If you believe Australia is a Ponzi economy, spare a thought for Canada.

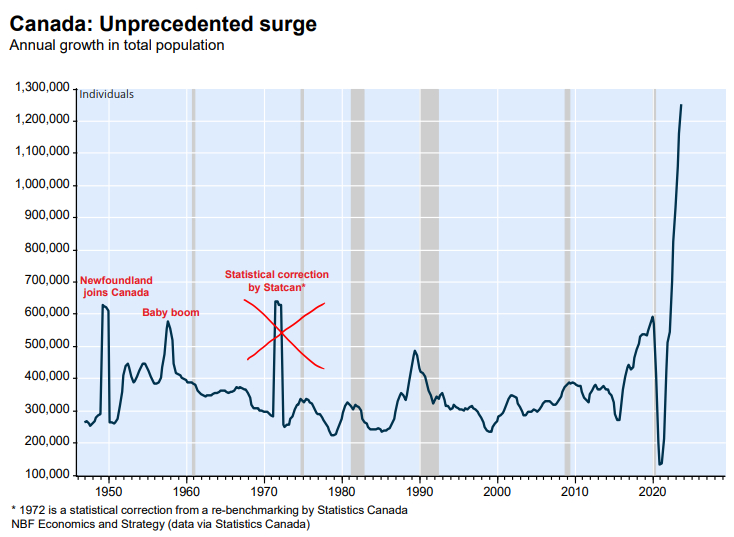

Canada’s population surged by more than 1.2 million people last year, driven almost entirely by net overseas migration:

