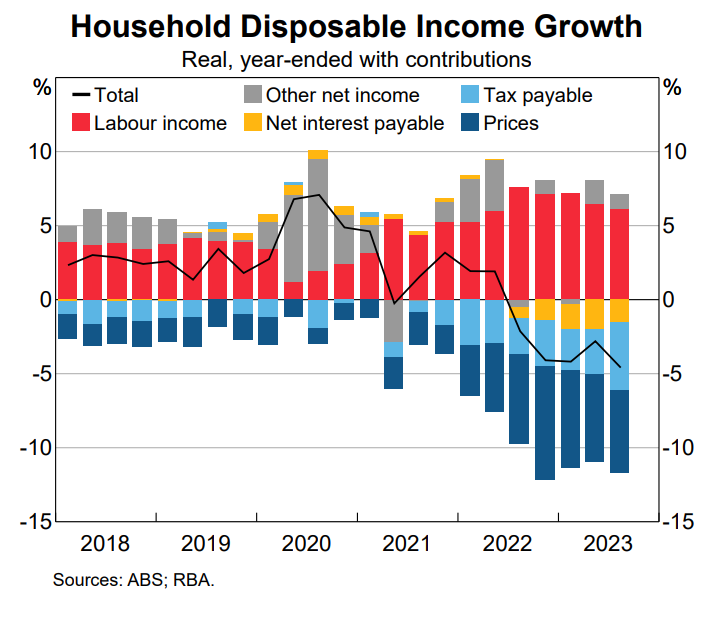

“Household consumption growth remains weak amid high inflation, strong growth in tax payments and higher interest rates”.

“Real disposable incomes have been declining for around two years and this has put pressure on household budgets”, the SoMP reads.

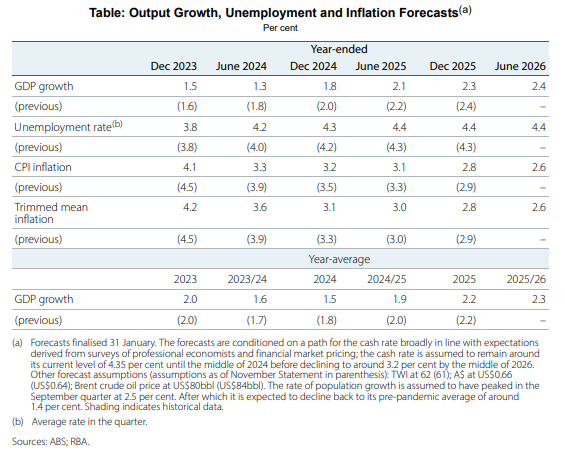

The RBA SoMP forecasts that Australia’s real GDP will grow by just 1.5% over 2024:

The RBA’s population growth forecasts are flaky, with the only reference in the SoMP being the following:

“The assumed level of the population has been revised slightly higher”.

“Recent net overseas migration has been stronger than expected while migration policy changes are expected to provide some offset over the forecast period; year-ended population growth is assumed to have peaked in the September quarter at around 2.5%, after which it is expected to decline back to its pre-pandemic average of around 1.5%”.

That assumed decline in population growth back to 1.5% is over the forecast horizon (i.e. by 2026). Therefore, population growth will be higher in 2024.

Thus, Australia is facing another year of per capita recession, whereby the economy does not grow as fast as the population, and everybody’s slice of the economic pie shrinks.

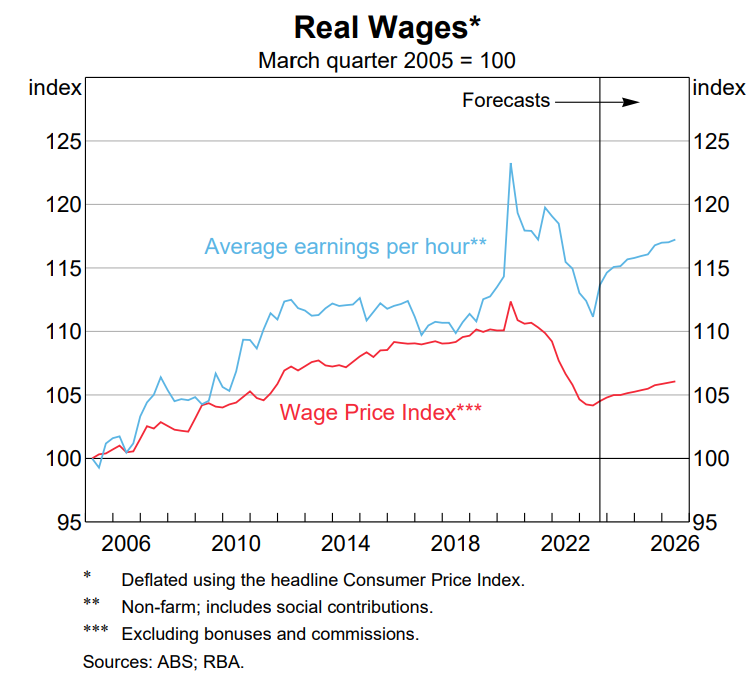

The RBA SoMP also forecasts that real wages will not recover their lost ground over the forecast horizon:

That is the making of another ‘lost decade’ right there, whereby Australian living standards continue to crumble while the aggregate economy chugs along via endless strong population growth (immigration).