Asian share markets are still doing well outside of China as Wall Street continues to lift all risk markets, but with some hesitation as we go into tonight’s US non farm payroll print. The USD is still mixed as a result although the Australian dollar is lifting higher to hold just below the 66 cent level.

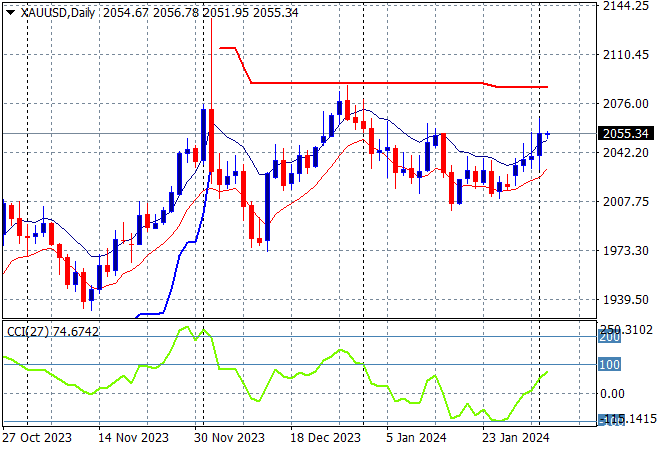

Oil prices remain volatile in the wake of Middle East tensions with Brent crude barely holding above the $79USD per barrel level while gold is still wanting to climb higher as it extends above the $2050USD per ounce level:

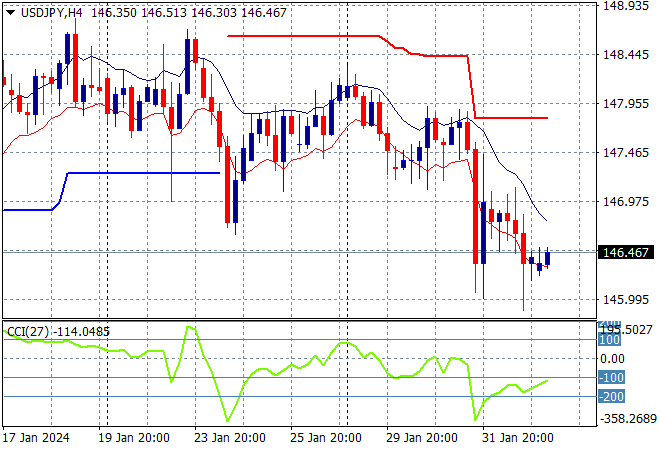

Mainland Chinese share markets are falling again in afternoon trade as the Shanghai Composite moves nearly 1.4% lower to 2732 points while in Hong Kong the Hang Seng Index is dead flat at 15566 points. Japanese stock markets lifted slightly with the Nikkei 225 closing 0.7% lower at 36249 points while the USDJPY pair has managed to lift slightly the big losses overnight, holding just below the mid 146 level:

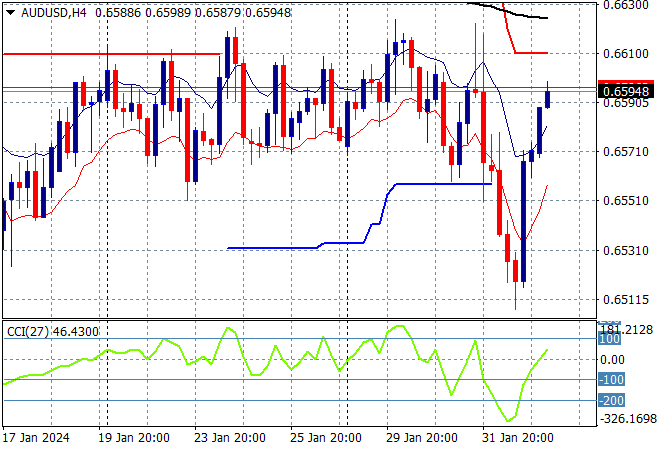

Australian stocks have bounced up in line with Wall Street as the ASX200 closed more than 1.4% higher at 7699 points while the Australian dollar also managed to bounce back up to the 66 cent level as it bounces off short term support:

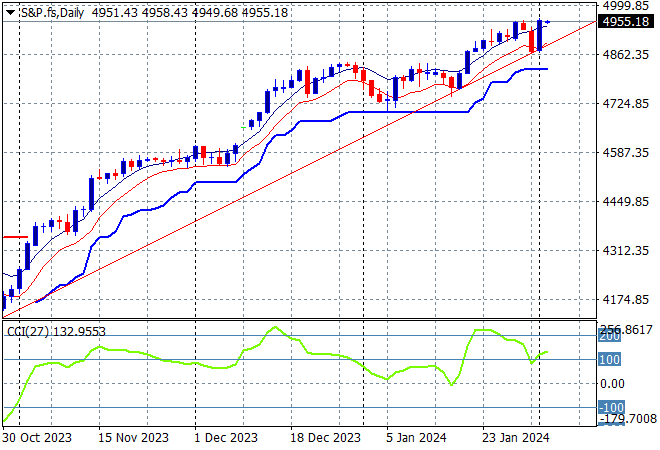

S&P and Eurostoxx futures are holding on to their overnight gains going into the London session with the S&P500 daily chart showing price action remaining well on trend as it reaches for the 5000 point level:

The economic calendar concludes the trading week with the big one for the month – US unemployment or non farm payrolls for January.