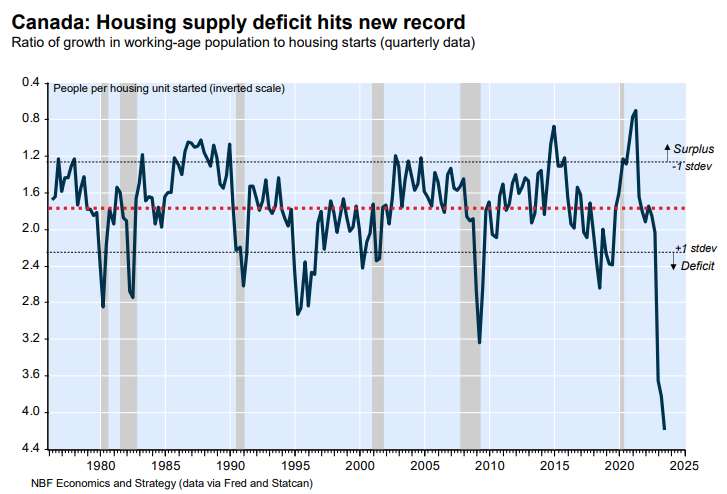

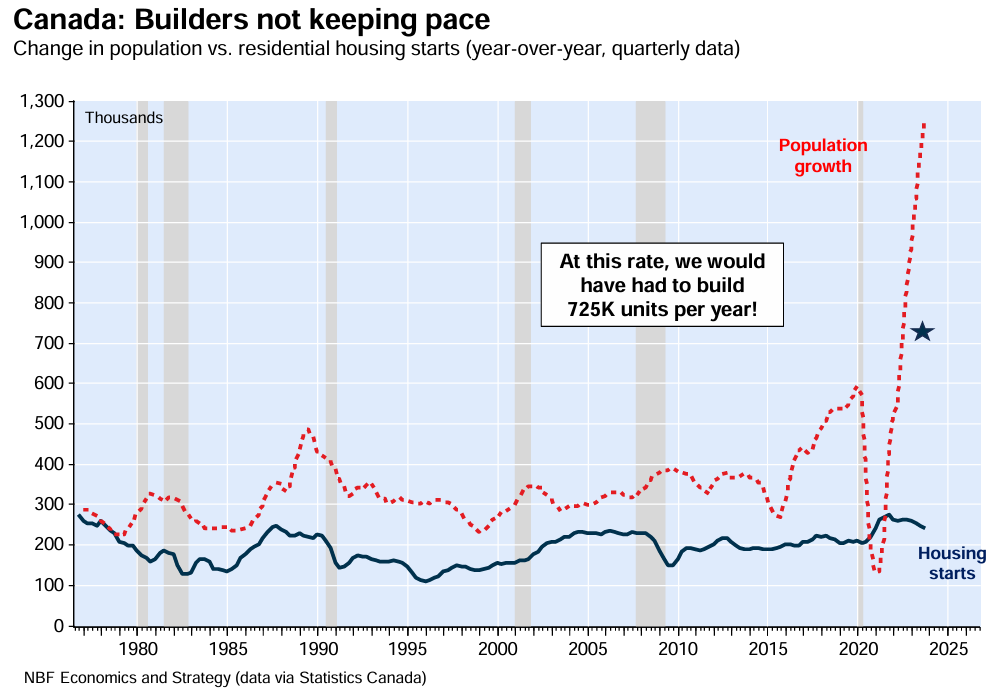

This population surge has created a diabolical shortage of housing across Canada:

With housing starts failing miserably to keep pace with population growth:

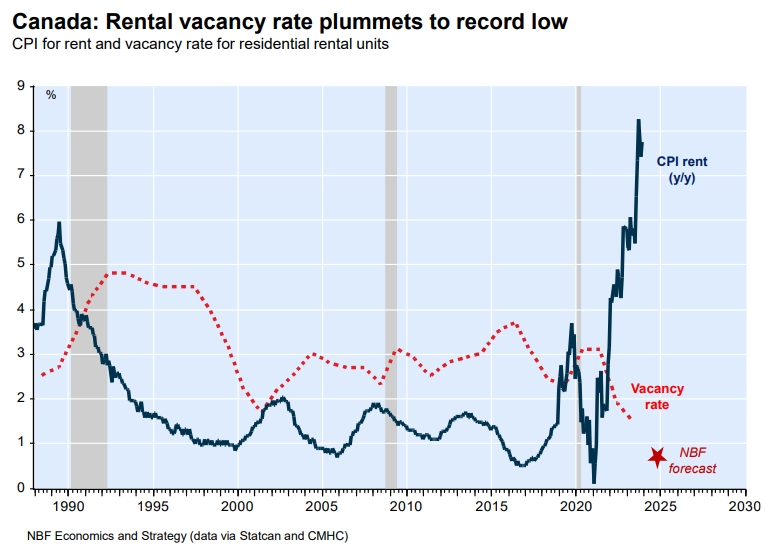

In turn, Canada’s rental vacancy rate has collapsed to a record low:

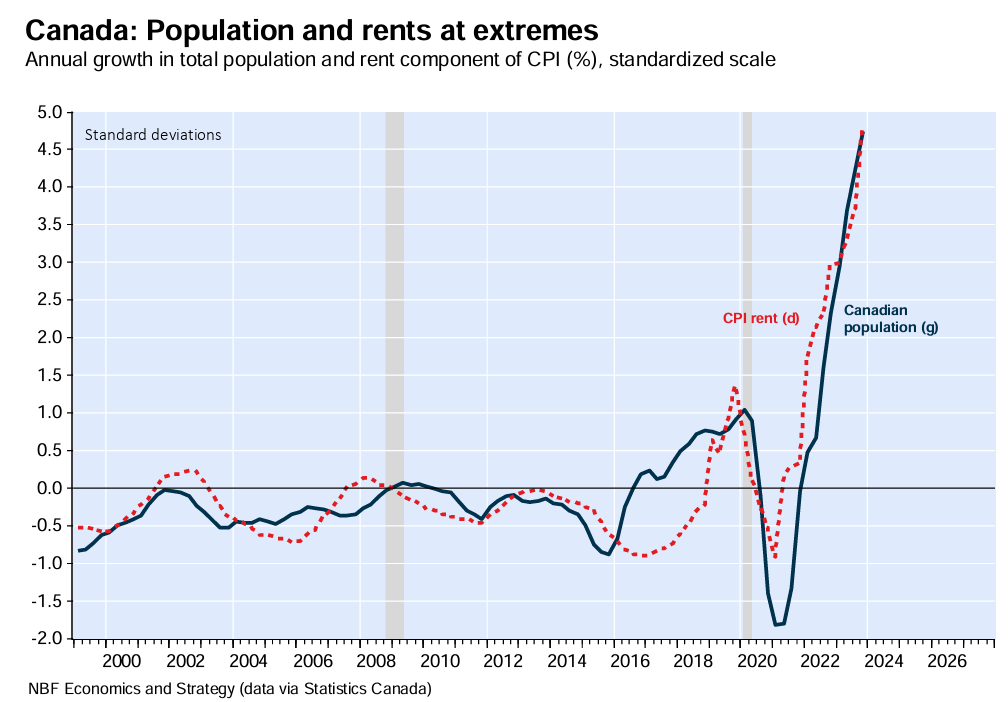

And Canada’s rents have soared into the stratosphere:

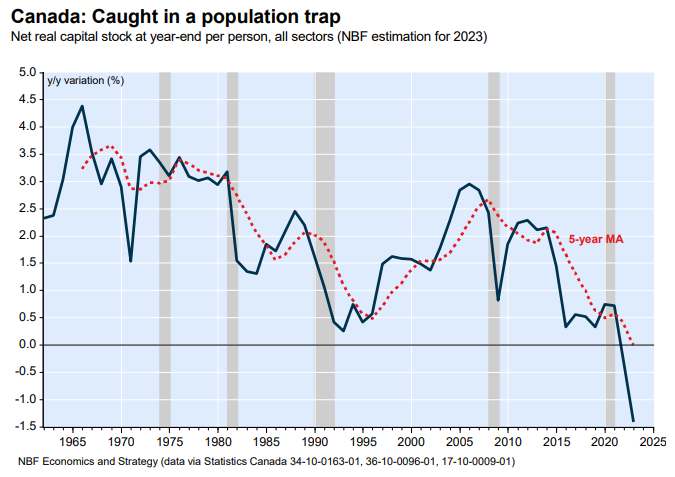

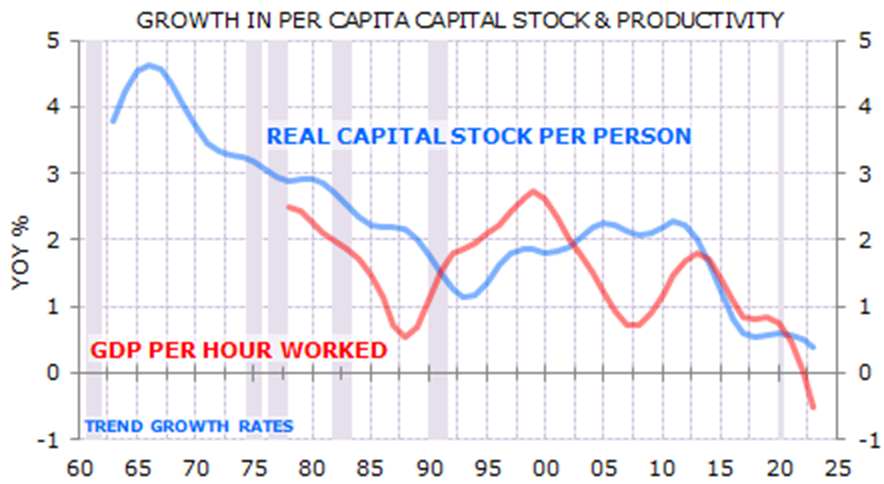

The population surge has also wrecked Canada’s productivity because business investment, infrastructure and housing have failed to keep up.

As a result, Canada has experienced severe “capital shallowing”, which has pulled down labour productivity (GDP per hour worked):

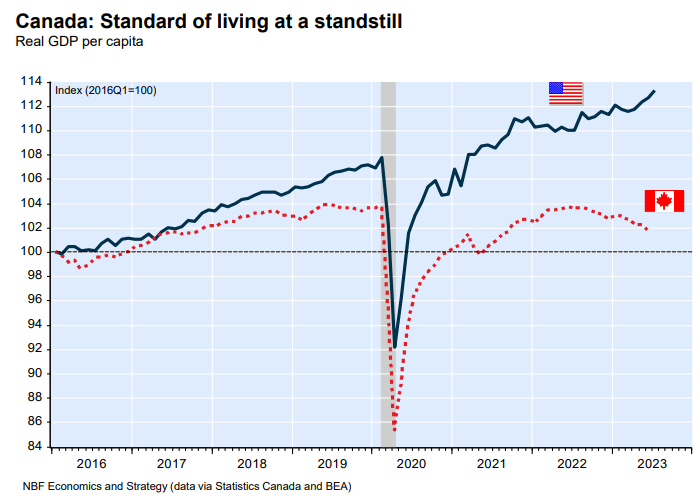

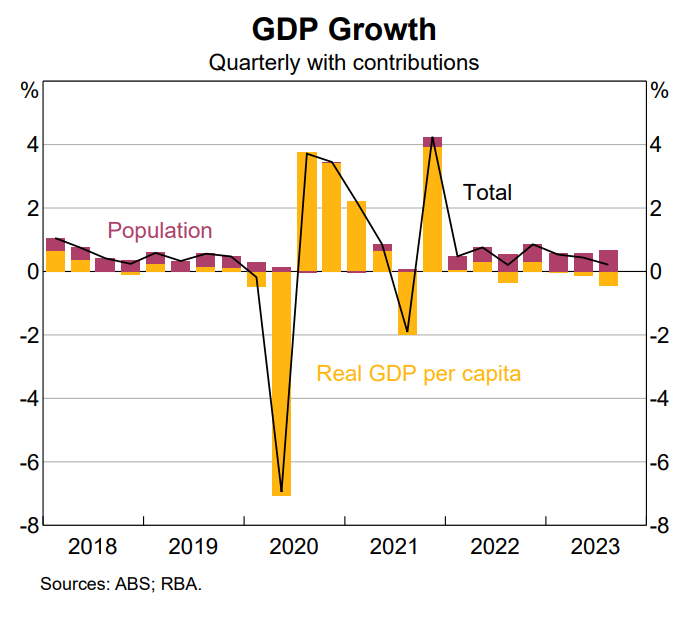

Canada’s record population growth has kept the aggregate economy growing at a somewhat respectable pace.

However, real per capita GDP is tracking at around 2017 levels:

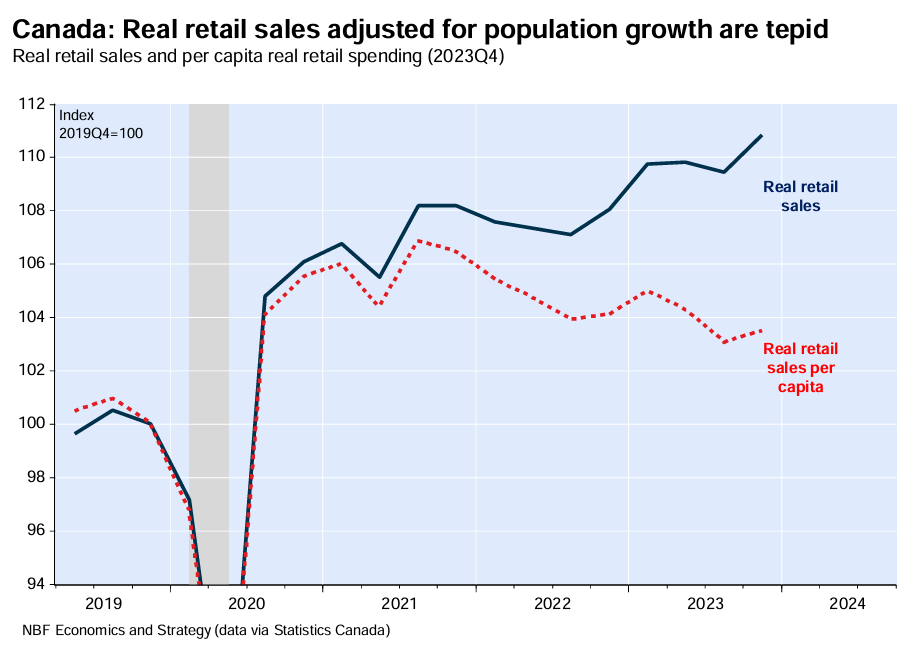

Canada’s per capita recession is also reflected in retail sales, which have grown in aggregate but fallen heavily in per capita terms:

Basically, the aggregate Canadian economy continues to grow thanks to extreme population growth, but everybody’s share of the economic pie (and living standards) is shrinking.

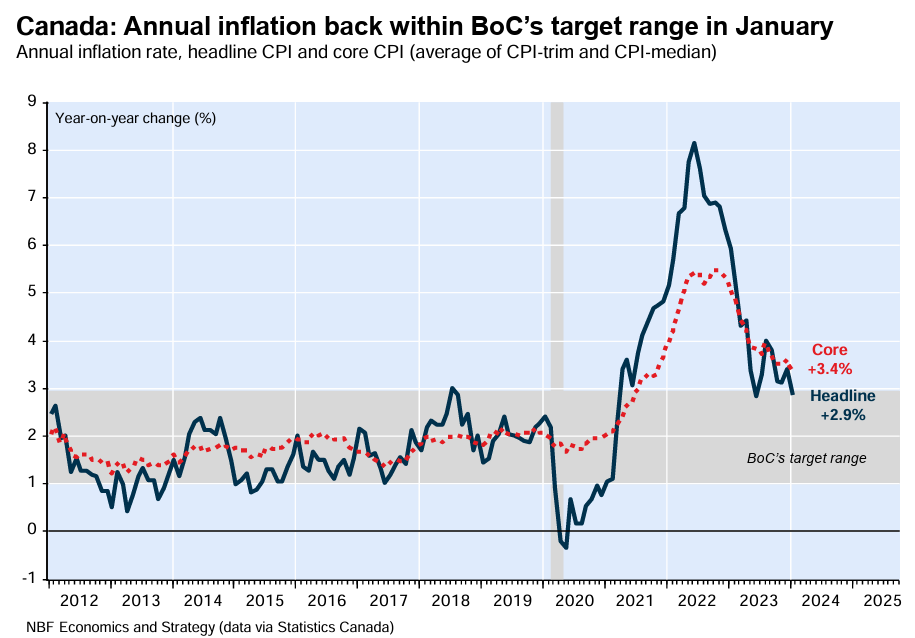

The only upside is that the weak Canadian economy has seen CPI inflation fall sharply across Canada:

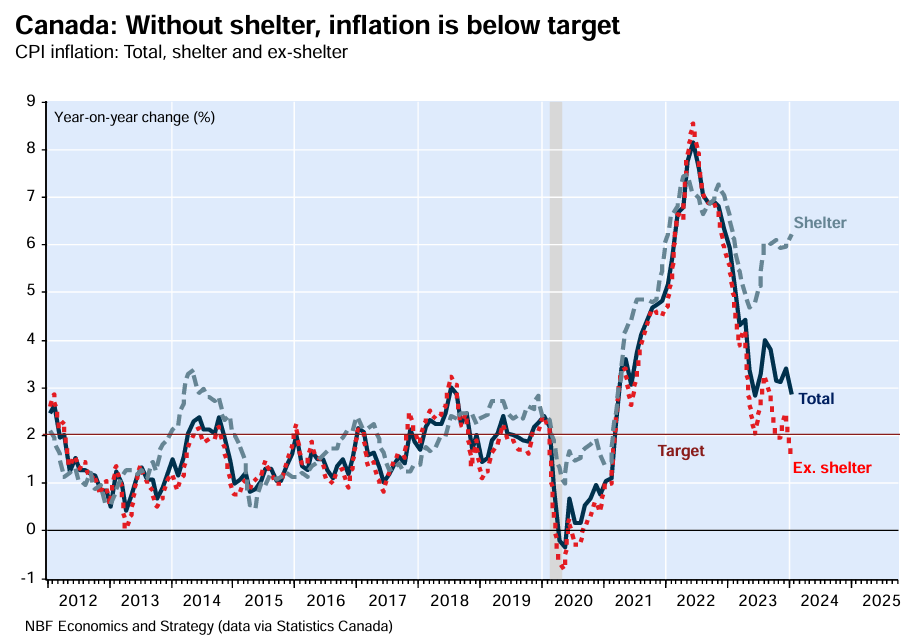

Moreover, without shelter inflation (e.g. rents), inflation would already be within the Bank of Canada’s target:

Similar, albeit less extreme, forces are playing out in Australia.

Australia’s record immigration has also delivered a per capita recession, falling per capita retail sales, and strongly rising rents, which has helped push up CPI inflation.

Australia has also experienced similar “capital shallowing” to Canada, which has killed productivity growth.

Canada and Australia are text book examples of what not to do if the goal is to increase the living standards of the incumbent resident population.